Cost Variance and the PMP Exam

The PMP exam, given by the Project Management Institute (PMI), is a standardized exam that is considered the gold standard for PMs worldwide. The PMI releases concepts, formulas, and processes that PMs industry-wide use to design, implement, and measure their projects. Having the PMP credential signifies that you’ve mastered the PMI material, have the experience necessary to use its concepts, and can perform your PM duties in the best way possible. In other words, it means you will complete that your projects correctly, every time.

The PMP certification exam tests professionals on 10 different knowledge areas:

- Project Integration Management

- Project Scope Management

- Project Time Management

- Project Cost Management

- Project Quality Management

- Project Human Resource Management

- Project Communications Management

- Project Risk Management

- Project Procurement Management

- Project Stakeholder Management

These knowledge areas group together the theories and techniques that make up the bulk of a project manager’s work. The 47 processes required for the PMP exam are spread out amongst the 10 knowledge areas. Cost variance falls under Project Cost Management, but the information required to calculate cost variance comes from multiple knowledge areas.

What Is Cost Variance for Project Management?

Cost variance (CV), also known as budget variance, is the difference between the actual cost and the budgeted cost, or what you expected to spend versus what you actually spent. This formula helps project managers figure out if they are over or under budget. A positive CV shows that the project is under budget, and a negative CV shows that the project is over budget. If the calculated cost variance is zero (or very close to zero), you are on budget. In earned value management, value always comes down to money, whether the commodity is time or actual dollars spent. Earned value management (EVM) is a project management technique that combines scope, time, and costs to forecast in a project. Determining cost variance uses many formulas that may spread across the PMP knowledge areas and is a slightly different way of organizing the information. The formula for CV is:

The formulas to determine the components of CV are as follows:

Earned value (EV) is the amount of money earned from the completed work in a specific timeframe. Actual cost (AC) is what is spent on a project. Because CV is about the money, it is often better to report it together with the project’s budget so your stakeholders can see the magnitude of variance. For the Project Management Professional (PMP) certification exam, CV is an essential part of the Project Cost Management knowledge area’s earned value management (EVM). Professionals who have passed the PMP exam say that the questions on EVM are difficult because not only do you need to memorize the formulas, but you also need to completely understand the concepts.

To calculate CV, consider the following example:

Ava is a developer who wants to have her condo development project completed in the next nine months. The cost of her project is $500,000. After four months, $300,000 has been spent, and 20 percent of the work has been completed. Find the project’s CV and figure out if you are over budget or under budget.

A concept similar to cost variance for the PMP exam is schedule variance (SV). PMS use SV to determine if they are behind schedule or ahead of schedule. It is the difference between the cost of work performed versus the cost of work scheduled. It is often reported with CV. The formula for SV is:

PV is planned value, the scheduled cost of work to be performed in a specific timeframe. For more information on schedule variance, see Hacking the PMP: How to Calculate Schedule Variance.

Project Cost Management

Cost management is planning and controlling the budget for a business. It includes all of the processes involved in accounting for the expenditures and incoming money including resource planning, cost estimates, budgets, and controlling the costs. In project cost management, this task falls on project managers, but cost management processes interact with each other and with processes in other areas as well. Based on the needs of the project, there could be more than one person or group who is involved in the process. The processes involved in this include:

- Resource Planning: In resource planning, the time, materials, labor, and equipment are defined, using historical information for any comparable projects and current standards. Once these are defined, you can then calculate the associated costs.

- Cost Estimating: During cost estimating, the project manager can either use information from other projects as a basis (if it is available) or mathematical estimates that eventually get refined with more information as the project progresses. The cost of each activity is defined.

- Cost Budgeting: In cost budgeting, the cost estimate and the project schedule are combined to give an indication of the total costs and the cost intervals. The cost budget gives an overview of when the costs will arise and sets a baseline. In small projects, cost estimating and cost budgeting map overlap so much that they appear to be a single process.

- Cost Control: In cost control, project managers measure the variances from the cost baseline and work to correct them. Project managers make a continuous forecast of the costs based on any changes and should be able to explain why variances exist.

In project cost management, if you are spending a specific number of dollars on your project, you are earning those dollars back into your project. Hence, every activity earns value that’s contributed to your project. The main formulas in the project cost management knowledge area include cost variance, schedule variance, cost performance index, and schedule performance index. To derive these values, a PM must also be able to calculate earned value, actual cost, and planned value.

Other formulas tested on the PMP exam and fall into the costing category include:

- Estimate at Completion (EAC): This is the total cost of the project at the end. This is often also called latest revised estimate (LRE). EAC is a forecast and may be calculated as the project progresses. There are three ways to calculate EAC, depending on your situation:

- Estimate to Complete (ETC): This is a forecast of how much money will need to be spent to complete your project. There are two ways to calculate ETC, based on your situation.

- Cost Benefit Analysis (CBA): CBA is often also called benefit-cost analysis (BCA). This is a process of estimating the costs and benefits of a proposed solution. You analyze the benefits first, and then subtract the costs of those actions. This approach must be systematic and take into account tangible and intangible factors. To learn more about this process, read An Expert Guide to Cost Benefit Analysis.To perform a CBA you must:

- Obtain comprehensive cost estimates

- Obtain comprehensive benefits estimates

- Choose a CBA formula

- Compute a schedule for a payback period

- Determine the best course of action

CBAs use ratios to determine the feasibility of the investment, and the net present value formula (NPV).

Where C = the expected cash flow per period, R = required rate of return, and T = number of periods over which the project is expected to generate income.

Once you understand this process, you can always use a cost benefit analysis template to aid in the calculations.

Variances in Cost Accounting

Cost accounting in the accounting field uses many of the same concepts as project management, but they are aimed at companies in their entirety, not just at a specific project or grant. Much of the time, there are more moving parts and pieces in an entire company, although some projects can feel like they are company-wide and therefore just as complicated. The information in cost accounting is internal and usually specific just to that business and doesn’t compare well with other businesses. If the expected costs exceed the actual costs, then there is a favorable variance (a favorable variance would increase the operating income). If the expected costs are lower, there is an unfavorable variance (an unfavorable variance would reflect a decrease in operating income). Variance analysis is performed the same way in accounting as it is in project management. In cost accounting, variances are examined for:

- Direct Labor Costs: This is the comparison of the expected and actual wages and labor. These numbers could be different due to poor scheduling, newly skilled workers being put into experienced positions, or difficulty in the creation of the product by sub-standard materials.

- Direct Product Costs: This is the comparison between the expected and actual material costs. This can occur if the material is damaged or spoiled during handling or storage or in the event of an industry shortage, which could result in higher base of shipping charges.

- Overhead Costs: This variance is the determination of overhead such as rent, taxes, insurance, and salaries, and the comparison between the expected and actual costs. These costs generally do not change dramatically from one time period to another, but must be tracked.

Any of these categories can account for a spending variance, which is any expense that is different than was budgeted for such as direct materials, labor, or overhead. This may also be called a rate variance, as it is dependent on the rate or assumptions used to budget.

The term controllable variance can also come up when discussing variance: simply put, the management can keep a controllable variance in check. However, some of the variances discussed in the following sections are out of everyone’s control, as companies are often at the mercy of marketplace pressures and fluctuations. With controllable variances, management is able to reduce the variance by putting policies in place or planning more carefully - an example is when management plans for workers with little experience as compared to those with lots of experience. This may affect the overhead efficiency variance without prior consideration.

What Is Cost Variance in Manufacturing Accounting?

Cost variance in manufacturing accounting is slightly different from traditional accounting cost variance. Manufacturing companies produce products by taking raw materials and turning them into finished goods. The formulas for variance still determine the difference between expected and actual costs in regards to materials, overhead, and labor. However, the output of manufacturing is tangible: they have accountable inventory, specified physical production sites, and often produce goods before having a customer order. However, some accounting concepts in manufacturing don’t apply to service or merchandise-oriented companies. For example, principles like the following:

- Add Value: Determining costs based on the cost of raw materials and the labor that is performed to produce a new good.

- Work in Process (WIP): Using a separate balance sheet for goods both not yet completed and those ready for sale.

- Incurred Manufacturing Expenses: Taking into account your add value and the actual cost of labor.

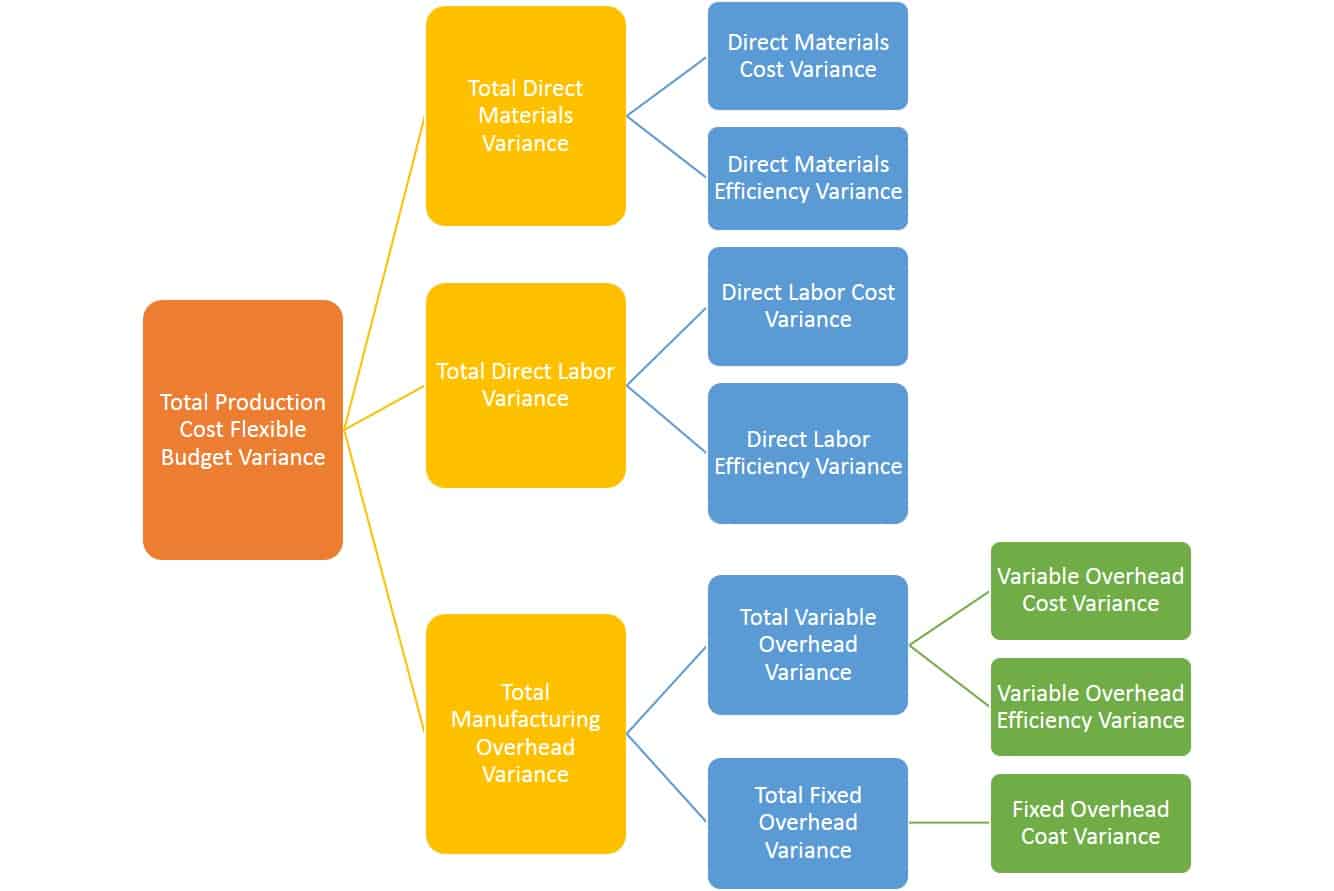

In manufacturing, the overarching cost variance is for production. The following is a diagram of the flow of relationships of the different cost variances and how their calculation filters into total production costs.

Variance Analysis

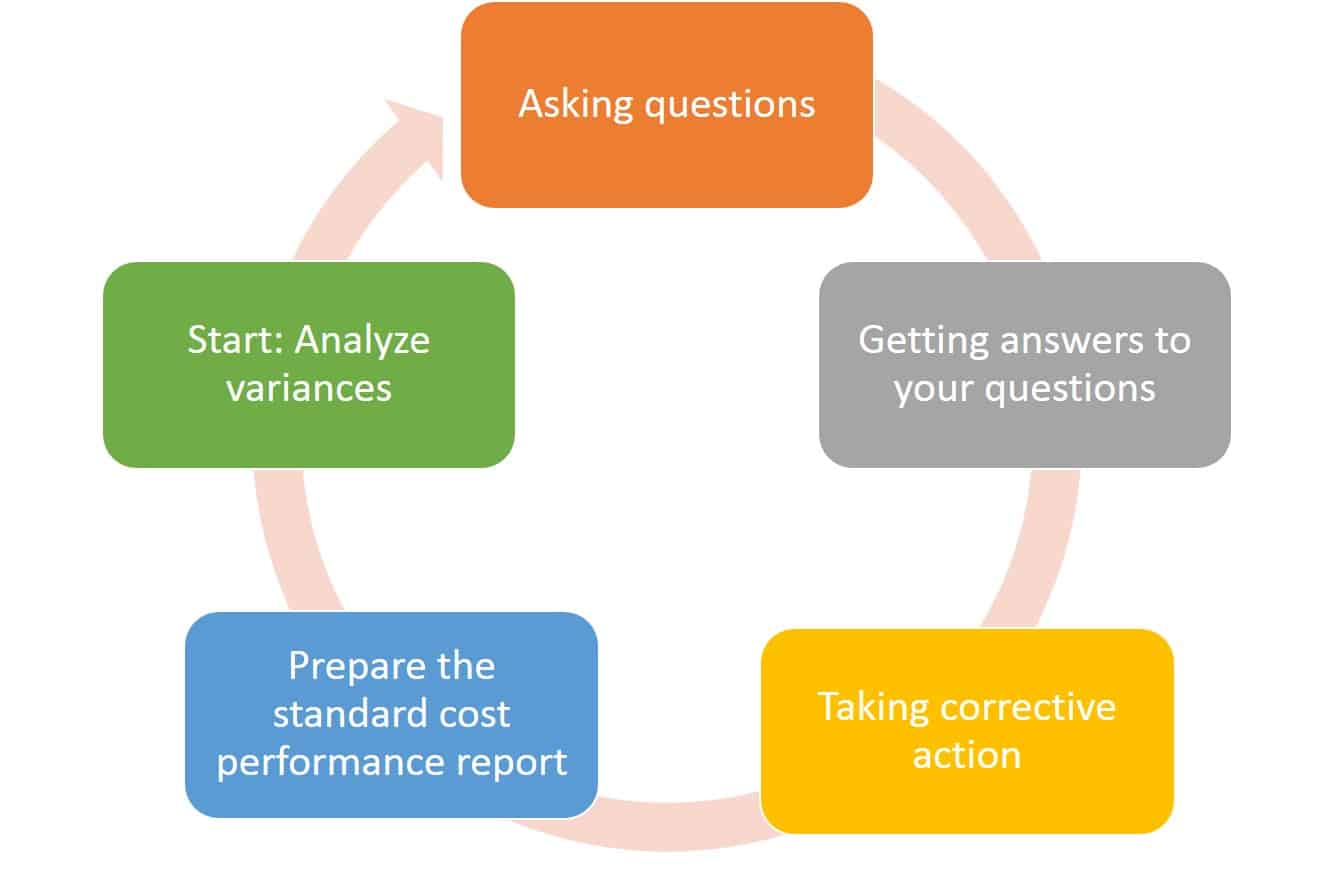

The project manager or company management analyst working on variance analysis looks for all these differences in expected and actual costs. A variance analysis cycle begins with analyzing the variances, figuring out your questions, getting clarification for your questions, taking corrective actions, and then preparing the standard cost performance report. Base the questions you ask on the variances that you find. For example, if your efficiency variance shows a positive result for your manufacturing company, you may want to ask how your workers produced the materials faster than anticipated, and whether this can be expected in the future. This can lead to other calculations, such as quality variance and labor variances. It’s best to perform variance analysis reporting after a new cycle of operations begins. This cycle is illustrated below.

Formulas for variance analysis help you calculate standard cost variances. These formulas are standardized across industries and should serve as examples of what to calculate for the major variances.

This price variance is interested in all the quantity purchased.

This quantity variance is only interested in the quantity used. Quantity variances occur when there are differences in the actual and expected usage of materials, machine time, or square footage. Quantity variances are dependent primarily on the baseline for set materials, and may simply indicate poor planning.

The formula for labor standard cost variance is:

Labor variance can occur because of poorly set standards, variation in staffing, and changes in benefits.

For variable overhead efficiency variance, the formula is:

Variable overhead efficiency variance measures how well the company uses its materials or human resources (in this example, the hours worked). With a variance in this category, managers that are researching the cause should look carefully at the underlying standard.

The formula for variable overhead spending variance is:

This variance is the compilation of the production expense information. The causes of this variance include outsourcing, changes in supplier pricing, or account misclassification resulting in accounts not appearing.

What Is a Budget?

In project management, a budget is the money assigned to a project. This money is specific to that project, is designated for a definite period of time, and is meant to deliver the goals of the project. Project budgeting is more about when to spend the money, and not as much about whether the budget is over or under spent. However, budgets are also a way to measure performance during a planning period. There are many concepts involved in budgeting. These include:

- Master Budget: This is the overall set of budgets in a project, and includes all the lower-level budgets broken down by the different phases or functional areas. For a company’s master budget, the time period is usually one fiscal year and it encompasses all of the different departments. A master budget contains a budgeted income statement and a budgeted balance sheet. A budgeted income statement is the predicted income for the budget’s time period, or the money set aside for the project and when it is due. A budgeted balance sheet has all of the line items typically found in a budget sheet, but it is a projection for future budget periods. This sheet is meant to test whether the project finances are realistic.

- Cost Performance Index (CPI): In project management, CPI gives you the ability to analyze the efficiency of the cost performance of any project, or how well the project is staying on budget. Specifically, you use CPI to measure the value of the work completed as compared to the actual money spent on the project. This is the ratio of earned value to actual cost and is expressed by:

- Flexible Budget: This is a budget that can change or adjust to changes in company activity. It gives a budget “range” and you can make adjustments based on the changes in operations and outputs. They also allow project managers to predict financial results at different levels of activity.

- Flexible Budget Performance Report: This report details the flexible budget.

- Fixed Budget: A fixed budget, also called a static budget, is the opposite of the flexible budget. No flex or wiggle-room is built in to accommodate changes in the company’s activity. The benefit of a fixed budget is that it keeps the company fiscally responsible and allows for accurate measurement of changes such as increased profits.

- Fixed Budget Performance Report: This report details the fixed budget.

- Standard Cost System: Use this tool to plan budgets, manage costs, and evaluate performance. In this system, base the actual costs on the expected costs and record periodic variances. You can calculate the average of the most recent actual cost for a certain amount of time, such as the last three to six months. Standard costing is often used in budgeting, inventory costing, overhead application, and price formulation. However, standard costing is not always appropriate, especially in fast-paced environments or on cost-plus contracts.

- Continuous Budgeting: This is a forecasting process based on the current and prior budget periods. The forecast is constantly readjusted by adding rolling monthly updates at the end of the current budget. As each month passes, the budget manager revises the budget model to reflect the current assumptions.

- Incremental Budgeting: A forecasting process where the budget manager makes small, incremental changes to the current budget and uses it for the future budget. This type of budgeting uses information from the previous year’s expenditures as a starting point, and assumes that there will be minimal changes.

- Budget Report: This report is used internally to present management with a comparison between the estimated budget and the actual company performance. It is meant to show how each area of the company is faring with respect to funds at a point in time, and how well those funds have been used to support the strategic goals of the company. This report does not share the health of the company, just how money is being spent.

- Budgetary Control: If the budget report is like a report card for the company’s money, budgetary control is the goals that the parents (stakeholders) set for their children’s grades. In other words, budgetary control is a set of goals set by management that work around an established budget.

- Management by Exception: Management only gets involved when there are notable deviations from the budget or plan and they need to focus on certain areas.

What Are Standards in Cost Management?

The budget is the expected cost for everything, whereas the standard is the cost per unit of input, such as overhead or materials per unit of output. This standard cost in manufacturing is the expected cost of producing the product, but the budget covers all the units. Standard costs are set by carefully considering amounts determined by experience and the expectations of the managerial staff. Use standard costs for planning labor, materials, and overhead, or to plan for the level of performance of goods or services. You can also use them to calculate variances.

Benchmarks are put in place to measure performance. Benchmarking is when a company sets budgetary performance goals. You can judge the improvement over time of a company using benchmarking. It’s imperative to decide whether to use practical standards or ideal standards.

Practical standards are those that have already been attained. They do not stretch your company at all. Sometimes setting ideal standards can discourage employees because they are the best-case scenario, and often unattainable. The production of a standard costing income statement can report these standards.

However, setting the different standards requires some knowledge about what factors go into each category. In setting certain standards, the following must apply:

- Direct material standards depend on price and quantity. Standards are set for price by the net of discounts and the final costs of the materials. While product design specifications set the quantity standards.

- Direct labor standards are dependent on the rate and time standards. Rate standards are set based upon the current wages and contracts for labor. Time standards use historic data and time studies.

- Overhead standards depend on your rate standards and activity standards. This rate standard is the portion of the overhead rate that may be variable. The activity standard is the actual base used to calculate the overhead. Setting the costs for standard overhead include reporting the expected fixed overhead, and any expected variable overhead that you glean from historical data.

What Is a Standard Cost System?

A standard cost system is a tool that accountants use for their standard costing. Whether you use a software system that comes as a complete package or a series of spreadsheets to capture this information, the results should be the same. Your standard cost system should capture all of your company’s structural nuances and reflect all of the decisions that your company makes.

The following are the spreadsheets that you should calculate regularly in your standard cost system. These should be compiled into a standard cost income statement for a specific time period (such as year-end), and leave you with your operating income.

- Direct Materials Purchased

- Direct Materials Usage

- Direct Labor

- Manufacturing Overhead

- Overhead Allocated

- Completed Goods

- Cost of Goods Sold

- Adjusted Manufacturing Overhead

How Can You Improve Your Memory for Test Taking?

Everyone assumes that their brain is a static organ, and that recall only goes downhill with age. However, regardless of your age, scientists have found that your brain has an amazing ability to continually change and adapt, forming new pathways. This ability is referred to as neuroplasticity, which is your brain’s ability to form new synaptic connections, allowing reorganization or new functionality to emerge throughout life. Some examples of neuroplasticity are more extreme than others. However, we regularly see the plasticity of our brain through its ability to take in new information daily. Our brain is constantly adding new pathways from the things we observe and learn every day. A more extreme example is the embedding of a cochlear implant, a medical device that functions by bypassing our main hearing mechanism - the ear. The implanted brain learns to hear without the ear by the nodes that go directly to the auditory nerve. Use of this device forces the brain to develop new neural pathways, reorganizing the way that the person hears.

However, neuroplasticity and the quality of your memory depends on the health of your brain. Whether you are studying for the PMP exam, just want to stay mentally sharp, or want to stave off decreases in your brain matter well into your elderly years, there are things that you can do to keep your brain healthy, including:

Sleep: Experts agree that if there is only one thing that you can do to promote memory, then sleep should be it. There is a difference in getting enough sleep and the optimal amount of sleep. Most adults can get by on six hours of sleep. However, for the same adults, their optimal amount of sleep may be seven to nine hours. Ways to improve the sleep that you are getting include sticking to the same sleep schedule (even on the weekends), cutting down on caffeine during the day, and cutting out all blue-light emitting devices 60 minutes before bedtime. Lastly, experts agree that naps also count in memory improvement, especially when you are developing new motor skills.

Exercise: It may seem counterintuitive to some people that working out your body will impact your brain, but researchers show that exercising increases the size of your brain’s hippocampus, the region thought to be the center of emotion and memory. This leads to memory improvements, even in late adulthood. The same researchers were also able to show that exercise is a protective factor from volume loss in the hippocampus later in life. Aerobic exercise is considered the best type for your brain.

Eat this, not that: By this time, everyone has seen the public health campaigns to get people to eat more fruits and vegetables. Healthy People 2020, health goals set for the U.S. by the Office of Disease Prevention and Health Promotion, adds new fruit and vegetable consumption objectives for Americans in every iteration. Not only is this due to the obesity epidemic in the U.S., but it is also in order to maximize the overall health of people - including brain health. For example, fresh produce like blueberries contain anthocyanins, which researchers have shown to boost memory by defending the brain from inflammation and oxidation. Both inflammation and oxidation affect the brain by decreasing the signals between the neurons. Other foods that are considered good for your brain include seafood, beans, nuts, whole grains, and olive oil. On the flip side, diets high in saturated fats and cholesterol significantly increase your risk of dementia, according to recent research. Alcohol in moderation is good for memory. However, excessive alcohol has the opposite effect on memory.

Supplements: There have been so many pop-culture advertisements the last few decades touting the brain-boosting power of one supplement or another, people often lose sight of what the supplement is trying to add to or replace. Supplements are meant to either increase the amount of or add in an ingredient to your diet. For some people, these are dietary elements they cannot get through food. For others, it is something they only sparingly receive. The best supplement always comes in a whole food form. This means that it is always better if you can get your vitamins and minerals in fresh food. Next, to food, supplements in pill, powder, or gummy form pale in comparison as your body processes them differently. That being said, if you must choose supplements, do so intelligently. Researchers recommend Omega-3 supplements for improvement of cognitive and physiological functions. With any supplements, however, take only what is recommended on the label, as more than recommended can lead to toxicity.

Meditate: To most people, it’s obvious that meditation can decrease stress by making you slow down and concentrate on your internal world for a while. However, research on the benefits of meditation has proliferated these days, and not only does the research point to lowered stress and an elevated mood, but some research claims that meditation can increase your concentration and attention significantly in a short time. Meditation seems worth the effort if you have a big exam like the PMP certification coming up.

Stay Mentally Active: The whole “use it or lose it” theory always comes up in brain discussions. Popular wisdom is always that the brain is a type of muscle and without use (i.e. exercise) it can atrophy just like the muscles in the rest of our body. Millions of dollars have been spent on the development and use of brain-training apps and games. Researchers say that although there is little empirical evidence supporting the relative worth of these activities, that it is probably good for you overall. However, some parameters should be noted. These include that brain training should include something new, be challenging, build on a skillset, and provide a reward of some type - even personal satisfaction. Overall, the apps on your phone may not be the best choice because they do not push you out of your comfort zone, regardless of the intellectual challenge.

Make Time for Social Activity: Many studies say that getting out and being social improves your memory, and may act as a protective factor for your memory later in life by decreasing cognitive decline. The exact mechanism of how this works is still under study, but researchers assume that some social pressure is probably part of the cause.

Learn More About Cost Variance and the PMP Exam

The following are five books recommended by people who have taken and passed the PMP exam. Some come with free tests, and some are just considered institutional knowledge that you shouldn’t ignore.

PMBOK® Guide Fifth Edition, by the Project Management Institute

PMP Exam Prep, 8th Edition, by Rita Mulcahy

The Velociteach All-In-One PMP Exam Prep Kit, by Andy Crowe

McGraw-Hill PMP Project Management Professional Exam, by Henrique Moura

Head First PMP, by Jennifer Greene and Andrew Stellman

Lastly, one of the best opportunities for solidifying your knowledge is to get a study partner or group. There are many websites that can match you with someone else who wants to study and is as serious as you are about taking the test, which gives you external accountability. Concepts such as cost variance can be parried back and forth until you understand them completely. Try Google Groups to find groups or partners available for studying for the test.

Easily Manage Cost Variance with Smartsheet

The best marketing teams know the importance of effective campaign management, consistent creative operations, and powerful event logistics -- and Smartsheet helps you deliver on all three so you can be more effective and achieve more.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.