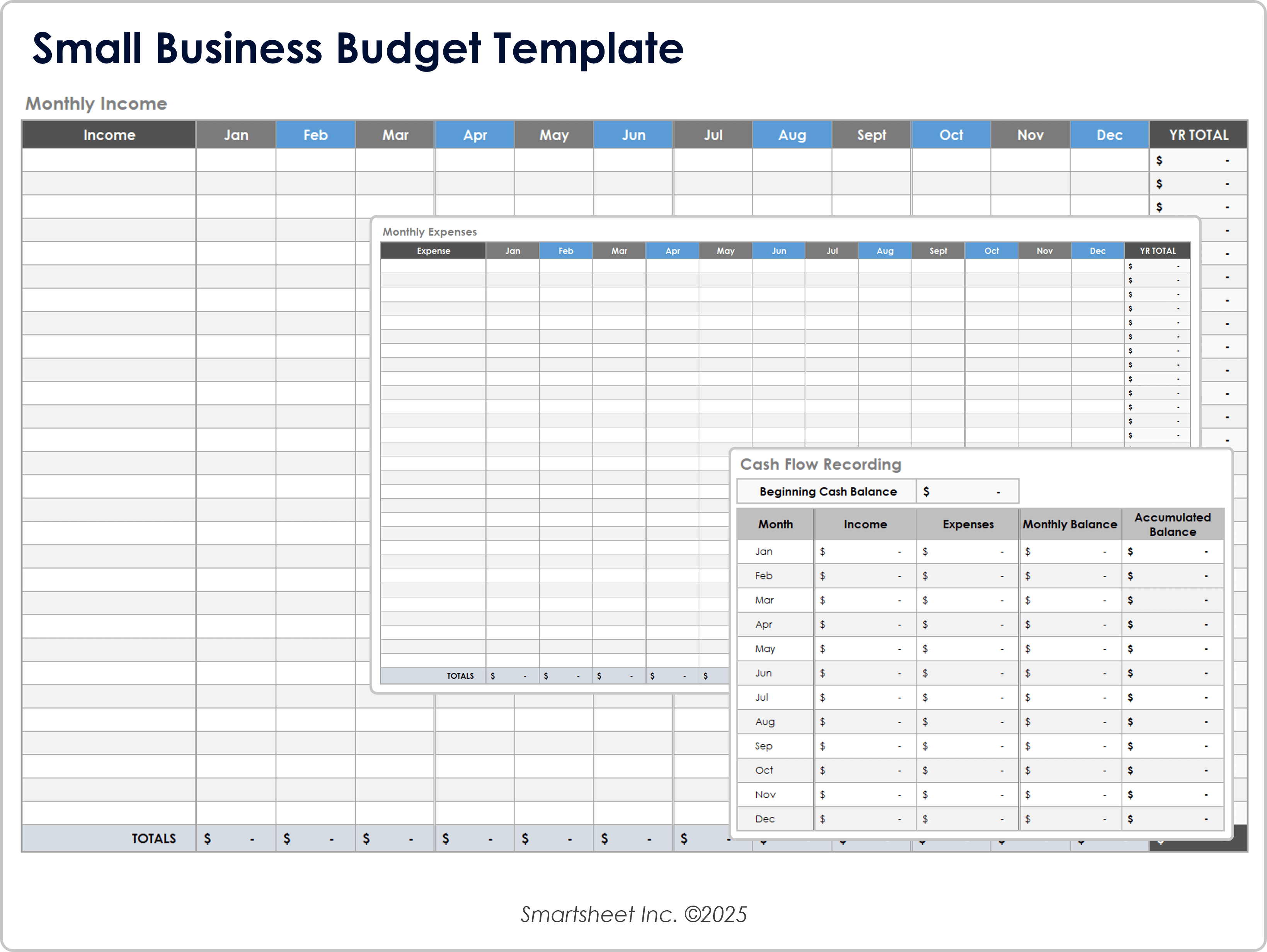

Small Business Budget Template

Download a Small Business Budget Template for

Excel

| Google Sheets

When to Use This Template: Small businesses needing quick, intuitive financial models will make strong use of this template. It streamlines and helps manage monthly income, expenses, and cash flow.

Notable Template Features: Income and expense sheets for tracking income and expenses across 12 monthly columns are the hallmarks of this template. You can use it to calculate monthly and yearly totals for all income and expenses. The sheet titled Cash Flow Recording lists transactions and balances.

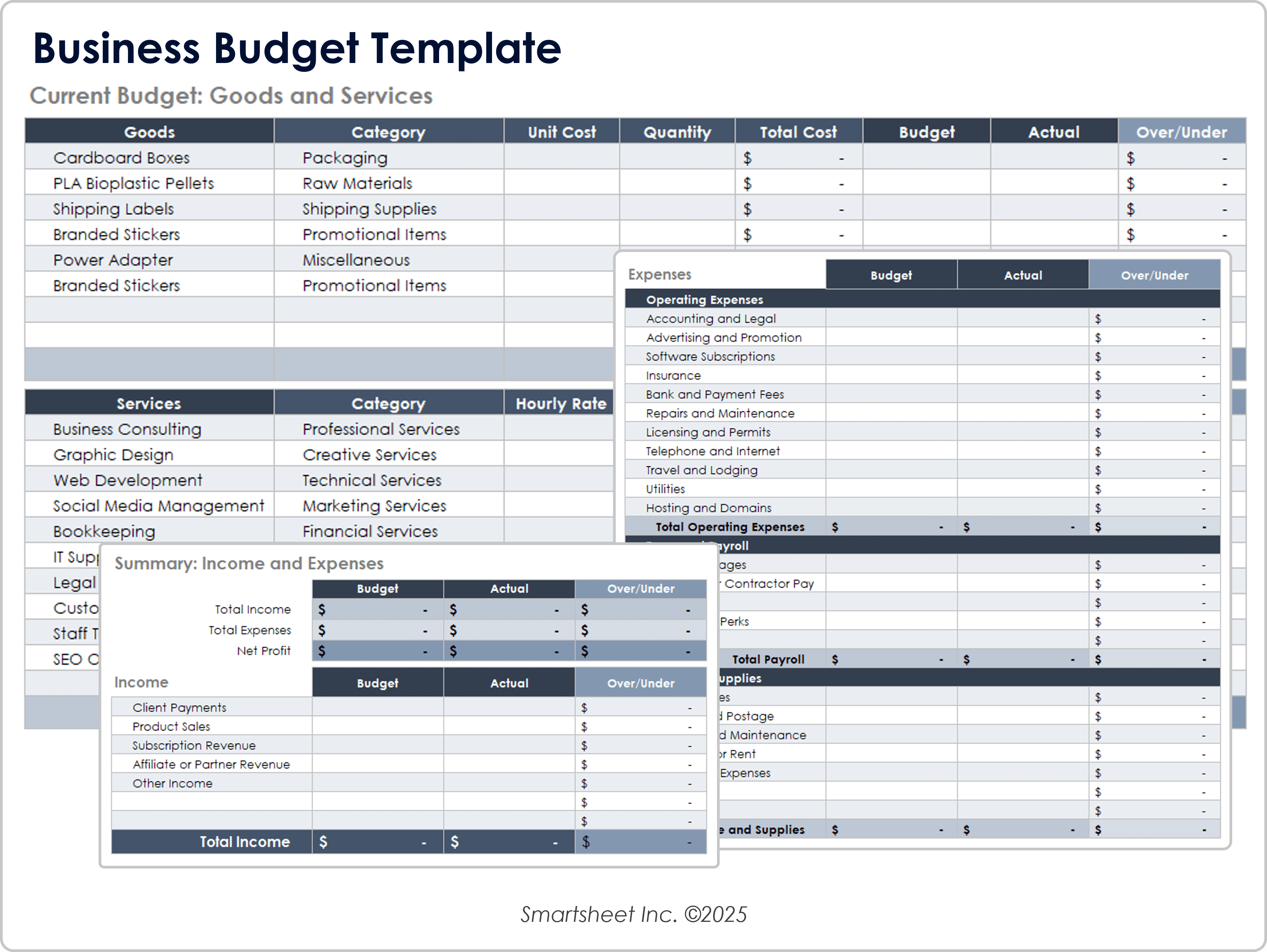

Business Budget Template

Download a Business Budget Template for

Excel

| Google Sheets

When to Use This Template: Use this business budget template to track operational expenses and earnings growth by category. The template is a solid option for budgeting and analyzing the costs of goods and services.

Notable Template Features: On this template, you’ll find a sheet for your current budget, where you can enter and categorize goods and services and calculate total costs and over/under amounts. On the summary sheet, you can input your planned and actual income and expenses.

These business budget templates for Google Sheets can help you manage your business’s income, expenses, and cash flow so that you can make informed financial decisions.

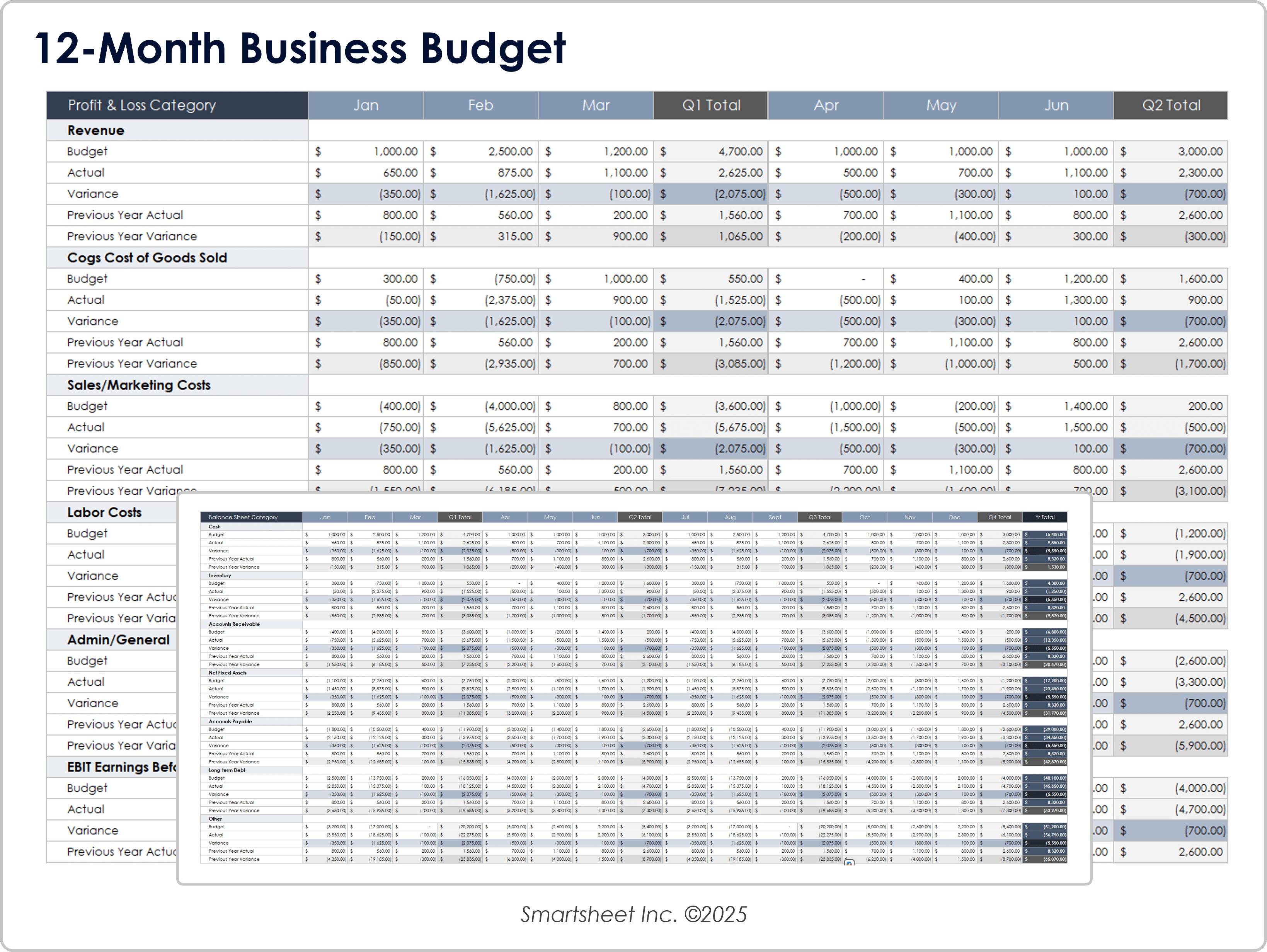

12-Month Business Budget Template

Download the 12-Month Business Budget Template for Excel

When to Use This Template: This template fits your needs for strategic business planning and monthly and quarterly budgeting visibility. You can use it to inform and prepare lender reporting and investment planning.

Notable Template Features: You can input monthly amounts to calculate quarterly and yearly totals on your profit and loss and balance sheet on this comprehensive 12-month template. You’ll find specific content rows listing budget, actual, and variance amounts for all categories.

Check out these free operating budget templates to help you plan, track, and manage your business’s finances.

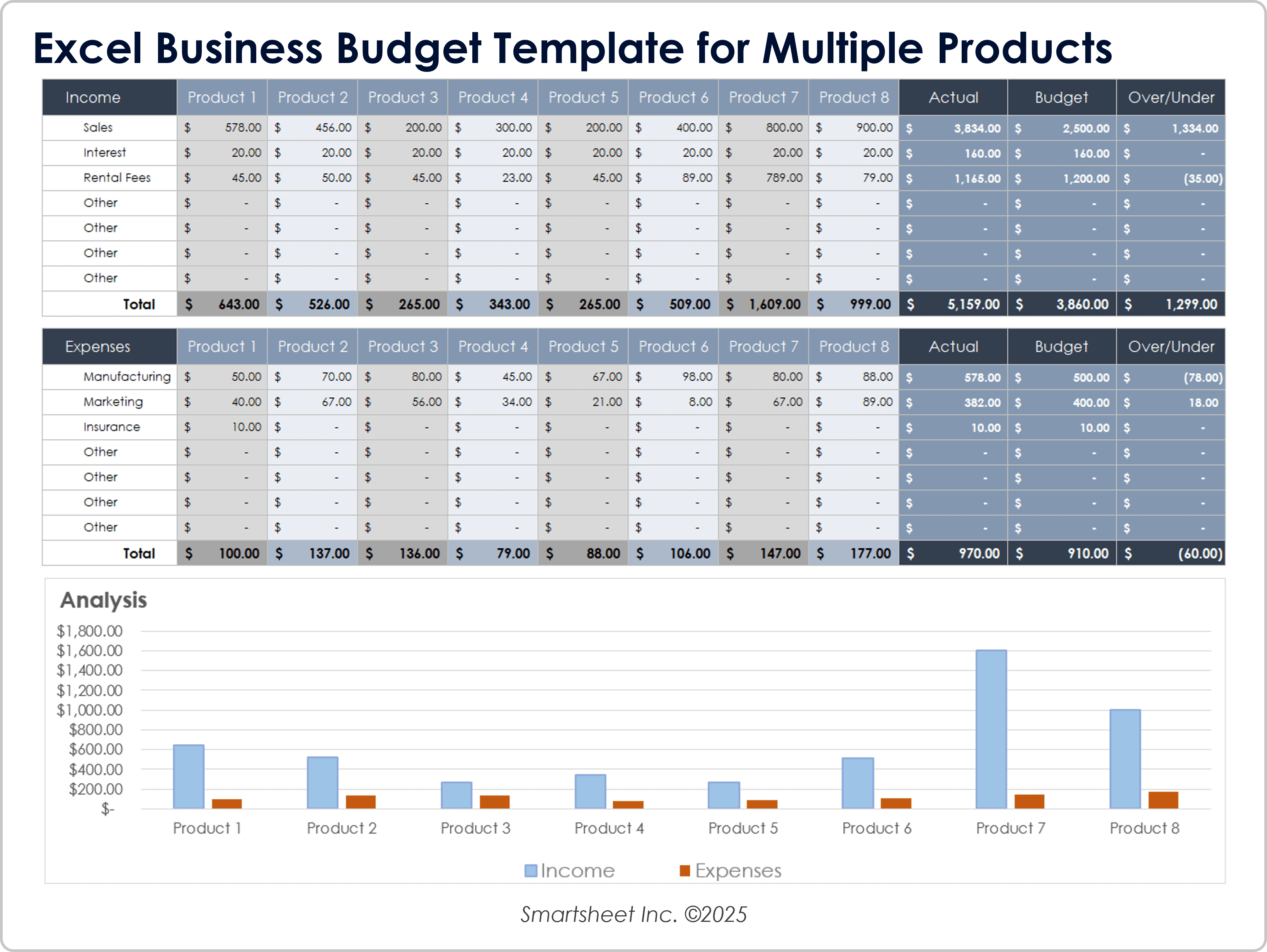

Business Budget Template for Multiple Products

Download the Business Budget Template for Multiple Products for Excel

When to Use This Template: Use this business budget template to track and analyze the income, expenses, and profitability of multiple products. The template helps you form the overall picture of business finances and health.

Notable Template Features: This streamlined and practical template allows you to customize and enter income and expense figures for eight side-by-side products. Note the bar graph that visualizes income, expense totals, and product differences.

Check out this collection of free nonprofit budget templates for more useful documents and information.

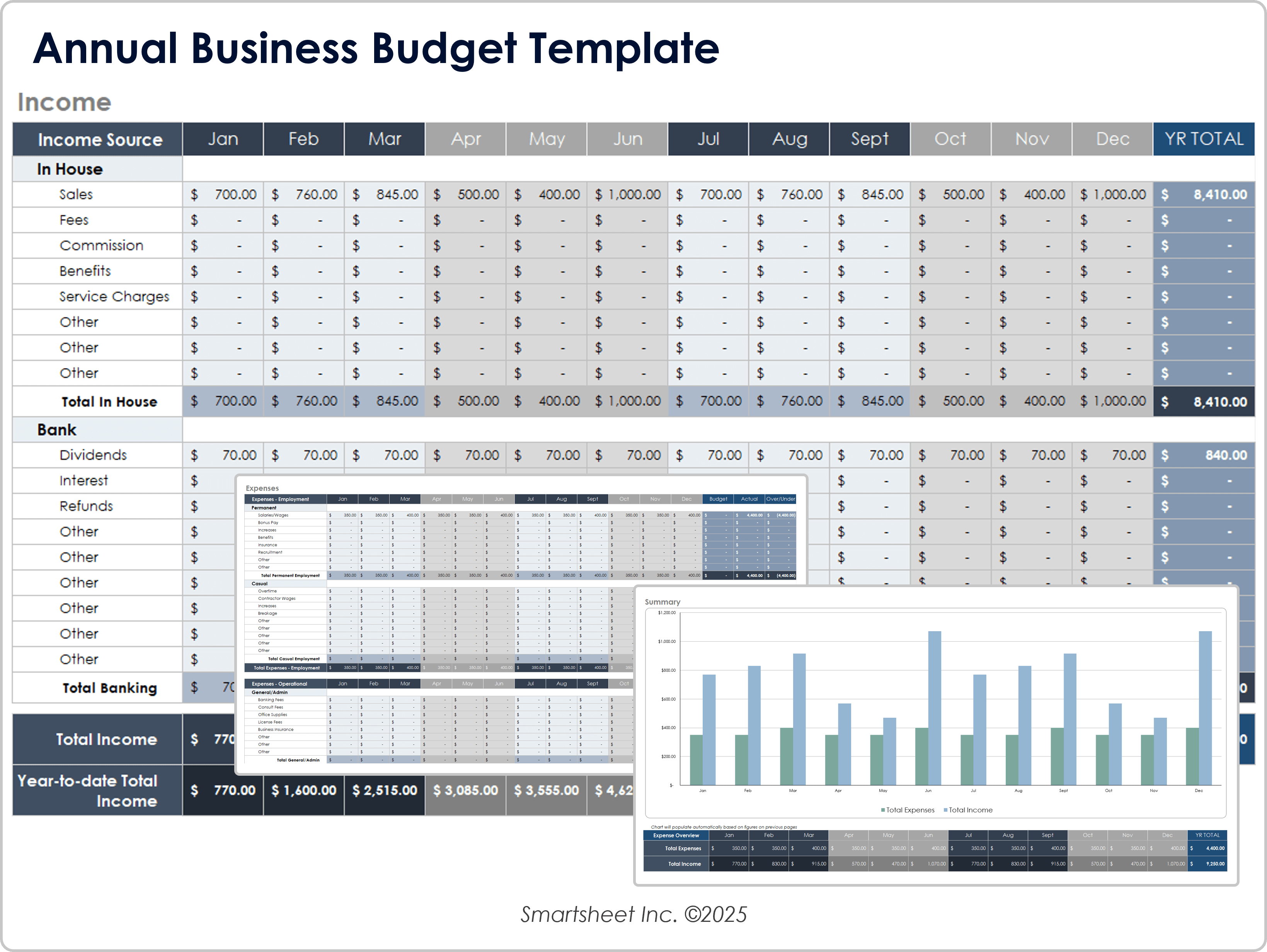

Annual Business Budget Template

Download the Annual Business Budget Template for Excel

When to Use This Template: Ideal for annual budget planning and executive reporting, this streamlined template focuses on simplicity and clarity.

Notable Template Features: On this template, you can view monthly tracking of income and expenses, and it compares planned and actual figures to calculate yearly over/under values for each item. The summary sheet includes a bar chart to help you visualize total monthly income and expenses.

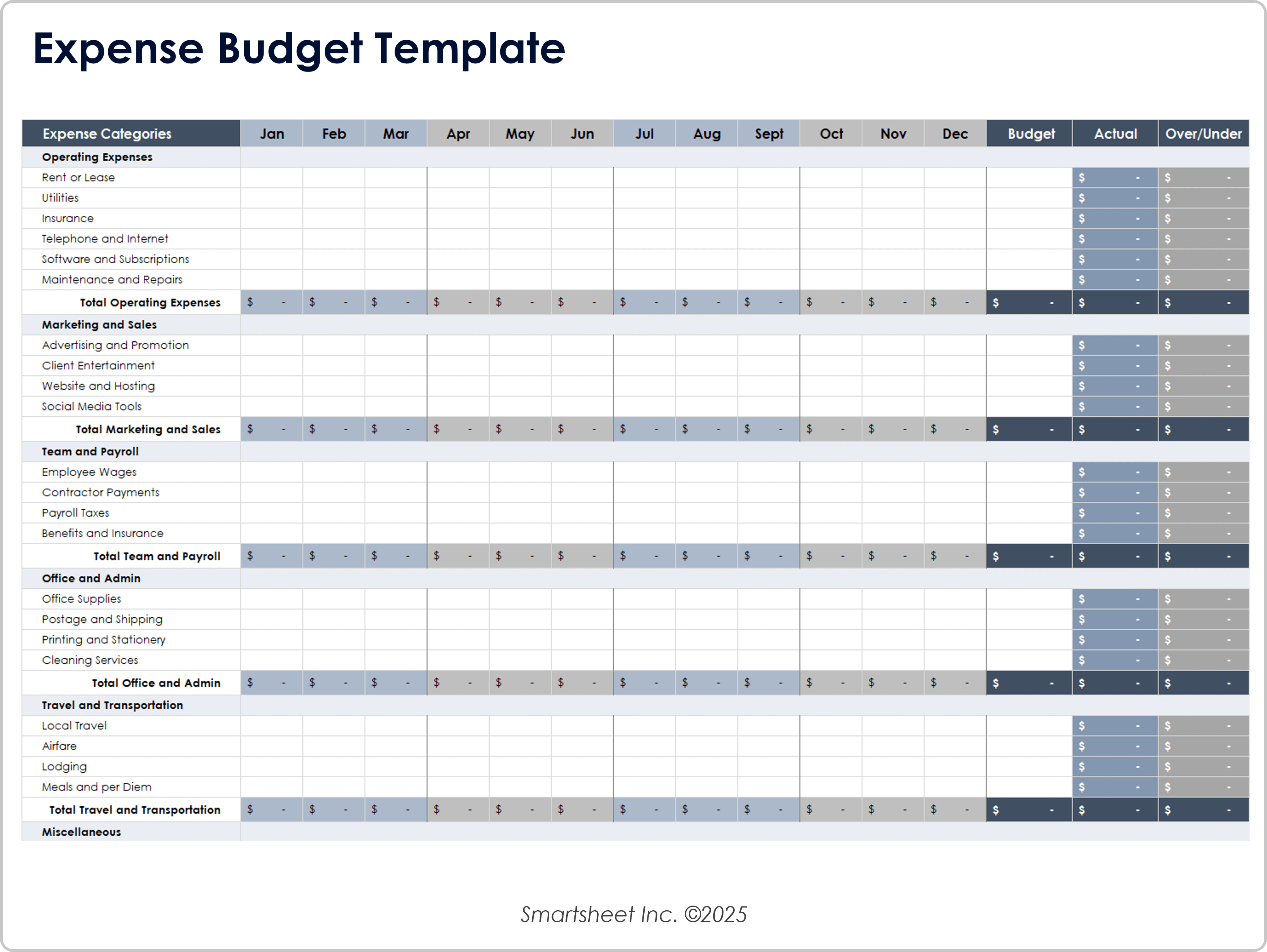

Expense Budget Template

Download an Expense Budget Template for

Excel

| Google Sheets

When to Use This Template: Use this expense budget template when you want to focus on monthly expenses. The template clarifies spending across expense categories, which can help you better control costs and spot spending trends.

Notable Template Features: You’ll find space on this template for entering and tracking expenses for 12 months with planned, actual, and over/under figures. The template includes expense categories such as operating expenses, marketing and sales, and office and admin.

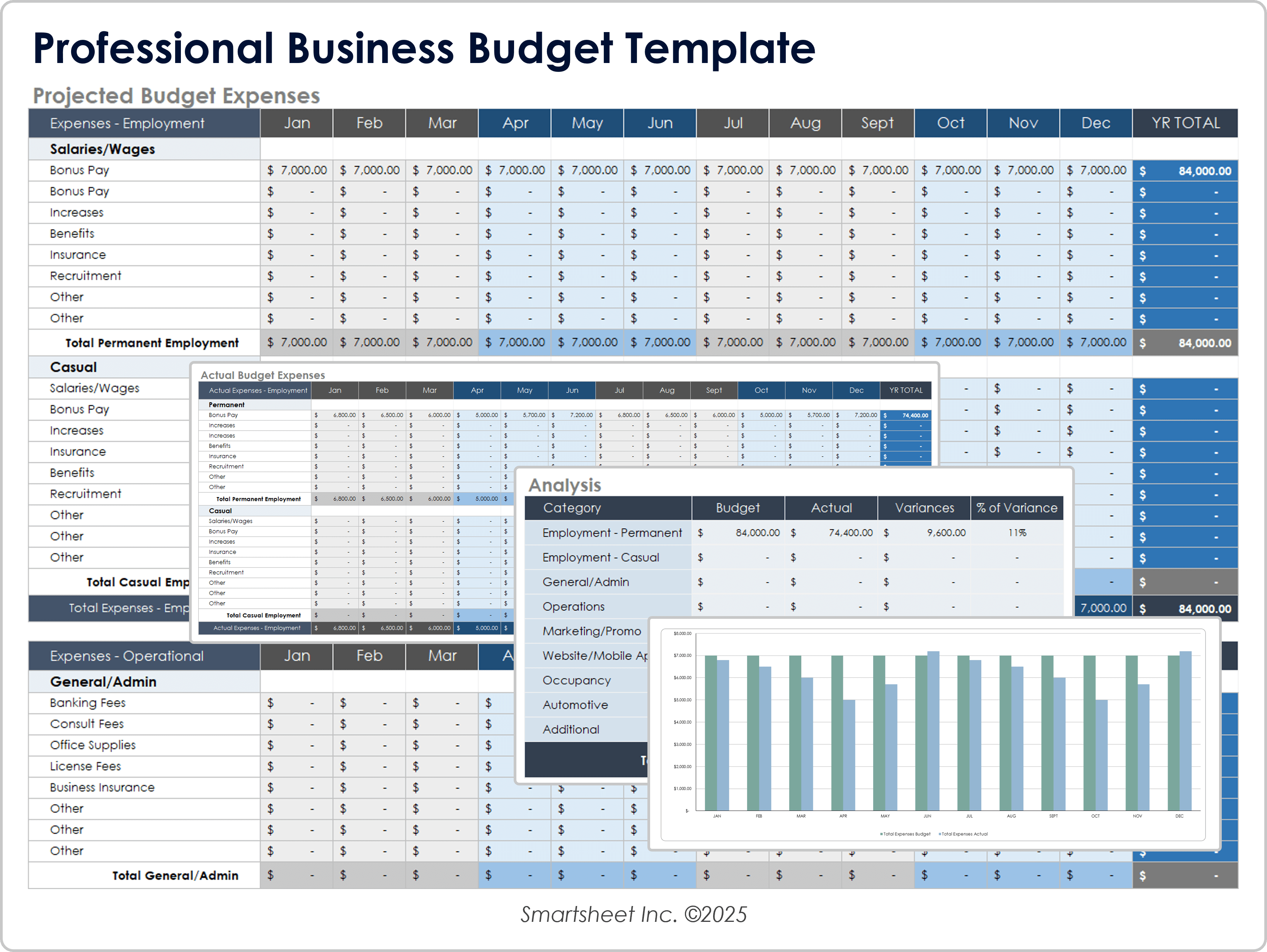

Professional Business Budget Template

Download a Professional Business Budget Template for

Excel

| Google Sheets

When to Use This Template: When you need precise spending visibility for budget accountability and performance reviews, this template is the perfect choice. Use it to budget, manage, and track specific cost drivers.

Notable Template Features: On this template, you can find sheets for entering and calculating planned and actual employment and operational expenses. On the analysis sheet, you can detail variances and their percentages for all expense categories.

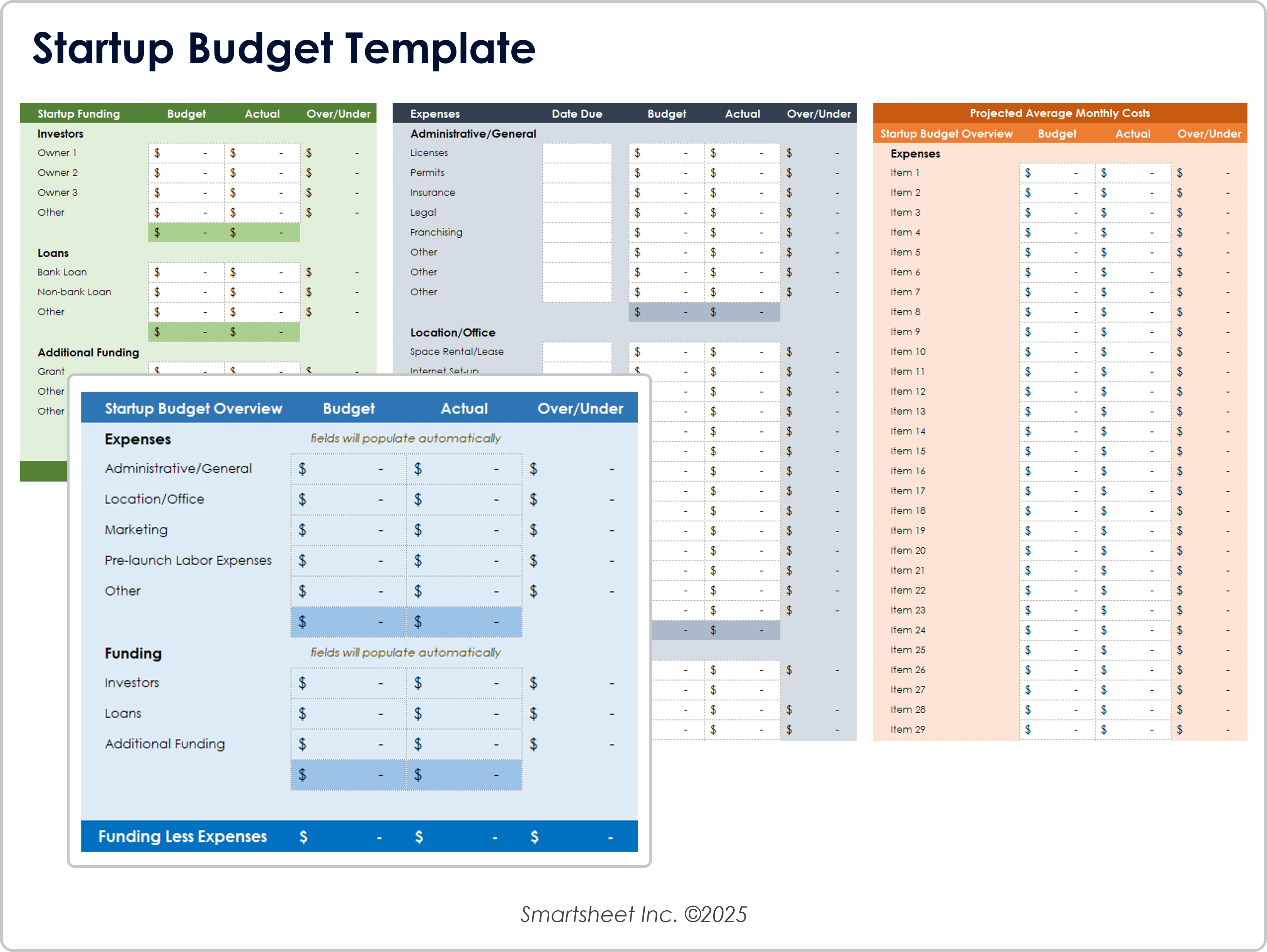

Startup Budget Template

Download a Startup Budget Template for

Excel

| Google Sheets

When to Use This Template: Use this startup budget template when planning and launching a new business. This is your go-to template for presenting budgets to investors, making feasibility studies, and reporting.

Notable Template Features: You can input startup budget, funding, and expenses and calculate projected and itemized monthly costs in specific sections on this template. Expense categories include administrative/general, location/office, and marketing, with columns for the expense due date, planned versus actual costs, and over/under figures.

Check out this collection of free startup budget templates to help guide financial planning, secure investors, and promote long-term business viability.

Why You Need a Small Business Budget Template

A small business budget template is a simple, trusted tool that helps you track costs, income, and profit to see how close you are to meeting your financial goals. It also lets you plan for surprise costs and spot ways to save or earn more.

Below are the details needed for a small business budget template:

- Planned Expenses: Enter the regular costs you expect to pay, such as wages, benefits, rent, utilities, and other core business needs.

- Additional Costs: Include less frequent or optional costs, such as marketing, legal support, travel, or employee training.

- Actual Costs: Record what you spent for each item to see how closely it matches your original estimates.

- Planned Income: Add the income you expect from sources such as product sales, client work, investors, or other funding.

- Actual Income: Enter the real income you received to compare against your forecasts and find gaps.

What Should a Small Business Budget Include?

A small business budget should cover all money going in and out of your business, including what you plan to spend, pay, and earn. It should track goods, services, and team costs, as well as any gaps between your budget and results.

These are the key parts of a small business budget:

- Goods and Services Costs: Add the cost of materials, packaging, and outside services that your business needs in order to deliver products or complete work.

- Operating Expenses: Include regular overhead costs, such as rent, utilities, insurance, and the tools or software your business relies on.

- Team and Payroll: Enter what you pay employees and contractors, including wages, benefits, and any short-term help.

- Planned vs. Actual Totals: Compare your budgeted numbers with actual results to spot differences and track accuracy.

- Net Profit: Subtract all your costs from your total income to see what your business earned.

How to Create a Small Business Budget

A small business budget helps you plan what to spend, forecast your income, and measure how close you are to reaching your financial goals. It also enables you to spot cost overruns, track cash flow, and make smarter spending choices as your business grows.

Follow these steps to build a small business budget:

- List Fixed and Variable Costs: Write down your costs that are more or less the same over time (example: rent, software, or wages) and what costs you incur that change routinely (such as shipping, materials, or freelance support).

- Add Goods and Services Costs: Include item-level costs for the raw materials, packaging, paid services, or labor that are needed to sell products or deliver work.

- Estimate Monthly and Annual Income: Enter the money you expect from sales, contracts, or outside funding so you can match it against your costs.

- Track Planned vs. Actual Income and Expenses: Use side-by-side columns to compare your budget with what happened to spot over- or underspending.

- Calculate Net Profit and Adjust: Subtract total expenses from income to see what’s left. If your actual numbers don’t match the plan, revise the budget to stay on track.

- Download the Template: Now that you've gathered the key numbers, download a small business budget template and complete it.

How to Manage a Small Business Budget

Managing a small business budget means checking how your spending and income match your plan, making updates when needed, and using those changes to guide smart business decisions. It helps you stay on track, handle shortfalls, and confidently plan ahead.

Here are some tips for managing your budget day to day:

- Review Income and Expenses Often: Set a regular time each week or month to check if your actual numbers match your budget.

- Track Over/Under for Each Item: Look for areas where you’re spending more or less than expected so that you can adjust quickly.

- Update Fixed and Variable Costs: As costs change, such as rent increases or new software, enter the new amounts so that your budget stays accurate.

- Adjust for Seasonal or One-Time Costs: Add rows or notes for exceptions, such as holiday spending, new hires, or equipment repairs.

- Compare Monthly and Year-to-Date Totals: Look at both short- and long-term totals to identify bigger trends in your profit and spending.

- Refine Your Plan Regularly: Keep your plan current so that you can use what you learn to improve your next budget cycle.

Discover a Better Way to Manage a Small Business Budget and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.