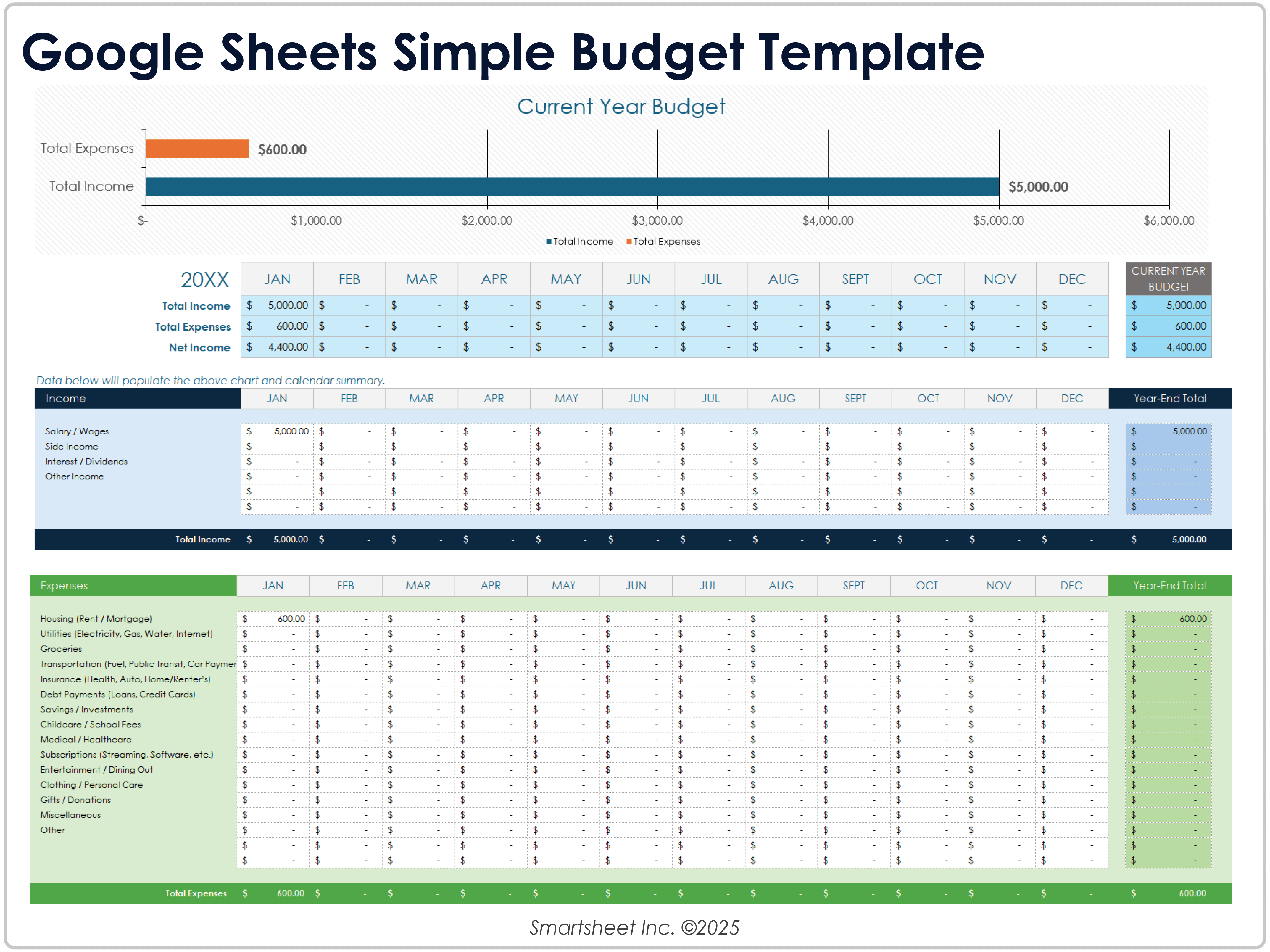

Google Sheets Simple Budget Template

Download the Simple Budget Template for Google Sheets

When to Use This Template: Use this simple budget template to track monthly income and expenses in a clear, accessible format. It’s a great tool for building cash flow awareness and can help you avoid overspending.

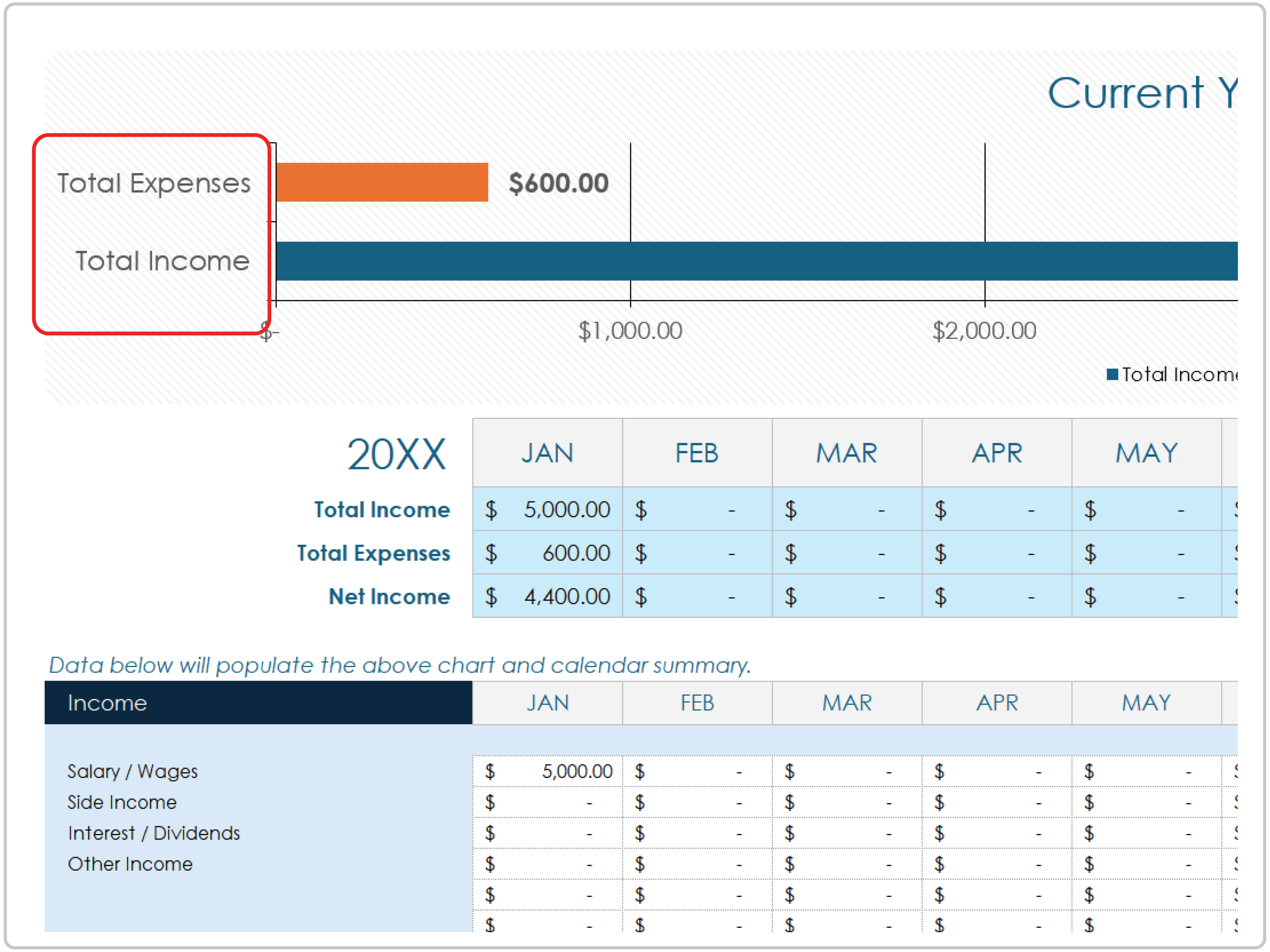

Notable Template Features: This template displays monthly total income, expenses, and net income data in the top section. It also features a bar chart where you can visualize a comparison between income and expenses.

Check out this collection of Excel budget templates to help you track income and expenses, save time, and meet financial goals.

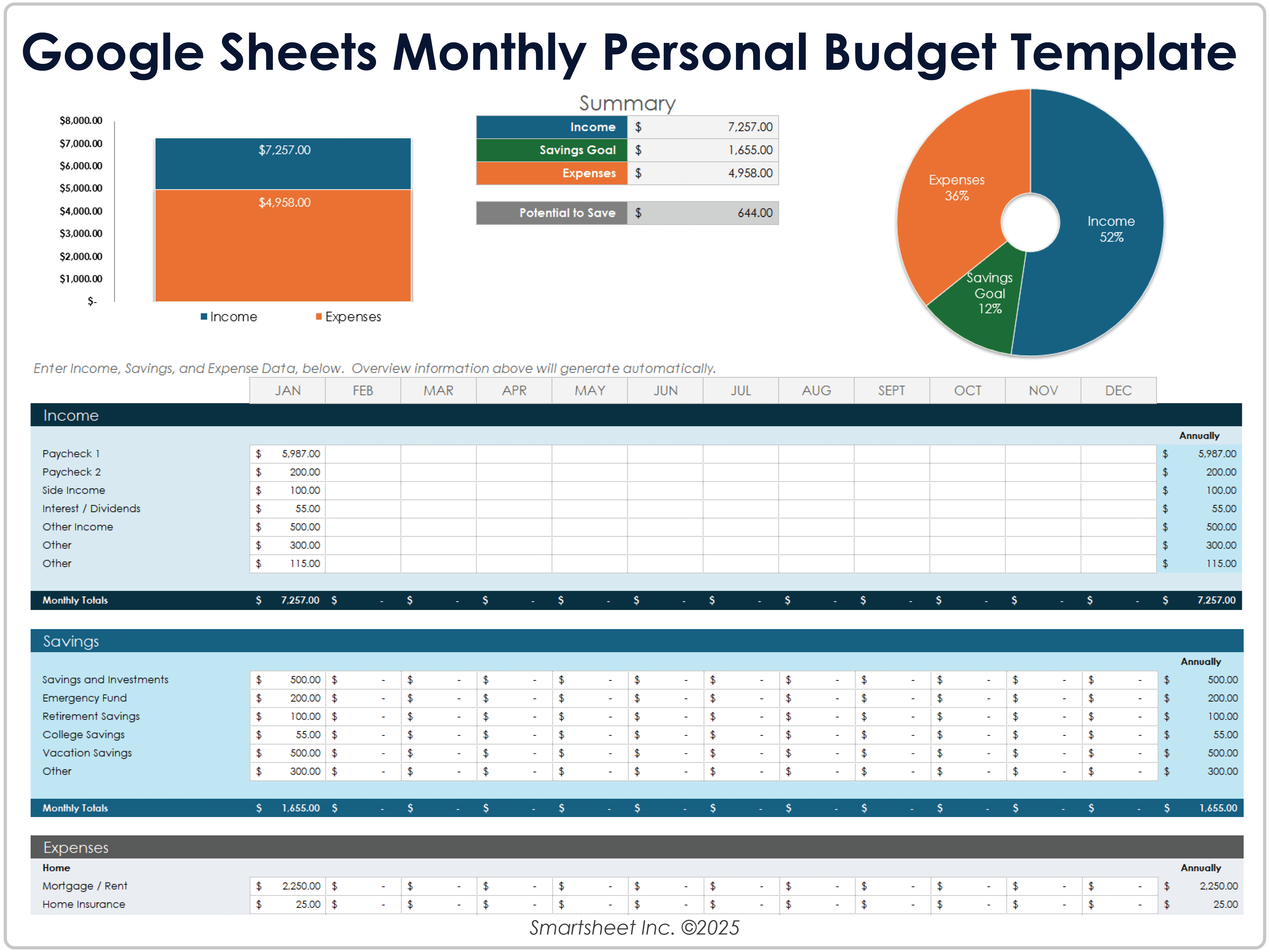

Google Sheets Monthly Personal Budget Template

Download the Monthly Personal Budget Template for Google Sheets

When to Use This Template: Use this personal budget template to plan and track monthly finances for a year. It also works well to manage variable income and expenses and establish consistent budgeting habits.

Notable Template Features: This template tracks and calculates monthly and annual expense totals for categories from home and transportation to entertainment, recreation, and family. It also includes a Savings section, where you can enter and track recurring and specific monthly amounts.

Check out these free business budget templates to help you manage financial resources and track expenses to align with business goals.

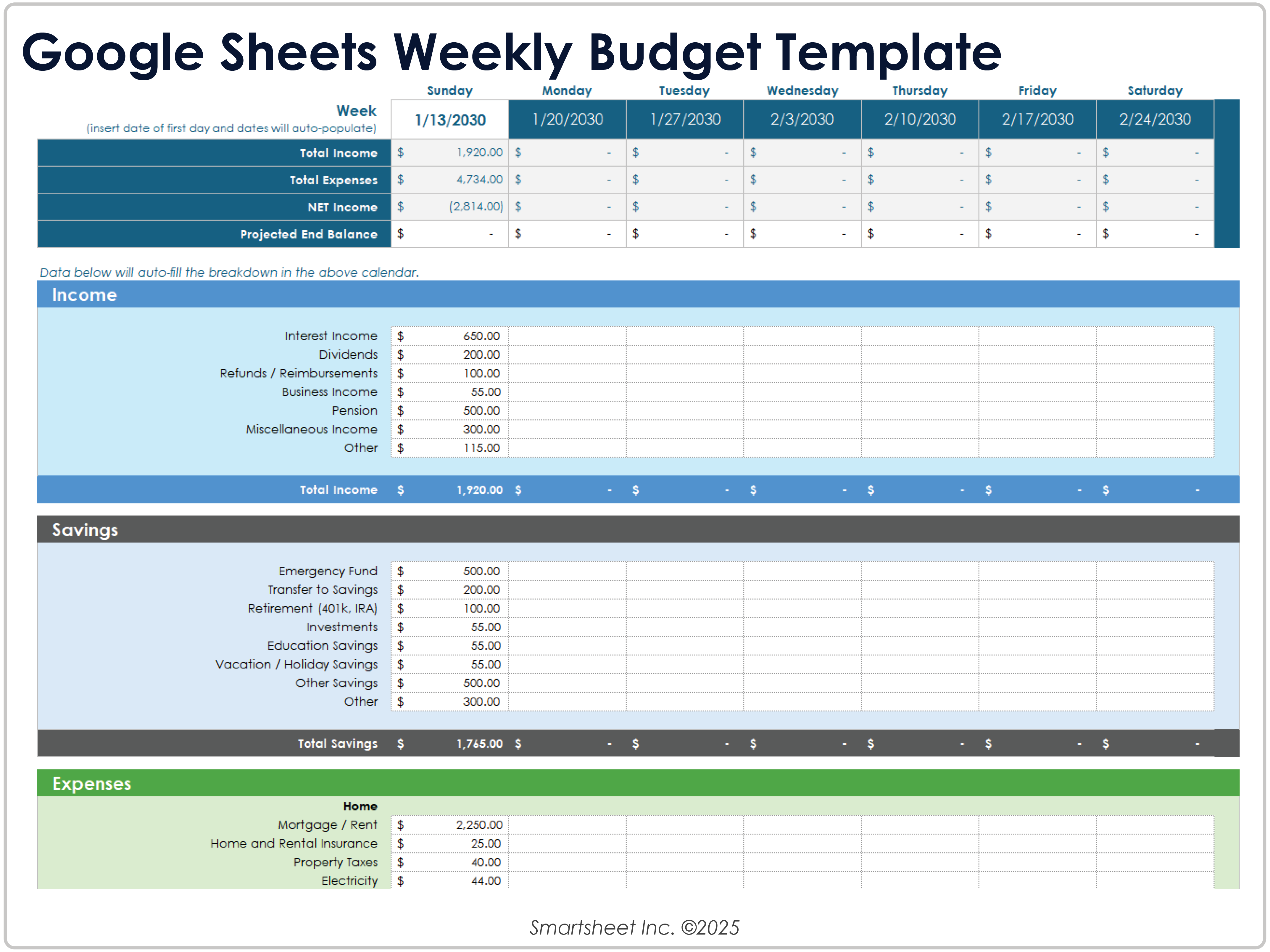

Google Sheets Weekly Budget Template

Download the Weekly Budget Template for Google Sheets

When to Use This Template: This budget template is ideal for users with variable pay schedules, hourly wages, and freelance income to plan and track short-term spending. Use it to manage your weekly budget.

Notable Template Features: The Income, Savings, and Expenses sections allow you to enter and track budget categories across 13 weeks. The top section shows income, expenses, and net income totals for weekly data.

Check out these business budget templates for Google Sheets to help you organize, manage, and track income and expenses and streamline budget processes.

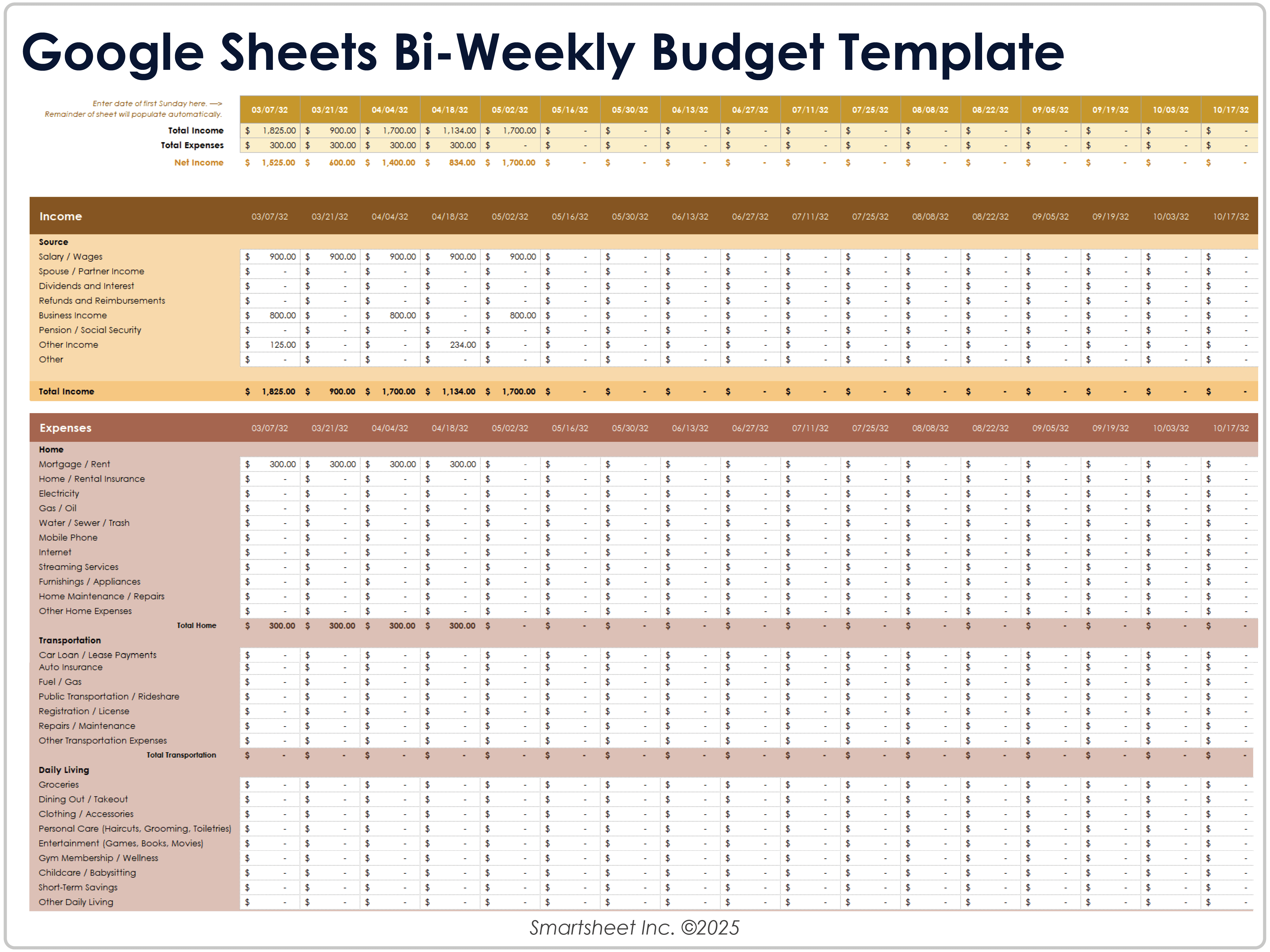

Google Sheets Bi-Weekly Budget Template

Download the Bi-Weekly Budget Template for Google Sheets

When to Use This Template: This template is ideal for bi-weekly budgeting with variable expenses. Use it to manage your budget over two-week periods, maximize cash flow, and avoid shortfalls.

Notable Template Features: The template features a Current Budget Total column that calculates totals across 18 bi-weekly date columns for all income and expenses. Expenses subheadings include Transportation, Entertainment, and Health.

Gain greater control over your financial health and improve accountability by leveraging various features available in this business budget management software.

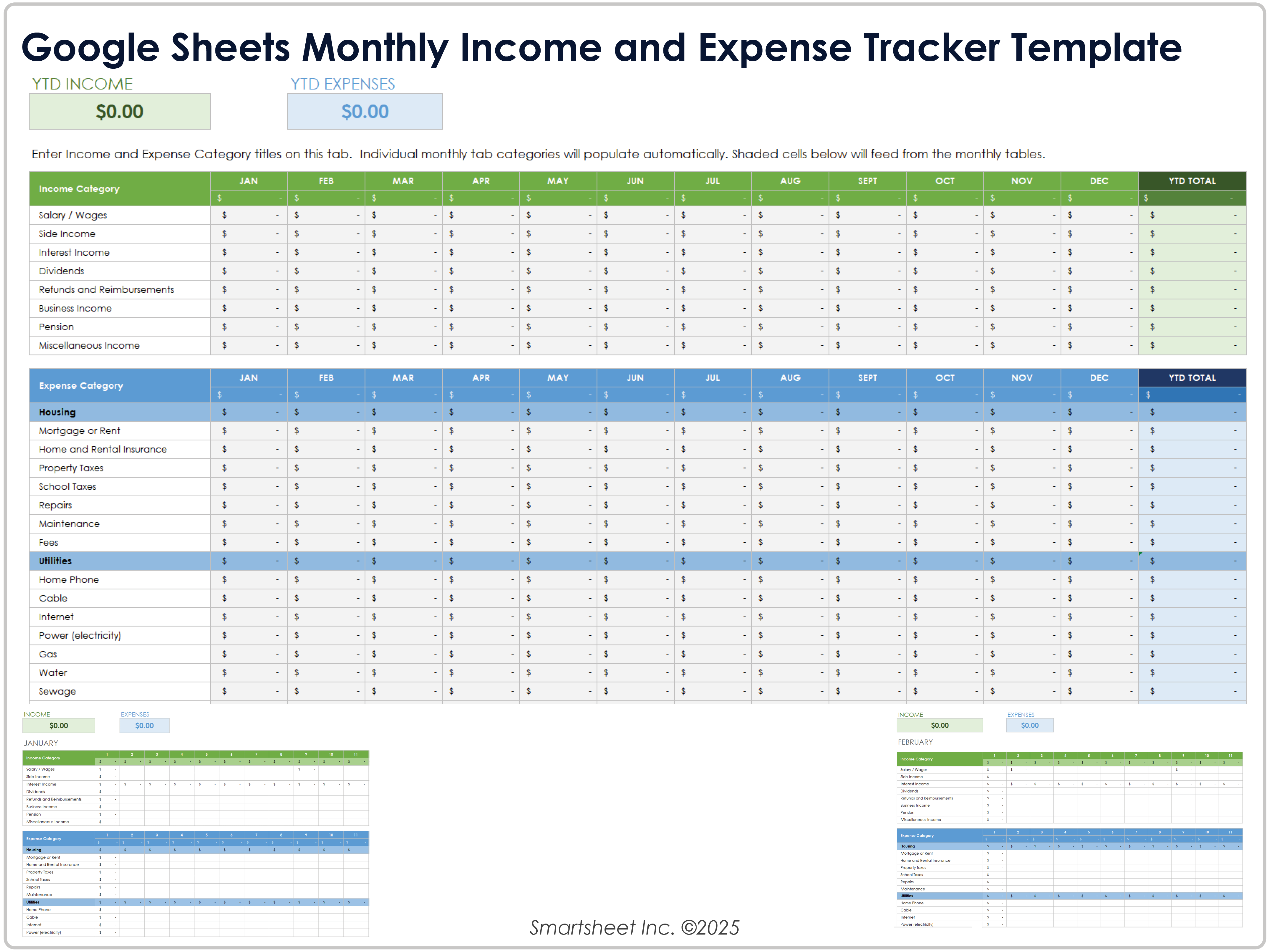

Google Sheets Monthly Income and Expense Tracker Template

Download the Monthly Income and Expense Tracker Template for Google Sheets

When to Use This Template: This template provides clear and simple monthly income and expenses tracking. Use it to create spending awareness and gain control over your total income and expenses.

Notable Template Features: This template features separate sheets for each month of the year. The Income Category and Expense Category sections allow you to record and track monthly line items with a total column following the end of the month.

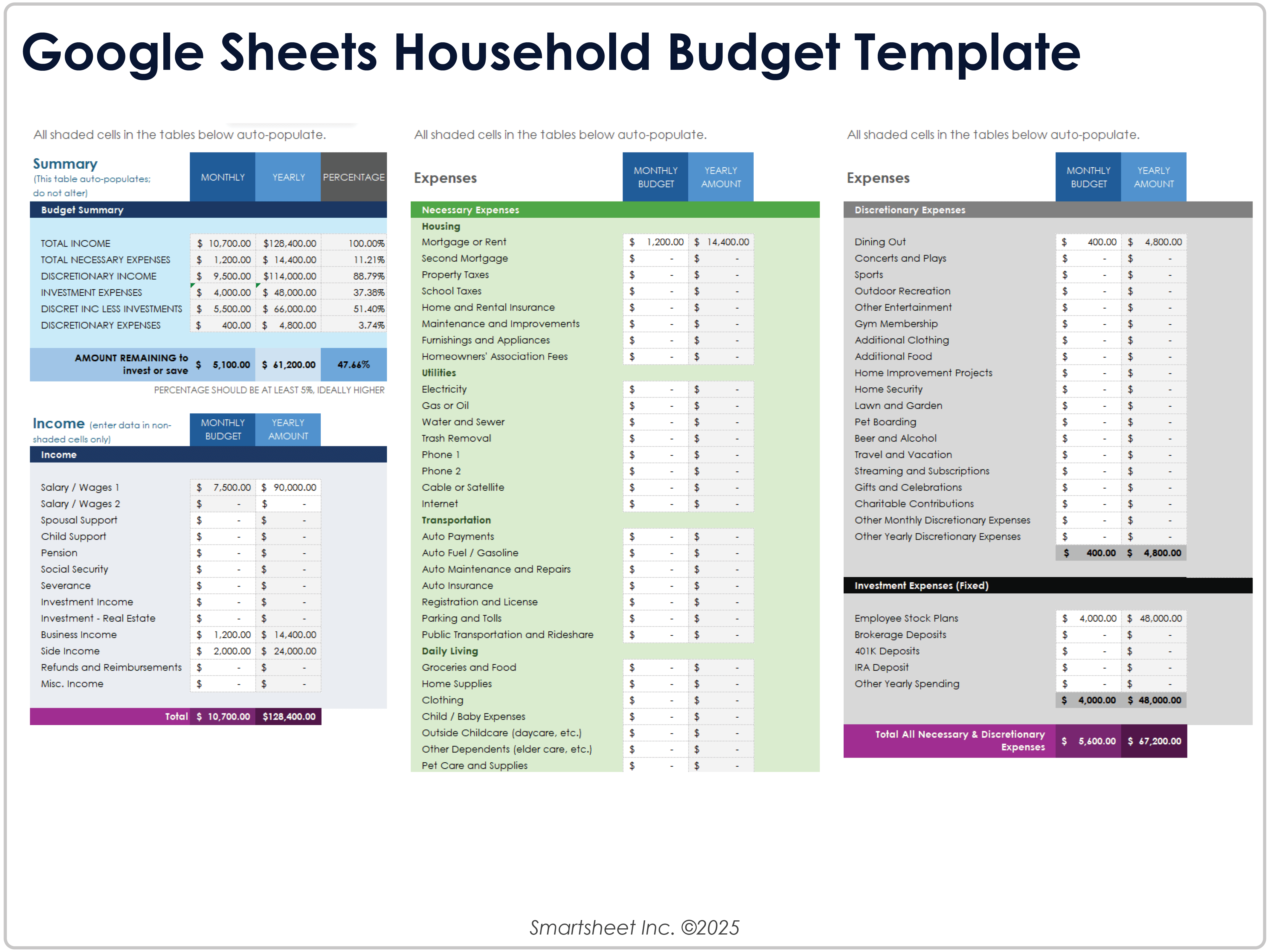

Google Sheets Household Budget Template

Download the Household Budget Template for Google Sheets

When to Use This Template: This template is ideal for planning and managing a comprehensive household budget, especially with multiple incomes and specific expense categories.

Notable Template Features: This template features Necessary Expenses, Discretionary Expenses, and Investment Expenses sections for entering individual budget figures. The Budget Summary section at the top of the template provides real-time monthly and yearly income and expenses totals.

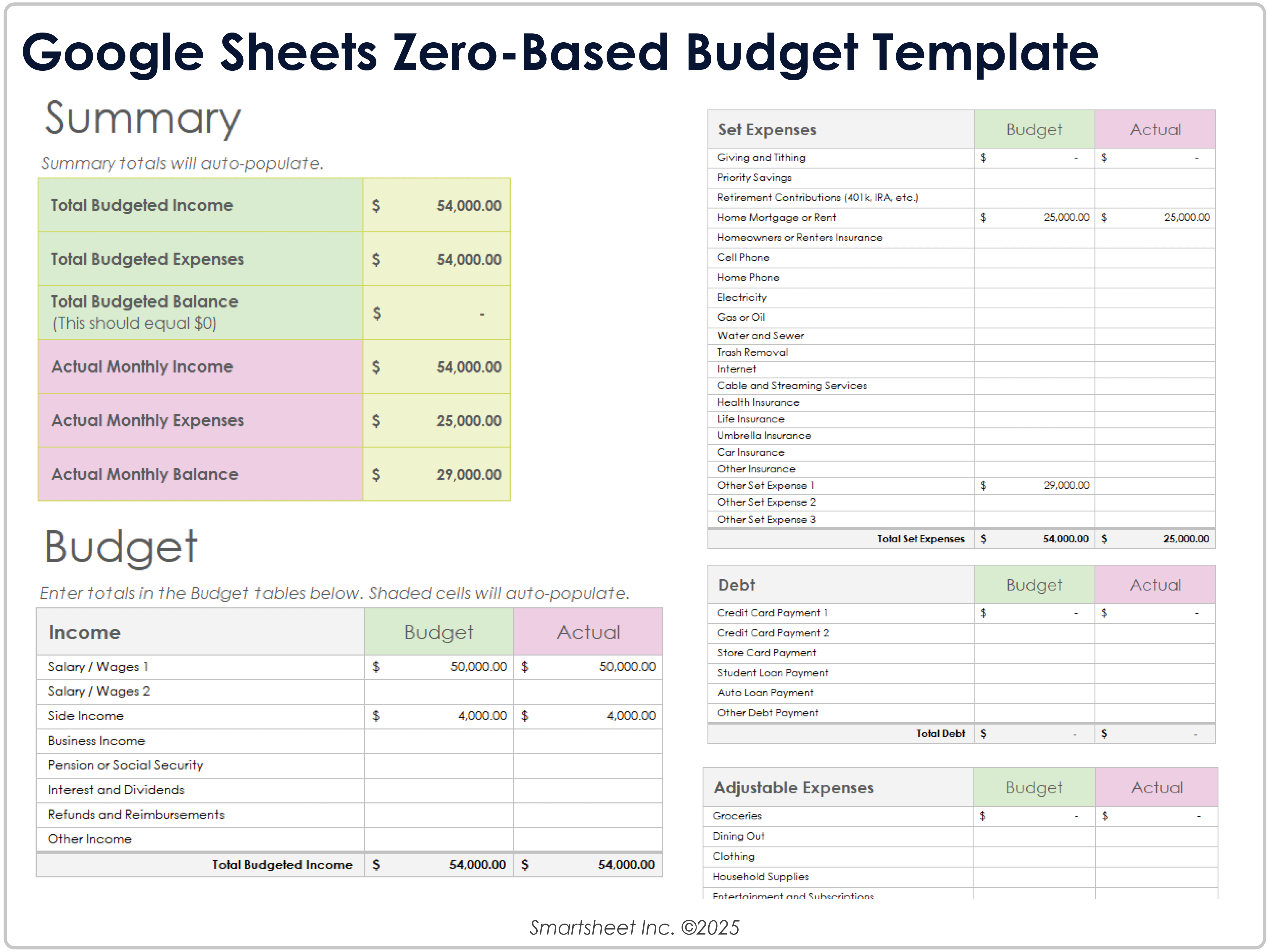

Google Sheets Zero-Based Budget Template

Download the Zero-Based Budget Template for Google Sheets

When to Use This Template: Use this zero-based budget template to align spending precisely with income. It is ideal for separating and categorizing expenses, savings, and debts.

Notable Template Features: This template has fields for assigning income amounts to specific categories for the month. The Total Budget Balance and Actual Monthly Balance rows show whether planned and actual spending meet the zero-based budget goal.

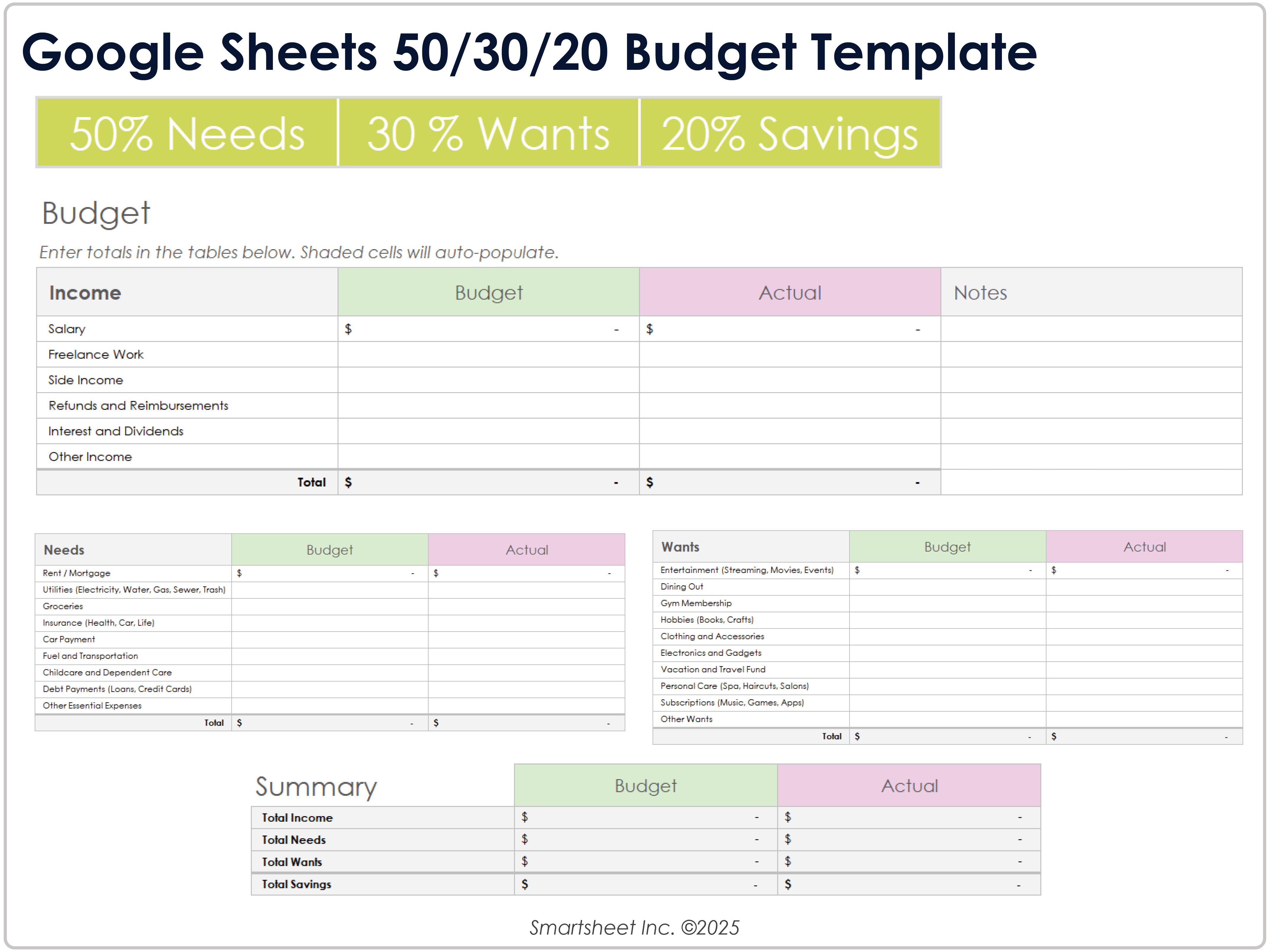

Google Sheets 50/30/20 Budget Template

Download the 50/30/20 Budget Template for Google Sheets

When to Use This Template: This template provides a simple budgeting framework to balance needs, spending, and savings. It’s a great tool to visualize how your finances align with the 50 percent needs, 30 percent wants, and 20 percent savings structure.

Notable Template Features: The Needs, Wants, and Savings sections allow you to categorize and balance your spending. This template includes Budget and Actual columns for all budget items to help align these figures with the 50/30/20 percentages.

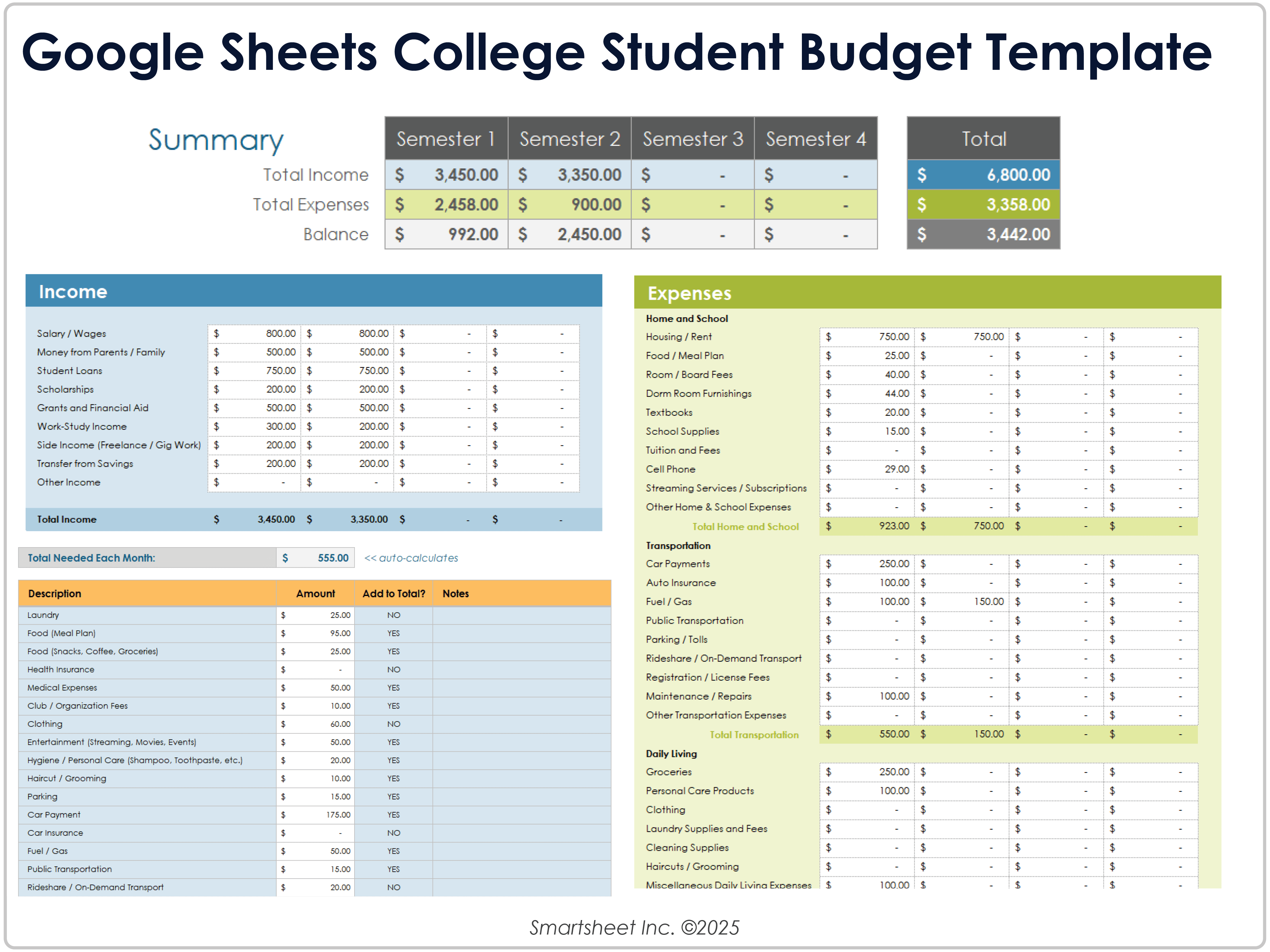

Google Sheets College Student Budget Template

Download the College Student Budget Template for Google Sheets

When to Use This Template: Use this template to plan and manage a college student-based budget. It helps students balance variable incomes and expenses for the academic year.

Notable Template Features: This template features a four-semester summary section to list total income, expenses, and balance data. It also includes a College Expense Estimator sheet, which you can use as a checklist for adding line items to the budget.

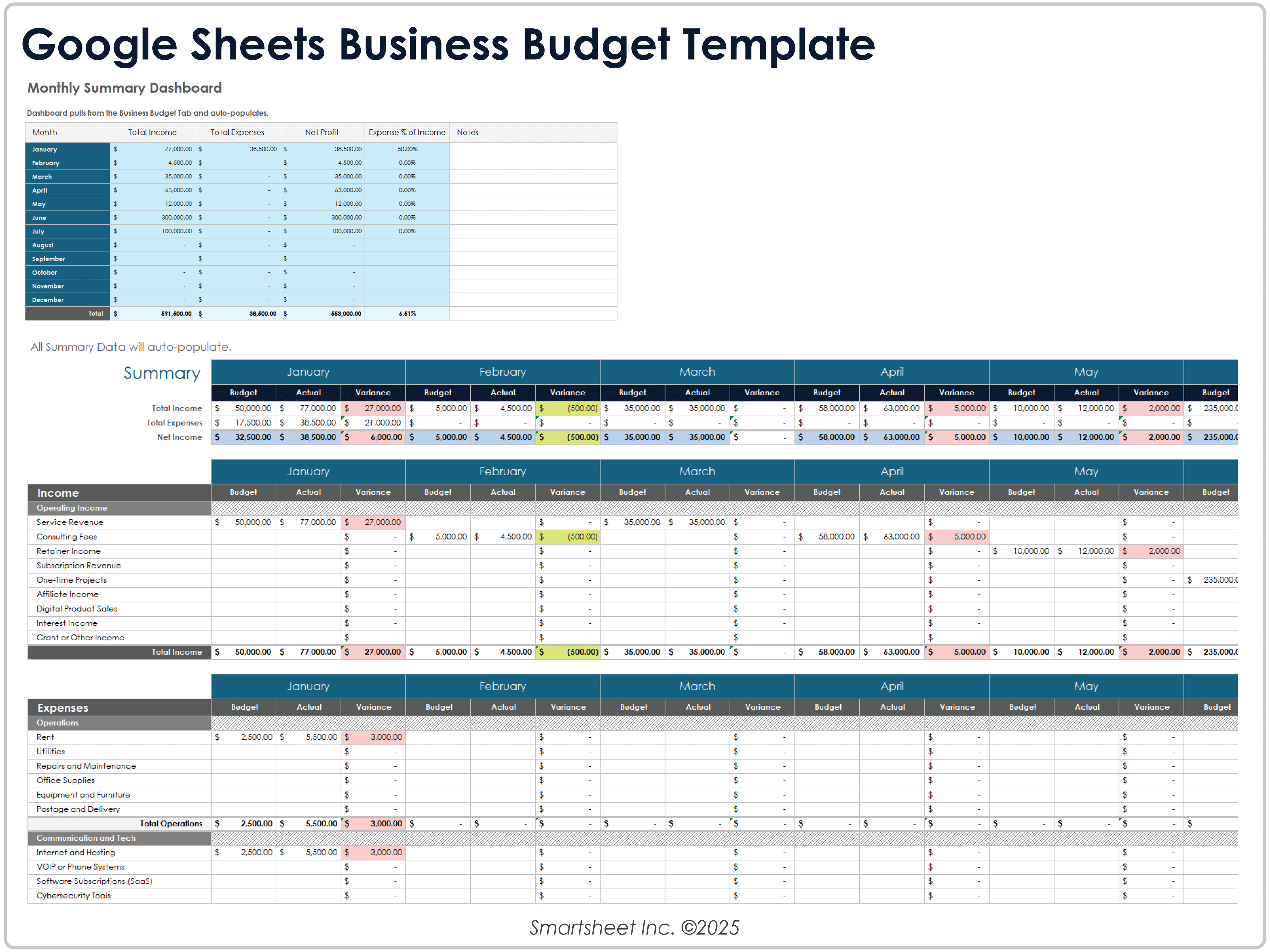

Google Sheets Business Budget Template

Download the Business Budget Template for Google Sheets

When to Use This Template: Use this business budget template to manage and track yearly income and expenses. It is ideal for operations and resource management personnel who don’t have a dedicated finance team.

Notable Template Features: Use the template rows to list and track budget and actual data for income and expenses. The summary section at the top of the template shows the totals for all monthly budgets and actual income and expenses.

Advantages of a Google Sheets Budget Template

Use a Google Sheets budget template to make managing income and expenses faster, more straightforward, efficient, and flexible. Templates save time with built-in tools, and they work from any device. Stay on track without advanced skills, extra software, or setup.

Below are some key advantages of Google Sheets budget templates:

- Live Updates Across Devices: Because Google Sheets is cloud-based, any changes you make on the templates are saved and visible immediately across all devices.

- Automatic Calculations: Built-in formulas add, subtract, and total amounts for you, so you don't need to do it manually. This saves time and cuts down on human error.

- Custom Layouts: Add, delete, or move rows and columns to meet your budget needs.

- Easy Sharing: Share your budget with others using a live link to collaborate and share real-time updates.

- Clear Charts and Totals: Visuals update as you go, so you can see where your money is at a glance.

How to Create a Budget Template in Google Sheets

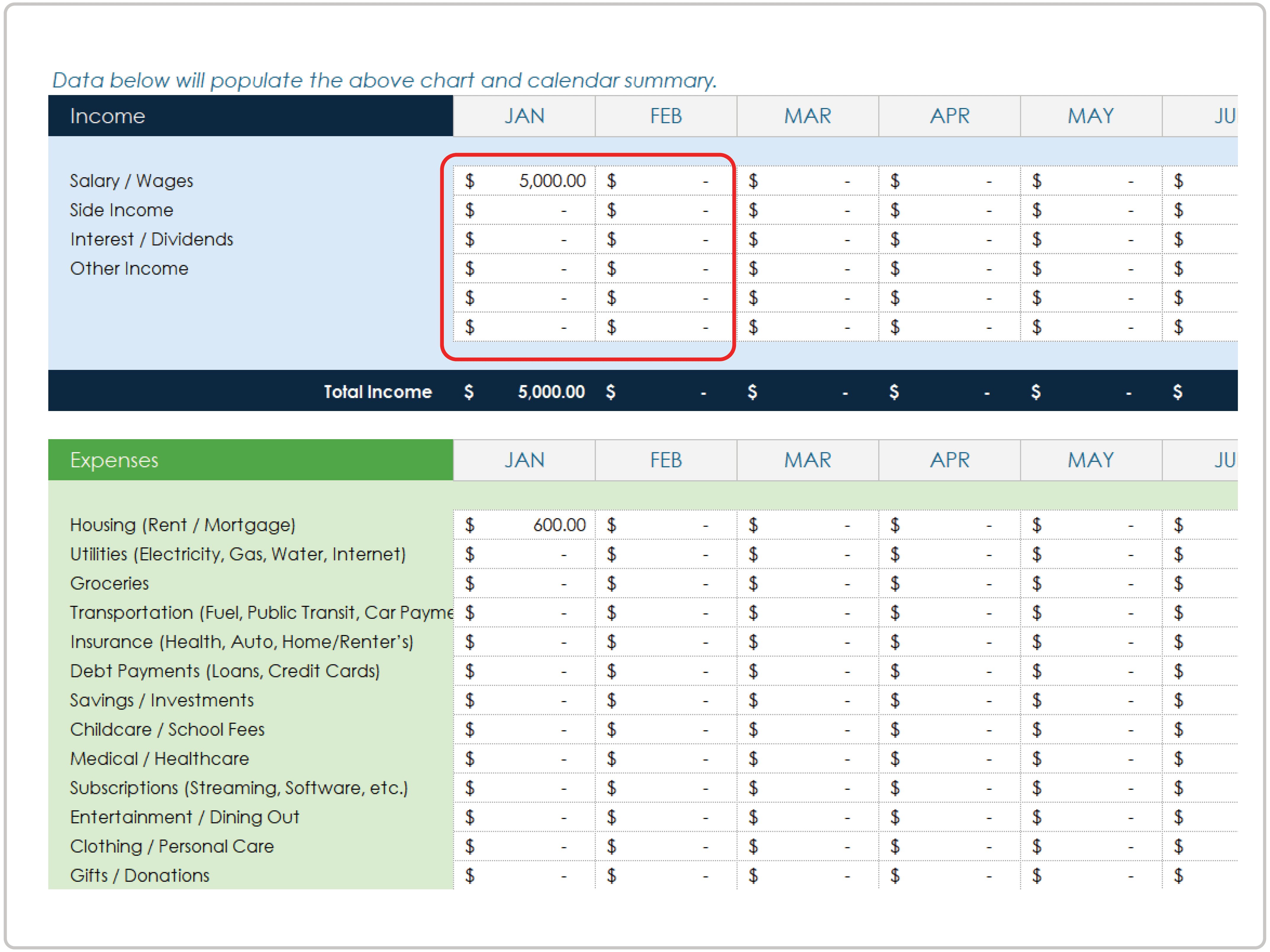

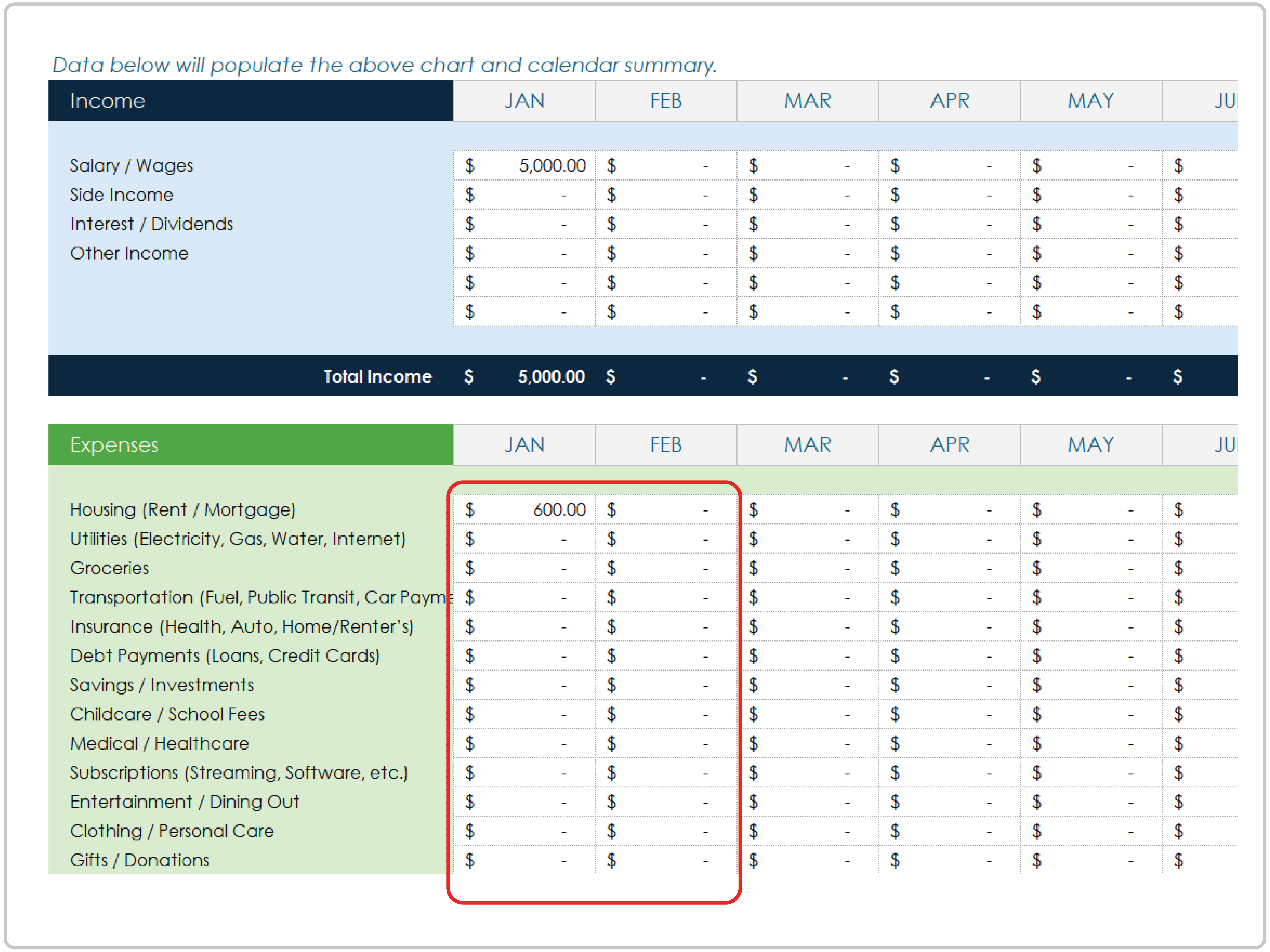

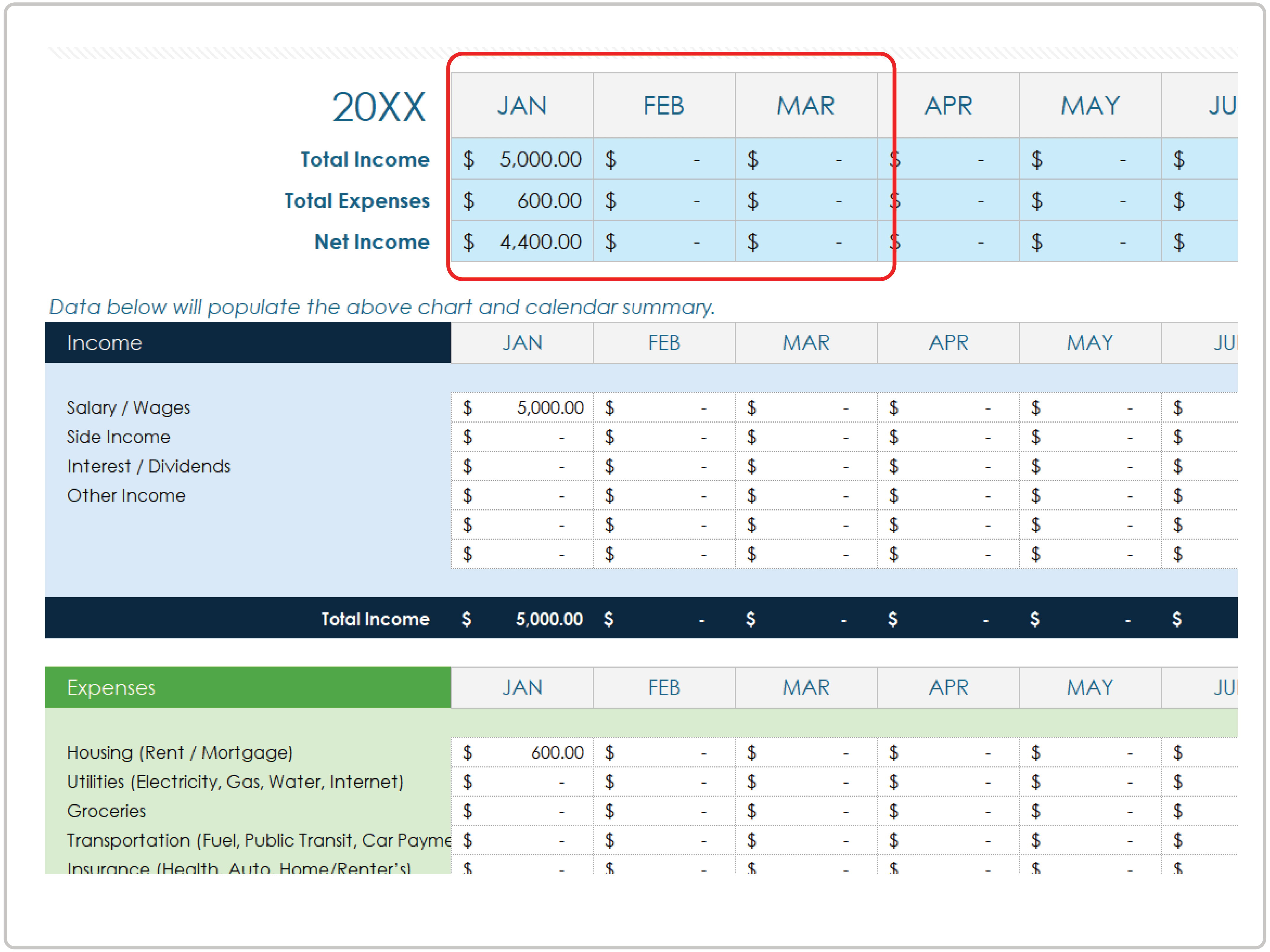

You can use a template to set up a monthly budget in Google Sheets. Enter your income and expenses, and the sheet automatically calculates totals and displays a chart comparing your current income and expense totals.

Below, you'll find a step-by-step guide to create a personal budget using a template in Google Sheets:

- Open the simple budget template in Google Sheets.

- In the Income section, enter your monthly income amounts per source.

- Scroll to the Expenses section and enter your monthly expenses per line item.

- Find the monthly Total Income, Total Expenses, and Net Income rows near the top of the sheet in the monthly columns. These values update automatically based on the numbers you enter.

- View the Total Income, Total Expenses, and Net Income rows for real-time yearly totals in the last right-hand column.

- See a visual comparison of your income and expenses at the top of the sheet. The Current Year Budget chart updates automatically as you enter your budget amounts.

Effectively Manage Personal Budget With Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.