Discounted Cash Flow Template

Use this simple, easy-to-complete DCF template for valuing a company, a project, or an asset based on future cash flow. Enter year-by-year income details (cash inflow), fixed and variable expenses, cash outflow, net cash, and discounted cash flow (present value and cumulative present value) to arrive at the net present value of your company, project, or investment. This reusable template is available in Excel and as a Google Sheets template that you can easily save to your Google Drive account and share with others.

Download Discounted Cash Flow Template - Excel

Looking for more information on regular cash flow templates? Visit our article on cash flow statement templates.

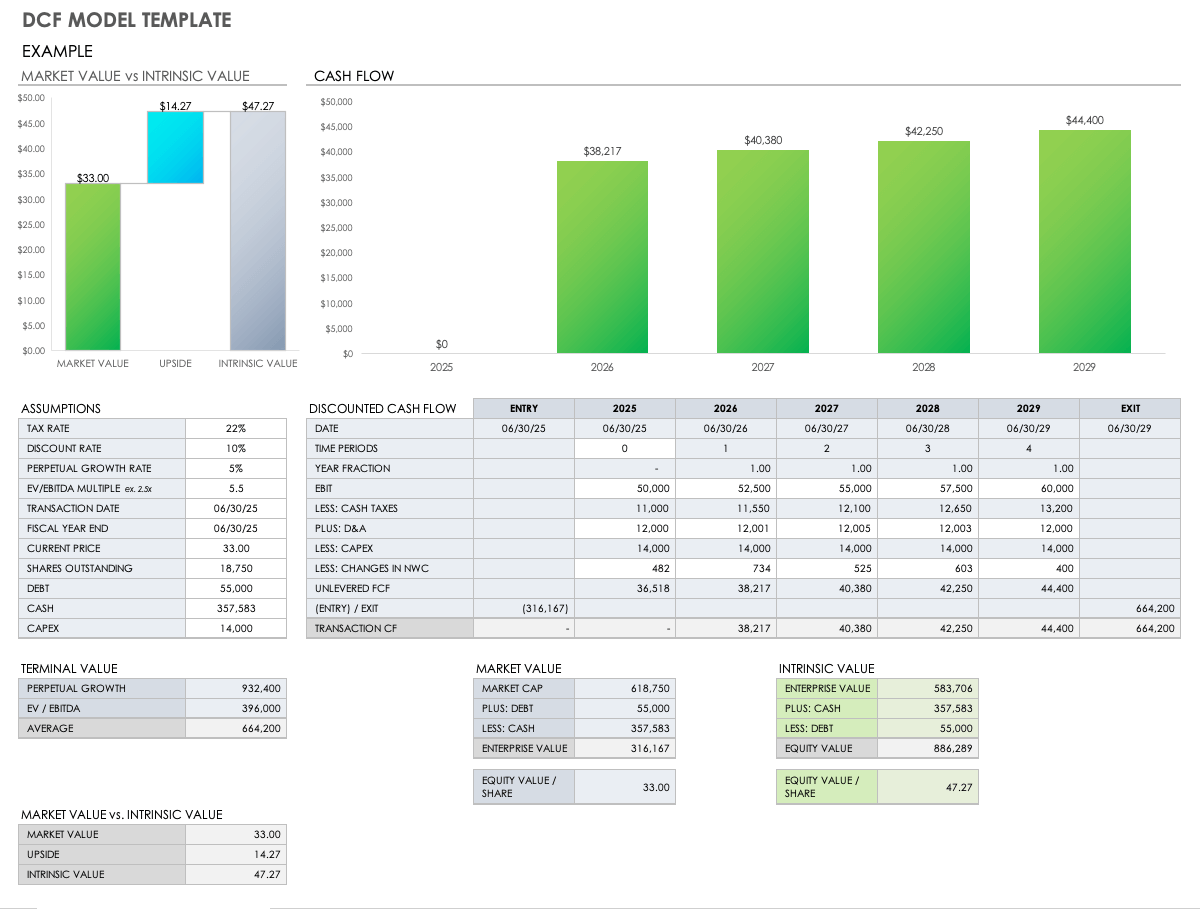

Discounted Cash Flow Model Template

This DCF model template comes with pre-filled example data, which you can replace with your own figures to determine its value today based on assumptions about how it will perform in the future. Enter year-by-year cash flows, assumptions (e.g., tax rate and perpetual growth rate), discounted cash flow data, terminal value (e.g., perpetual growth), and rate of return. The template will then generate a dashboard view of your company or investment’s market value as compared to its intrinsic value. (Market value is the current value of your company with its stock price factored in; intrinsic value is an estimate of the true value of your company, regardless of its market value.)

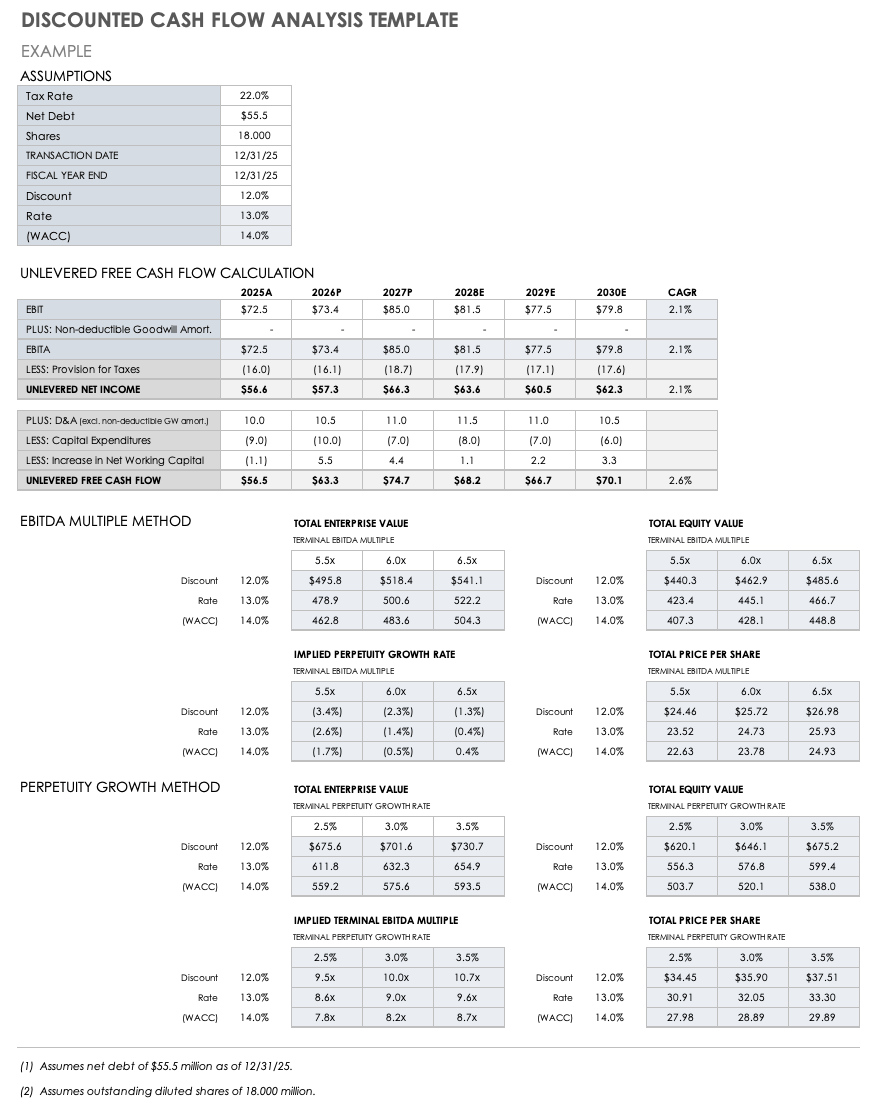

Discounted Cash Flow Analysis Template

Designed to accurately estimate your company’s intrinsic value compared to its market value, this unique analysis template provides you with the ability to determine whether the market value is justified, based on your company’s fundamentals and projected future performance.

This template includes unlevered free cash flow (UFCF) calculation, which refers to your company’s cash flow prior to accounting for financial obligations. Additionally, it calculates earnings before interest taxes, depreciation and amortization (EBITDA), and a perpetuity growth method, which accounts for the value of free cash flows that grow at an assumed constant rate in perpetuity. In tandem, these three sections provide insight into the true value of your company as a result of projected cash flows.

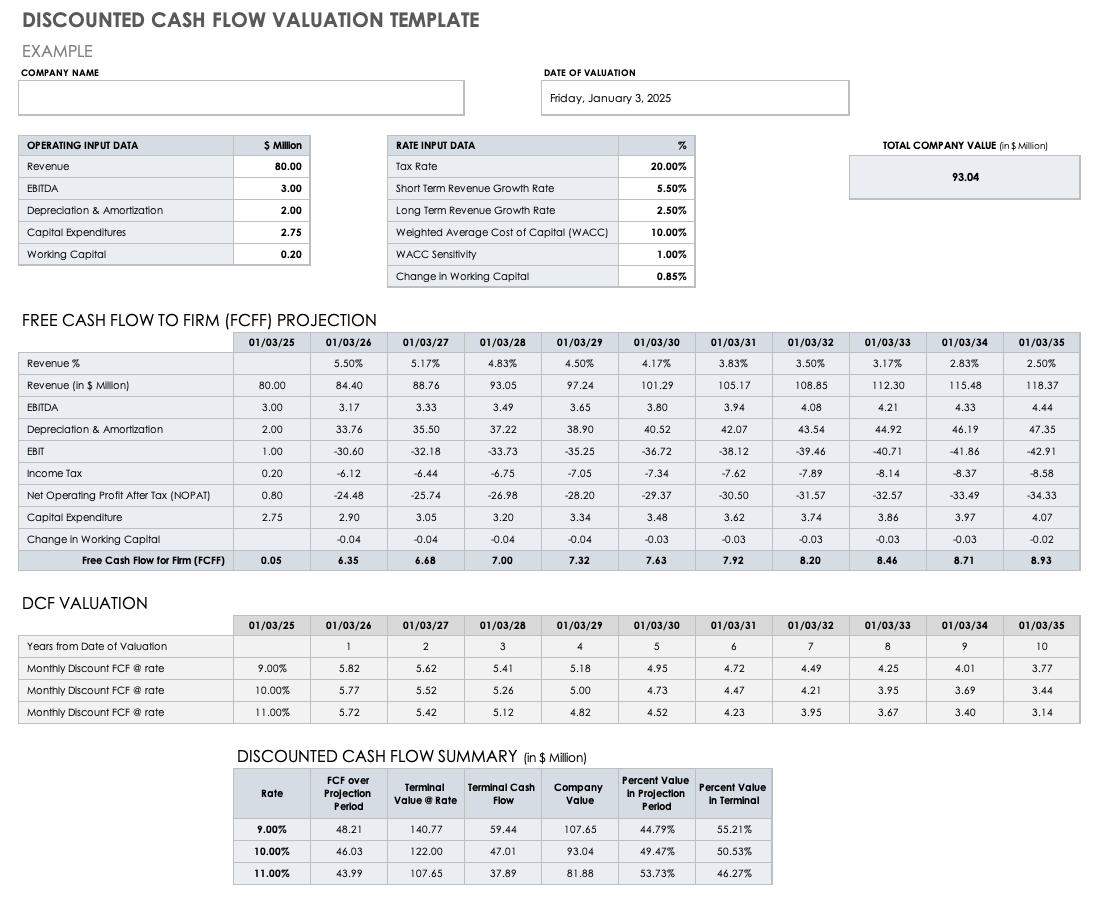

Discounted Cash Flow Valuation Template

Get an accurate picture of your company’s true value — with projected future cash flows factored in — by using this streamlined DCF valuation template. The template incorporates your company’s future cash generation capacity as compared to current cash flow and allows you to compare your present holdings based on projected cash flows generated over future periods. You can then enter a discount rate (also called cost of capital) to determine your company’s present actual value.

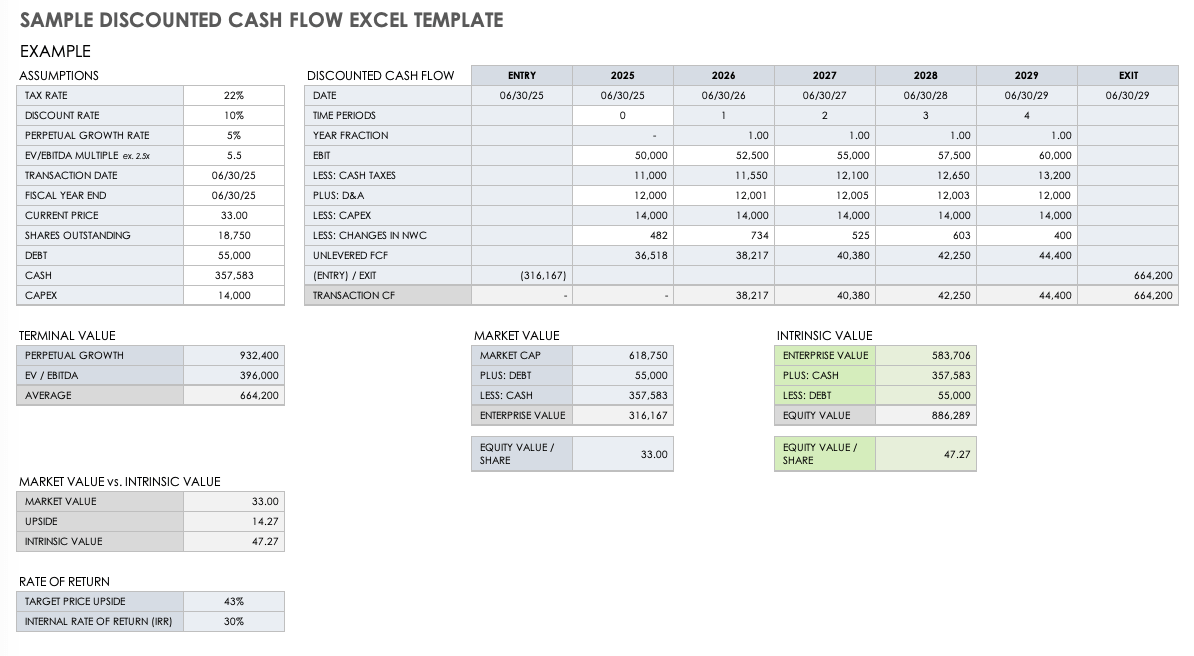

Sample Discounted Cash Flow Excel Template

This sample DCF Excel template provides you with an easily scannable view of your company’s or investment’s true value by using the time value of money (TVM), which refers to the preferred benefit of receiving money presently rather than a similar sum at a future date. Net operating loss, free flow, and unlevered free cash flow factors give you an accurate picture of your company’s DCF actual valuation to ensure your company or investment is represented with an accurate financial projection.

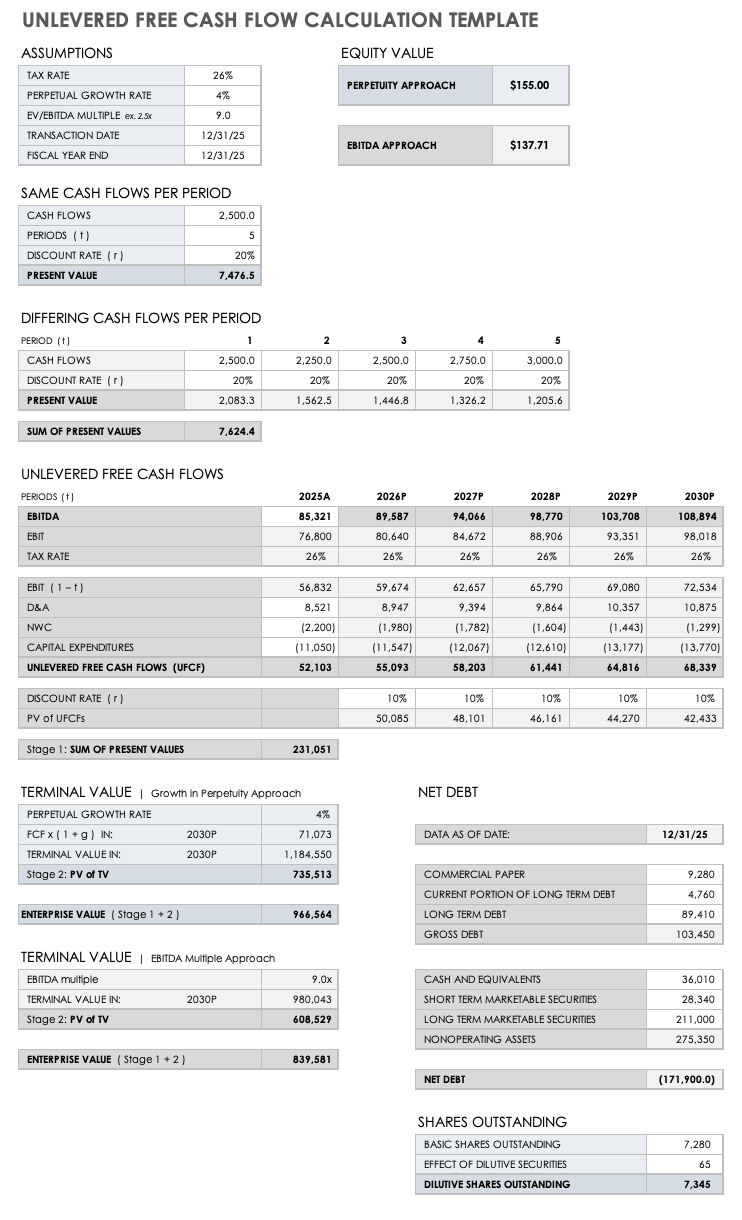

Unlevered Free Cash Flow Calculation Template

This UFCF calculation template provides you with insight into the tangible and intangible assets generated by your business that are available for distribution to all capital providers. UFCF includes revenue, cost of goods sold (COGS), taxes, depreciation and amortization, alterations in working capital, and capital disbursement. This template includes year-over-year columns intersecting with the following rows: revenue, operating income, earnings before interest and taxes (EBIT), and net operating profit after taxes (NOPAT) — all to pinpoint your business’s UFCF and actual value.

Download Unlevered Free Cash Flow Calculation Template - Excel

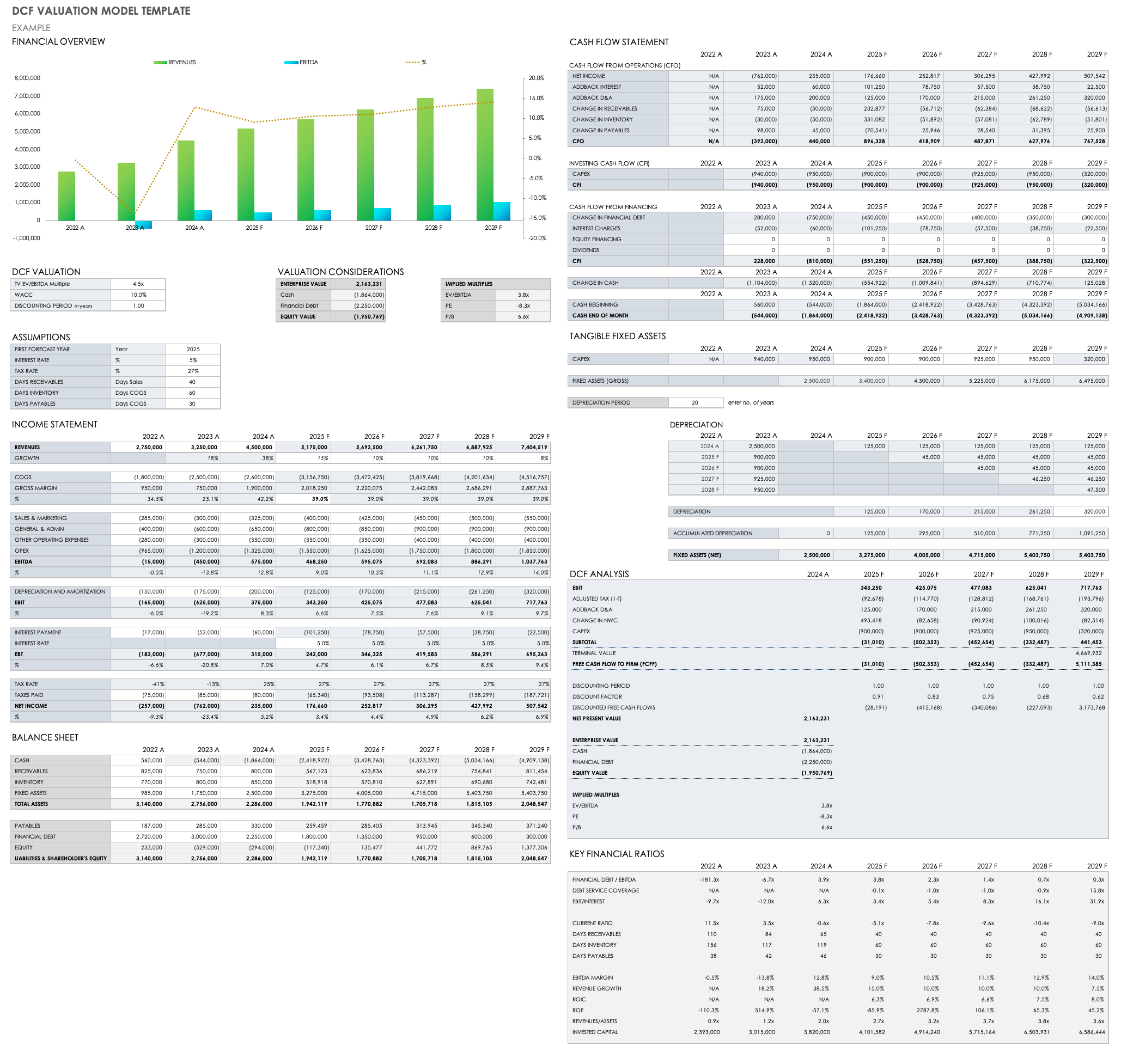

Discounted Cash Flow Valuation Model Template

Keep apprised of your company’s valuation based on expected cash flow streams with this DCF valuation model template. The customizable template includes annual DCF analysis columns, as well as sections to factor in valuation considerations, assumptions, income statement, balance sheet, cash flow statement, key financial ratios, and tangible fixed assets — culminating in an auto-generating financial overview chart. This template is the perfect tool to determine the value a company using the DCF valuation method.

Download Discounted Cash Flow Valuation Model Template - Excel

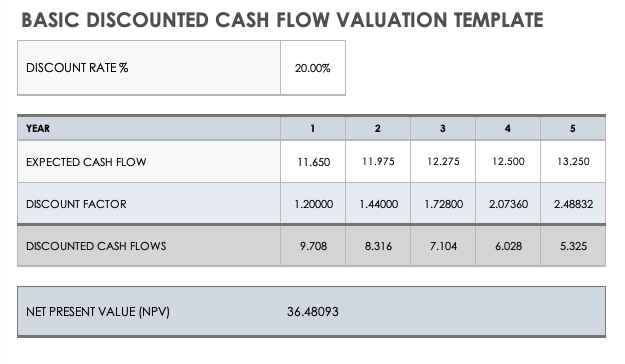

Basic Discounted Cash Flow Valuation Template

Get an overview of your company’s or investment’s intrinsic value with the simple equations in this basic DCF valuation template. To calculate intrinsic value, take the present value of future free cash flows and add it to cash proceeds from your company’s or investment’s eventual sale. Enter year, cash flow, discount factor, discount rate, DCF, and net present value (NPV) to gain exact valuation. You can save this basic DCF valuation template as an individual file — with customized entries — or as a template for other applications, where you might need to provide details of other assets’ true value and respective discounted cash flows.

Download Basic Discounted Cash Flow Valuation Template - Excel

Discounted Cash Flow Model with Company Valuation Template

This template is ideal for companies that want to determine their value based on future cash flow projections. A forecasting tab allows you to enter forecasting variables (e.g., revenue growth factor) and valuation model outputs (e.g., gross profit margin) to provide you with the present value (PV), as well as the market value of the company’s assets. A DCF tab provides you with the ability to adjust revenue, gross profit, EBITDA, EBIT, and NOPAT details. In tandem, these two tabs’ calculations provide you with an exact account of the total present value of company operations and the total market value of the company’s assets.

Download DCF Model with Company Valuation Template - Excel

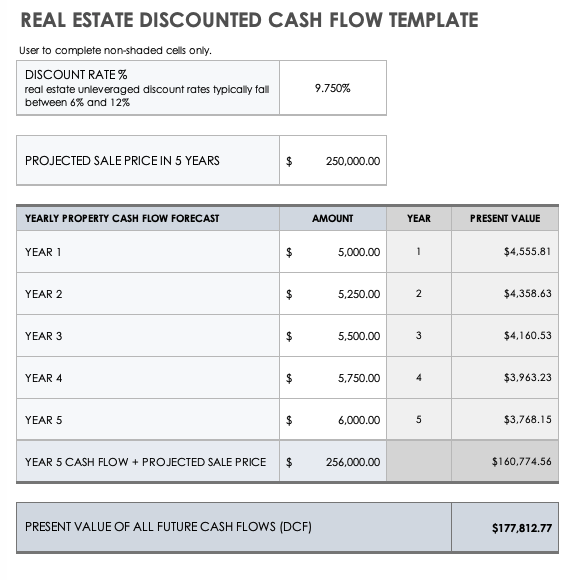

Real Estate Discounted Cash Flow Template

Make sound real estate investments with this unique template, which offers a holistic picture of the true year-over-year value of any given property investment. This real estate-specific DCF template allows you to enter all relevant information about a certain property, including projected cash flows, discount rate, and sale price, which total the sum of all future DCFs that the investment is expected to produce. This provides you with the intrinsic value of your property.

Manage Discounted Cash Flow Projections and Finance Operations Better with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Any articles, templates, or information provided by Smartsheet on the website are for reference only. While we strive to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, articles, templates, or related graphics contained on the website. Any reliance you place on such information is therefore strictly at your own risk.

These templates are provided as samples only. These templates are in no way meant as legal or compliance advice. Users of these templates must determine what information is necessary and needed to accomplish their objectives.