What Is a Profit and Loss Statement?

A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. It captures how money flows in and out of your business.

A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report. Creating one is a standard way to compile historical data for your business to tell its financial story over time. Each monthly or quarterly reporting period, analyze the data vertically to see your business's monetary resource allocation. Over time, you will also analyze the data horizontally in context with other profit and loss statements to help you to make informed financial decisions and forecasts. You can also use the same technique to understand other businesses' finances.

Why Do You Need a Profit and Loss Statement?

You need a profit and loss statement to make the most informed choices for your business strategy. As an honest reflection of how your money works in your business, the statement shows what changes need to happen to increase profit.

Ivanka Menken, Managing Director and Co-founder of The Art of Service, emphasizes the importance of a P&L statement: “The numbers don't lie. [A profit and loss statement is] important to truly understand your business’s revenue and profit numbers to know if your revenue is helping or hurting your profitability. Many businesses go broke, especially when the focus is solely on revenue, [and not on] the cost of sales or the profitability of activities.”

A profit and loss statement helps you see exactly how money flows into your business, where you spend that revenue, and what adjustments you need to maximize profit. For example, you may discover that your cost of goods sold (COGS) is too high and needs to be reduced with a less expensive production option. By making changes to improve your margins, you can increase net revenue for the following months. Once you implement the new plan, you can measure its impact over time with the data from future P&L statements.

Additionally, a P&L statement is necessary to prove that your business is a trustworthy, solid investment. Financial backers or investors contributing capital to the business, banks at which you’re applying for a loan, or buyers interested in the business can use the document to determine your business’s capability to make a profit and view your financial trends over time. Essentially, the profit and loss statement showcases your ability to identify complex business problems and articulate how you solved them from a financial standpoint.

What Can a Profit and Loss Statement Tell You About Your Business?

Profit and loss statements show your business health over time. A reported loss signals that something isn’t functioning correctly within the business. After analyzing the document, you can pinpoint the cause of the loss and develop a stronger business strategy.

When comparing the statements in the context of other periods, you can clearly identify business areas that are performing well and those that need to be optimized.

Pam Prior, speaker, podcaster, and creator of Profit Concierge, shares an essential tip: “Do something with the information. Knowing history for history’s sake doesn’t do much for you.” Once you record, report, and analyze the information based on 12 months of history, you can use formulas to project the next 12 months. Your P&L statements are the basis of financial forecasting for the following year.

Your income statement is the most important financial statement for your business. Use it, along with one of our free small business budget templates, to simplify and strengthen your small business financial planning.

What Goes on a Profit and Loss Statement?

A profit and loss statement contains three basic elements: revenue, expenses, and net income. More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (EBITDA).

Basic income statements contain the following elements:

- Gross Revenue: The amount of money you received as payment for your products or services (also called gross sales).

- Cost of Goods Sold (COGS): Expenses for everything involved in creating your product, such as manufacturing materials, contractors, etc. Note that COGS does not include your operating expenses (i.e., salaries, facility rent).

- Net Revenue: The gross revenue minus COGS; also known as gross profit or gross income.

- Expenses: This refers to any fixed or operating expenses required to run the business, including salaried employees, rent, advertising and marketing expenses, utilities, and insurance. A basic statement accounts for interest, taxes, depreciation, and amortization as part of the total expenses. Use a small business expense template to easily itemize your expenses.

- Net Profit: Also called net income, this is the net revenue minus the total expenses. If the calculation is negative, it is called a loss or a net loss.

Pro Tip: Menken advises that companies avoid getting too detailed and granular when creating a profit and loss statement, as doing so can defeat the document’s purpose.

Use a small business profit and loss template if you are less familiar with spreadsheet software. As your company grows, so will the complexity of your profit and loss statement — in time, you can transition to more advanced profit and loss templates, which typically include more information, such as the following: - Operating Profit: The profit before interest or taxes and after accounting for general costs. Subtract the operating expenses from the net revenue to calculate this figure.

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): This line measures the business’s profitability and compares companies with each other. This figure is commonly used for corporations and large public companies. In some cases,, you may only calculate EBIT, meaning the operating profit plus depreciation and amortization.

- Additional Income: This includes anything not calculated in revenue, such as interest income, dividends, and donations.

Pro Tip: As Prior shares, “Everything you need to create a basic profit and loss statement is already on your bank statement and credit card statement. As your business grows or for more complicated businesses, outsource to a bookkeeper as soon as you can afford one. You won’t have to clean up mistakes, saving money over the long run.”

How Do You Prepare a Profit and Loss Statement?

Preparing a profit and loss statement involves two multi-stage steps. First, find your gross profit by subtracting your COGS from your gross revenue. Then, subtract your total expenses from the gross profit to calculate the net income.

Before you start, gather the necessary documents. For a basic P&L statement, you only need your credit card and bank account statements. Supplement these documents with invoices, receipts, and other transactions not listed on your credit card or bank statements.

To get started, you’ll need to know the basic formulas. Use our quick-reference guide below until you are familiar with the formulas. We’ve also indicated when to use each formula in our step-by-step instructions for preparing a basic profit and loss statement.

1. Calculate Gross Profit

You can calculate your gross profit by taking the sum of the gross revenue and subtracting the COGS. These figures are pre-tax amounts. Use the following formula to find the gross profit:

Gross Profit = Gross Revenue - COGS

- Total your gross revenue from sales and other pre-tax income and create a line item for the total amount.

- Total your COGS and create a line item for this figure.

Pro Tip: Menken recommends that businesses look at the income and expense lines and consider if they are a cost of sales or an expense. Understanding the difference will help you know where you can save money (by lowering your expenses) and where you need to increase investments to increase revenue.

The difference between costs and expenses is as follows: A cost refers to a payment made toward the production of the goods you sell, and an expense refers to a fixed monthly cost that is necessary for business operations, such as rent, salaries, and utilities. Generally, expenses are recurring payments and costs are one-time payments. - Subtract COGS from the gross revenue to find your gross profit. If the number is negative, your business has incurred a loss for this period.

2. Total All Expenses

In this example, since we are preparing a basic small business profit and loss statement, we will simplify the expenses by including the operating and non-operating expenses.

- Itemize your operating expenses (salaried employees, facilities, marketing, etc.) and non-operating expenses (interest, depreciation, taxes, amortization).

- Total all expenses as a separate line item.

Note: As your business grows and becomes more complex, so will your financial documents. You may wish to expand your income statement to itemize the EBIT or EBITDA separately as a way to compare your business profit with competitors.

Pro Tip: Prior advises statement preparers to use itemized categories (i.e., contractor payments, travel, software, marketing) to help you see how they perform over time and how the money spent generates more net profit.

3. Calculate Net Income

The final step is to calculate the net income (also called net earnings) using the following formula:

Net Income = Gross Profit – Total Expenses

- Subtract your total expenses from the gross profit to find your net income.

- List this figure on a separate line.

Pro Tip: Menken advises, “If you feel overwhelmed by all these numbers, then make it simple. Take the aggregate numbers for your income, cost of sales, and expenses. You’ll then have a five-line overview of your business. From there, you can drill down into more detail when you are ready for more information.

”You can use any spreadsheet tool to create a profit and loss statement that automatically performs calculations. You can also use a template that contains built-in calculations. To get started, visit our step-by-step tutorial on how to create a profit and loss statement in Excel.

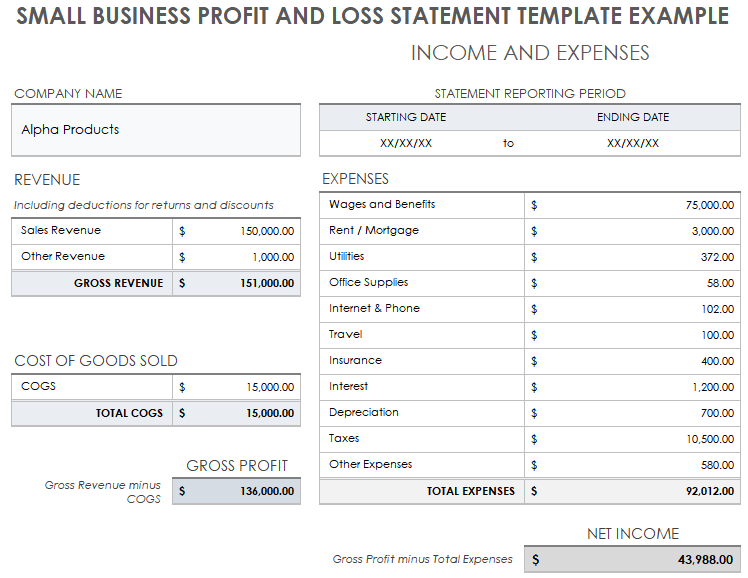

Profit and Loss Statement Template Example

Download Profit and Loss Template Example — Microsoft Excel

To help you create a profit and loss statement, we’ve filled out a free small business profit and loss statement as an example. Download the fully customizable example template to see how the numbers work and fill in your own figures.

You can also visit our profit and loss templates page to find the free template that best meets your needs.

How Often Do You Prepare a Profit and Loss Statement?

Businesses routinely prepare a profit and loss statement each month, quarter, or year. As a standard, many organizations prepare the statement monthly to line up with bank cycles.

Pam Prior highly recommends monthly statements: “The standard is monthly because banks tend to cycle each month. Essentially, you’re taking the info from the bank and credit card statements and putting it into a format to see what you made and what you spent. When you do this monthly, you have 12 data points over the course of a year, versus four quarterly or one annual report. Since data informs decisions, 12 points of data provide the most clarity.”

Startups and new businesses that do not have a financial history use a pro forma financial statement instead of a profit and loss statement. The pro forma is a projection of finances and is necessary when you are applying for business financial backing.

How to Read a Profit and Loss Statement

To read a profit and loss statement, you must first identify the preparation method: accrual or cash basis. Next, scan the document to review the finances during a single period. Then, analyze the trends over time by comparing data from other P&L statements.

Preparers typically use one of two primary reporting methods on the income statement:

- Accrual Basis: In this method, you report income and expenses on the income statement as they occur. For example, you would record the sale of a single product upon delivery to a customer who promises to pay in the future.

- Cash Basis: Here, you report income and expenses on the income statement at the time of the transaction. For example, you would record the sale of a single product or service only when money for that product has exchanged hands.

The accrual method is most common in publicly traded companies and is more accurate in reporting the overall health of the company. The cash method is common for personal finances and small businesses and is much simpler, especially when you’re starting out.

Pro Tip: Prior urges new businesses to start preparing income statements using the cash basis method.

To determine the profit margin, we’ve detailed the common formulas and how to use them with your income statement data below:

Vertical (Common-Size) Analysis

A vertical or common-size analysis is a financial tool analysts use to interpret financial documents like a profit and loss statement. The method calculates major line items (gross profit, operating profit, and net profit) from your income statement as a percentage of its base line item (gross revenue). These percentages are called margins. Analyzing the document using profit margins allows you to understand the impact of each reporting period for your business, and also produces relative terms to accurately compare your company’s finances to other companies, regardless of their scale.

- Scan the Document: Look at the big picture by reviewing the net revenue, expenses, and net income. Note if anything looks surprising, and then scan the statement line by line to gain a general understanding of how finances performed for that particular period.

- Calculate Your Profit Margins: Profit margins are the percentage of expenses in relation to the total revenue. Calculate the gross profit margin, operating profit margin, and net profit to interpret the financial data. Below are the formulas for each margin, using the following example figures:

- Gross Revenue: $20,000

- Cost of Goods Sold: $15,000

- Operating Expenses: $1,000

- *Non-operating Expenses: $500

- *Non-operating expenses include interest, taxes, depreciation, and amortization. They should be itemized individually on the statement.

- Gross Profit Margin: This is the profit your business made relative to what it costs to produce them. Remember that gross profit equals gross revenue minus COGS. The formula to find your gross profit margin is as follows:

Gross Profit Margin = (Gross profitGross revenue) x 100 - Gross Profit Margin Example: If you paid $15,000 for goods and sold them at $20,000, your gross profit will be $5,000. To find the gross profit margin, divide the gross profit ($5,000) by the gross revenue ($20,000) and multiply that number by 100 to get the percentage. Your gross profit margin for this example is 25 percent.

- Operating Profit Margin: The percentage of expenditures it takes to operate your business (i.e., marketing and PR costs, salaries, taxes, interest, supplies, vendor and contractor payment, professional fees, such as accountants and lawyers) in relation to the revenue. Your operating profit does not include non-operating expenses (interest, taxes, depreciation, and amortization) and only uses the EBITDA to determine this margin. Remember that operating profit equals gross revenue minus (COGS + operating expenses). The formula to find the operating profit margin is as follows:

Operating Profit Margin = (Operating profitGross revenue) x 100 - Operating Profit Margin Example: If your operating costs were an additional $1,000 on top of the COGS ($15,000) and you subtract it from your gross revenue ($20,000), your operating profit is $4,000. Divide your operating profit ($4,000) by the gross revenue ($20,000) and multiply it by 100. Your operating profit margin in this example is 20 percent.

- Net Profit Margin: This formula calculates all expenses from revenue, including COGS, operating expenses, taxes, interest, depreciation, and amortization in relation to the total revenue. Remember that net profit equals gross revenue minus total expenses. The formula is as follows:

Net Profit Margin = (Net profitGross revenue) x 100 - Net Profit Margin Example: Using the same figures from the previous examples and assuming that your taxes, interest, depreciation, and amortization were $500 in addition to the $1,000 operating expenses, we’ll input the numbers into the calculation for net profit:

Net Profit = [(Gross Revenue – COGS) - (operating expenses + taxes, interest, depreciation, amortization)]

[($20,000 - $15,000) – ($1,000 + $500)] = $3,500

Divide your net profit ($3,500) by the gross revenue ($20,000) and multiply it by 100. Your net profit margin is 17.5 percent.

- Analyze the Profit Margins: Look closely at individual lines in each section (gross revenue/sales, COGS, net profit, expenses, and net income). What needs to happen to increase your margins? Can you lower COGS or operating expenses without compromising your product or company values? What needs to happen to increase sales? Did something go particularly well for this month? Try to replicate it for the following month. Compare the line items to determine where to strategically adjust.

Horizontal (Serial) Analysis

After analyzing the document vertically, compare the statements month to month (or quarter to quarter or year to year) horizontally to see the story of where the money is going. Place your net profit margins on a graph to see the information in context. You’ll discover big-picture insights, general business trends, and increasing or decreasing profit margins. You can use this information to forecast your business direction and compare it with other companies’ public financial statements.

Financial expert Prior says, “The really cool thing is when you see a profit and loss statement in columns that show each month. This system shows your financial story over time. This way, you can see if the money you’re spending is working for you and generating revenue — profit is the whole point of business. Once you have this piece in place, you can make informed decisions on what to do next. You’ve got the data to interpret, develop a strategy, and measure its impact.”

Beyond the basic steps of reading and analyzing a P&L statement, it is important to keep outside factors in mind to develop insights for your strategy. Read your profit and loss statement like you would a story. Ask questions when something isn’t adding up as expected. As you read the statement, consider in your strategy the following factors:

- Seasonality: The time of year impacts a number of areas on your statement. Items may be more expensive during a specific period, thereby increasing the COGS. Holidays can increase sales with demand. By including seasonality, you can interpret dramatic changes and develop creative solutions to create more income during off seasons.

- Income Sources and New Offerings: If your business has expanded its offerings, are they worth the resources you’re putting into them? Are the profit margins high enough to keep the offerings? Do you need to shift more money to market the product and increase sales? Your profit and loss statement helps guide the best choices about how well your new product performs.

- Bottom Line: Typically, the COGS increases with revenue. If you see that the COGS exceeds revenue, you need to make immediate decisions to change a loss into a profit. To increase your bottom line, ask if there’s any way you can reduce these expenses without jeopardizing the quality of product or company values.

- Big Picture: Look at your net income as the big picture. For example, it is cost-effective to purchase items in bulk for the year. Still, it will appear negative on the income statement for a particular month. Ultimately, you’ll recoup the money over time for higher margins, but you need to keep an eye on the big picture to see this in the income statement.

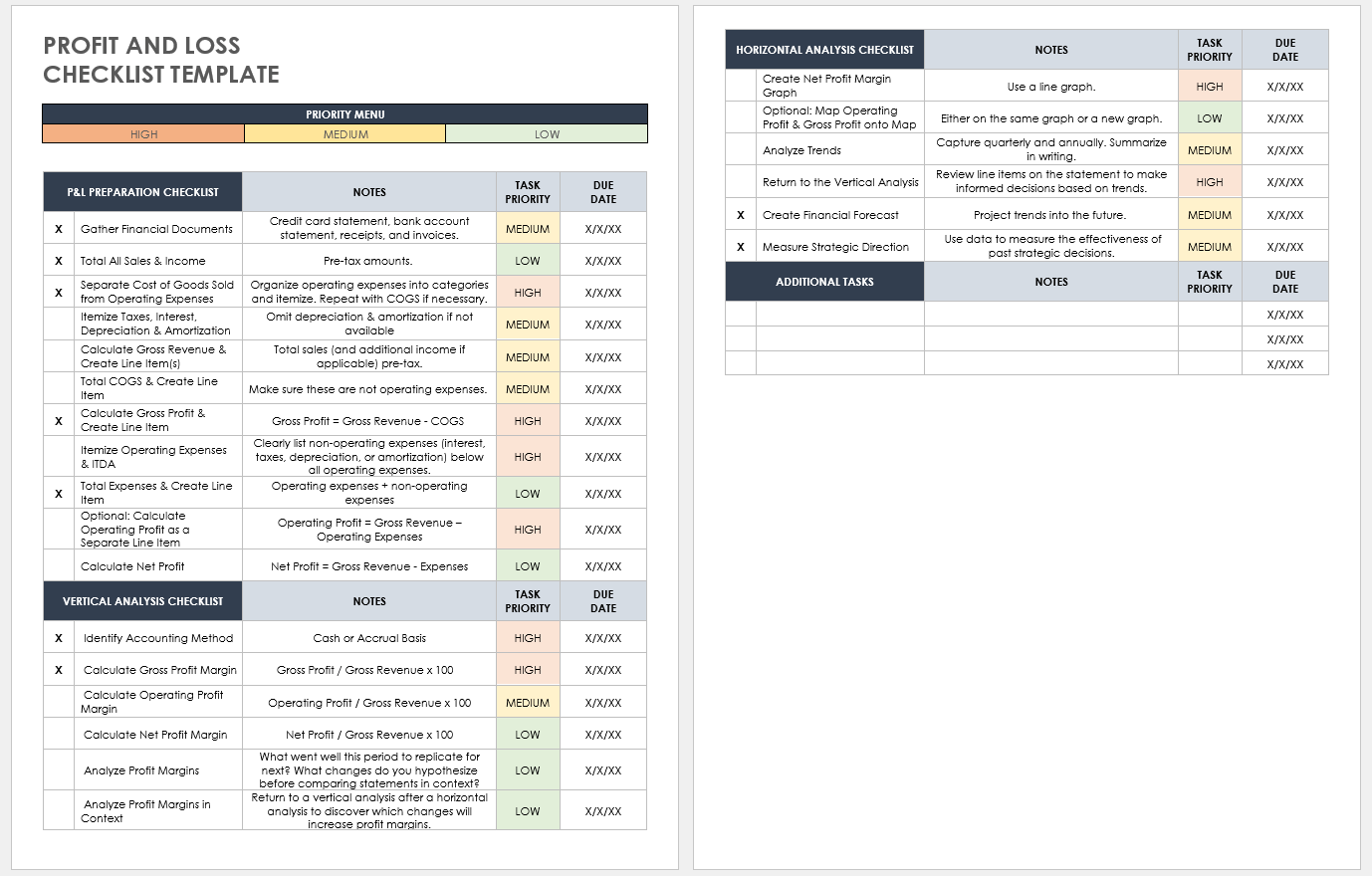

Profit and Loss Statement Checklist

Download Free Profit & Loss Statement Checklist

Microsoft Word | Adobe PDF | Google Docs

Whether you are just beginning to prepare your profit and loss statement or are analyzing profit and loss statements vertically or horizontally, use our quick reference checklist to ensure you don’t miss a step. This complete checklist includes quick reference income statements and profit margin formulas to help you cover all your bases.

Balance Sheet vs. Profit and Loss Statement

A balance sheet is different from a profit and loss statement. It captures a snapshot of the business’s assets, debts, and equity in a single moment, whereas a P&L statement demonstrates the performance of the overall business.

Pam continues, “A profit and loss statement tells you what happens over a period of time. A balance sheet is a record or a snapshot in time as of a certain date, of the values of the things in the business. It’s critical to know if something belongs on a balance sheet or a profit and loss statement.”

All balance sheets calculate the owner’s (or shareholder) equity by assessing the company assets against its liabilities:

- Assets: What your business owns, including tangible items like cash, investments, and owned property, as well as prepaid expenses known as accounts receivable.

- Liabilities: These are items that your business owes, including any loans, accrued expenses, accounts payable, etc.

- Owner’s Equity: This is the amount that the owner of a private company has after subtracting liabilities from assets. This is called shareholder equity for public companies.

The balance sheet is also a supporting document when creating a cash flow statement. The cash flow statement is another financial document that monitors cash flow in and out of the business, sufficient funds for bills, and how well the business generates money.

Get the Most Out of Your Profit and Loss Statements with Smartsheet

Discover a better way to connect your people, processes, and tools with one simple, easy-to-use platform that empowers your team to get more done, faster.

With Smartsheet, you can align your team on strategic initiatives, improve collaboration efforts, and automate repetitive processes, giving you the ability to make better business decisions and boost effectiveness as you scale.

When you wear a lot of hats, you need a tool that empowers you to get more done in less time. Smartsheet helps you achieve that. Try free for 30 days, today.