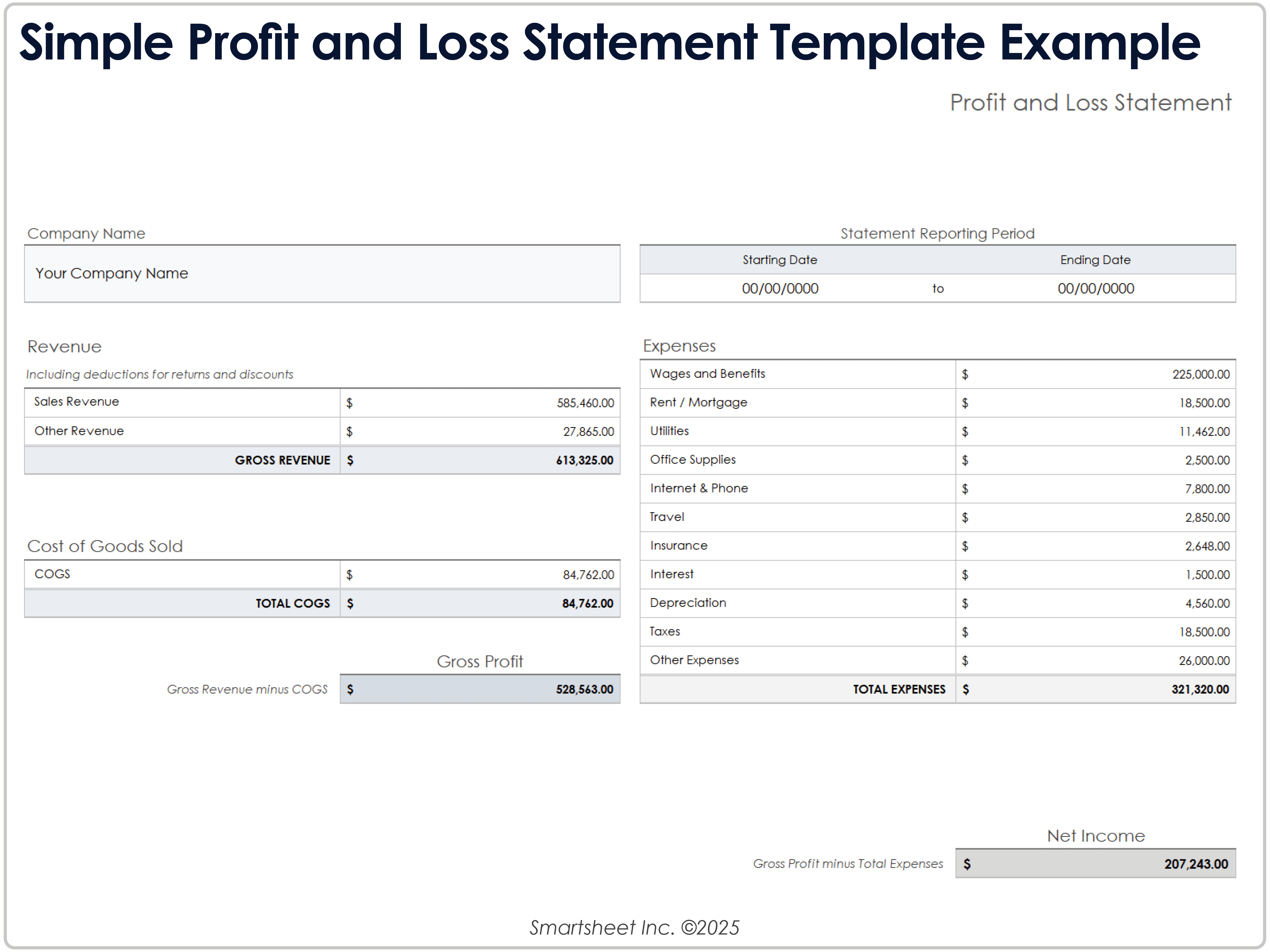

Simple Profit and Loss Statement Template

Download Blank and Sample Versions of a Simple Profit and Loss Statement Template for

Excel

|

Microsoft Word

|

Adobe PDF

| Google Sheets

When to Use This Template: Use this simple profit and loss template for a high-level view of your business’s financial performance. This template works well for small businesses that want to track income, direct costs, and overheads in one place.

Notable Template Features: This template suits quarterly or annual reporting periods and allows you to choose the reporting period. The template separates revenue, cost of goods sold (COGS), and operating expenses to calculate gross profit and net income. It includes essential expense categories such as wages, rent, and taxes.

Annual Small Business Profit and Loss Statement Template

Download an Annual Small Business Profit and Loss Statement Template for

Excel

| Google Sheets

When to Use This Template: Use this annual profit and loss statement for a year-over-year view of financial performance. This template fits businesses that sell products or services and want to analyze growth across multiple years.

Notable Template Features: This template tracks revenue, direct costs, and operating expenses for up to three years, so you can compare business performance over time. The template calculates totals for each section, gross profit, and net income before and after taxes.

Check out our step-by-step guide to creating a profit and loss statement, and find more template options in our collection of small business profit and loss templates.

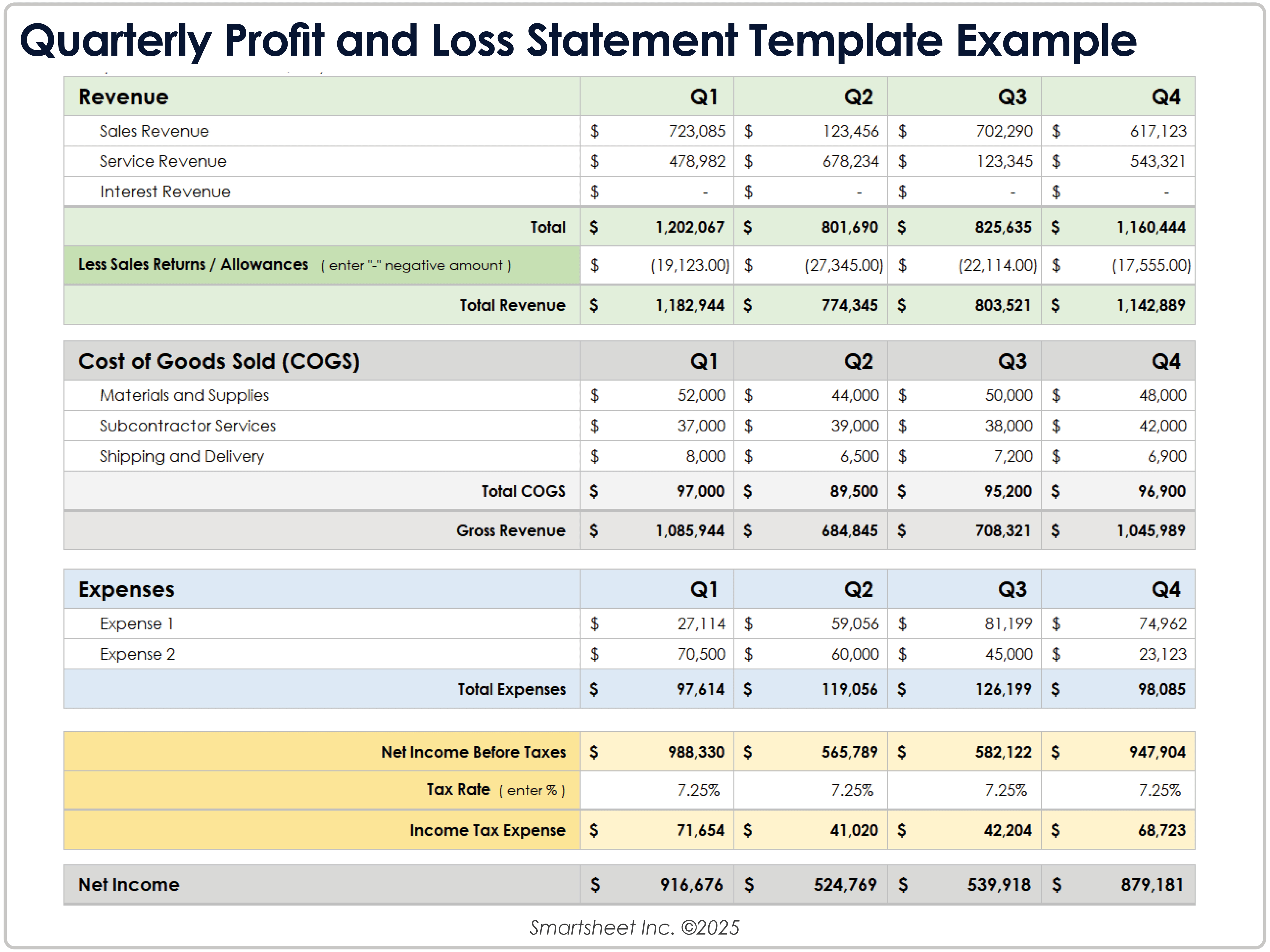

Quarterly Profit and Loss Statement Template

Download Blank and Sample Versions of a Quarterly Profit and Loss Statement Template for

Excel

| Google Sheets

When to Use This Template: Use this profit and loss template to monitor revenue and expenses on a quarterly basis. This format supports budgeting, forecasting, and trend analysis.

Notable Template Features: This template organizes revenue, sales adjustments, and expense categories across four quarters for a detailed view of operational health. The template includes fields for tax rate, income tax expense, and net income. Built-in calculations and the spreadsheet format provide flexibility and clarity for financial reporting.

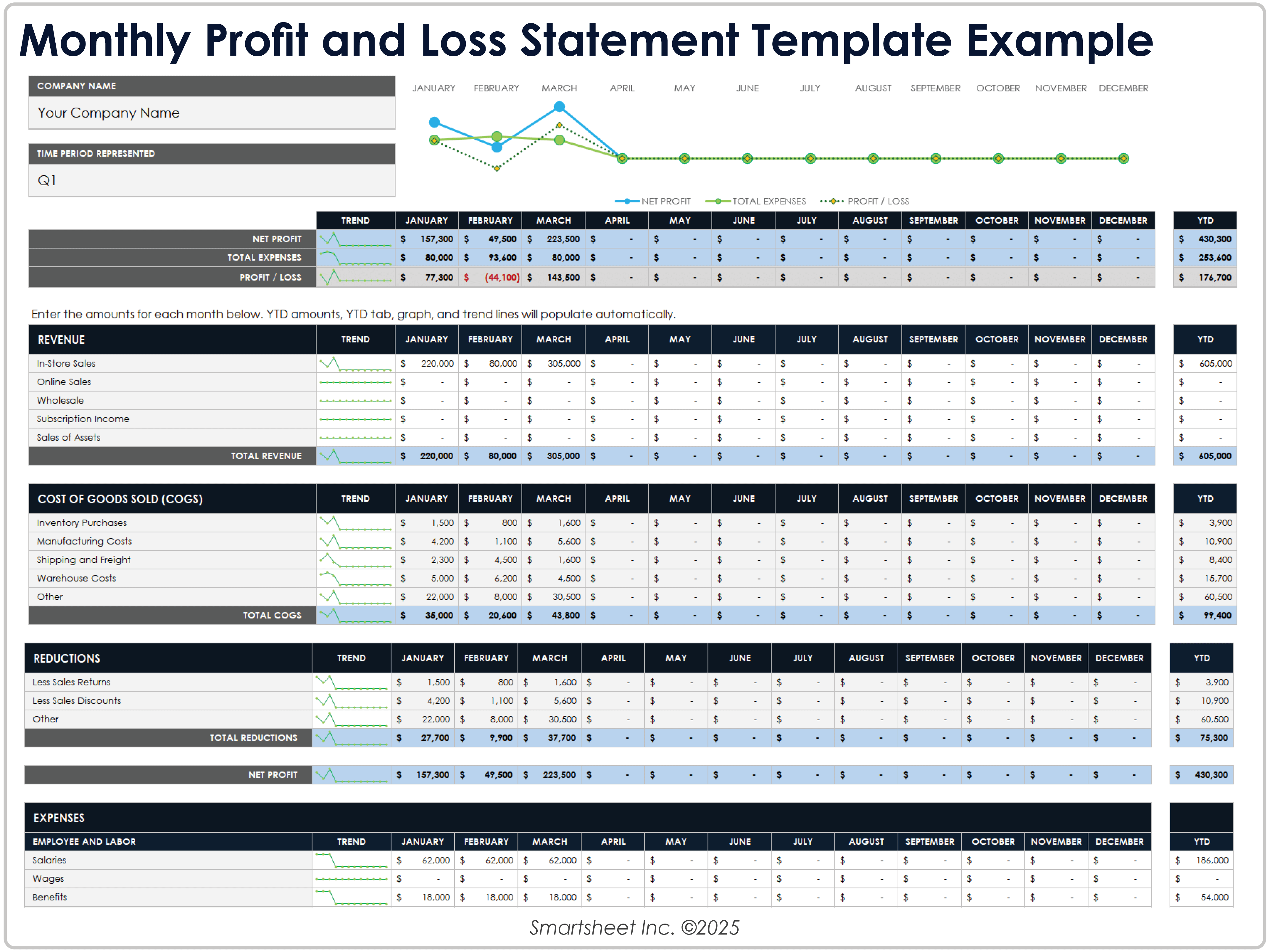

Excel Monthly Profit and Loss Statement Template

Download Blank and Sample Versions of the Monthly Profit and Loss Statement Template for Excel

When to Use This Template: Use this monthly profit and loss template to monitor business income, expenses, and profitability over the course of the year. Manage seasonal trends and adjust spending and sales strategies month by month.

Notable Template Features: This template provides month-by-month tracking across detailed revenue and expense categories, including labor, professional services, and general operations. Trend lines allow you to visualize gross profit, total expenses, and net income over time. The template also includes year-to-date totals for a comprehensive financial snapshot.

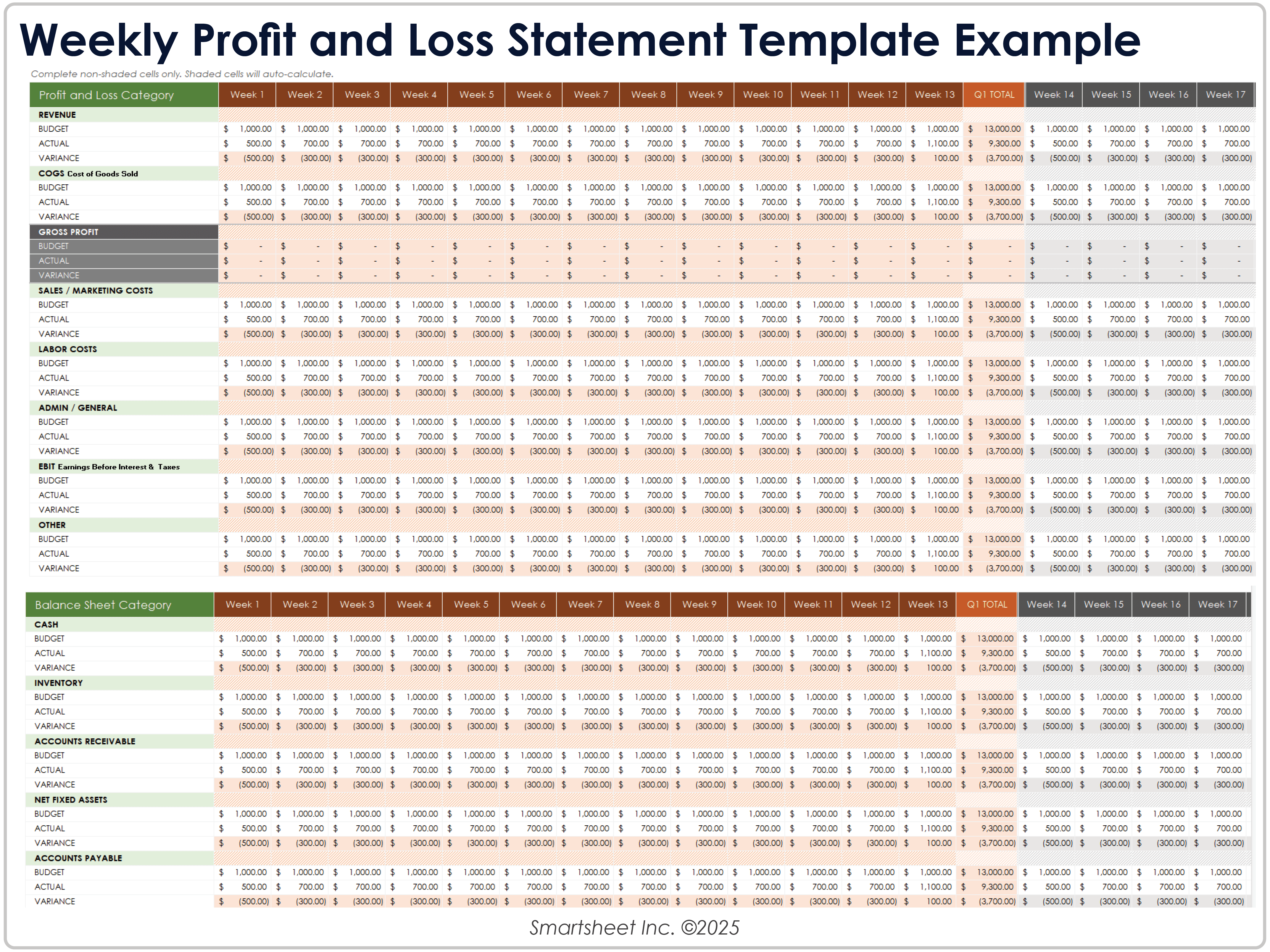

Weekly Profit and Loss Statement Template

Download Blank and Sample Versions of a Weekly Profit and Loss Statement Template for

Excel

| Google Sheets

When to Use This Template: Track your week-by-week budgeted revenue versus your actual revenue with this weekly profit and loss template.

Notable Template Features: This template’s detailed profit and loss category sections include revenue, COGS, sales, and marketing costs; labor and administrative costs; and earnings before interest and taxes (EBIT). Week-by-week columns provide you with more detailed insight into your profit and loss, and they can help you determine whether you need to reduce costs or increase revenue to boost your profits.

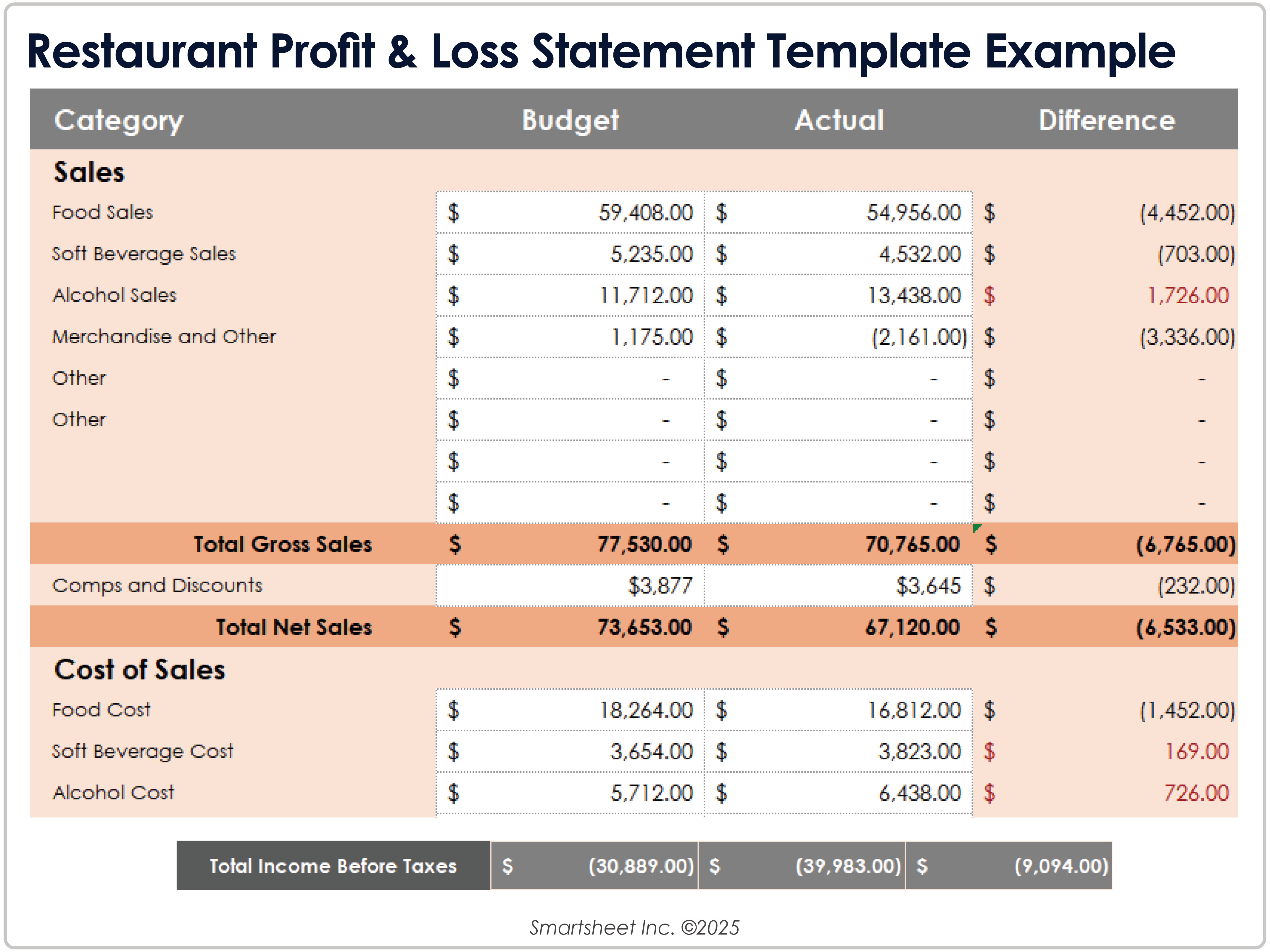

Excel Restaurant Profit and Loss Statement Template

Download the Restaurant Profit and Loss Statement Template for Excel

When to Use This Template: Use this restaurant profit and loss template to track food, beverage, and operational performance over a chosen time period. This template is designed to help independent restaurants, cafes, and other food businesses monitor profitability and control costs.

Notable Template Features: This template separates revenue by food, beverage, and merchandise categories. It organizes expenses into labor and operational sections, making it easy to analyze where your business spends the most. A built-in gross profit and net income summary gives quick visibility into financial health.

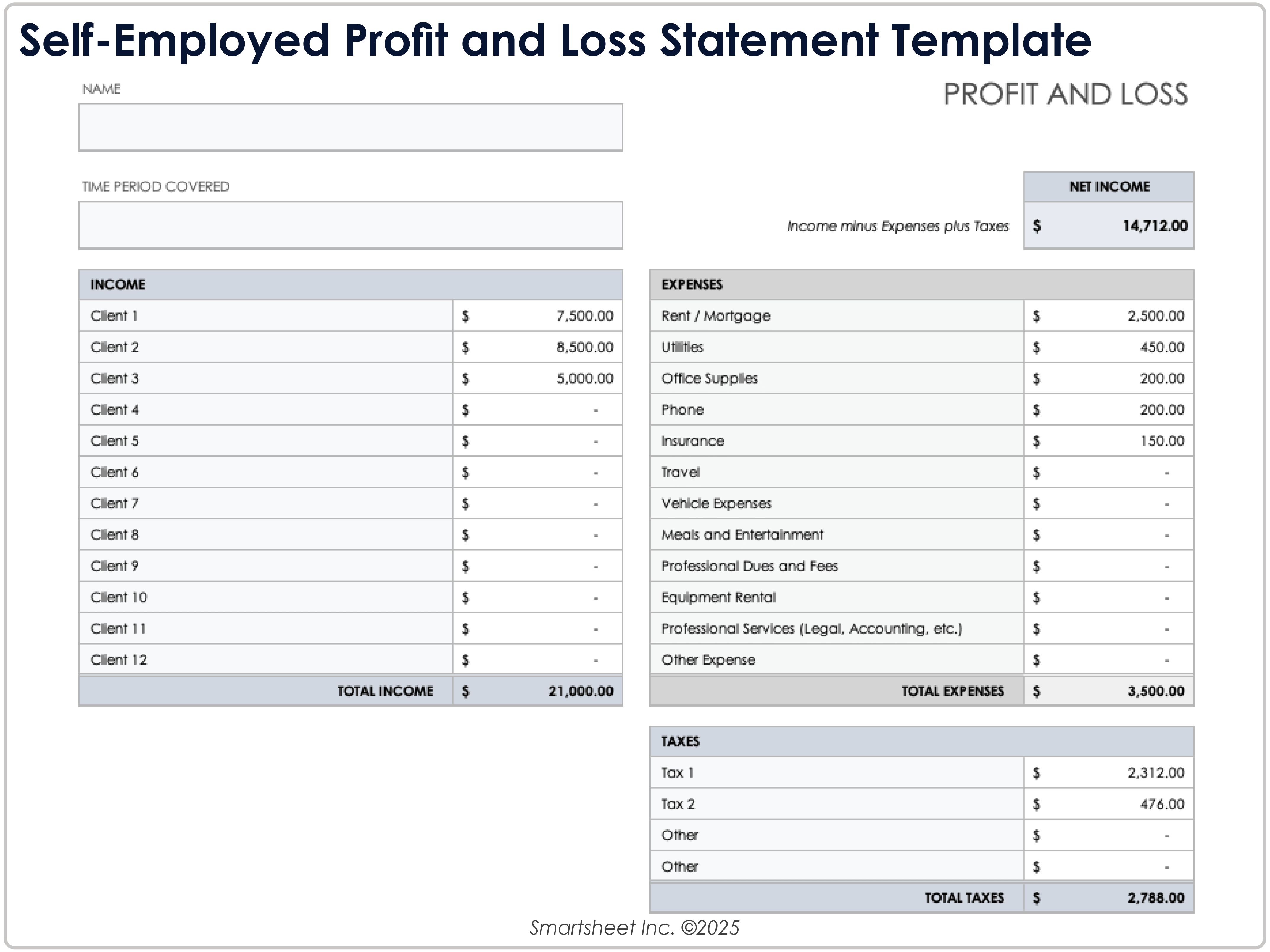

Self-Employed Profit and Loss Statement Template

Download a Self-Employed Profit and Loss Statement Template for

Excel

|

Adobe PDF

| Google Sheets

When to Use This Template: Use this self-employed profit and loss template to track income and expenses for freelance or contract work.

Notable Template Features: This template breaks down income by client and separates business expenses into categories, such as rent, insurance, and professional services. It includes a dedicated tax section to help calculate total expenses with taxes and final net income. A summary box at the top of the template displays your net profit.

Excel Pro Forma Profit and Loss Statement Template

Download Blank and Sample Versions of the Pro Forma Profit and Loss Statement Template for Excel

When to Use This Template: Use this pro forma profit and loss template to forecast business performance over multiple years. This template works well for startups, growing companies, and businesses preparing for investment, loans, or strategic planning.

Notable Template Features: This template provides a multiyear forecast of revenue, COGS, gross profit, and detailed operating expenses, which are broken down into selling or operating expenses and general expenses. It calculates net income before and after taxes, and accounts for extraordinary gains or losses for a comprehensive view of projected financial performance.

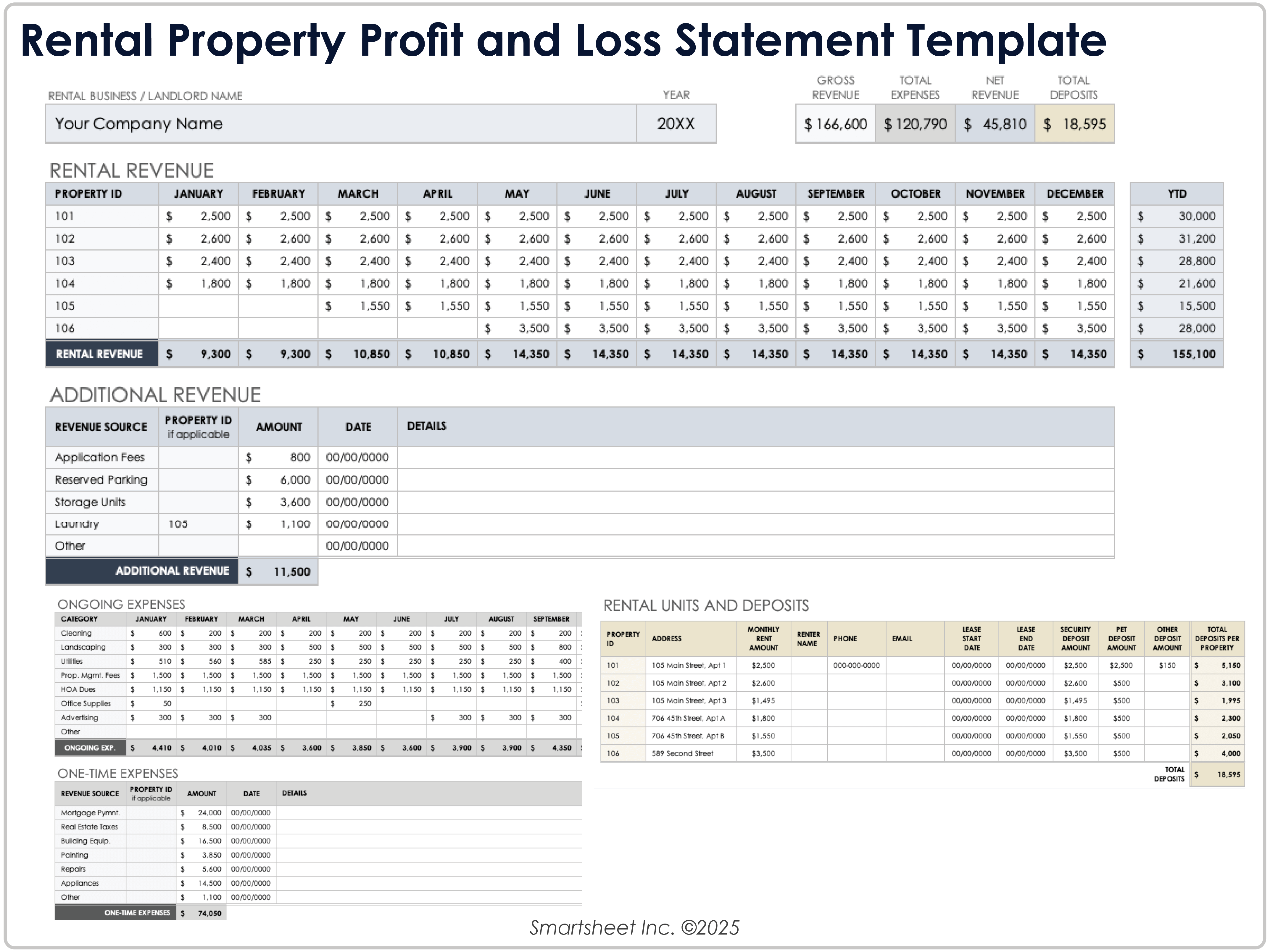

Excel Rental Property Profit and Loss Statement Template

When to Use This Template: Use this template to determine whether your rental revenue is exceeding the cost of maintenance and other expenses. This template also allows you to keep track of whether renters’ deposits need to be returned or can be kept as compensation once renters vacate the space.

Notable Template Features: This template lists rental revenue for each property, additional revenue (such as application fees, reserve parking, storage unit, laundry, etc.), and ongoing expenses. A dashboard-style tally shows your gross revenue, total expenses, and net income. In the Deposits tab, list all renter deposits, and the template will calculate totals in the Total Deposits field.

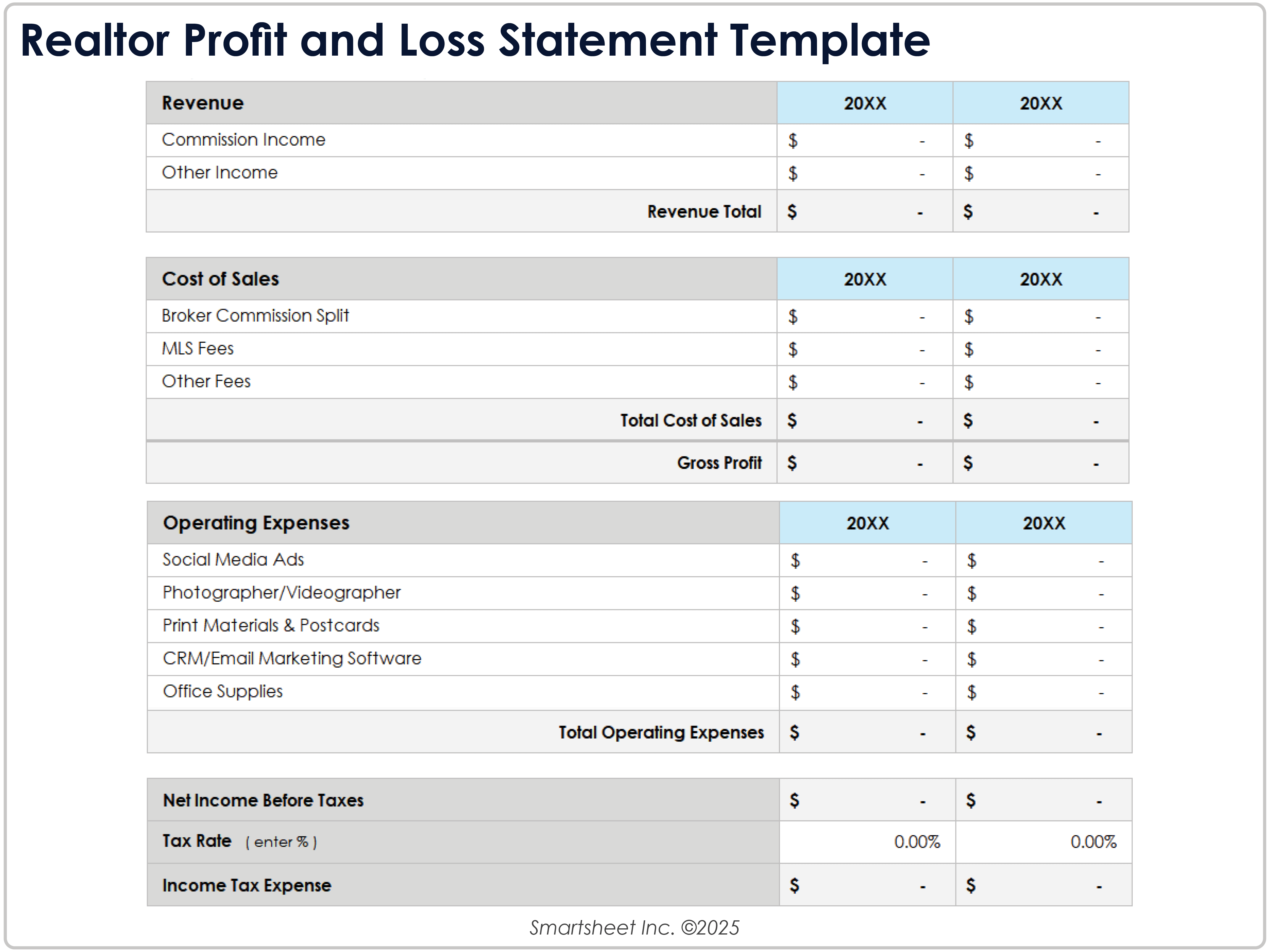

Realtor Profit and Loss Statement Template

Download a Realtor Profit and Loss Statement Template for

Excel

| Google Sheets

When to Use This Template: Use this profit and loss statement template for realtors to track annual business income, direct costs, and operating expenses over one year or more. The side-by-side yearly format also helps compare performance and identify trends.

Notable Template Features: This template organizes revenue into real estate commissions and other income, then subtracts direct costs such as broker splits and MLS fees to calculate gross profit. The template breaks down operating expenses into categories such as advertising, continuing education, and accounting fees. It also includes sections for tax rate, income tax, and net income.

Hotel Profit and Loss Statement Template

Download Blank and Sample Versions of a Hotel Profit and Loss Statement Template for

Excel

| Google Sheets

When to Use This Template: Use this hotel profit and loss statement template to track and evaluate financial performance across all revenue-generating areas of your property. Hotel managers or owners can use this template for detailed visibility into operations and profitability.

Notable Template Features: This template lists revenue categories such as guest rooms, food and beverages, and events, and it allows you to calculate net revenue after deducting sales returns and allowances. It also provides example items for direct hotel costs and operating expenses. The organized layout makes it easy to pinpoint where profit is earned and where money is spent to support decisions about pricing, staffing, and service offerings.

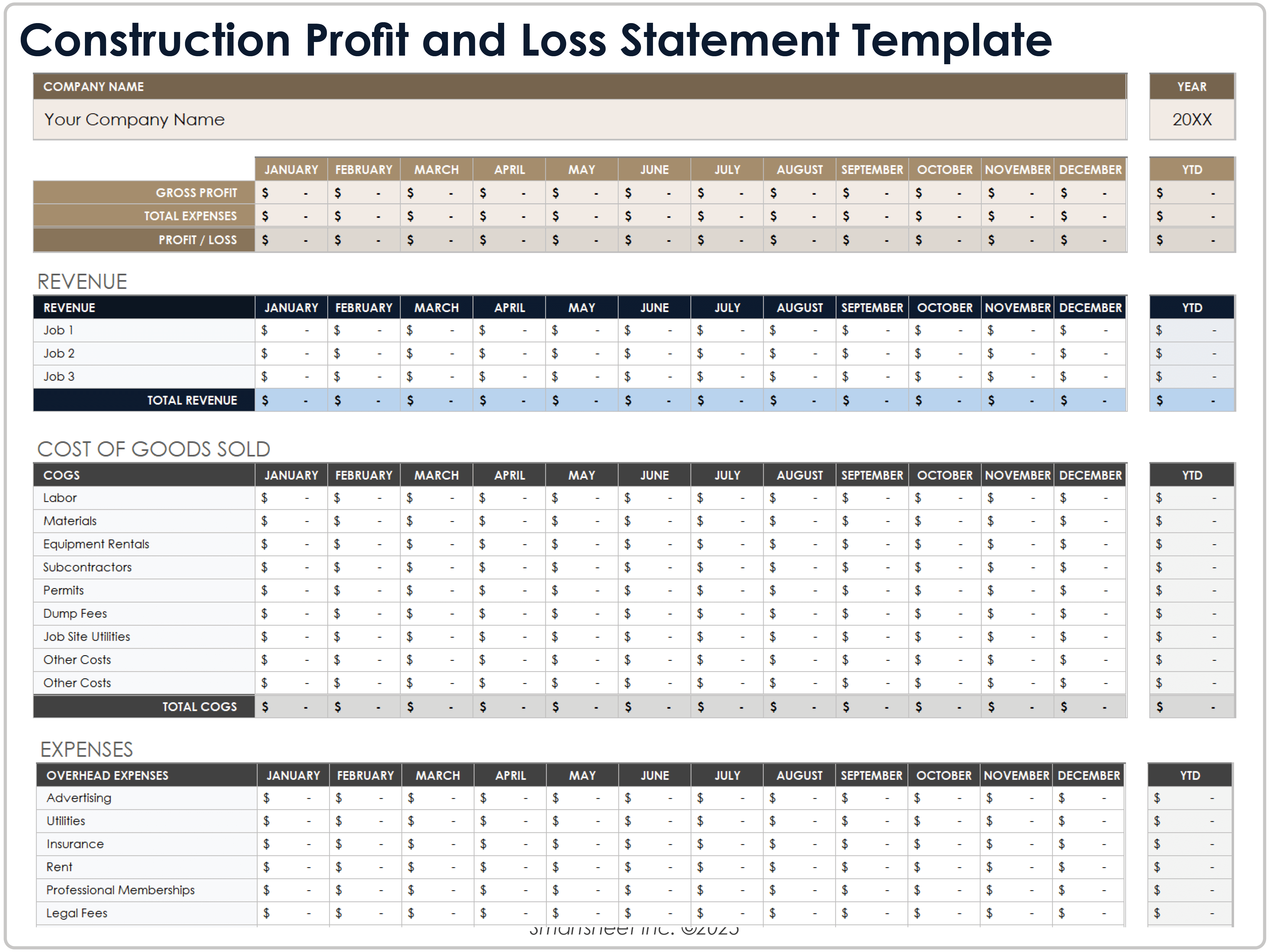

Construction Profit and Loss Statement Template

Download a Construction Profit and Loss Statement Template for

Excel

| Google Sheets

When to Use This Template: Assess your construction company’s profit and loss with this comprehensive template. Provide owners, construction financial managers, or other stakeholders with an accurate, month-by-month financial picture of your construction company’s total profits.

Notable Template Features: The template comes pre-filled with construction-specific costs, such as labor, materials, equipment rentals, subcontractors, permits, dump fees, etc. The template also provides sections for overhead expenses and taxes, and you can view monthly and annual totals at the top of the template for quick reference.

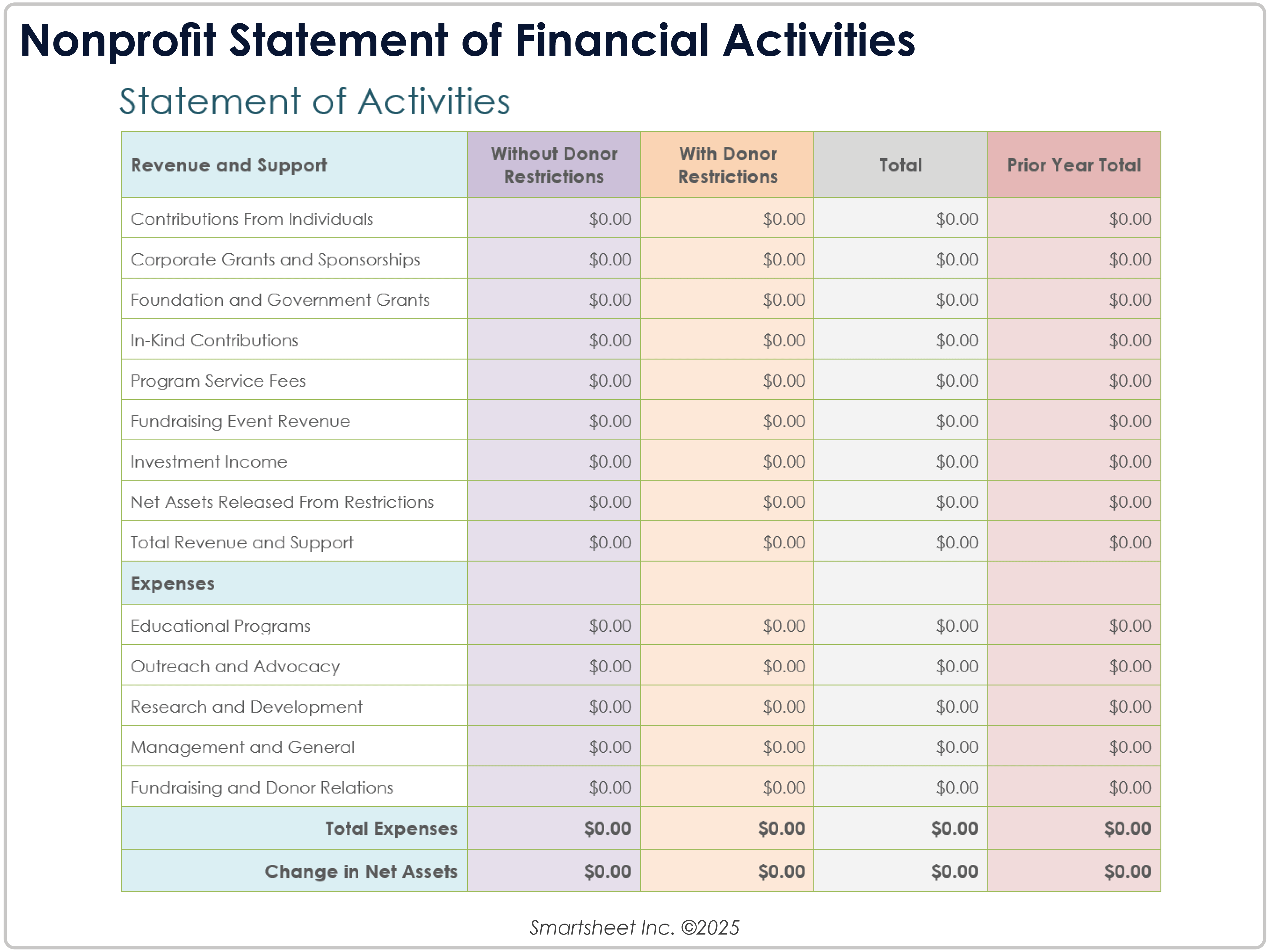

Nonprofit Statement of Financial Activities Template

Download a Nonprofit Statement of Financial Activities Template for

Excel

|

Microsoft Word

When to Use This Template: Use this nonprofit statement of activities template for annual reporting, board presentations, grant applications, or tax preparation. Nonprofits of any size can use this template to demonstrate financial accountability and program impact.

Notable Template Features: This template separates revenue and expenses by donor restriction and includes a prior year total column for comparison. The Excel version of this template calculates total support and programmatic spending while showing the net change in assets to give leadership and funders a complete picture of financial health. The layout is easy to edit, customize, and integrate into professional reports or audit packages.

What Is a Profit and Loss Template?

Businesses use profit and loss (P&L) templates to list revenue and expenses to determine profitability. Use a P&L template to calculate your net income (gross income minus expenses), and whether you need to increase income or reduce costs.

Whether a business sells goods or provides services, a P&L statement can help determine how it has been performing in the past and predict how it may perform in the future. For new businesses, a profit and loss statement will give you a good idea of how things are going. Regardless of the type of business, the first step is to determine the period of time to be evaluated — this is usually a quarter but can be a month, a year, or even a week.

P&L statements are typically prepared by owners or accountants, and used by owners, officers, and shareholders to get a feel for the state of the business. A P&L statement can also give potential investors or buyers a quick view of the state of the business.

Individuals can also use a profit and loss template to track their personal expenses and income so they know if they are saving money or spending more than they make.

While P&L templates may vary, most include the following components:

- Company Name: Enter the name of your company.

- Statement Reporting Period: Select a reporting period for the P&L statement (e.g., weekly, monthly, quarterly, annually, etc.).

- Revenue: List all sources of revenue (e.g., sales, dividends, interest, rent, etc.) and the associated monetary amounts.

- Gross Revenue: List and review your gross revenue.

- Cost of Goods Sold: Enter the cost of goods sold by your company. This figure includes materials and labor costs, but excludes indirect expenses, such as sales and distribution costs.

- Gross Profit: Review your gross profit (i.e., your gross revenue minus COGS) for accuracy.

- Expenses: Itemize all of your expenses (e.g., wages and benefits, rent or mortgage, utilities, office supplies, etc.).

- Total Expenses: Add up all your itemized expenses to find your total expenses.

- Net Income: Calculate your net income by subtracting your total expenses from your gross profit.

Additionally, some more advanced P&L templates include the following additional components:

- Reductions: Enter any less sales returns, less sales discounts, or less cost of goods sold related to inventory, which will affect inventory costs (e.g., shipping, handling, insurance, etc.).

- Net Sales: To calculate net sales, subtract any discounts, allowances, or returns from your gross sales amount.

- Cost of Sales: List the total of all the costs accrued by selling your products or services.

- Tax Rate: Enter the tax rate your organization pays on its earned income.

- Taxes: Itemize your expenses related to taxes to determine your true net income after taxes. Doing so helps you estimate your organization’s income tax liabilities.

Once you’ve completed these steps, you’ll see your net profit or loss.

Additionally, note that operating income can be determined by subtracting gross profit from total expenses, and that operating expenses can be determined by adding all expenses.

For more resources, see our selection of financial planning templates and business plan templates.

How to Make a Simple Profit and Loss Statement

To make a simple profit and loss statement, list all sources of income, then subtract the cost of goods sold to calculate gross profit. Next, subtract operating expenses such as rent, wages, and utilities. The result is your net income, showing your business’s profit or loss.

Learn how to build a profit and loss statement using a template and find important formulas and tips to get started.

Optimize Your Company’s Financial Health With Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.