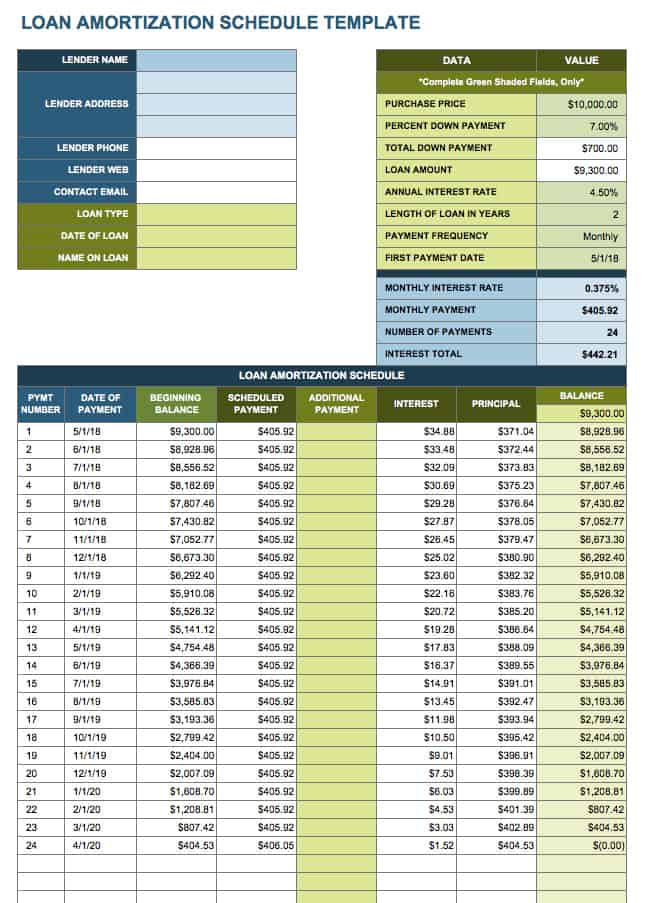

General Loan Amortization Schedule Template

This all-purpose Microsoft Excel amortization schedule template can be used for a variety of loan types including personal loans, mortgages, business loans, and auto loans. It calculates the interest and principal payments for a given loan amount within a set timeframe. This amortization table Excel template will show you the balance remaining after each payment, and the amount of interest paid to date. It also calculates the total number of payments necessary to pay the loan balance in full, so you can plan accordingly.

Download General Loan Amortization Schedule Template

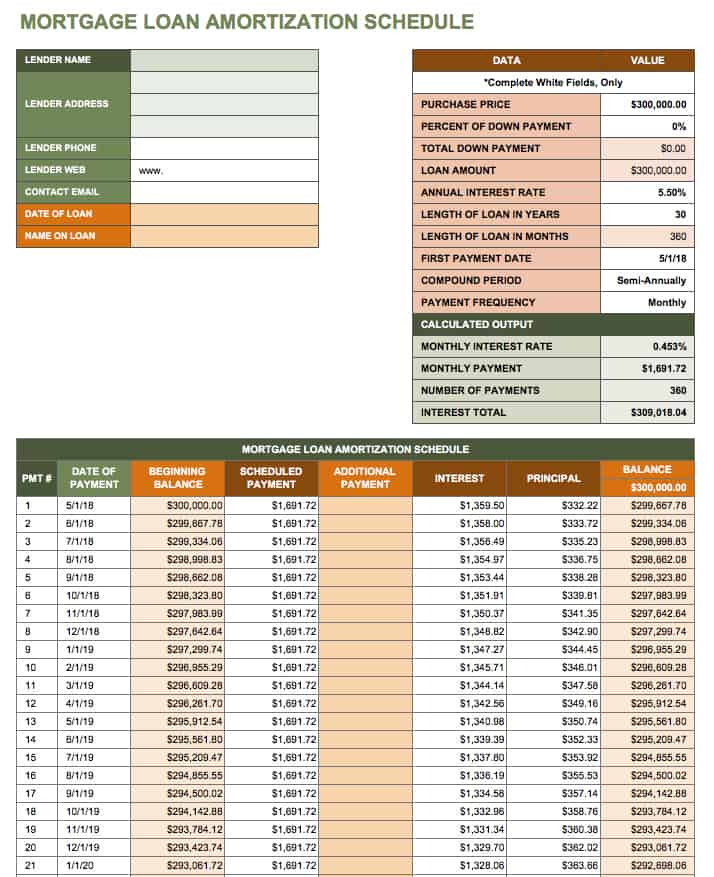

Mortgage Loan Amortization Schedule Template

This loan amortization calculator Excel template can be used for a home mortgage loan—one of the most common types of amortizing loans. Use this template to calculate the balances paid and owed, as well as the distribution of payments across the interest and principal. This will help you determine how many payments remain until you officially own your home. You can also see how much you will save by making extra mortgage payments.

Download Mortgage Loan Amortization Schedule Template

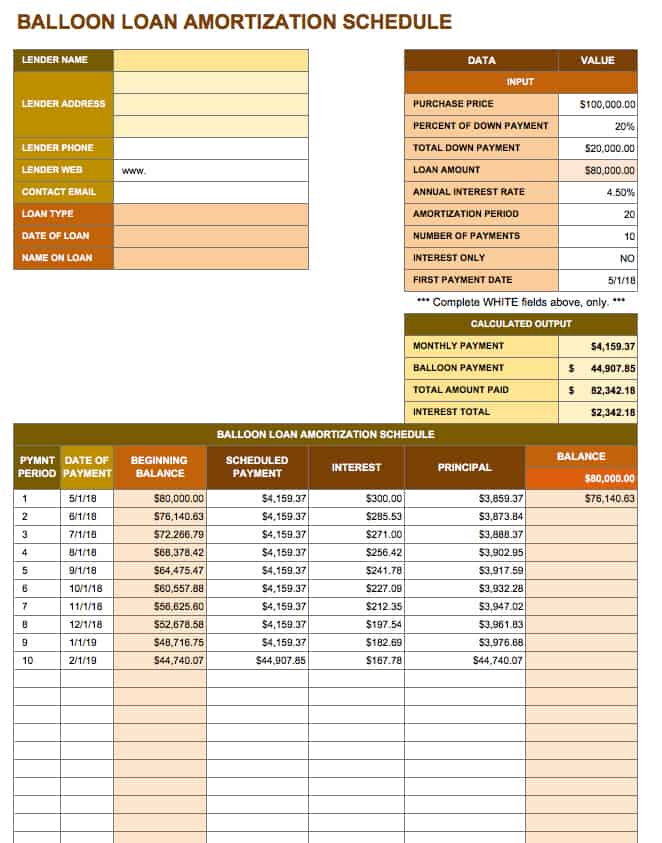

Balloon Loan Amortization Schedule Template

Use this Excel amortization schedule template to determine balloon payments. A balloon payment is when you schedule payments so that your loan will be paid off in one large chunk at the end, after a series of smaller payments are made to reduce the principal. This loan amortization template will calculate both your monthly payments and the balloon payment amount and schedule.

Download Balloon Loan Amortization Schedule Template

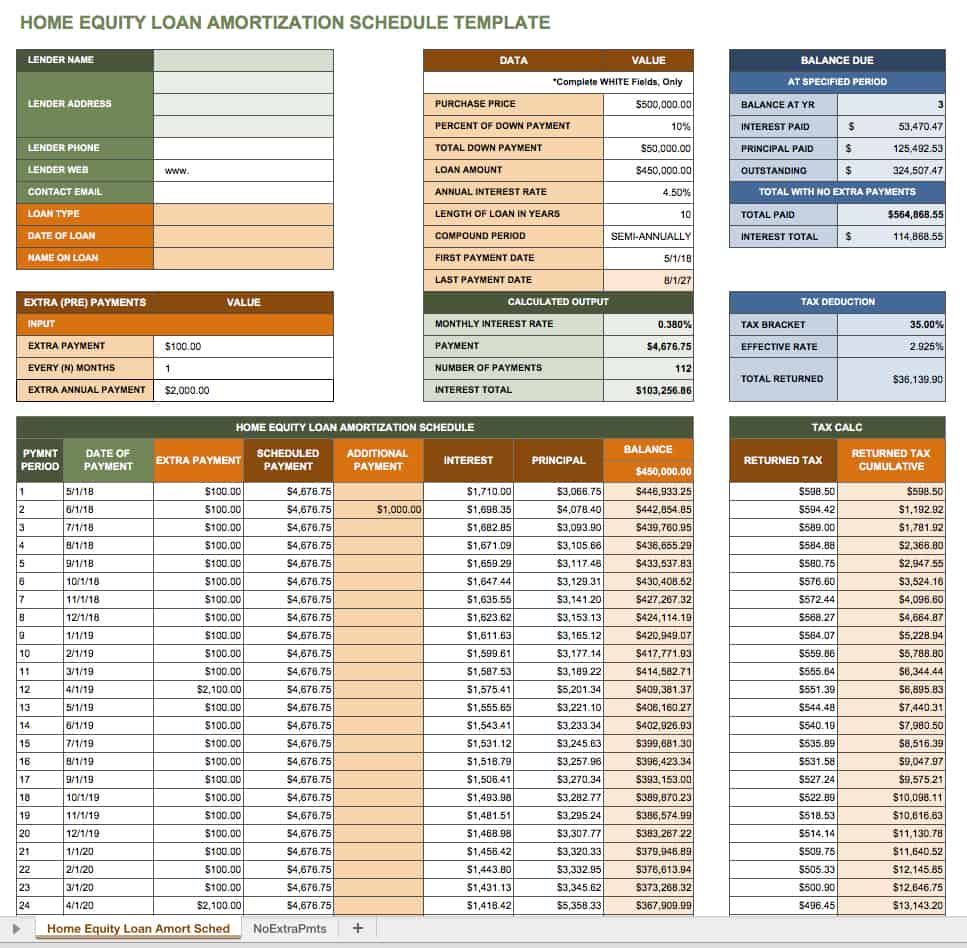

Home Equity Loan Amortization Schedule Template

This amortization Excel template allows you to calculate how much equity you have in your home after a specific number of years. Since a home equity loan is essentially a second mortgage, you can determine how long it will take you to pay off each of your loans. This template can also help you answer important questions related to selling your home, such as the amount of equity you’ll build over a certain period of time, how much you’ll owe if the value of your home drops, and what happens if you make extra payments.

Download Home Equity Loan Amortization Schedule Template

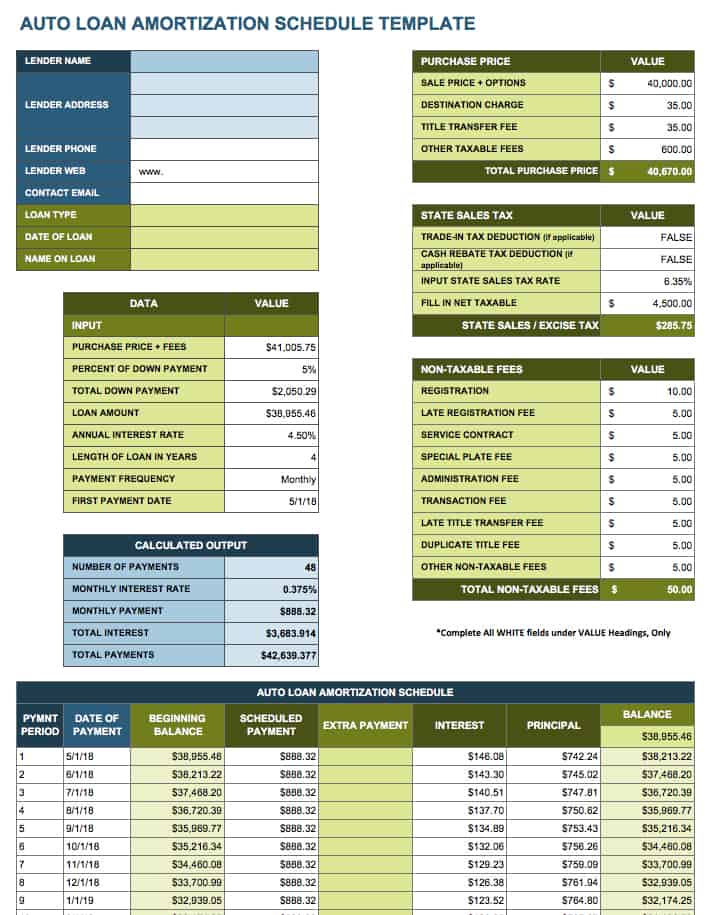

Auto Loan Amortization Schedule Template

Use this loan amortization Excel template to determine the total loan amount when you purchase a car, factoring in trade-ins, rebates, down payments, sales tax, and any other extra fees. You can calculate the time it will take to pay off your loan, and experiment with how making extra payments can expedite your full ownership of the car.

Download Auto Loan Amortization Schedule Template

Use Smartsheet’s Amortization Tool for a More Collaborative Experience

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.