The enterprise work management platform

The foundation for managing projects, programs, and processes that scale.

Try Smartsheet for freeWatch a demo

Trusted by over 90% of Fortune 100 companies

Flexible solutions fit your work at any scale

Drive growth and impact

Companies of all sizes can scale with confidence and deliver value as business requirements evolve.

We work the way you do

Chances are, Smartsheet integrates with software you’re already using. Because we believe if it works for you, it works for us.

Trusted by experts

We move beyond best practices to make sure everything you do with us is safe and secure, from access to policies to the data flows through your work. We’re enterprise-grade, so you can focus on innovation with the trust that we have your back.

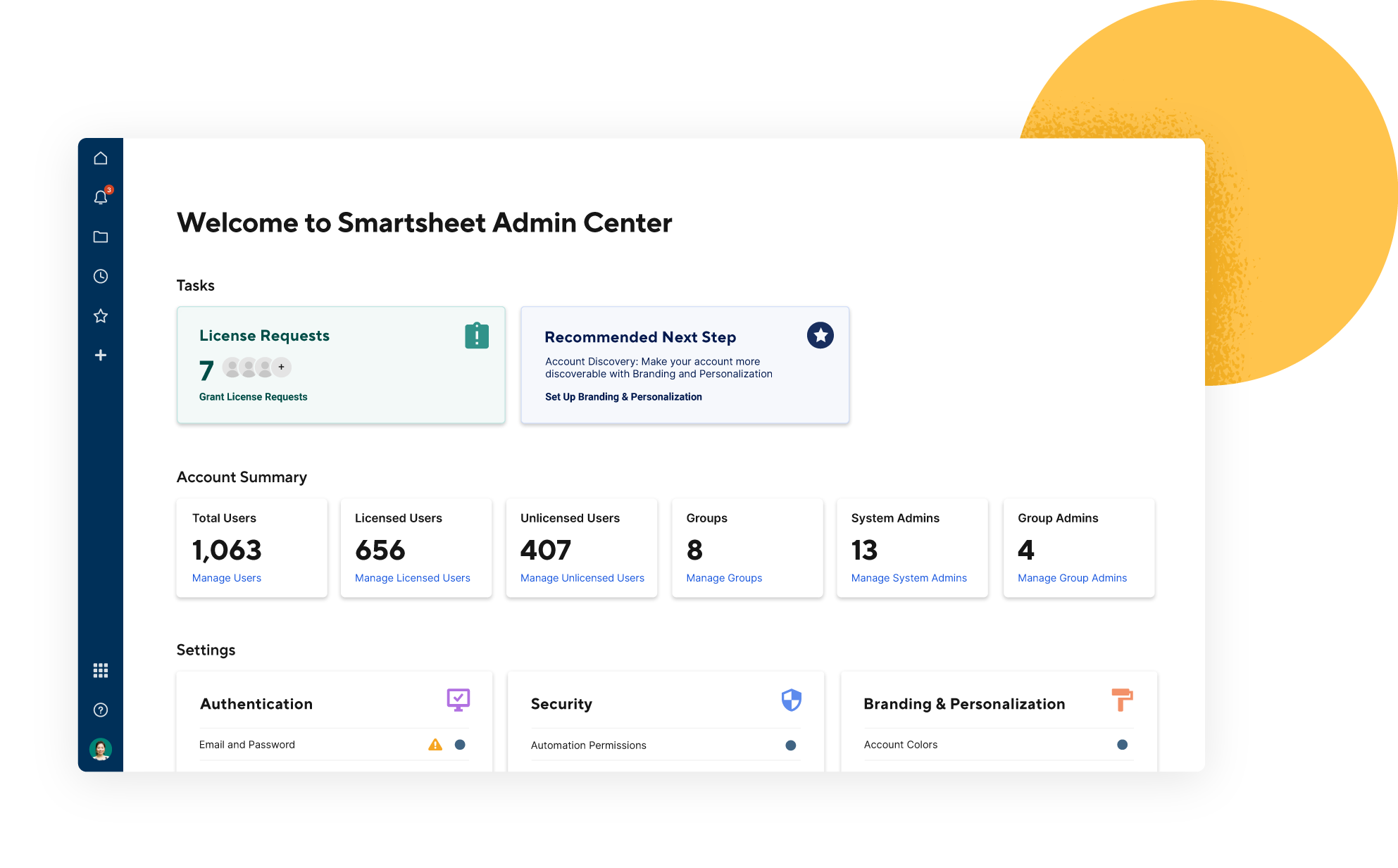

We get IT

IT Professionals, breathe easy. We build our platform with you in mind to give you granular control and visibility over access, data, and security.