Cost benefit analysis: What is it?

A cost benefit analysis (also known as a benefit cost analysis) is a process by which organizations can analyze decisions, systems or projects, or determine a value for intangibles. The model is built by identifying the benefits of an action as well as the associated costs, and subtracting the costs from benefits. When completed, a cost benefit analysis will yield concrete results that can be used to develop reasonable conclusions around the feasibility and/or advisability of a decision or situation.

Why Use Cost Benefit Analysis?

Organizations rely on cost benefit analysis to support decision making because it provides an agnostic, evidence-based view of the issue being evaluated—without the influences of opinion, politics, or bias. By providing an unclouded view of the consequences of a decision, cost benefit analysis is an invaluable tool in developing business strategy, evaluating a new hire, or making resource allocation or purchase decisions.

Origins of Cost Benefit Analysis

The earliest evidence of the use of cost benefit analysis in business is associated with a French engineer, Jules Dupuit, who was also a self-taught economist. In the mid-19th century, Dupuit used basic concepts of what later became known as cost benefit analysis in determining tolls for a bridge project on which he was working. Dupuit outlined the principles of his evaluation process in an article written in 1848, and the process was further refined and popularized in the late 1800s by British economist Alfred Marshall, author of the landmark text, Principles of Economics (1890).

Scenarios Utilizing Cost Benefit Analysis

As mentioned previously, cost benefit analysis is the foundation of the decision-making process across a wide variety of disciplines. In business, government, finance, and even the nonprofit world, cost benefit analysis offers unique and valuable insight when:

- Developing benchmarks for comparing projects

- Deciding whether to pursue a proposed project

- Evaluating new hires

- Weighing investment opportunities

- Measuring social benefits

- Appraising the desirability of suggested policies

- Assessing change initiatives

- Quantifying effects on stakeholders and participants

How to Do a Cost Benefit Analysis

While there is no “standard” format for performing a cost benefit analysis, there are certain core elements that will be present across almost all analyses. Use the structure that works best for your situation or industry, or try one of the resources and tools listed at the end of this article. We’ll go through the five basic steps to performing a cost benefit analysis in the sections below, but first, here’s a high-level of overview:

- Establish a framework to outline the parameters of the analysis

- Identify costs and benefits so they can be categorized by type, and intent

- Calculate costs and benefits across the assumed life of a project or initiative

- Compare cost and benefits using aggregate information

- Analyze results and make an informed, final recommendation

As with any process, it’s important to work through all the steps thoroughly and not give in to the temptation to cut corners or base assumptions on opinion or “best guesses.” According to a paper from Dr. Josiah Kaplan, former Research Associate at the University of Oxford, it’s important to ensure that your analysis is as comprehensive as possible:

“The best cost-benefit analyses take a broad view of costs and benefits, including indirect and longer-term effects, reflecting the interests of all stakeholders who will be affected by the program.”

How to Establish a Framework

In establishing the framework of your cost benefit analysis, first outline the proposed program or policy change in detail. Look carefully at how you position what exactly is being evaluated in relationship to the problem being solved. For example, the analysis associated with the question, “should we add a new professor to our staff?” will be much more straightforward than a broader programmatic question, such as, “how should we resolve the gaps in our educational offering?”

Example:

Once your program or policy change is clearly outlined, you’ll need to build out a situational overview to examine the existing state of affairs including background, current performance, any opportunities it has brought to the table, and its projected performance in the future. Also make sure to factor in an objective look at any risks involved in maintaining the status quo moving forward.

Now decide on how you will approach cost benefits. Which cost benefits should be included in your analysis? Include the basics, but also do a bit of thinking outside the box to come up with any unforeseen costs that could impact the initiative in both the short and long term.

In some cases geography could play a role in determining feasibility of a project or initiative. If geographically dispersed stakeholders or groups will be affected by the decision being analyzed, make sure to build that into the framework upfront, to avoid surprises down the road. Conversely, if the scope of the project or initiative may scale beyond the intended geographic parameters, that should be taken into consideration as well.

Identify and Categorize Costs and Benefits

Now that your framework is in place, it’s time to sort your costs and benefits into buckets by type. The primary categories that costs and benefits fall into are direct/indirect, tangible/intangible, and real:

- Direct costs are often associated with production of a cost object (product, service, customer, project, or activity)

- Indirect costs are usually fixed in nature, and may come from overhead of a department or cost center

- Tangible costs are easy to measure and quantify, and are usually related to an identifiable source or asset, like payroll, rent, and purchasing tools

- Intangible costs are difficult to identify and measure, like shifts in customer satisfaction, and productivity levels

- Real costs are expenses associated with producing an offering, such as labor costs and raw materials

Now that you’ve developed the categories into which you’ll sort your costs and benefits, it’s time to start crunching numbers.

How to Calculate Costs and Benefits

With the framework and categories in place, you can start outlining overall costs and benefits. As mentioned earlier, it’s important to take both the short and long term into consideration, so ensure that you make your projections based on the life of the program or initiative, and look at how both costs and benefits will evolve over time.

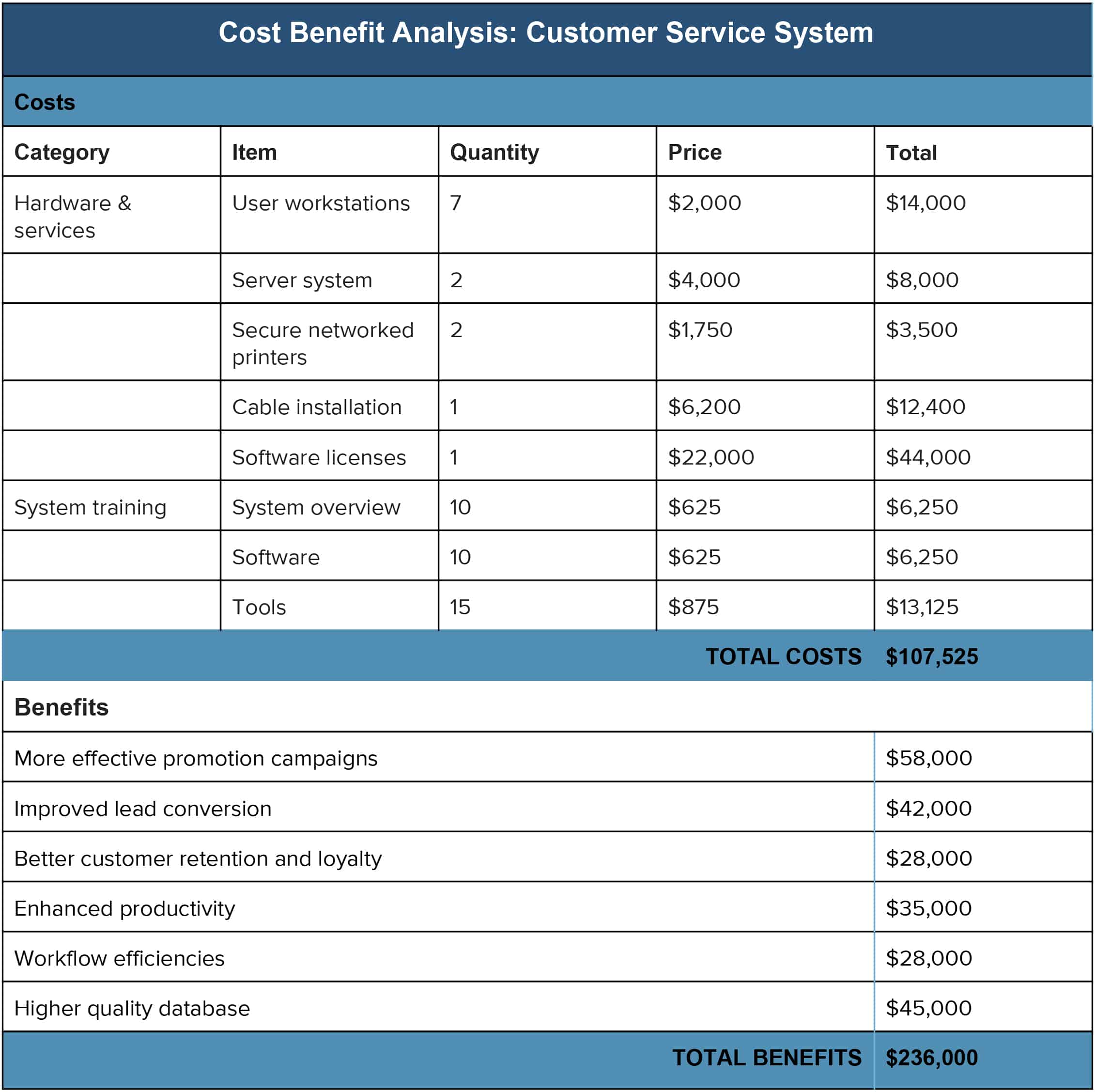

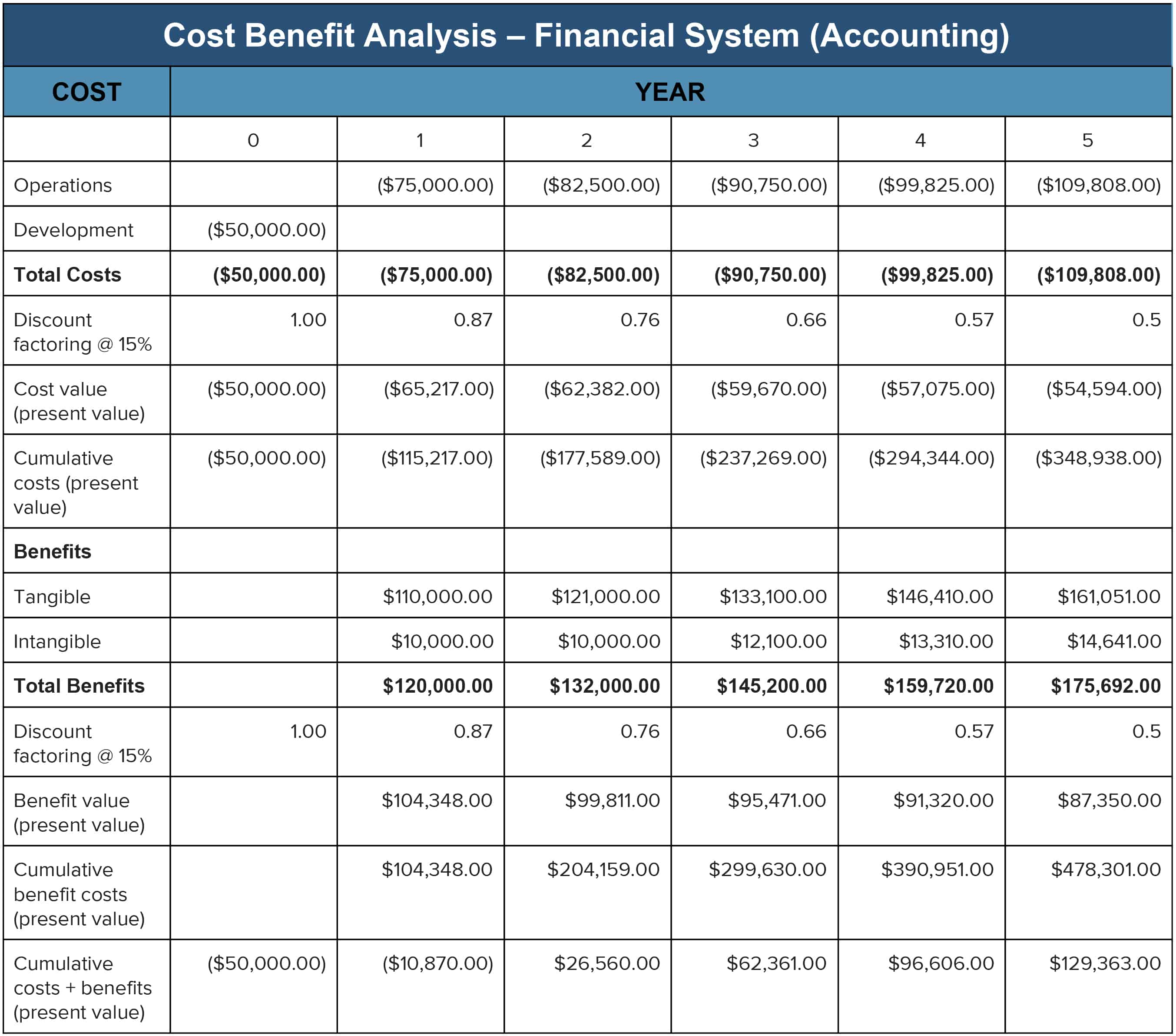

Example:

TIP: People often make the mistake of monetizing incorrectly when projecting costs and benefits, and therefore end up with flawed results. When factoring in future costs and benefits, always be sure to adjust the figures and convert them into present value.

Compare Aggregate Costs and Benefits

Here we’ll determine net present values by subtracting costs from benefits, and project the timeframe required for benefits to repay costs, also known as return on investment (ROI).

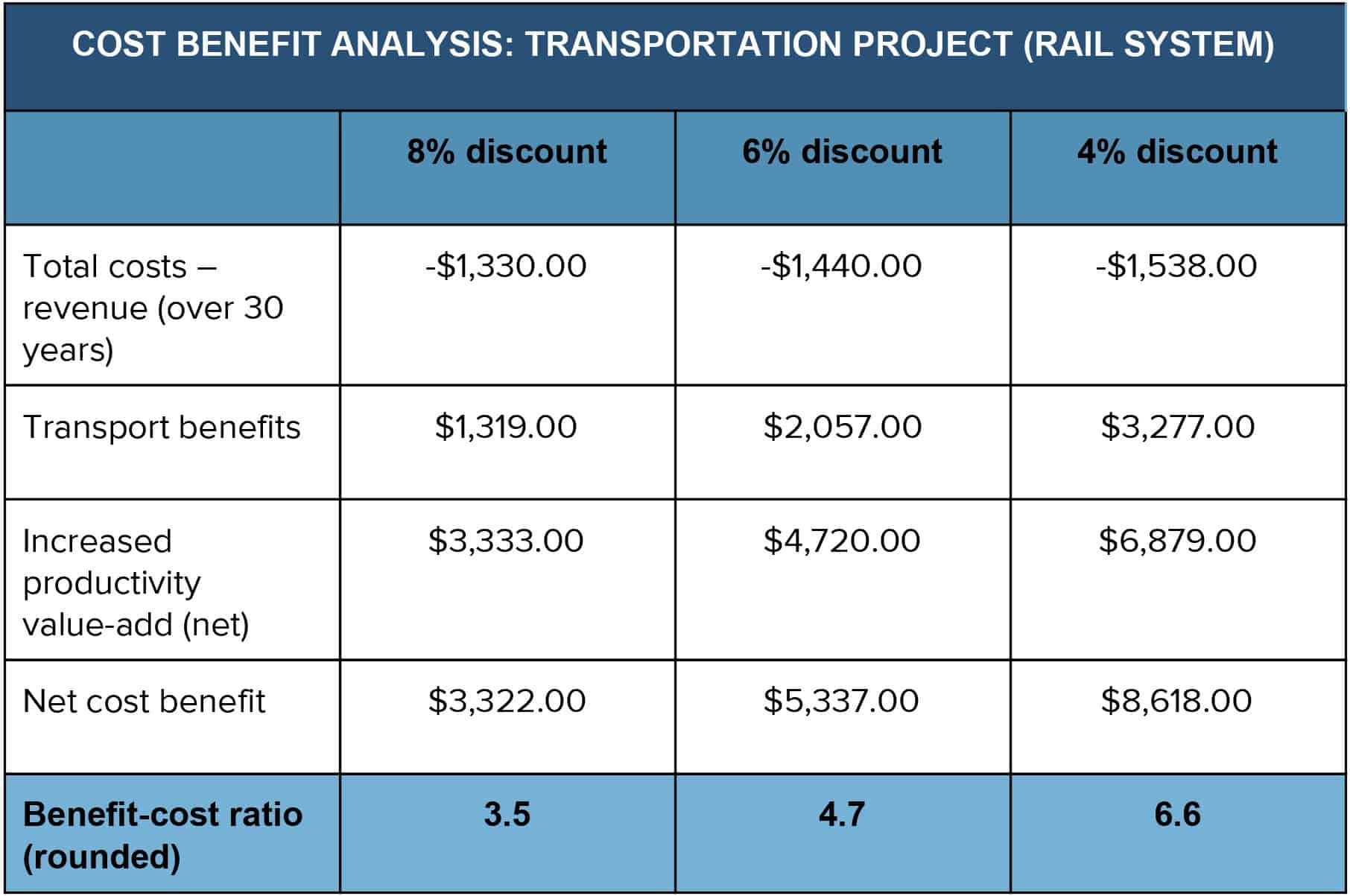

Example:

The process doesn’t end there. In certain situations, it’s important to address any serious concerns that could impact feasibility from a legal or social justice standpoint. In cases like these, it can be helpful to incorporate a “with/without” comparison to identify areas of potential concern.

With/Without Comparison

The impact of an initiative can be brought into sharp focus through a basic “with/without” comparison. In other words, this is where we look at what the impact would be—on organizations, stakeholders, or users—both with, and without, this initiative.

Thayer Watkins, who taught a course on cost benefit analysis during his 30-year career as a professor in the San Jose State University Department of Economics, offers this example of a “with/without” comparison:

“The impact of a project is the difference between what the situation in the study area would be with and without the project. So that when a project is being evaluated the analysis must estimate not only what the situation would be with the project but also what it would be without the project. For example, in determining the impact of a fixed guideway rapid transit system such as the Bay Area Rapid Transit (BART) in the San Francisco Bay Area the number of rides that would have been taken on an expansion of the bus system should be deducted from the rides provided by BART and likewise the additional costs of such an expanded bus system would be deducted from the costs of BART. In other words, the alternative to the project must be explicitly specified and considered in the evaluation of the project.”

TIP: Never confuse with/without with a before-and-after comparison.

3 Steps for Analyzing the Results and Make a Recommendation

In the home stretch of the cost benefit analysis, you’ll be looking at the results of your work and forming the basis to make your decision.

1. Perform Sensitivity Analysis

Dr. Kaplan recommends performing a sensitivity analysis (also known as a “what-if”) to predict outcomes and check accuracy in the face of a collection of variables. “Information on costs, benefits, and risks is rarely known with certainty, especially when one looks to the future,” Dr. Kaplan says. “This makes it essential that sensitivity analysis is carried out, testing the robustness of the CBA result to changes in some of the key numbers.”

EXAMPLE of Sensitivity Analysis

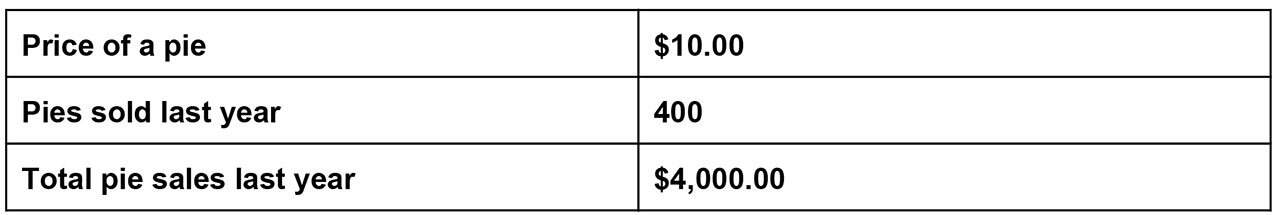

In trying to understand how customer traffic impacts sales in Bob’s Pie Shop, in which sales are a function of both price and volume of transactions, let’s look at some sales figures:

Bob has determined that a 10% increase in store traffic will boost his pie sales by 5%. This allows Bob to build the following sensitivity analysis, based upon his sales of 400 pies last year, that demonstrates that his pie sales are significantly impacted by fluctuations or growth in store traffic:

2. Consider Discount Rates

When evaluating your findings, it’s important to take discount rates into consideration when determining project feasibility.

- Social discount rates – Used to determine the value to funds spent on government projects (education, transportation, etc.)

- Hurdle rates – The minimum return on investment required by investors or stakeholders

- Annual effective discount rates – Based on a percentage of the end-of-year balance, the amount of interest paid or earned

Example:

Here is a template where you can make your Cost Benefit Analysis

Download Simple Cost Benefit Analysis Template

3. Use Discount Rates to Determine Course of Action

After determining the appropriate discount rate, look at the change in results as you both increase and decrease the rate:

- Positive - If both increasing and decreasing the rate yields a positive result, the policy or initiative is financially viable.

- Negative - If both increasing and decreasing the rate yields a negative result, revisit your calculations based upon adjusting to a zero-balance point, and evaluate using the new findings.

Based upon these results, you will now be able to make a clear recommendation, grounded in realistic data projections.

The Risks and Uncertainties of Cost Benefit Analysis

Despite its usefulness, cost benefit analysis has several associated risks and uncertainties that are important to note. These risks and uncertainties can result from human agendas, inaccuracies around data utilized, and the use of heuristics to reach conclusions.

Know the Risks

Much of the risk involved with cost benefit analysis can be correlated to the human elements involved. Stakeholders or interested parties may try to influence results by over- or understating costs. In some cases, supporters of a project may insert a personal or organizational bias into the analysis.

On the data side, there can be a tendency to rely too much on data compiled from previous projects. This may inadvertently yield results that don’t directly apply to the situation being considered. Since data leveraged from an earlier analysis may not directly apply to the circumstances at hand, this may yield results that are not consistent with the requirements of the situation being considered. Using heuristics to assess the dollar value of intangibles may provide quick, “ballpark-type” information, but it can also result in errors that produce an inaccurate picture of costs that can invalidate findings.

In addressing risk, it’s sometimes helpful to utilize probability theory to identify and examine key patterns that can influence the outcome.

Uncertainties

There are several “wild-card” issues that can influence the results of any cost benefit analysis, and while they won’t apply in every situation, it’s important to keep them in mind as you work:

- Accuracy affects value – Inaccurate cost and benefit information can diminish findings around value.

- Don’t rely on intuition – Always research benefits and costs thoroughly to gather concrete data—regardless of your level of expertise with the subject at hand.

- Cash is unpredictable – Revenue and cash flow are moving targets, experiencing peaks and valleys, and translating them into meaningful data for analysis can be challenging.

- Income influences decisions – Income level can drive a customer’s ability or willingness to make purchases.

- Money isn’t everything – Some benefits cannot be directly reflected in dollar amounts.

- Value is subjective – The value of intangibles can always be subject to interpretation.

- Don’t automatically double up – When measuring a project in multiple ways, be mindful that doubling benefits or costs can results in inconsistent results.

Controversial Aspects

When thinking about the most controversial aspects of cost benefit analysis, all paths seem to lead to intangibles. Concepts and things that are difficult to quantify, such as human life, brand equity, the environment, and customer loyalty can be difficult to map directly to costs or value.

With respect to intangibles, Dr. Kaplan suggests that using the cost benefit analysis process to drive more critical thinking around all aspects of value—perceived and concrete—can be beneficial outcomes. “[Cost benefit analysis] assumes that a monetary value can be placed on all the costs and benefits of a program, including tangible and intangible returns. ...As such, a major advantage of cost-benefit analysis lies in forcing people to explicitly and systematically consider the various factors which should influence strategic choice,” he says.

Cost Benefit Analysis in the Real World

Extending Transport Options in Seattle

Originally built for the 1962 World’s Fair, the Seattle monorail runs between the Seattle Center and the city’s downtown area. Several times over the past 50+ years, the city has considered extending monorail service to key areas in order to provide more transport options for residents. The following is an excerpt from a cost benefit analysis performed by DJM Consulting and ECONorthwest on behalf of the Elevated Transportation Company to assess an expansion project.

Costs

The estimated costs for constructing and operating the monorail are $1.68 billion (in 2002 dollars). This includes a total capital cost of $1.26 billion and a total discounted stream of operating costs of $420 million (at approximately $29 million a year), using the same discount rate (7.95%). Operating costs were discounted over a span of 22 years, from 2008 through 2029.

Benefits

Benefit type Benefit value (millions, 2002$)

Value of travel time savings $77.1

Parking savings 28.7

Reduced auto operating/ownership costs 11.2

Reliability 7.7

Road capacity for drivers 4.6

Reduction in bus-related accidents 3.7

Reduction in auto-related accidents 2.6

2020 Benefits $135.6

Benefits accrue for 23 years from 2007 through 2029. A discount rate of 7.95% was used to estimate the total benefits, in 2002 dollars. The net benefits were evaluated to be $2,067,263,000.

Analysis

- Net present value B-C = $390,164,000

- Benefit-cost ratio B/C = 1.23

- Nominal rate of return = 7.95%

Sensitivity Analysis

A team of outside engineers and contractors determined that there is a 60% chance the monorail project would come in at or under budget and a 90% chance the project will come in under 1.15 times the budget. The travel demand forecasters included a 10% range around their estimate of future monorail ridership. For the case where the costs are low and the benefits are high, a 9.9% return is expected. For the case where the costs are higher than expected and the benefits are lower, a 5.2% return is expected.

Read the full analysis here.

Solid Waste Reduction in California

California's Department of Resources Recycling and Recovery’s mission is to help state residents achieve the highest waste reduction, recycling and reuse goals in the U.S. The following is an excerpt from a cost benefit analysis performed in 1997 to compare the costs of Cardiovascular Group’s (CVG) solid waste reduction program to its economic benefits.

Costs

According to the Environmental Manager, one employee spends eight hours per day on recycling duties. This employee is paid an average of $5.50 per hour. The Environmental Manager spends an estimated 5% of his time ($100,000/per year compensation) directing the solid waste reduction program. Utilizing this cost data, the calculations below demonstrate that CVG spent an estimated $16,440 in 1997 on its solid waste reduction program:

(1 Employee) X ($5.50/hr.) X (8 hrs./day) X (260 work days/year)

= $11,440 per year + 5%(100,000)

= $16,440 per year

Benefits

1995 Disposal cost reductions (1989 Baseline disposal costs – 1995 disposal costs)

= $99,190 - $26,800

= $72,390

1996 Disposal cost reductions (1989 Baseline disposal costs – 1996 disposal costs)

= $99,190 - $33,850

= $65,340

Average Annual Disposal Cost Reduction (DCR) (1995 DCR + 1996 DCR)/ 2

= ($72,390 + $65,340)/2

= $68,865

Analysis

- Net present value B-C = $390,164,000

- Benefit-cost ratio B/C = 1.23

- Nominal Rate of Return = 7.95%

From these data, it is clear that CVG has benefited economically from its solid waste reduction programs. Average annual costs amounted to $16,440 per year, while benefits equaled $1,308,865 per year. Therefore, net savings from CVG’s solid waste reduction program amounted to $1,292,425 per year.

Discover a Better Way to Manage Your Finance Operations

Befähigen Sie Ihr Team, über sich selbst hinauszuwachsen – mit einer flexiblen Plattform, die auf seine Bedürfnisse zugeschnitten ist und sich anpasst, wenn sich die Bedürfnisse ändern. Mit der Plattform von Smartsheet ist es einfach, Arbeiten von überall zu planen, zu erfassen, zu verwalten und darüber zu berichten. So helfen Sie Ihrem Team, effektiver zu sein und mehr zu schaffen. Sie können über die Schlüsselmetriken Bericht erstatten und erhalten Echtzeit-Einblicke in laufende Arbeiten durch Rollup-Berichte, Dashboards und automatisierte Workflows, mit denen Ihr Team stets miteinander verbunden und informiert ist. Es ist erstaunlich, wie viel mehr Teams in der gleichen Zeit erledigen können, wenn sie ein klares Bild von der geleisteten Arbeit haben. Testen Sie Smartsheet gleich heute kostenlos.