What Is Client Lifecycle Management?

Organizations use client lifecycle management to attract, engage, and retain clients. Good client lifecycle management provides insight into how clients actually experience working with a company. The practice helps ensure the lifecycle remains positive and the client stays in the fold.

While the financial industry uses client lifecycle management to help meet Know Your Customer (KYC) regulatory requirements, a wide range of industries uses it to retain customers. Here are some characteristics of effective client lifecycle management:

- Includes the use of software or a software as a service (SaaS) solution to help manage client data and follow regulatory requirements

- Extends client onboarding; companies may think of it as “continuous onboarding”

- Helps organizations understand clients’ evolving needs

- Focuses on putting clients at the center of business decisions

“Client lifecycle management includes everything from onboarding to providing digital services, to inevitably monitoring compliance and taking appropriate risk and mitigation actions when necessary,” says Chris Huff, chief strategy officer for Kofax, a process automation software provider.

You can learn more about best practices and expert advice on how to set up a system to effectively manage clients and maintain good relationships from out article "Tips and Best Practices for Mastering Client Management".

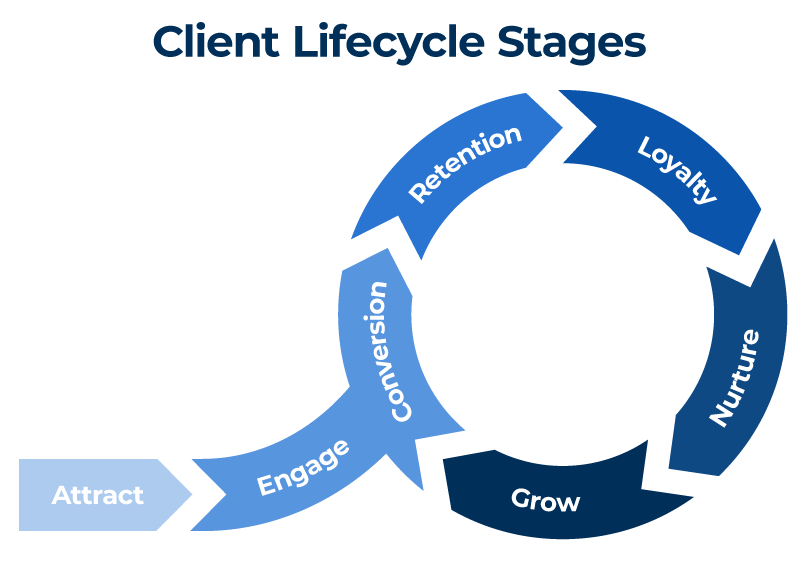

Client Lifecycle Stages

A client lifecycle includes stages for attracting prospective clients, winning their business, and keeping them as clients. Your organization must understand how to serve the client best and the important touchpoints in each stage.

“Effective client lifecycle management frequently examines the customer/client experience and its requirements across the full spectrum of the relationship it has with a provider,” says Brian Zotti, Senior Vice President of Services and Operations at Contek Consulting LLC, a business strategy consultancy.

Zotti outlines the touchpoints in the relationship as follows:

- The point of contact the provider has with the customer/client

- The point the customer/client receives critical information about the buying decision

- The point the customer/client makes the buying decision

- The point the customer/client uses the product or service

- The point the customer/client may want or need enhanced or different products or services the provider might offer

Here’s what happens during the client lifecycle stages:

- Attract/Reach: Sometimes called the discovery stage, this involves your organization’s attempts to attract clients. Most often, this means marketing to a broad or narrow niche of potential clients. Much, though not all, of that marketing takes place online and includes using your website, social media, and other digital channels.

- Engage: You’ve identified and started to engage with a specific prospective client to tell them about the benefits of doing business with you.

- Conversion: You’ve converted the prospect into a client (to first buy your product or service).

- Retention: You’ve won the client. (Congrats!) Now your organization needs to do everything possible to serve the client well and convince them to retain your services. The first phase of the retention stage, onboarding, is critical. Onboarding starts when you introduce a client to your service or product. At this time, the two sides exchange information and particulars to ensure that work for the client, and the client relationship, starts out well. You may also introduce the client to the team. A bad start to the relationship can poison it for good and hasten its demise. Learn more about this stage by reading “The Definitive Guide to Client Onboarding.”

“When I think about client lifecycle management, that onboarding stage is super important because it sets the table for customer expectations,” shares Dylan Max, head of growth marketing at Netomi, an artificial intelligence customer service company focused on support automation with chatbots and conversational AI.

Consider the relationship between a financial adviser and a new client. For example, if the adviser “commits to three 30-minute or hour-long calls within the first two months … the chance that person will become a lifelong customer improves significantly,” Max explains. “It’s all about weighing the costs versus the benefits.” “When a client first comes onboard, they are assessing your business and have certain expectations,” says Justin Butlion, a business analytics consultant and founder of ProjectBI, which provides information and advice on using business analytics and data. “The business needs to wow the client as soon as possible in order to start the relationship on the right foot. A client that is happy with the initial engagements with the business is more likely to put in the necessary effort to leverage the company’s offerings and see success.” - Loyalty: This is the ultimate goal. At this stage, an organization has done great work for its clients and won their support. The client has done business with the company repeatedly and became a “brand ambassador,” publicly praising your organization. A brand ambassador may be your organization’s most powerful tool in attracting new clients.

How Poor Client Lifecycle Management Causes Problems

Ineffective or misguided client lifecycle management often results in communication breakdowns and, eventually, lost clients who are unsatisfied with the company’s service. Here are other possible negative results:

- Off-Boarding Clients by Mistake: Your organization can misclassify clients or improperly document or track them in other ways. In this scenario, an organization’s systems might assume past clients have left.

- Inefficient Manual Workarounds: When companies practice client lifecycle management ineffectively, staff is forced to fashion inefficient workarounds to accomplish a small part of the lifecycle management that is necessary to do their jobs.

- Missed Opportunities: With better understanding of your clients and their relationship with your organization, you can instigate new ideas and programs. These changes are beneficial to clients and can improve revenue and profits.

- Heavy Fines: In some industries, especially financial services, regulations mandate monitoring and tracking of some customer activity. The most obvious example is Know Your Customer (KYC) regulations in the banking industry. The regulations mandate a process of confirming the identity of customers with a goal of preventing money laundering and other illegal activities.

Examples of Poor Client Lifecycle Management

Poor client lifecycle management can cause real problems. You not only lose clients, but lose them repeatedly, which leads to your organization’s failure. Here are two examples of poor client lifecycle management and suggestions for improvement:

Problem: After some marketing efforts, an organization generates a list of prospective clients. The organization reaches out to the entire list and attracts a couple of clients who aren’t good fits. Here’s why: the prospective clients have unrealistic expectations of costs to do their work; their teams aren’t experienced in working with companies in your industry; and the companies are new and aren’t profitable.

The relationships sour quickly. Your team spends significant time working with them to begin projects, but the clients almost immediately decide not to participate, ending the relationship.

Solution: Your organization must understand who it wants to land as clients. You must research prospective clients early in the process to ensure they are a good fit. Perform this due diligence early — before signing a contract — to avoid spending too much time or money pursuing the prospective clients.

Problem: During onboarding, an organization provides basic information about using its online product. The company also shares a trove of details about enhancements (available for additional fees) and other products. Your client becomes confused about how to use their purchased product and feels insulted that your organization is trying to get more money from them before they start using what they bought. The client asks for a refund, and the relationship becomes short-lived.

Solution: When onboarding new clients, be ready to help with their purchase and answer their questions directly. This is not the time to try to upsell them to enhanced or new products. Offer that option later, when they’re pleased with your product or service.

Best Practices in Client Lifecycle Management

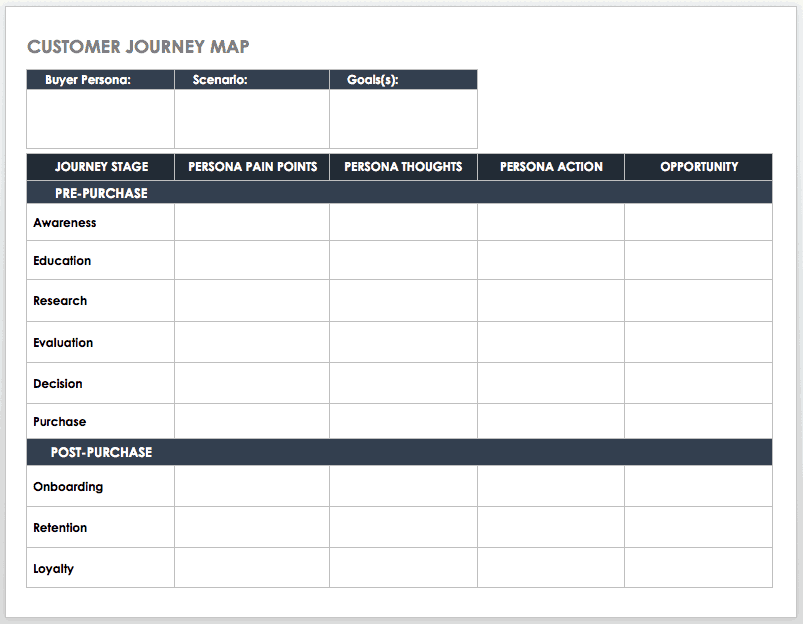

Experts recommend a range of best practices for effective client lifecycle management. These strategies include creating a customer journey map to better understand how they experience your products or services and tracking data on how they use your product.

Consider these best practices:

- Establish Your Business Goals: Your organization can’t determine how best to perform client lifecycle management when it doesn’t understand its business goals. It’s vital to establish those goals before diving into client lifecycle management work. “You have to have clear business goals and keep them at the forefront of your mind,” advises Netomi’s Max. “The reality is the world is always changing, so what might be considered important metrics now in terms of driving business might not be an important metric moving forward.”

- Create a Client Lifecycle Management Plan: ProjectBI’s Butlion says, “The company's client lifecycle management plan should be shared with the entire company, so everyone is aligned with how the lifecycle of a client works and how each team contributes to it.”

- Create a Customer Journey Map: A customer journey map is useful for analyzing and mapping a client’s experiences with your organization. The practice ensures that departments are working in concert on clients’ needs and on internal handoffs, providing the best possible experience for clients. Below, you can download a template to help create a customer journey map.

Download Customer Journey Map

- Track Metrics: Many metrics can offer hints at upcoming client churn or the impending loss of clients. An organization must determine which metrics to track and monitor to gain insight into the client experience and their satisfaction or dissatisfaction.

It’s important to understand common industry benchmarks, so you can compare your performance against possible competitors. For example, in business-to-business marketing (and many industries), important metrics are the percentage of marketing budget and the percentage of marketing staff time devoted to retaining current clients versus trying to attract new ones.

“The most common issue in generating a sound and reliable strategy is the quality, availability, and reliability of the data being used and input into the client lifecycle management software,” says Zotti, from Contek Consulting. More details on specific client lifecycle management metrics to track are below. - Understand Your Industry: Sometimes, providing clients with the basics isn’t enough, so looking at winning strategies can help give you an edge. “Having that diversified exposure to other industries, and what is working well, allows you to create a more holistic experience for your clients,” explains Netomi’s Max.

- Don’t Overdo Unsolicited Communications: You want to communicate with your clients and offer help. But remember that repeated unsolicited communications can be a major turnoff.

“You don’t want to overload clients with communications,” says Butlion. “The occasional email or phone call works, but a company doesn't want to gain the reputation of being a spammer.” - Stay with the Plan: Don’t make wholesale changes to your client lifecycle management plan too often. “You should revise the client lifecycle management plan no more than once a year unless the company goes through a significant change,” advises Butlion.

Benefits of Client Lifecycle Management

Effective client lifecycle management offers a range of benefits that your organization can achieve whether or not it uses CLM software. Benefits include a better understanding of your client, increased efficiency, and an improved ability to comply with regulations.

By using a software solution, you can take advantage of compiling and tracking all your data in one place, which makes it easier to recognize issues and coordinate changes. Here are some benefits of overall client lifecycle management:

- Helps Assess and Decrease Risk: Evaluating risk is especially important in the financial industry, and it’s critical to other industries. “An effective client lifecycle management program elevates an organization's ability to improve their risk assessments, (which will) minimize costly risk mitigation and remedial downstream actions,” says Kofax’s Huff.

- Satisfies Regulatory Obligations: Government regulations require proof of monitoring and tracking beyond the KYC regulations in banking. A client lifecycle management program can ensure that a company follows KYC and other regulations, including those that require monitoring and tracking related to taxes and other business processes.

- Allows You to Be Proactive with Clients: A good system can provide insights into a company’s clients and their needs, and how they are or are not using its product or services. An organization can use that data to proactively communicate with clients about helping them further. (To learn more about proactively communicating with customers, read "Tips and Software for Mastering Customer Communication Management").

A good client lifecycle management system — used by financial service organizations, for example — can also perform basic processes for clients, freeing up advisers for more high-value assistance. - Helps Meet Goals and Needs of Clients: Most important, software can help an organization help itself by aiding its clients. A company can use the system to better understand and satisfy clients’ goals and needs.

Here are some benefits of client lifecycle management software:

- Increases Efficiency: An organization can see a significant increase in efficiency in how it collects and processes client data.

- Improves Time to Revenue: A streamlined client onboarding experience — even when there are complicated regulations to follow — means they become paying clients faster.

- Ensures Consistency: A software solution provides everyone in the organization with access to the same updated client information. A client won’t receive redundant requests or contradictory messages from different departments in the same company.

“Companies are also able to use the software to synchronize a customer’s profile across the organization. There’s one source of truth that multiple lines of business can use, thereby improving operational efficiency through a reduction of redundant activities, which ultimately benefits the customer,” says Kofax’s Huff. - Enhances Client Experience: The software can improve the client experience with your organization. The solution can offer insights that help a company understand a client’s needs and goals.

- Provides a Competitive Advantage: Client lifecycle management gives organizations a competitive advantage by allowing them to be more agile in responding to clients’ needs and, in some cases, regulators’ requests.

- Allows for Better Targeting: Companies can use a solution’s advanced predictive analytics to better comprehend their clients and their needs — and better sell to them.

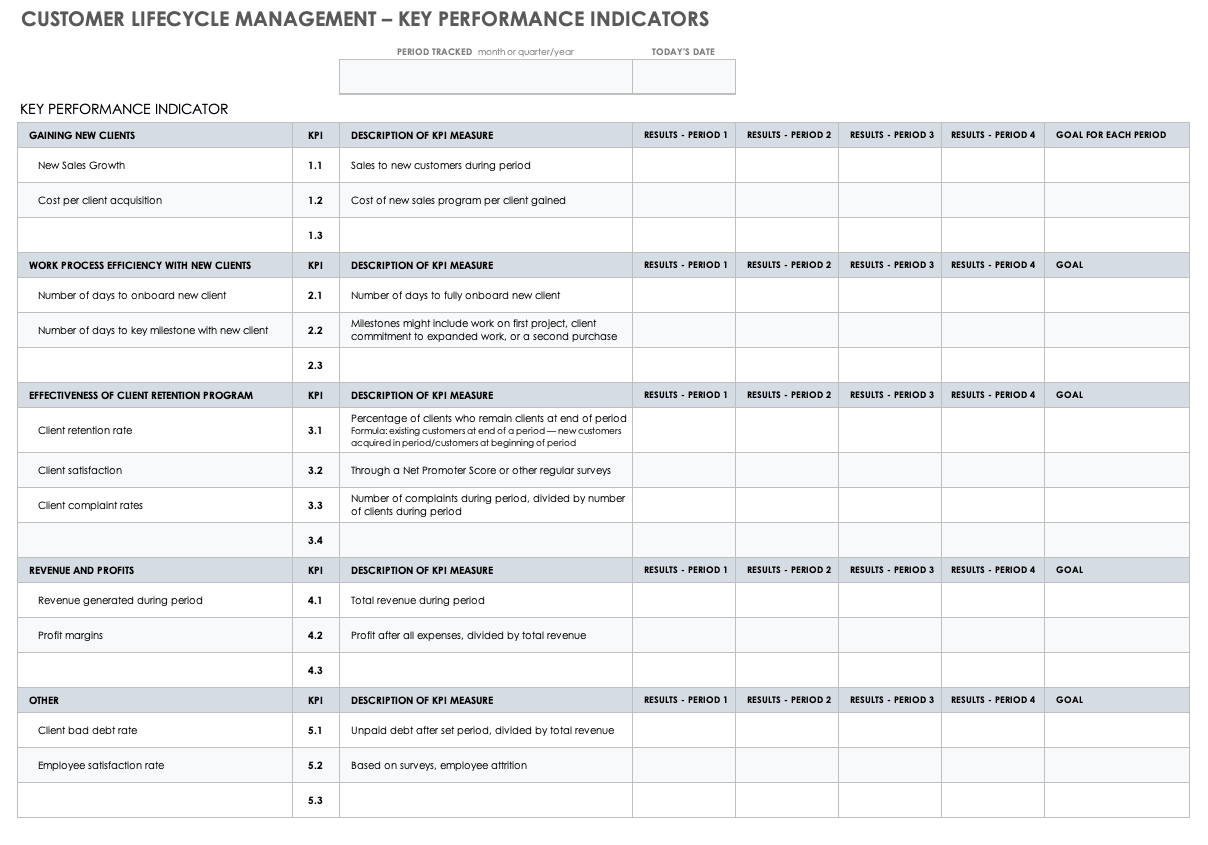

Key Performance Indicators for Your Client Lifecycle Management Program

Key performance indicators (KPIs) can help your organization evaluate how its client lifecycle management program is working and how it contributes to overall improvements. Key performance indicators to monitor include client satisfaction, client retention rates, revenue generated, and profit rates. Check out some relevant KPIs to track below.

KPIs that measure effectiveness and efficiency of a program to gain new clients:

- New sales growth that occurred over the period of time when a new program begins

- Cost per client acquisition includes the program compared to the number of clients gained

KPIs that measure efficiency of work processes with new or current clients:

- Number of days to onboard a new client

- Number of days to achieve key milestones (progress on first project, or client commits to expanded work or makes second purchase) with a new client

- Number of client interactions during the onboarding process

- Average handle time, or how long it takes to resolve an issue with a client (Netomi writes in depth about average handle time and other customer service KPIs)

KPIs that measure effectiveness of client retention:

- Client retention rate focuses on the percentage of clients who remained clients at end of a set period

- Client satisfaction based on a company’s Net Promoter Score

- Client satisfaction looks at the CSAT score

- Client complaint rates collects the number of complaints during a period, divided by the number of clients during that period

To learn more about other key performance indicators that can track how your organization is doing with clients, read “Expert Advice for Effective Client Retention Management.”

Overall revenue and profit KPIs:

- Revenue generated during a set period

- Profit margin (your organization’s profit after all expenses, divided by total revenue)

Other KPIs:

- Client bad debt rate is the unpaid debt after a certain period divided by total revenue

- Employee satisfaction rate based on surveys or employee attrition can show employee frustration with being unable to adequately serve clients

- Risk metrics measure effectiveness of your organization’s data management, privacy safeguards, and consumer protection

Download Key Performance Indicators for Client Lifecycle Management Template

Client Lifecycle Management Technology

Client lifestyle management software or SaaS solutions analyze each transaction and process you complete with your clients. You can use that data to examine those interactions and better understand your client’s needs.

Overall, the technology can help your organization avoid the following:

- Data Silos: Different departments within your organization have the same or similar information about a client but don’t share it with others.

- Bottlenecks: The delay of client onboarding or similar processes due to requesting the same information, or client data isn’t processed efficiently.

- Human Error: ProjectBI’s Butlion shares, “The main benefit of client lifecycle management software is that it allows you to implement a complex plan at scale while significantly reducing the chance of human error.” He adds that good software “can reduce a massive amount of friction and guide your customer success staff in such a way that eliminates decision fatigue.”

But your organization must do research and make decisions before choosing a specific solution. Those include:

- Outlining your client lifecycle management goals, phases, and system. Your organization needs to understand how it wants to evaluate its work with clients, and how it wants to measure success, before purchasing software.

“In other words, companies should not procure technology as a means to defining the client lifecycle management phases,” says Zotti, from Contek Consulting. - Deciding whether to develop a system in-house or purchase a third-party solution. By building a system in-house, your organization can create something that fits its needs exactly. But that also means the company needs the staff to create and support it.

Buying a third-party solution makes more sense for many organizations. But Zotti warns, “An organization needs to invest in in-house capabilities that will allow it to manage the evolving needs of the business and translate those needs into the client lifecycle management solution.” And the organization needs to ensure the software is appropriately tracking all processes and functioning properly, Zotti adds. - Selecting a solution that supports on-premises, cloud-based, or both options. For years — especially in the financial services industry — most solutions were on-premises. Banks and similar organizations concerned about data security believed on-premises solutions were safer. Increasingly, cloud solutions are proving to be highly secure, as well, and those options can make it easier for organizations to implement and ensure continual updates. Current solutions include on-premises, cloud-based, and hybrid options.

Client lifecycle management solutions can perform a wide range of tasks, including the following:

- Provide client questionnaires

- Connect with your organization’s customer relationship management (CRM) software, including your CRM calendar for outreach to clients. (To learn more about customer relationship management software, read “Customer Relationship Management (CRM): Beyond The Technology.” To learn more about CRM, read “How to Perform Effective Client Relationship Management, Including Tips from Experts.”)

- Create client outreach campaigns

- Period reviews of client purchasing and other data

- Customization for clients, including what’s needed for financial planning

- Regulatory reviews, especially in the financial services industry

- Regulatory compliance updates

- Client support updates

- Ensure that client data and information are compiled and coordinated across your organization’s lines of business, geographic location, and more

- Sort and differentiate client data, based on department needs

- Humanize the client experience with your organization by allowing quick employee access to client information

- Improve client service and client experience

Kofax’s Huff says his company noticed an increased interest in client lifecycle management technologies after the emergence of the pandemic and the resulting changes in society. “We’ve seen a recent uptick in enterprise customers seeking to accelerate their digital transformation as they navigate the economic downturn caused by pandemic lockdown actions,” Huff says.

“Client lifecycle management investments have centered on adding digital capabilities and solutions to underinvested areas of the business [so companies can] better interact with and care for their customers,” he adds.

What Is a SaaS Client Lifecycle?

A client lifecycle for a software as a service (or SaaS) company is when the company works to attract prospective clients, convert them into clients, and keep them as repeat clients.

The retention stage is especially vital for SaaS organizations; that’s likely the only time customers and clients use a SaaS solution.

What to Look for in a Client Lifecycle Management Solution

Experts say some broad attributes are crucial in a good client lifecycle management solution. Look for these basic attributes:

- Secure: Whether you select an on-premises or a cloud-based solution, ensure it offers top security for all data and that there is a simple process to continually update that security.

- User-Friendly: An on-premises solution should be easy for your staff to use and tweak where necessary. “The best software should be ‘CIO-durable and business-scalable' — meaning the software should exceed CIO security and network requirements, but also be low-code enough where the business citizen developer community could develop and operate the software,” advises Huff.

- Easily Integrated with Associated Software: The software or SaaS solution should be easy to integrate with your organization’s other client data and relevant applications.

“The vendor should bring the power of an ecosystem,” says Huff. That means a solution should connect to CRM and enterprise resource planning software, among other technologies.

Trends in Client Lifecycle Management

Advances in technology are changing client lifecycle management software and will likely significantly influence its capabilities in the future. Those advances include the development of blockchain technologies and AI. Here are details:

- Blockchain: This technology may be best known for its use in cryptocurrencies like bitcoin. Blockchain is a digital structure that stores transactional records in a public network and structures data in a way that makes the transaction impossible to tamper with or corrupt.

But blockchain is finding a home in many other secure transactions. Financial institutions are increasingly using blockchain technologies. And more companies are applying the concept to client lifecycle management software. - Artificial Intelligence: AI can now exist within products and, thus, as a form of client or customer lifecycle management. Client lifecycle management solutions are using AI to better understand client data and to help forecast future behavior. This information helps companies take action before losing a client.

Max, from Netomi, says some computer printers now have built-in AI. “The [AI printer] can send a message saying: You’re running low on ink, would you like to buy more? That makes the customer experience better and the printer company is able to recapture more of the customer lifetime value.”

Improve the Client Lifecycle with Real-Time Client Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.