What Is a Cash Flow Forecast?

A cash flow forecast provides estimates of a company’s future revenue and expenses. The forecast shows the cash a company will have on-hand at various future dates and is a vital financial document for any company.

In a cash flow forecast, “cash” refers to funds that are easily available and spendable — this includes money in checking and savings accounts, as well as other funds that you can quickly convert into cash to spend.

A simple cash flow forecast might take a few hours to create, and then about an hour to update, which you should do periodically.

Here are some primary ways a cash flow forecast can add value to your company:

- Liquidity Management: The forecast provides insight into how much cash a company will have on hand to pay upcoming bills.

- Interest and Debt Reduction: Understand when your company can use available cash to pay down debt (this can reduce the credit card or loan interest the company has to pay).

- Half-Year or Full-Year Reporting: Gain insight into what your company’s six-month and full-year financial reports will look like.

- Overall Performance Gauging: Use the forecast to help determine whether revenue and cash flows are above or below expectations. These assessments can guide you in making any necessary changes.

- Long-Term Planning: Longer-term forecasts can help with your company’s three-year planning (or longer).

Cash Flow Forecast Challenges and Pitfalls to Avoid

Cash flow forecasting can present challenges if not done correctly. Pitfalls to avoid include using imprecise financial numbers or failing to perform regular cash flow forecasts at all.

Here are details on those and other challenges and pitfalls to avoid:

- Using Imprecise Financial Figures: In 2014, Kyriba, a company that offers cloud-based treasury management software, surveyed more than 200 financial professionals at companies. The survey found that only 32 percent of these employees thought their cash flow forecasts were mostly “accurate.”

About 53 percent said their forecasts had “significant” variance. Eight percent said their forecasts were “very inaccurate, with major variances.”About two-thirds — 65 percent — of those respondents said the primary reason for the inaccuracy was they didn’t have the needed “visibility” into the financial numbers that the forecast needed and used. Sometimes this occurs because of poor communication between the departments who supply figures and the department creating the forecast.

So, when the financial experts don’t have solid numbers, they make imprecise guesses, which leads to forecasts that can be significantly wrong. - Having Difficulty in Forecasting Accounts Payable and Accounts Receivable: Companies need solid estimates of these items on the balance sheet in order to create a strong cash flow forecast.

- Being Overly Optimistic about Future Revenues: We all believe that sales will improve in the next quarter, and improve even more in the quarter after that. But a cash flow forecast is useless if it’s not based on hard realities. Be accurate and realistic about your data — using rosy scenarios for revenue will only cause major problems when those forecasts don’t materialize. Worse, you won’t have money to pay your bills.

- Not Properly Documenting Your Current Financial Activities: Past revenue and expenditures help you accurately predict future cash flow.

- Not Performing a Cash Flow Forecast at All: Some of the above problems may make you avoid performing cash flow forecasts. Or, you may think they are unnecessary because your company is performing well and isn’t showing obvious cash flow problems. However, every company should do cash flow forecasts — even the most successful companies have cash flow variances that can cause problems if they aren’t addressed.

Potential Effects of Not Performing Proper Cash Flow Forecasting

Companies that don’t periodically perform cash flow forecasting often experience cash flow surprises. Those occurrences can cause problems in paying bills or require companies to find cash through financing with high interest rates.

In fact, these problems often cause more than inconvenient surprises. In 2018, a CB Insights study that analyzed 101 startup failures revealed that running out of cash was the second most common cause of business failure — about 29 percent of businesses failed for that reason.

Benefits of a Cash Flow Forecast

Cash flow forecasts provide a number of benefits. They help a company plan for periods when cash will be low, or when it might need financing. Forecasts also offer insight into the effects of sales programs or other business changes.

Here are some benefits of a cash flow forecast:

- Manage Cash Flow: The forecast will show the times when your company will experience surpluses or shortages of cash.

- Analyze Effects of Changes: A forecast can reveal the results of changes in sales strategies or the potential results in hiring a new employee or switching a supplier.

“It’s really important, when you’re growing a business or making changes to your business model, [to ask,] ‘When am I going to run out of money?’” says Ivanka Menken, Founder and CEO of The Art of Service, an Australia-based management consulting firm. - Evaluate the Value of a New Project: A company may want to create a project cash flow forecast to analyze the revenues and costs from taking on a specific project or job. A project cash flow forecast also helps companies plan for major expenses related to a project. Construction companies and marketing and advertising agencies often create project cash flow forecasts. Learn more about project cash flow forecasts by reading this article.

- Mitigate Obstacles: A forecast can allow you to make adjustments and create contingency plans to deal with significant cash flow change.

- Spot Issues with Customer Payments: A forecast can highlight times at which customers are significantly or habitually late in making payments.

- Keep Suppliers and Employees Happy: Forecasts generally help companies avoid surprising cash shortfalls, which translates to on-time salaries and payments to employees and suppliers.

- Enhance Understanding of Customers and Suppliers: Your company can analyze how to engage customers that repeatedly pay late or suppliers that might offer discounts for upfront payments.

- Boost Profits: Forecasts allow you to track cash flow continually, which can lower borrowing and other costs, and keep your company profitable.

- Helps You Plan for Expected Sales: A forecast helps you plan for expected sales decreases or increases.

- Prepare for Expected Expenses: Forecasts help you plan for expected increases in expenses during a future period.

- Plan for Investments: A forecast can show when you’ll have surplus cash flow, so you can make investments to help your business grow.

Menken says it’s vital “to forecast and have an idea of your cash flow, and whether or not an investment now is a good idea, or a growth strategy is a good idea or not.” - Provide Insights into the Cost of Growth: A forecast will show you the future costs of investments in your business, from new employees to new equipment. Use that data to analyze whether the investments are worthwhile.

- Reduce the Cost of Capital: A forecast indicates when you will run low on cash, so you can prepare for lower-cost financing.

- Gain Confidence in Your Financial Systems: Regularly scheduled cash flow forecasts will inform your company where your financial systems are working well or need tweaking.

How to Forecast Cash Flow

At its most basic level, a cash flow forecast assesses your organization’s current cash, and then forecasts cash inflows and outflows for a number of periods into the future. The forecast shows expected cash on hand at the end of each period.

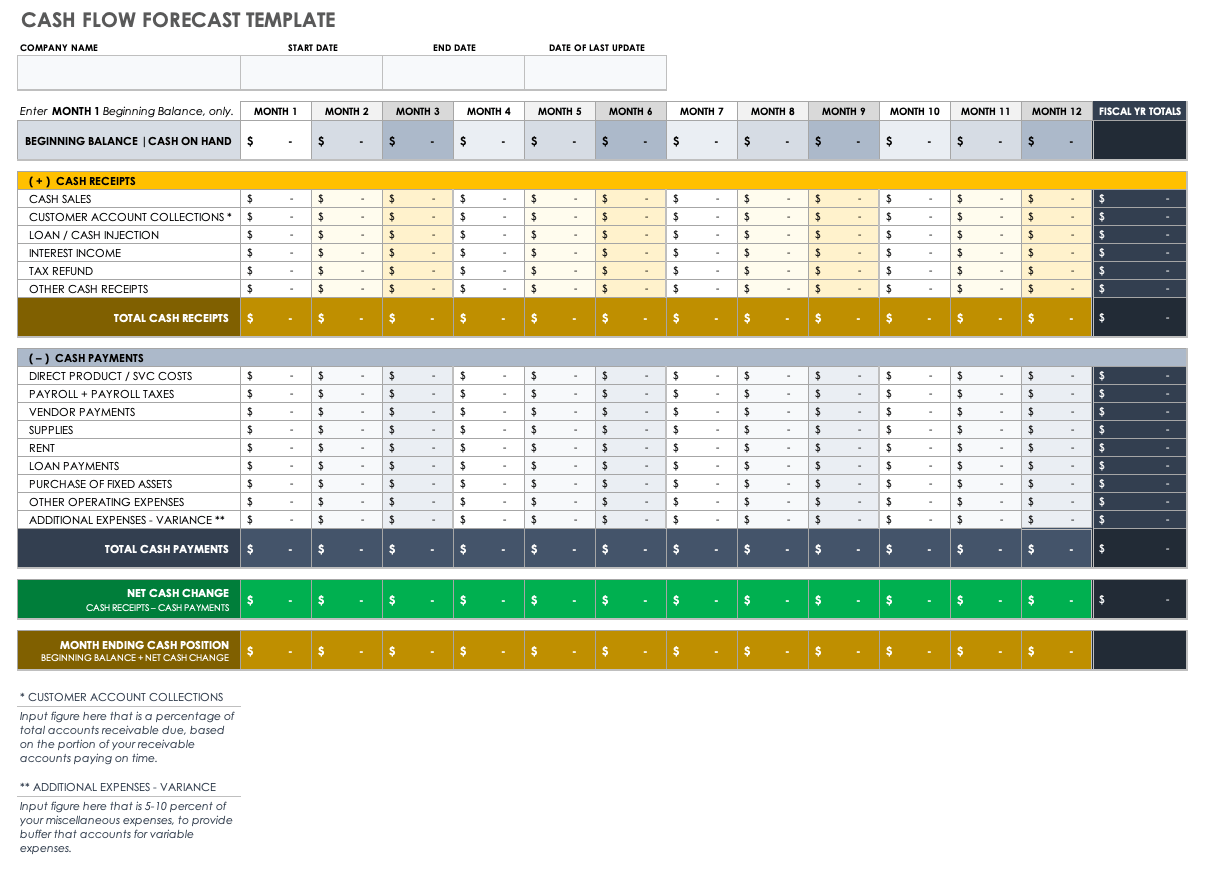

Use this cash flow forecast template to provide basic details about your company’s projected cash flow. The template includes sections to list beginning and ending cash balances, cash sources, cash uses, and cash changes during the month. These details provide an accurate picture of your organization’s projected month-by-month financial liquidity. Ultimately, this template will help you identify potential issues that you must address in order for your business to remain on sound fiscal footing.

Download Cash Flow Forecast Template

You can find other cash flow forecast templates for specific situations by reading “Free Cash Flow Forecast Templates.”

5 Basics Steps to Forecasting Cash Flow

There are basic steps that can help with your cash flow forecasting, such as assessing some past financial numbers. You’ll want to make projections on future revenue and costs based on those numbers, as well as other factors.

Here are some basic steps that can help your cash flow forecasting:

- Assess Past Financial Numbers: Take a look at your current and past cash flow statements. (You can learn more about cash flow statements and the formulas you need by reading, link for cash flow-formulas piece.) Review sales figures and overall revenue for the past couple of years, and assess basic expenses for those two years. This time period can give you a good sense of what to expect, including seasonal fluctuations and long-term trends.

- Factor in Some Basic Assumptions for the Future: These assumptions might include the expected change in the consumer price index, wage increases, and seasonal sales.

- Estimate Revenue: Most of these numbers will come from weekly or monthly sales. Include any price increases (from both your company and its competitors), as well as other external factors. Then, add any non-sales revenue, like tax refunds and asset sales.

- Include Your Receivables Cycle: As part of (or connected to) your revenue estimates, factor in how much sales revenue will be paid in cash and how much will be paid over time. Don’t assume that all sales revenue will come in when your customers’ payments are due. Use payment history to determine what percentage of sales revenue will arrive on time and what percentage might appear in subsequent months.

- Estimate Likely Costs and Outflows: Using your past costs as a guide, estimate likely future expenses. Also include other expected outflows, including those for tax payments, loan payments, and purchase of assets.

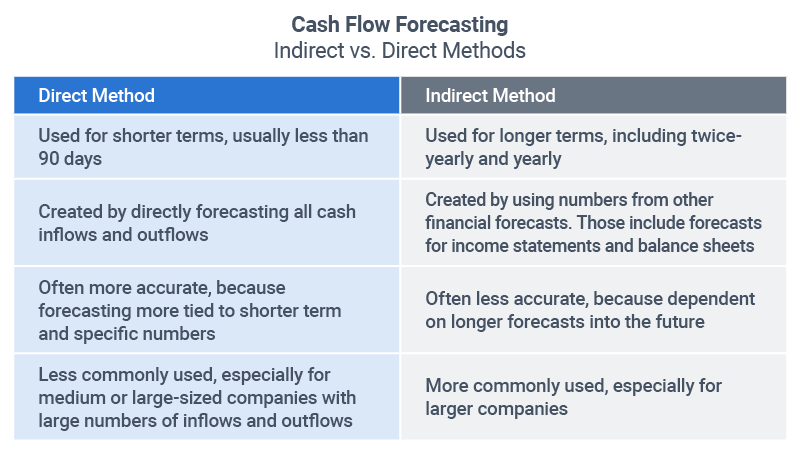

Direct vs. Indirect Cash Flow Forecasting

You can perform a cash flow forecasting using either the direct or indirect method. The direct method, ideal for shorter periods, identifies all likely future inflows and outflows. The indirect method, which is best for longer terms, uses forecasts from other financial statements.

You can also use the direct or indirect method to generate cash flow statements.

Tools that Can Help with Forecasting

If you’re just getting started creating a cash flow forecast, a spreadsheet may be the only tool you need. However, as you continue to perform them, you might prefer using software that can automate the process.

- Cash Flow Forecasting Software: Specialized software can help with cash flow forecasting. One option is LivePlan, which allows you to input financial figures, including sales, expenses, and other numbers for your business. A user can then alter projections to explore various scenarios and see how they affect cash flow and available cash.

- Creating a Spreadsheet: Menken, from The Art of Service, says a company can build a simple spreadsheet that has entries for basic inflows and outflows of cash, including rent, utilities, and wages. Include dates when you pay these bills and other less frequent outflows.

“That is how you start to build your cash flow forecast,” she says. “Every day, you complete the spreadsheet for the day with the actual numbers, until you start to get a feeling for the cadence of the business. Do your clients pay on a certain date every month? Do you have subscription sales where you can predict when the money comes into your account? Start to pre-populate your spreadsheet for the next three to six months, until you’re confident it is giving you the correct information.” Then, she says, you can start working on a longer-term forecast.

Why Are Cash Flow Forecasts Important to Small Businesses?

Cash flow forecasts are important for any company, but they are especially critical for small businesses, which may have fewer cash reserves and less access to borrowing money.

- Fewer Cash Reserves: Larger companies may have larger funds of cash, but smaller companies may generally have just enough money on-hand to pay their normal monthly expenses. A month of unexpected costs can deplete those reserves to zero.

- Less Access To Credit: When cash begins to decrease, larger companies likely have more access to credit — from banks and investors, or through other means. Small businesses have fewer options for credit. For example, loans from the Small Business Administration often require an extensive application process. A small business has the time to move through that process only if it’s been able to forecast its cash issues far in advance.

How to Manage a Cash Flow Forecasting Process

In all but the smallest of organizations, a cash flow forecasting process will involve gathering data from several people or departments. In larger organizations, a treasury or finance team will manage the process.

Here are a couple of keys to success for an effective cash flow forecasting process:

- Get Data from People and Systems: A forecast depends on finance systems and statements your organization has already created, and their accuracy. Employees within your organization who understand those systems and that data are also key.

- Employee Buy-In Is Vital: Employees must understand the importance of the cash flow forecast, and be enthusiastic about providing the best data so they can help create the best possible forecast.

Cash Flow Forecasting Best Practices

Experts recommend a number of best practices to create the most accurate cash flow forecasts. Top suggestions include looking closely at past financial numbers; paying attention to unusual costs that might occur; and updating forecasts frequently.

Here are some additional essential best practices:

-

Get Input from Key People: Employees who understand your company’s financial numbers integrally can provide important input.

-

Analyze Key Indicators, Like Sales Forecasts: Pay attention to how changes your company makes can affect revenue and thus, your cash flow forecast. For example, a sales strategy to reach a broader group of potential customers can change a forecast.

-

Understand that Cash Flow and Revenue Are Different: Revenue on your income statement represents what you’ve sold, but not what’s been paid for. So, revenue is not cash or cash flow, and you can’t treat it as cash.“

You might have a million dollars in sales, then use that million-dollar figure in all of your forecasting calculations,” says Sherif Hassan, CEO of Capiform, which provides smaller banks with an online platform to help them analyze credit and provide loans. Hassan, who also is the Founder and Principal for Syh Strategies, a strategic consulting firm, explains that it's a huge mistake to think that way: that million dollars isn’t in your bank account yet. “That might be the number one reason people run out of money and go out of business,” he shares. “Sales is not cash.” -

Look Closely at All Potential Inflows and Outflows: Start with your recent and current financial numbers. Next, consider future factors, like consumer confidence and inflation. Take into account how quickly customers are paying for your company’s services or products, and whether you’re taking steps to improve that speed of payment. And, acknowledge any variability on your costs to do business.

-

Prepare a List of ‘Other’ Cash Inflows and Outflows: This exercise will help you identify all possible inflows and outflows. Use this time to think about any unusual inflow or outflows — those that don’t occur monthly and may not even occur annually. These might include inflows like tax refunds, government grants, or cash from the sales of assets. Outflows might include new equipment, new benefits from employees, or lawsuit settlements.

-

Create and Test Various Scenarios: Changing some key variables in your cash flow forecast can help you see how that affects overall cash flow. What if you decide to spend $200,000 to invest in equipment to improve production? What if you add three people to your sales team to bolster sales, or pay for an outside service to collect bad debt? The results of those scenarios can help you decide whether to make certain investments and think about how to bolster cash in various periods.

-

Timing Is Everything: Cash flow and cash flow forecasting are of course supremely affected by timing. Timing includes the date customers pay you, the date you must pay suppliers, and the date you pay quarterly federal taxes. You must ingrain all of those cash inflows and outflows — both recurring transactions and rare ones — within the forecast.

-

Monitor Results and Make Adjustments: Whether you do cash flow forecasting every week or every six months, ensure that is informed by actual results. If you do a cash flow forecast monthly, look at your cash flow statement (based on actual results) and make the necessary modifications.

-

Build in Variances: Many companies build variances into their forecasts to account for unexpected costs or other small changes in totals. Include an “other” category in expenses that accounts for a small extra percentage of total costs.

-

Determine How Far Out You Want to Plan: Some companies perform a cash flow forecast every six months. Many others do it more frequently — some even perform weekly cash flow forecasts. If you have predictable annual inflows and outflows, creating a forecast every six months might be sufficient. If you’re a new business, or experience a continual flux in sales and costs, weekly (or even more frequent) forecasts might be necessary.

-

Don’t Forecast More than 12 Months in Advance: Trying to forecast more than 12 months in advance has limited value. There are too many variables that are impossible to predict more than 12 months out. The forecast you create for 18 months from today will likely be inaccurate.Menken says that cash flow forecasts too far into the future are “always garbage in and garbage out. You’re better off doing a good quality [forecast] over a shorter time. Do that for a couple of short time periods, until you get really good at it. Then, push it out to six months.”

-

Continually Evaluate: You may decide to perform cash flow forecasts monthly or quarterly. What if circumstances with your company change? Don’t think of any cash flow forecast as written in stone until it’s time to do another. Continually evaluate your budget and any major adjustments. Then, create a new forecast when it makes sense.

Difference between Cash Flow Forecast and Budget

A budget shows expected revenue and expenses for an entire set period (often 12 months). A cash flow forecast shows actual inflows and outflows of cash when they occur — on a monthly, weekly, or even daily basis.

The cash flow forecast reflects actual cash being spent and cash on-hand. A budget outlines income and expenses based on when they occur — not when you receive the income or pay for expenses. A budget also serves as more of a comprehensive planning document, outlining goals for revenue and spending over a year, for example.

Variables that Can Complicate a Cash Flow Forecast

A number of variables in revenue or expenses can complicate cash flow forecasting. They may be somewhat common and only occur occasionally, such as every month or every quarter.

It’s vital to try to predict and account for the following variables in any cash flow forecast:

- Months with an unusual number of paydays for employees. When a company pays employees every two weeks, there are months with three paydays. If your company pays employees every week, there are months with five paydays.

- Seasonal peaks and valleys in sales.

- The need to hire seasonal workers.

- Insurance and other annual payments, which can cause discrepancies on weekly, monthly, or quarterly cash flow forecasts.

- Quarterly estimated tax payments, which cause issues on weekly or monthly cash flow forecasts.

Discover a Better Way to Manage Cash Flow Forecasts and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Any articles, templates, or information provided by Smartsheet on the website are for reference only. While we strive to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, articles, templates, or related graphics contained on the website. Any reliance you place on such information is therefore strictly at your own risk.

These templates are provided as samples only. These templates are in no way meant as legal or compliance advice. Users of these templates must determine what information is necessary and needed to accomplish their objectives.