What Is Discounted Cash Flow?

Discounted cash flow is a type of analysis that determines the value of a company or an investment based on what it might earn in the future. The analysis tries to ascertain the current value of projected future earnings.

What Is a Discounted Cash Flow Analysis?

Discounted cash flow analysis refers to the use of discounted cash flow to determine an investment’s value based on its expected future cash flows. Experts refer to the process and the accompanying formulas as a discounted cash flow model.

Benefits and Drawbacks of Discounted Cash Flow

People use the discounted cash flow method to judge an investment’s fundamental value. This differs from simple market sentiment, wherein you evaluate the investment based on how a stock exchange values a company’s stock or the marketplace values similar companies.

As its main benefit, a discounted cash flow analysis uses financial numbers that are based in reality: cash flow generated by the business. By contrast, the other primary valuation methods (comparable company analysis and precedent transaction analysis, explained below) rely on outsiders’ beliefs or conjectures about the value of a company or stock compared to similar companies or investments. These models can be inaccurate, as the analysis might not reflect the fundamental financial health of the company.

That said, discounted cash flow has drawbacks — notably, it relies on projections of future cash flow. While these projections are based on current cash flow, at best they are attempts to predict the future. They can be very inaccurate, especially when analysts are trying to predict cash flow several years into the future. Those inaccuracies can in turn result in an incorrect value as determined by the discounted cash flow analysis.

Advantages of a Discounted Cash Flow Analysis

The main advantages of a discounted cash flow analysis are its use of precise numbers and the fact that it is more objective than other methods in valuing an investment. Learn about alternate methods used to value an investment below.

Here are some of the primary advantages of a discounted cash flow analysis:

- Extremely Detailed: It uses specific numbers that include important assumptions about a business, including cash flow projections, growth rate, and other measures to arrive at a value.

- Determines the “Intrinsic” Value of a Business: It calculates value apart from subjective market sentiment and is more objective than other methods.

- Doesn’t Need to Use Comparables: DCF analysis does not require market value comparisons to similar companies.

- Considers Long-Term Values: It assesses the earnings of a project or investment over its entire economic life and considers the time value of money.

- Enables Objective Comparison: DCF analysis allows you to analyze different types of companies or investments, and to arrive at an objective and consistent valuation for all of them.

“The most powerful thing about discounted cash flow ... [is that] it’s really useful to compare assets that are completely different,” says Ryan Maxwell, a former financial analyst with Deutsche Bank and Chief Financial Officer at FirstRate Data, a boutique financial data firm. “If you’re interested in buying a copper mine, how do you compare that with a stock? How do you evaluate those? They are completely different investments. The best tool for that is DCF — provided they both have an income stream. It requires there be some sort of cash flow.” - Can Be Performed in Excel: While specialized software can help you perform a discounted cash flow analysis, you can also execute the analysis using an Excel spreadsheet.

- Suitable for Analyzing Mergers and Acquisitions: The objectivity ensured by discounted cash flow analysis helps company leaders judge whether a company should merge with or acquire another company.

- Calculates Internal Rate of Return: Performing discounted cash flow analysis can help companies calculate the internal rate of return (IRR) on investments, which allows them to compare the value of competing investments.

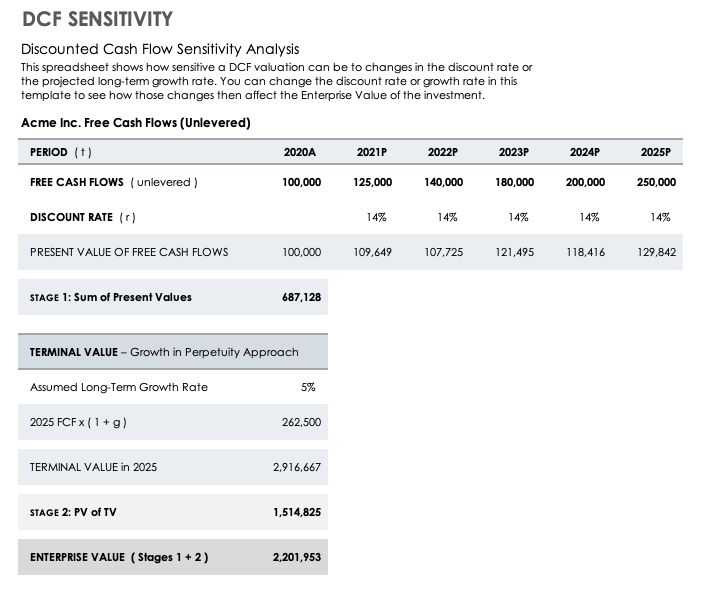

- Allows for Sensitivity Analysis: The discounted cash flow model allows experts to assess how changes in their assumptions of an investment would affect the final value the model produces. Those variable assumptions might include cash flow growth or the discount rate pegged to making the investment.

You can use a template to see how changes in either the projected growth rate or the discount rate in a discounted cash flow analysis would affect the value of the original analysis you calculated for the investment. Download this free template and customize it with your own figures.

Download Document Showing Sensitivity Analysis within Discounted Cash Flow — Microsoft Excel

Disadvantages of a Discounted Cash Flow Analysis

A discounted cash flow analysis also has limitations, as it requires you to collect a significant amount of data and relies on assumptions that can, in some cases, be wrong.

Here are the primary limitations or disadvantages of a discounted cash flow analysis:

- Requires Significant Data, Including Data on Projected Revenue and Expenses: Performing a discounted cash flow analysis requires a significant amount of financial data, including projections for cash flow and capital expenditure over several years. Some investors might find it is difficult to gather the needed data; even simple processes take some time.

- Sensitive to the Projections It Relies On: The analysis is very sensitive to its variables, which include projections of future cash flow, the investment’s perpetual growth rate, and the discount rate that experts believe is proper for the investment.

“You’re taking what is a hard job — forecasting maybe 10 years of cash flow — and making it very, very hard by saying, ‘I now need to forecast that really into perpetuity,’” says Ray Wyand, a former Vice President at Citibank in structured finance and the CEO of Gini, a company that offers machine learning tools to help businesses improve the quality of their cash flow forecasting. “The problem is, at that point, it’s enormously sensitive. So the difference between a 9 percent growth rate and a 12 percent growth rate — you go from being a midsize company to taking over the world.” - Analysis Depends on Accurate Estimates: A discounted cash flow analysis is only as good as the estimates and projections it uses.

“Discounted cash flow depends on the quality of the cash flow projections,” says Christian Brim, a certified public accountant and CEO of Core Group, a company that helps small businesses grow profitably with better financial information. “When you’re dealing with a situation where there are a lot of unknowns … and it’s hard to project the cash flows … DCF is really kind of meaningless.”

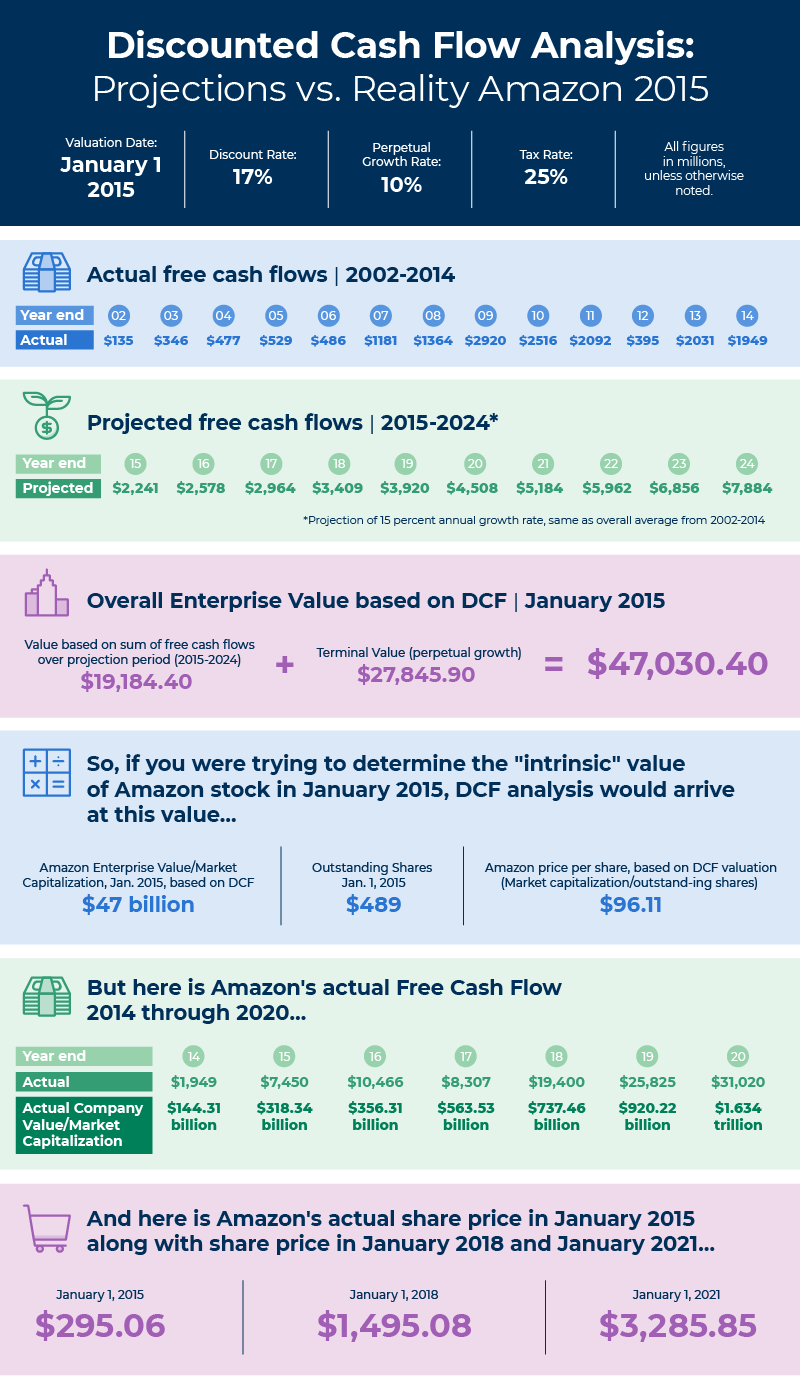

To see how inaccurate projections for future cash flow can provide a very inaccurate value for a company or investment, download this example of a hypothetical discounted cash flow analysis of Amazon in 2015. It shows a discounted cash flow analysis that projects future Amazon cash flow based on past cash flow up to 2014. It arrives at a value of Amazon stock that is much lower than its actual value in early 2015 or its later stock value. - Depends on Confidence in Future Cash Flows: Because projections and assumptions must be accurate in order to provide reliable valuations, the analysis works best when you have high confidence in an investment’s future cash flows.

“That’s the primary issue in DCF: It breaks down when you don’t have regular cash flows or very predictable cash flows,” says Maxwell from FirstRate Data.

“As a business owner, I don’t always know how I’m going to get from point A to point B,” says Brim. “Discounted cash flow — or pretty much any financial measure — is essentially a linear calculation. It assumes constant things, and that’s not the way business works.” - Prone to Complexity: Because of the data needed for the discounted cash flow formulas, the analysis can become overly complex.

- Details Might Result in Overconfidence: Because people use detailed data and projections to perform a discounted cash flow analysis, they may have more confidence in the resulting valuation than they should. That valuation is still based only on predictions of the future.

- Doesn’t Consider Valuations of Competitors: An advantage of discounted cash flow — that it doesn’t need to consider the value of competitors — can also be a disadvantage. Ultimately, DCF can produce valuations that are far from the actual value of competitor companies or similar investments. That might mean those other company values are wrong — but it might also mean the discounted cash flow analysis isn’t considering market realities and is itself wrong.

- The Terminal Value Challenge: An important part of the discounted cash flow formula is the terminal value of the investment, which is the present value of a company or investment after the multiyear forecast period. That terminal value might represent assumed cash flow in all future years beyond the forecast period or the total value of the company or investment if it were sold at the end of the forecast period. Either way, the terminal value is very difficult to estimate. And it generates a large portion of the total value that the discounted cash flow formula produces.

- Difficulties with Weighted Average Cost of Capital: The discounted cash flow analysis also uses the subject company’s weighted average cost of capital (WACC), which represents the company’s cost of capital from all its sources, as part of its formula. It can be a difficult number to accurately assess.

- Not Adept at Assessing Starkly Different Types of Investments: Discounted cash flow can assess widely varying types of investments as long as they all have somewhat predictable cash flow. But it is not as adept at assessing investments of vastly different sizes, with very disparate cash flow projections, or with varying confidence in those projections.

“If you’re comparing really disparate situations — a startup to a publicly traded company, for instance — there is too much difference,” says Brim of Core Group.

How to Value a Company: Details on Three Primary Valuation Methods

| Valuation method | Discounted Cash Flow | Comparable Company Analysis | Precedent Transactions |

|---|---|---|---|

| How accomplished |

|

|

|

Advantages |

|

|

|

| Limitations |

|

|

|

| Used most often for |

|

|

|

Alternatives to Using Discounted Cash Flow

Experts use three primary alternatives to put a value on companies or investments. Other than discounted cash flow, the other primary valuation methods are comparable company analysis and precedent transaction analysis.

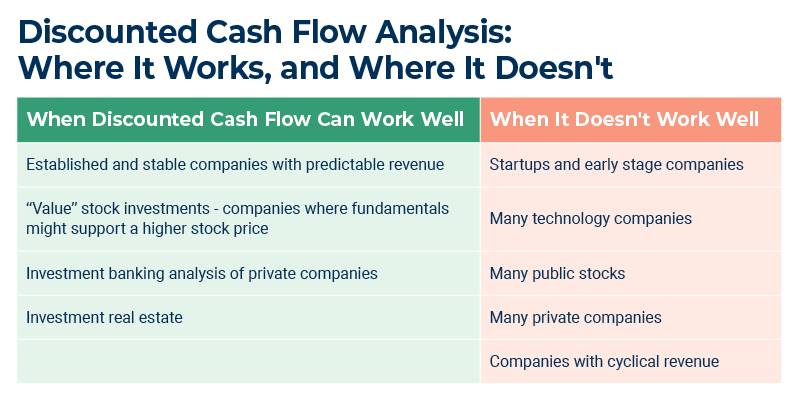

When to Use Discounted Cash Flow

You’ll want to use discounted cash flow to assess the value of an investment when its cash flow is relatively stable and predictable.

Discounted cash flow often works well in the following cases:

- When a Company’s Operations (or Investment Returns) Are Consistent and Can Be Predicted with Some Certainty: Discounted cash flow was largely the result of valuing bonds, which have very predictable returns, says Wyand from Gini. “It works really well when you have a steady set of cash flows that you can predict,” he says. In essence, it provides “the value of all of the residual cash that the company spits out.”

- When a Company Draws Its Revenue from Various Sources: Using a different valuation method might be difficult in such cases because there would be no similar companies to allow a comparables analysis.

- When Value Investors Are Evaluating a Company: These are investors looking to buy stock in companies that appear to be undervalued based on a fundamental analysis of their financial results. In these cases, value investors can use discounted cash flow analysis to determine whether the company’s future cash flows will make it worth more money than the market says.

- In Investment Banking: Many experts believe discounted cash flow is better able to determine the value of private equities for investment bankers as opposed to stocks in many public companies.

- In Investment Real Estate: Because the analysis works so well with steady and predictable cash flows, “I would say if you’re buying a house as an investment, DCF is a very good way to look at that,” Wyand says.

When Not to Use Discounted Cash Flow

Discounted cash flow works less well when future cash flow is likely to be varied or is unpredictable.

Where Discounted Cash Flow Analysis Would Not Work Well

- Companies with Cyclical Revenue: Using discounted cash flow is difficult for companies with revenue that varies significantly because of business cycles. That might include home construction companies, for example. It becomes too difficult to forecast future earnings from year to year.

- Internal New Product Evaluations: Companies often want to do an internal evaluation of a potential new product. Discounted cash flow can have limited value to do so. “I think it might be a blunt instrument sometimes, when you’re doing an internal evaluation: ‘Should we launch this product or invest more in an existing product?’” says Brim from Core Group. “You might have better data to do your cash flow projections. But it doesn’t capture all of the things you can’t measure, like ‘How does this affect the company culture or the overall direction of the company?’”

- Private Companies: It can be difficult to get the financial data needed in the formula for many private companies.

- Public Stocks: Many experts believe discounted cash flow currently doesn’t work well to value many public stocks. The price of many public stocks would exceed the value that discounted cash flow would suggest. That might mean stocks are overpriced. Or it might mean discounted cash flow isn’t an appropriate way to value stocks in the current market.

“I think if you ran a very disciplined DCF through a lot of publicly listed stocks, you would probably find nothing to buy right now,” says Wyand from Gini. - Startups and Early-Stage Companies: They have no sales track record, and it is much more difficult to project cash flow.

- Technology Companies: Many tech companies have significant expenses when they begin and won’t have predictable cash flow for a few years or more. But investors still value many publicly traded tech companies very highly — even young ones.

“If you use DCF for a lot of tech companies, they tend to look quite expensive,” says Maxwell from FirstRate Data. According to Maxwell, if an investor relied on a discounted cash flow analysis to assign value to many tech companies in past years, “you would have lost out” on significant stock price increase by not buying the stock.

How to Determine Discount Rate when Valuing Assets

The discount rate is a very important variable in discounted cash flow because it allows you to assess what it costs a company to generate its cash flows. It also allows you to assign a risk level to an investment.

In the formula, the discount rate includes the subject company’s weighted average cost of capital, which refers to the various ways the company can access capital to pay for its infrastructure and operations.

Experts raise the discount rate for companies and investments that are riskier. That lowers the final value for a risky investment versus a less risky investment. The concept recognizes that the buyer should pay less to take on the risk when the business generates less revenue than predicted or has to end operations entirely.

“At a very high level, (the discount rate) is the risk of the project,” says Maxwell of FirstRate Data. “You’re investing in a restaurant, or you’re investing in a utility company. The restaurant has a lot more risk. The discount rate should be a lot higher.”

An expert might also raise the discount rate for certain companies in certain situations. A business that must be closed or partially closed during a pandemic would require a higher discount rate, for example.

“Essentially, these discount rates are meant to capture the risk of an investment,” Wyand says. “If you can correctly analyze discount rates, if you can forecast what discount rates should be, then you'll be the richest person in the world. It's very, very hard.”

Simplify Successful Forecasting and Valuation with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.