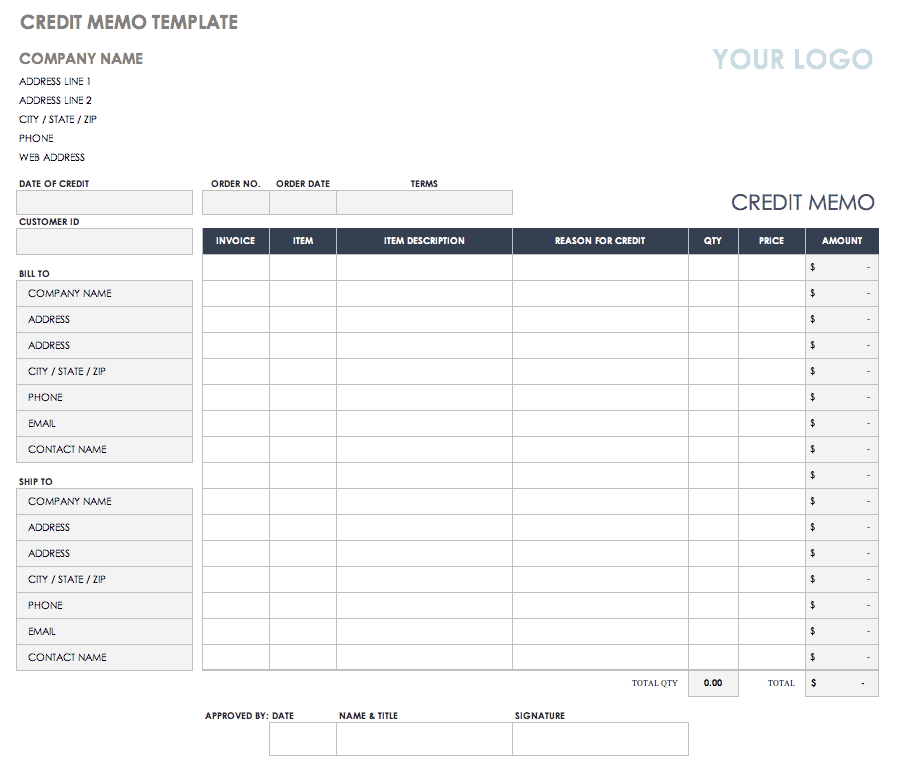

Credit Memo Template

Formatted similar to an invoice, this Microsoft Excel template provides an itemized list for entering goods or services. There is also space for writing the reason for the credit memo, customer contact info, ID number, and date. This is a basic credit note template that provides automatic calculations for ease of use and efficiency.

Download Credit Memo Template

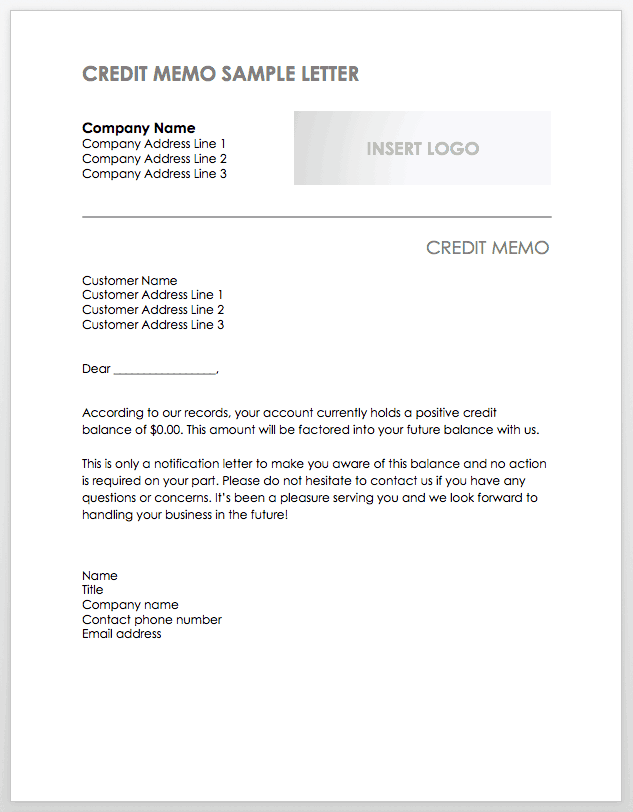

Credit Memo Sample Letter

If you need a credit memo in a letter format, this template provides sample text that you can edit for your specific situation. Download the template as a Word or fillable PDF file, add business details, transaction information, and other necessary content, and then email or print the completed version. Include a customer or memo tracking number for easy reference.

Download Credit Memo Sample Letter

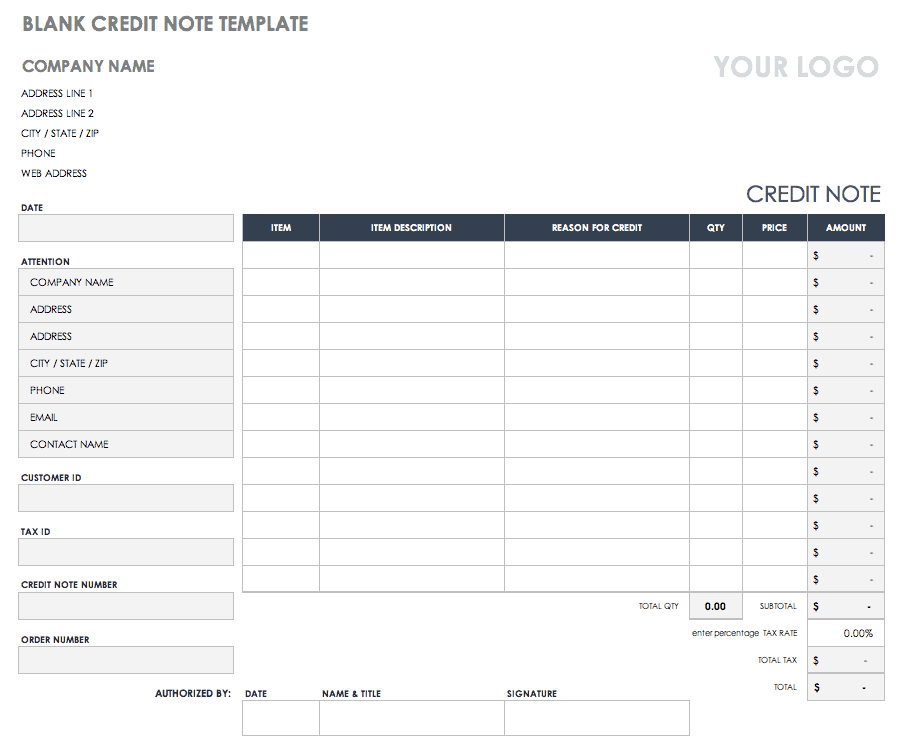

Blank Credit Note Template

This credit note is designed for goods that are being returned. The template offers a slightly different layout than a typical invoice and has plenty of space for entering your details. There are sections for adding the corresponding invoice number, the reason for the return, tax information, unit prices including discounts, and total value.

Download Blank Credit Note Template

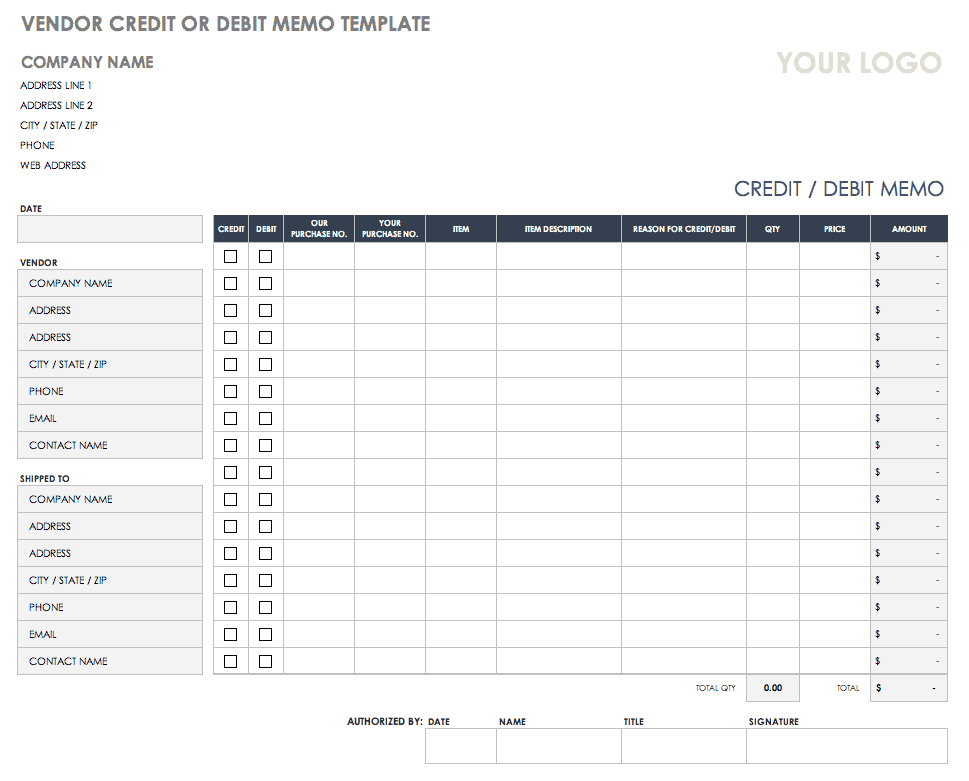

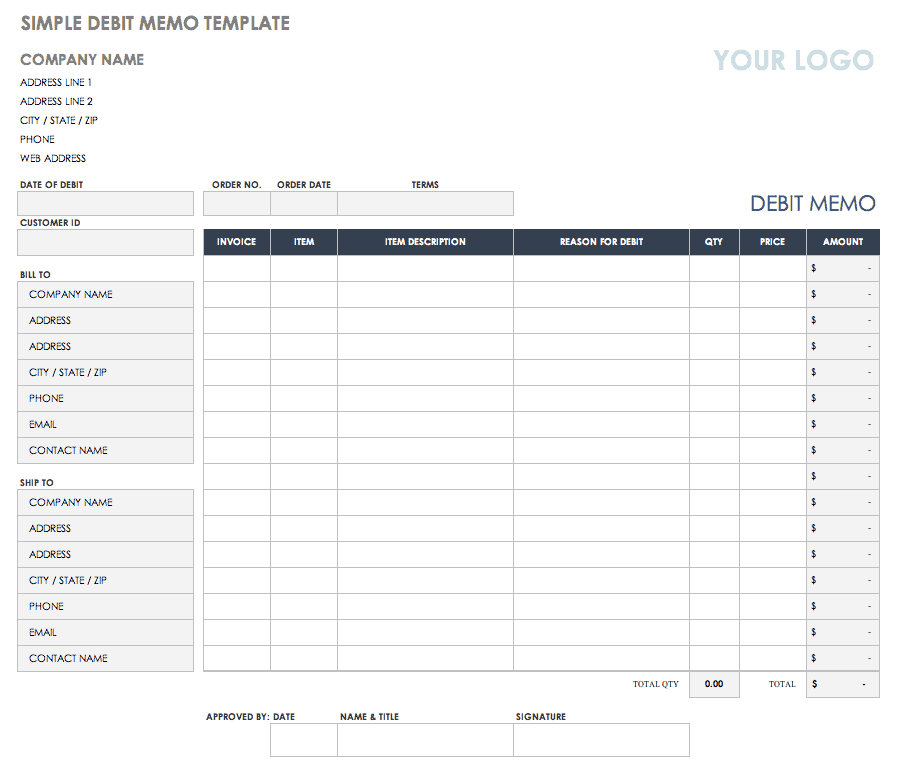

Vendor Credit or Debit Memo Template

Designed for use with vendors, this template can function as a credit or debit memo form. Select the correct version so recipients can clearly see which type of form they are receiving. Enter vendor details, information about items purchased and prices, and the reason for the memo. The template also includes signature lines for approvals.

Simple Debit Note Template

Designed with efficiency in mind, this debit note template looks similar to an invoice and is used by both the sender and the receiver. Enter a date for the note and explanation for why it is being sent, and then add details about items being returned, payments owed, or invoice corrections that need to be accounted for. The template also provides room for a business address, phone number, and other important details.

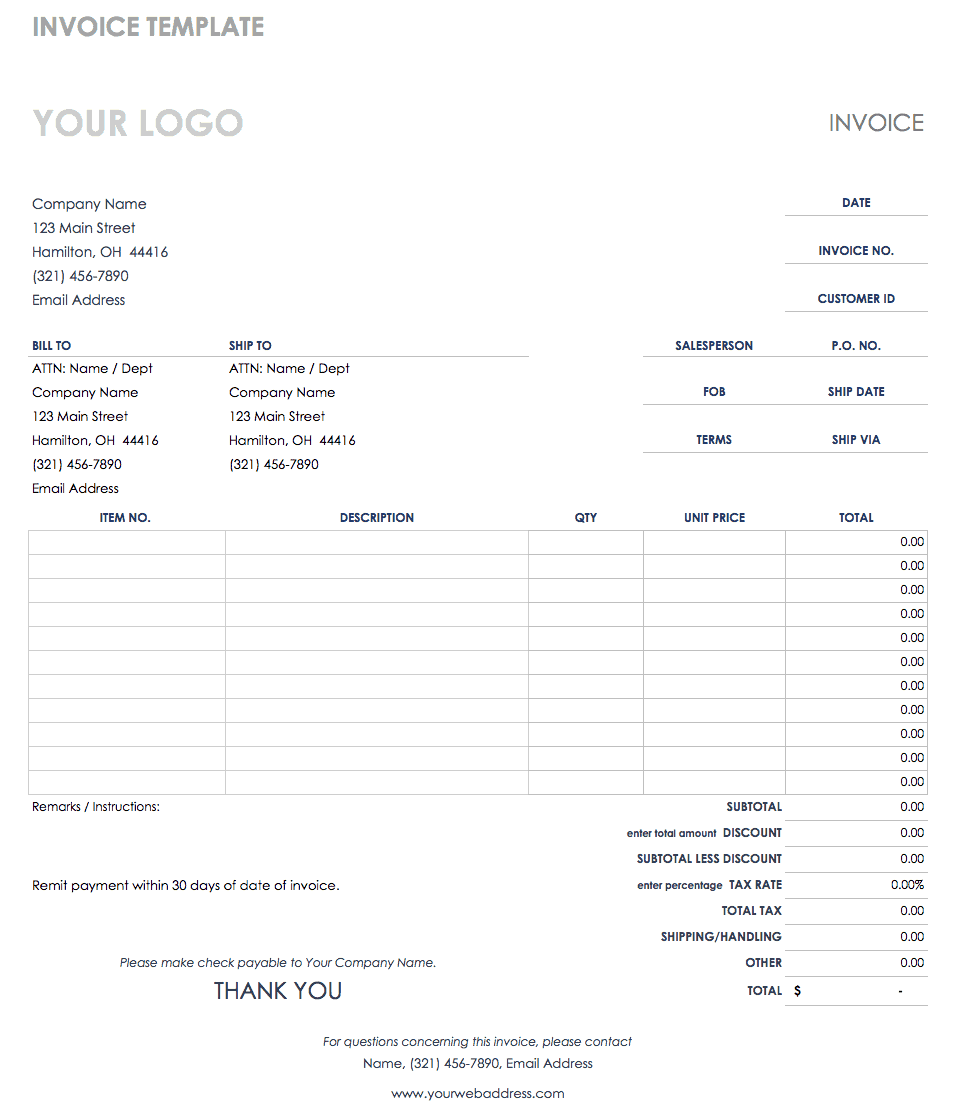

Invoice Template

This invoice is a Google Sheets template, so you can easily save it to your Google Drive account. Customize the template by adding a company logo and adjusting the color scheme. The invoice includes sections for billing and shipping information, item numbers, descriptions of goods purchases, quantities, and costs. The template calculates total amounts due, including taxes and shipping charges.

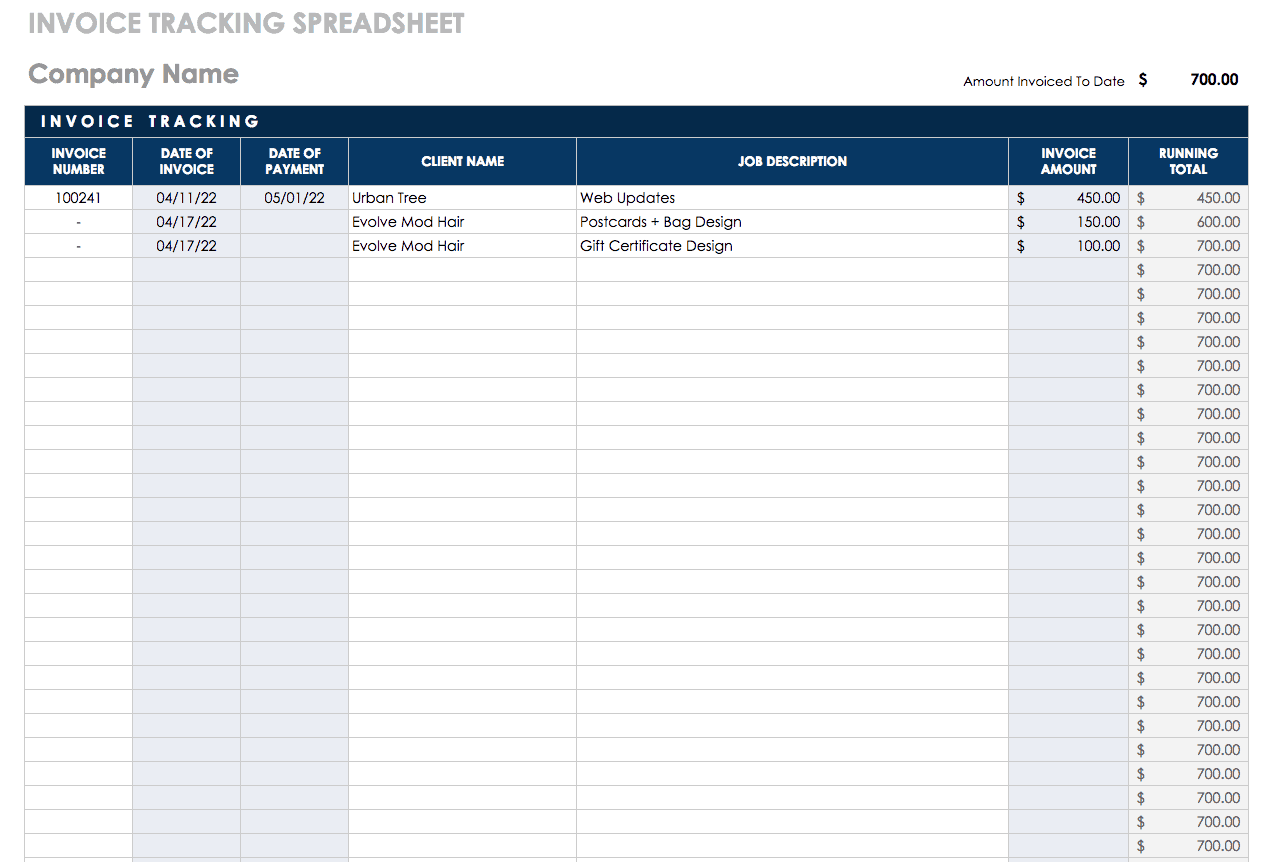

Invoice Tracking Spreadsheet

This basic spreadsheet template makes it easy to find past invoices and see payments made and outstanding balances. Businesses can use this sheet to track goods or services sold to customers. Similarly, buyers can also use it to track payments they’ve made to various suppliers. Modify the template by adding or deleting columns to suit your business needs.

What Is a Credit Note?

A credit note, also known as a credit memo, notifies a buyer that they are receiving a credit on their account for returned goods, either to correct an overcharge or incorrect taxes on a previous invoice, or for another reason. The note functions similarly to a consumer receiving store credit for returning a retail purchase, which they can then use to purchase other items at the store. However, credit notes are typically commercial documents used between businesses. For example, a vendor would issue a credit note to a customer to document the reason for and amount of credit. The buyer can then use that credit memo to update their accounting books to reflect the reduction in liability to pay the seller and a decrease in expenses. For returned items, the buyer updates their purchase return account, whereas the seller updates their sales return account to show the decrease in revenue.

There are several reasons that a seller might issue a credit note. If a buyer receives damaged or deficient goods, a credit may be issued for future purchases and to document the return of the goods. Other reasons that a buyer’s account may need to be credited include incomplete orders, accidentally sending an invoice to a buyer, or customer dissatisfaction with the items received. A credit note may also be used when a buyer is purchasing services rather than goods if the service does not meet customer expectations.

A memo is typically thought of as a written document, in a letter format, used for business communications. While a credit memo or note can be written in paragraph form, it is often formatted like an invoice. Regardless of the layout of a credit note, the following information is generally included:

- Reason for Credit Note: Stating this clearly provides helpful documentation for both buyer and seller.

- Items Purchased: An itemized list of goods or services along with quantities makes it easy to see which products are being returned.

- Prices: These are the unit prices for each item, which the seller and buyer agreed upon as the initial purchase.

- Negative Amounts: Unlike an invoice, which shows the total sum owed for purchased items, a credit notes shows a negative amount since it is showing a reduction in the amount owed. The total amount may also include any taxes that were added to the original cost of the returned goods.

A credit note may also reference the original invoice and include a separate serial number for record-keeping. Similar to invoices and receipts, credit memos also tend to include details like customer contact information and ID numbers.

What Is a Debit Memo For?

A debit memo, also called a debit note, is used to document and update accounting records and signifies an amount owed. A buyer may send a debit memo to a seller in order to request a credit memo for goods that will be returned. In business-to-business (B2B) transactions, goods are often purchased on credit, which means that the buyer receives products from the supplier before making a payment.

These transactions are accounted for by adding and subtracting credits and debits until an invoice is sent for the actual payment owed. If a buyer issues a debit note for returning items that have not yet been paid for, the note would show the accounting adjustments on the buyer’s end, and the seller would then issue a credit note to reflect the adjustments on their end. In this sense, debit and credit notes are part of the record-keeping process for tracking shipments and payments.

Sellers can also issue debit notes to request additional payment if a buyer was mistakenly undercharged on a previous invoice. They can also be used to remind a buyer of debt obligations if they still owe an outstanding amount. Some businesses use debit memos as shipping receipts to show what goods the buyer is receiving. Again, this is not an invoice, even if the memo shows the amount that the buyer will be billed.

In some cases, debit notes are also used to indicate commission or interest owed. The memo provides a way of documenting B2B transactions that are outside of the normal revenue stream — for instance, between a parent company and a subsidiary, or a third-party business that has been commissioned by another company to provide services to a client.

Depending on how a debit note is being used, it may be written like a memo, a receipt, or even a simple postcard reminding you about debts owed. If a buyer is submitting the debit note for returned goods, it may show the anticipated credit amount along with the reason for the return and a list of returned items. Debit notes for invoice corrections or payment reminders typically include information about the upcoming invoice or amounts currently due. Debit notes also generally include a date for the note, tracking numbers, contact info, and approval signatures. Unlike credit notes, which show negative amounts, debit notes show positive amounts to indicate money owed.

Not all companies use credit or debit notes, but if one business requires it to meet internal regulations, they can request that the company send the necessary info for their records. Businesses can choose from software tools or templates to manage credit and debit memos, depending on the size and scope of their operations.

Is a Debit Memo the Same as an Invoice?

A debit memo may look like an invoice, but the two are distinct. Debit memos are sent to vendors by buyers to request credit for returned goods. Invoices, however, are always issued by the seller to inform the buyer that an amount is owed. Debit memos are typically issued for transactions that have not yet been paid for, and serve to update accounting records for proper invoicing.

Is a Credit Memo a Refund?

A credit memo shows the amount owed to a buyer for returned items. If the goods were already paid for, that amount could be issued to the buyer as a refund. But since businesses often purchase products on credit, the items may be returned before any cash has been paid. In that case, the credit memo indicates a change in the buyer’s credit account rather than a refund.

What Is a Debit Memo and Credit Memo in Payables?

An account payable shows a credit balance based on how much a company owes a supplier. When products or services are purchased on credit, the accounts payable account balance increases. When a payment is sent to the supplier, the balance decreases.

For example, if a buyer issues a debit memo to a seller for returned goods that were purchased with credit terms, it indicates an adjustment to the buyer’s account payable. When the seller accepts this and issues a credit memo, the seller’s account receivable then also needs to be updated.

Discover a Better Way to Manage Credit and Debit Notes and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.