What Are Operational Audits?

Operational audits are a forward looking process, and are part of many organizations’ ongoing business improvement process toolkit. The findings of operational audits are intended to diagnose which areas need attention and to safeguard assets by averting potential future risks. The Operational Auditing Handbook borrows The Institute of Internal Auditors’ (IIA) definition of an operational audit: “A systematic process of evaluating an organization's effectiveness, efficiency and economy of operations under management's control and reporting to appropriate persons the results of the evaluation along with recommendations for improvement.”

While an audit is usually associated with financial matters, operational audits are more comprehensive and go beyond financial data (although that type of reporting is often included). The primary information sources are policies and achievements related to the objectives of the organization.

Operational audits are a ‘deep dive’ into every facet of management. As a result, start-to-finish time frames can vary from a few weeks to many months, depending on scope, complexity, and size of the organization, and whether the audit is for the entire entity or a particular business unit. Unlike financial audits, which are conducted by external entities, operational audits are often carried out by an internal auditor.

To clarify the many different moving parts involved in this type of audit, expert and instructor/mentor Seetharam Kandarpa offers his observations and best practices.

In addition to the information Kandarpa provides in this article, you can review his latest instructional SlideShare, Auditing Fundamentals.

What Is the Objective of an Operational Audit?

“The first step is to establish its objectives,” explains Kandarpa. Objectives can vary depending on the type of organization and its KPIs, or whether the audit is being conducted to answer a specific concern from challenges arising in areas like human resources, customer relations, or manufacturing slow downs. There may also be government compliance issues to consider such as consumer safety.”

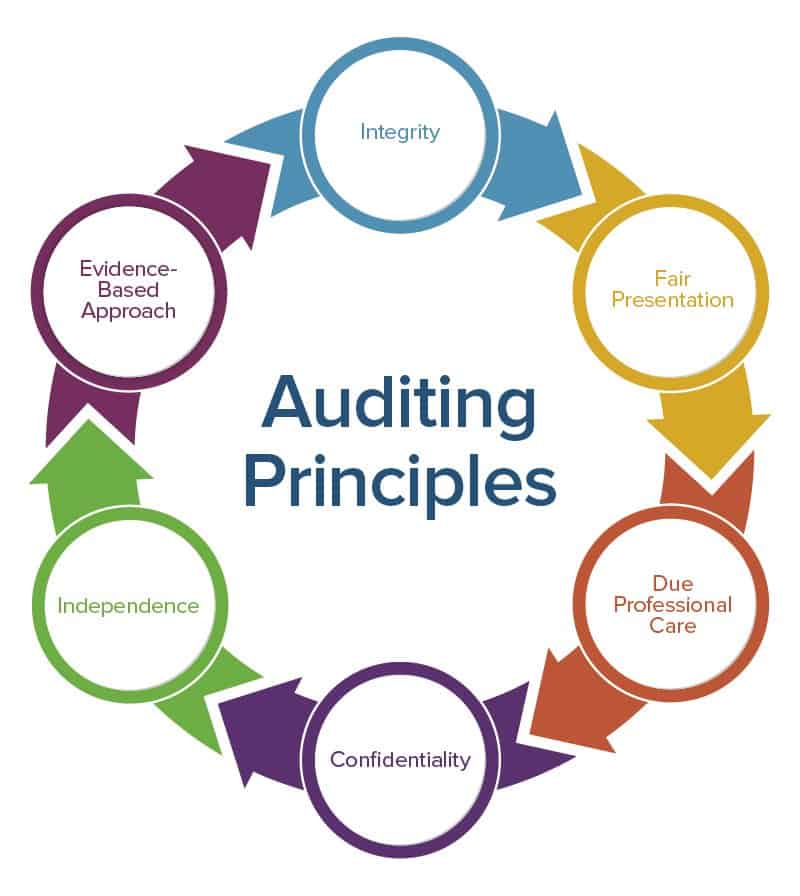

Part of the objective should also be to maintain quality in the auditing process. “The standards that apply are defined by ISO 19011, and that is what I recommend as a best practice,” says Kandarpa. The graphic below covers the main standard areas that govern audits:

Source: How to Conduct a Quality Internal Audit, Seetharam Kandarpa

- Integrity: Withstand pressures that may be exerted and take care to comply with any legal requirements.

- Fair Presentation: Present all results fairly and report significant concerns.

- Due Professional Care: Use diligence, due care, and reasoned judgments in every situation.

- Confidentiality: Keep information secure, and protect confidential or sensitive information.

- Independence: Maintain impartiality and keep actions and reporting bias-free.

- Evidence-Based: Depend on a fact-based approach to reach reliable conclusions.

Understanding the true status of operations is the basis for a healthier, more competitive, and more profitable organization.

Benefits of Organizational Audits

Conducted by an internal or external auditor, audits are objective. They supply a fresh perspective on the good and not-so-good aspects of organizational practices and processes. The final report should make management aware of problems they might not have otherwise understood, and gives them a knowledge-base for making improvements. Executives can also use organizational audit results to motivate team members and emphasize existing or new goals. Subsequent actions can then lead to greater profitability, legal compliance, and employee satisfaction in the long term.

Kandarpa says that from an overarching perspective, operational audit programs are valuable to four entities:

The Organization can achieve its aims by applying disciplined, systematic methods to assess and advance the effectiveness of control, risk management, and governance processes.

- The Individual can continuously improve their ability to apply knowledge and skills to deliver the intended results.

- The End User or Consumer receives more cost efficient and high-quality products or services.

- The World benefits from a better, more sustainable future.

Organizations can expect to achieve five primary goals or main advantages by performing any operational audit:

- Influence Positive Change: Understand how future processes, policies, procedures, and other types of management are producing maximum effectiveness and efficiency.

- Review Internal Controls: Establish the potential impact of successes and failures in the specialized functional areas of operation.

- Understand Risks: The type of risks associated with business and operational risk range from business interruption, employee omissions or errors, IT system failure, product failure, safety and health issues, loss of key employees, fraud, loss of suppliers, and litigation.

- Identify Improvement Opportunities: As a result of understanding risks, auditors can determine where to make improvements and how to mitigate risks and improve opportunities. The broad categories of risk - and where improvements should occur - are operational risk, financial risk, environmental risk, and reputational risk.

- Inform Senior Management: The results of the audit should appear in a clear report that provides objective analysis, appraisals, recommendations, and pertinent comments concerning the activities reviewed.

Operational Audits Are Continuous Improvement Tools

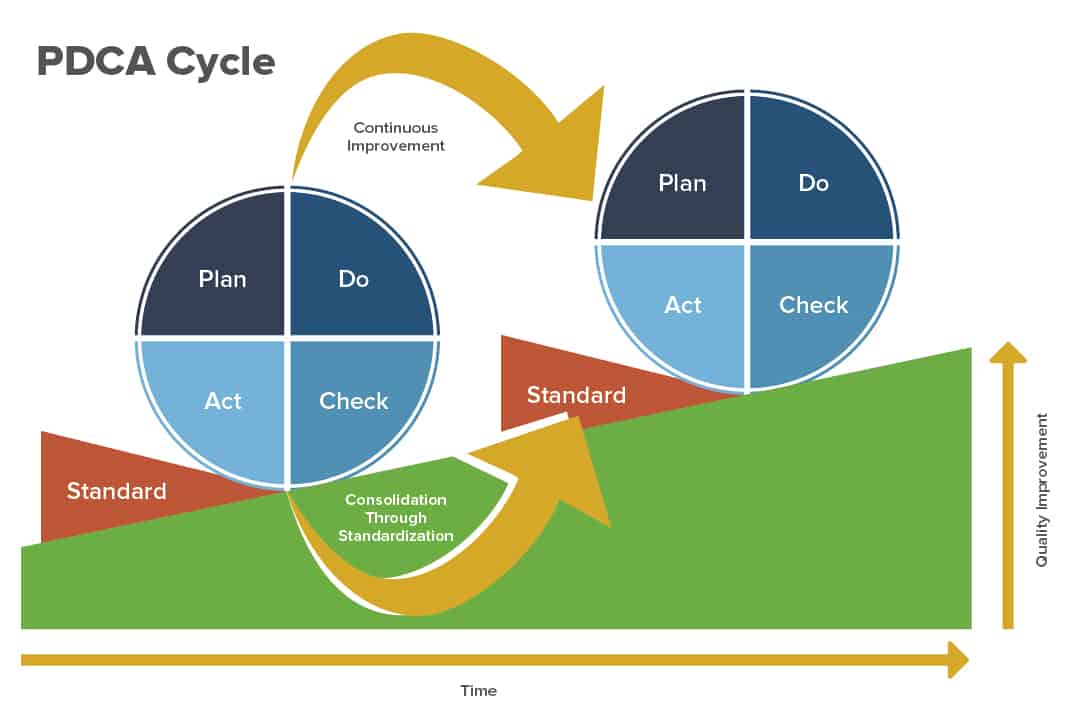

To meet the challenges of a rapidly changing marketplace and regulatory environment, companies must continually reinvent the way they do business. As Kandarpa notes, “The most widely used tools are the plan-do-check-act or Deming Cycle, which the auditor uses in their own auditing activities.” Organizations should conduct audits regularly to support continuous improvement and to check the progress of quality measures recommended in previous audits.

The internal audit isn’t immune to the pressures organizations can experience, so auditors need to find innovative means to help their company succeed. Many companies or specific departments (such as IT) focus on incremental improvement to improves processes, products, and services, or all three.

Source: How to Conduct a Quality Internal Audit, Seetharam Kandarpa

Learn more by reading How BPI Experts Attack Business Process Improvement.

Operational Audit Challenges

When asked about the biggest challenges to conducting operational audits, Kandarpa says, “Top management support for the auditing program can sometimes be difficult to obtain, since, by its nature, the process highlights management issues.” He adds, “There needs to be effective management processes in place to handle conflict management which may arise due to the audit, and a systems approach to linking organizational goals and objectives.”

Change Management

Change management needs to be well-handled. The results of the audit will likely lead to multiple changes, and team members and managers may have difficulty adjusting to different expectations, processes, personnel, or budgets. Change can also affect teamwork, but those issues can be mitigated. To learn about how to manage and build strong teams who can deal with change, review Everything You Need to Know About Team Assessments.

A helpful tool to help manage change is to use RACI (Responsible, Accountable, Consulted, Informed) principles to achieve change that may result from an operations audit. Get more details on how to implement RACI effectively by reading A Comprehensive Project Management Guide for Everything RACI, which also includes free templates to help teams cope and flourish during times of change.

Operational Auditing Expenses

There are costs involved during and after an audit. If the auditor is a consultant, of course, there will be fees for their engagement. There is also the cost of having projects or production slow temporarily when managers and employees are working with the auditor. If the auditor usually holds another position within the company, there may be a slowdown in his or her regular job responsibilities. As mentioned, there may be costs associated with necessary changes.

Auditor Evaluation

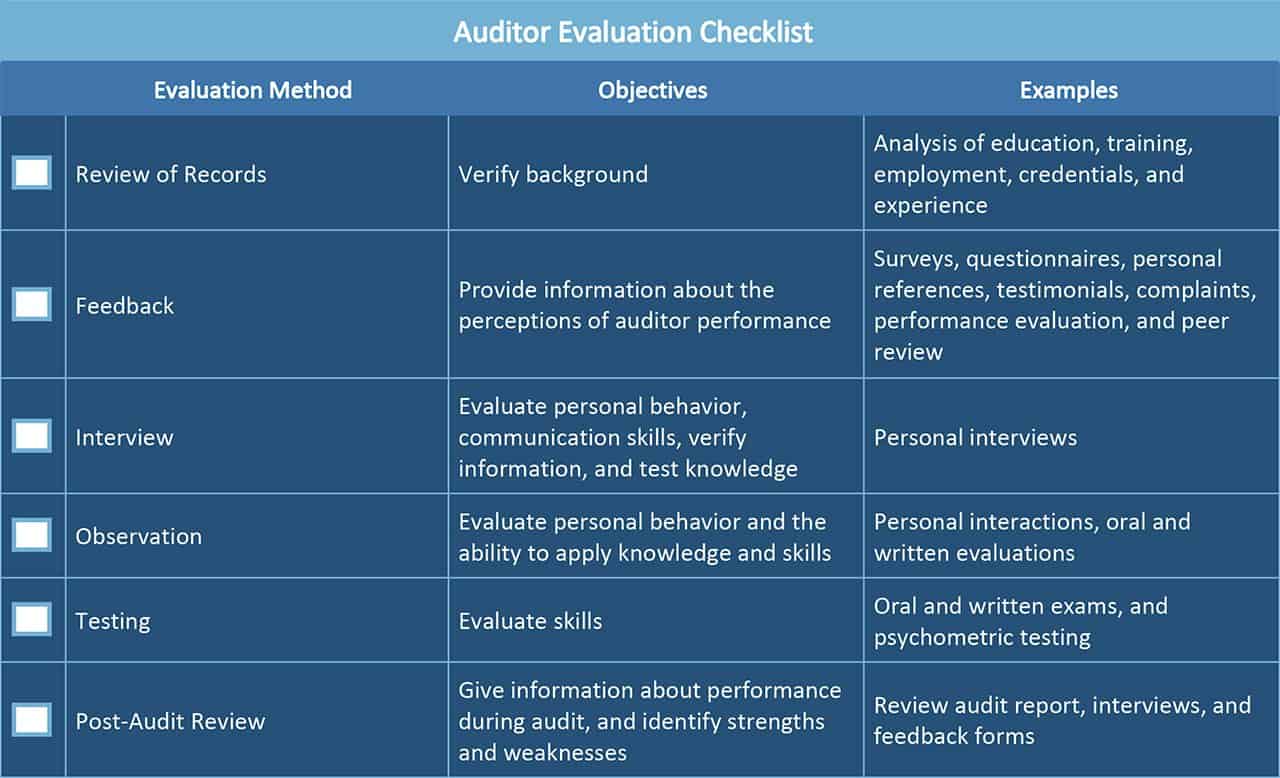

Considering the major responsibility of the auditing position (whether the auditor or auditors are operating internally or externally), Kandarpa believes that “The competence of the auditor or auditors should be determined based on explicit evaluation criteria.”

He provides this evaluation checklist to help assist in the selection of the best candidate:

Source: How to Conduct a Quality Internal Audit, Seetharam Kandarpa

Download Auditor Evaluation Checklist

Demand for Internal Auditing Experts Is Increasing

As proof that the number of operational audits is increasing, the need for internal auditing experts is on the rise. Robert Half International has found that the demand for internal auditors in the United States is going strong and that the need for internal auditors is growing faster than the average for all occupations through 2024. Demand for the profession is also mounting in Europe and Asia.

Different Types of Operational Audits

In addition to overall operational audits, some subcategories cover specific business functions and operations:

- Financial Audits or Review: Financial audits focus on financial controls as they relate to reporting to internal and external governing bodies. Financial statement auditing is the bailiwick of external auditors. Internal audits complement the work of operational audits, which includes some form of budget, or a financial review.

- Operational Audits: As noted, operational audits focus on the review and assessment of single or multiple business processes.

- Department Reviews: Different departments or divisions may run a periodic analysis to assess the adequacy of controls, how well assets are safeguarded, how resources are used, and if there is compliance with applicable laws.

- Information System (IT) Audits: Information systems audits investigate overall infrastructure and networks, technical operations, data center operation, project management, and review security status and procedures.

- Investigative Audits: When a company suspects a risk of security breach, or when one has occurred on the part of an individual or department, there is often an investigative audit to understand causes and additional background information and research.

- Compliance Audits: Compliance audits review the level of compliance with external regulatory requirements or internal policies.

- Marketing Audits: A marketing audit is a broad, precise, and autonomous probe into the marketing of a company or a business. An audit holds both an external situation analysis and a thorough review of internal marketing goals, strategies, capabilities, processes, and systems. The result is actionable recommendations to improve progress toward stated goals.

- Follow-Up Audits: After an operational audit report has been issued, it is standard practice to follow up to evaluate corrective actions, usually within a six month period.

Operational Audit Process and Checklist

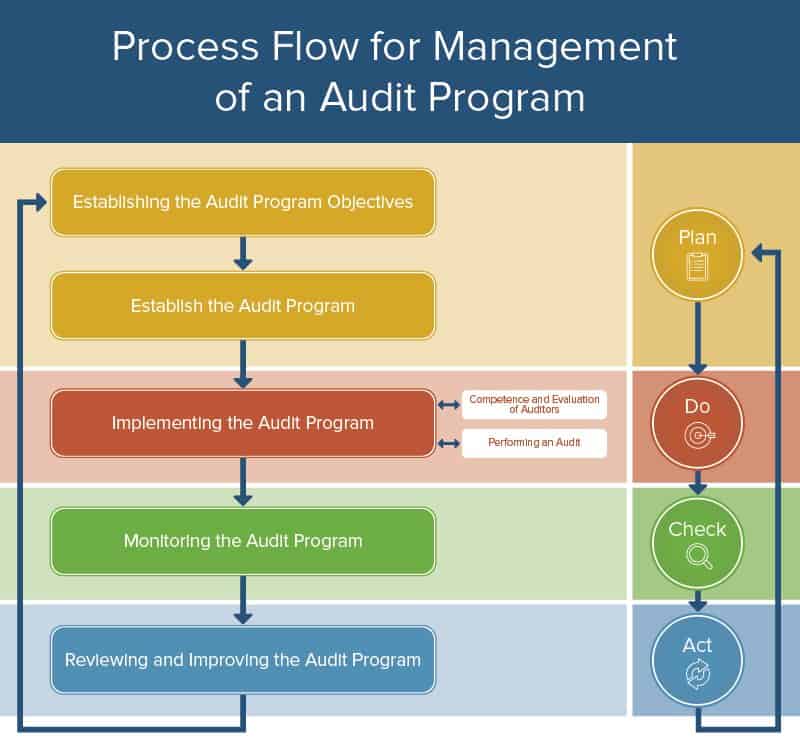

The overall process flow for operational audits, according to Kandarpa, has a set of steps, which includes the use of PDCA for quality and continuous improvement:

Source: How to Conduct a Quality Internal Audit, Seetharam Kandarpa

- Establishing Objectives: Base objectives on management goals and priorities. Consider the characteristics of products, projects, processes, and any changes to them. Take into account management system requirements, contractual and legal requirements, and other requirements. Evaluate suppliers and the needs and expectations of interested parties, including customers. Take into account the auditee’s level of performance, risks, previous audit results, and the maturity of the management system being audited.

- Establishing the Audit Program: Identify the responsibilities of the audit program manager and establish his or her competence of the person. Determine the scope and potential risks, then set procedures and identify resources.

- Implementing the Audit Program: Define the objectives, scope, and criteria, and select the audit team members and assign responsibility to the audit team leader. Manage the outcome and records.

- Monitoring the Audit Program: Assess conformity with the program, schedule, and objectives, and then assess the performance of the audit team members and the ability of the audit teams to implement the plan. Evaluate feedback of all stakeholders. Some factors can determine the need to modify the program, including audit findings, the demonstrated level of management system effectiveness, and changes to the auditee’s management system, standards, and other requirements.

- Reviewing and Improving the Audit Program: Evaluate if objectives have been achieved. Use lessons learned as inputs for continual improvement. The review should consider results and trends, conformity with procedures, the evolving needs and expectations of interested parties, records, alternative or new auditing methods, the effectiveness of the measures to address associated risks, and confidentiality and information security issues relating to the audit program.

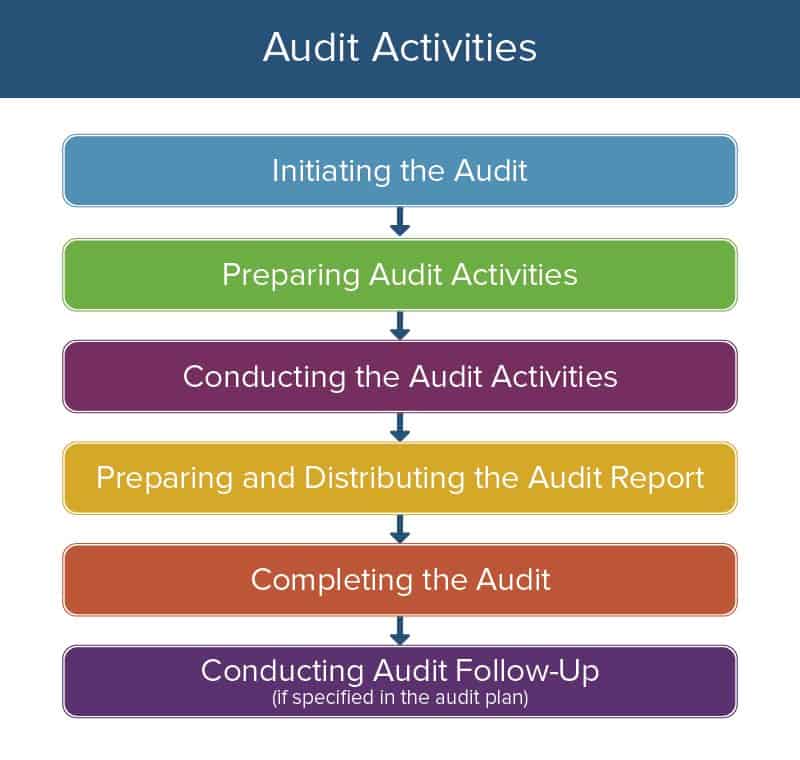

Operational Audit Activities

What’s included in a typical audit implementation? Kandarpa provides an overview and a brief look into the details for each phase:

Source: How to Conduct a Quality Internal Audit, Seetharam Kandarpa

- Initiating the Audit: Establish initial contact with the auditee and any designated leaders. Determine the feasibility of the audit and review the assignment to ensure the objectives are achievable.

- Preparing Audit Activities: Review pertinent documents. Prepare the audit plan, assign work as needed, and organize necessary action plans and documents.

- Conducting Audit Activities: Conduct a meeting to confirm that all parties agree to the proposed plan. Introduce team members to management and each other. Double check that you can perform the audit actions defined in the plan as intended. Review documents as needed throughout the process. The team should regularly meet to review and exchange information, assess progress, and reassign work if necessary.

Source: How to Conduct a Quality Internal Audit, Seetharam Kandarpa

- Collecting and Verifying Information: After you receive the audit documents, review the information sources. Audit the evidence and evaluate it against the audit criteria. Review conclusions.

- Generating Audit Findings: The findings will conform or not conform with audit criteria. For a non-conforming finding, record the supporting evidence. Review the information with the auditee to ascertain if the evidence is correct. The team should meet to review findings at designated and/or appropriate audit stages.

- Conducting the Audit Activities: Before the closing meeting to review findings, the audit team should confer and collect information against objectives. The team should agree on conclusions, prepare recommendations, and discuss follow-up. Have a closing meeting facilitated by the team leader to present the findings and conclusions.

- Preparing and Distributing the Audit Report: The team leader reports the results with a complete, accurate, concise, and clear audit record, and delivers it within the agreed period. In case of a delay, auditee and program manager should discuss why it happened. The report must be dated, reviewed, and approved based on agreed upon procedures. Distribute the report as defined in the plan to the appropriate recipients.

- Completing the Audit: Work is complete when all planned audit activities are accomplished. Documents are kept or destroyed based on the procedures and applicable requirements set at the beginning of the audit. If disclosure is necessary, inform the audit client and auditee as soon as possible. Add lessons learned from the audit to the continual improvement process.

Operational Auditing Checklists

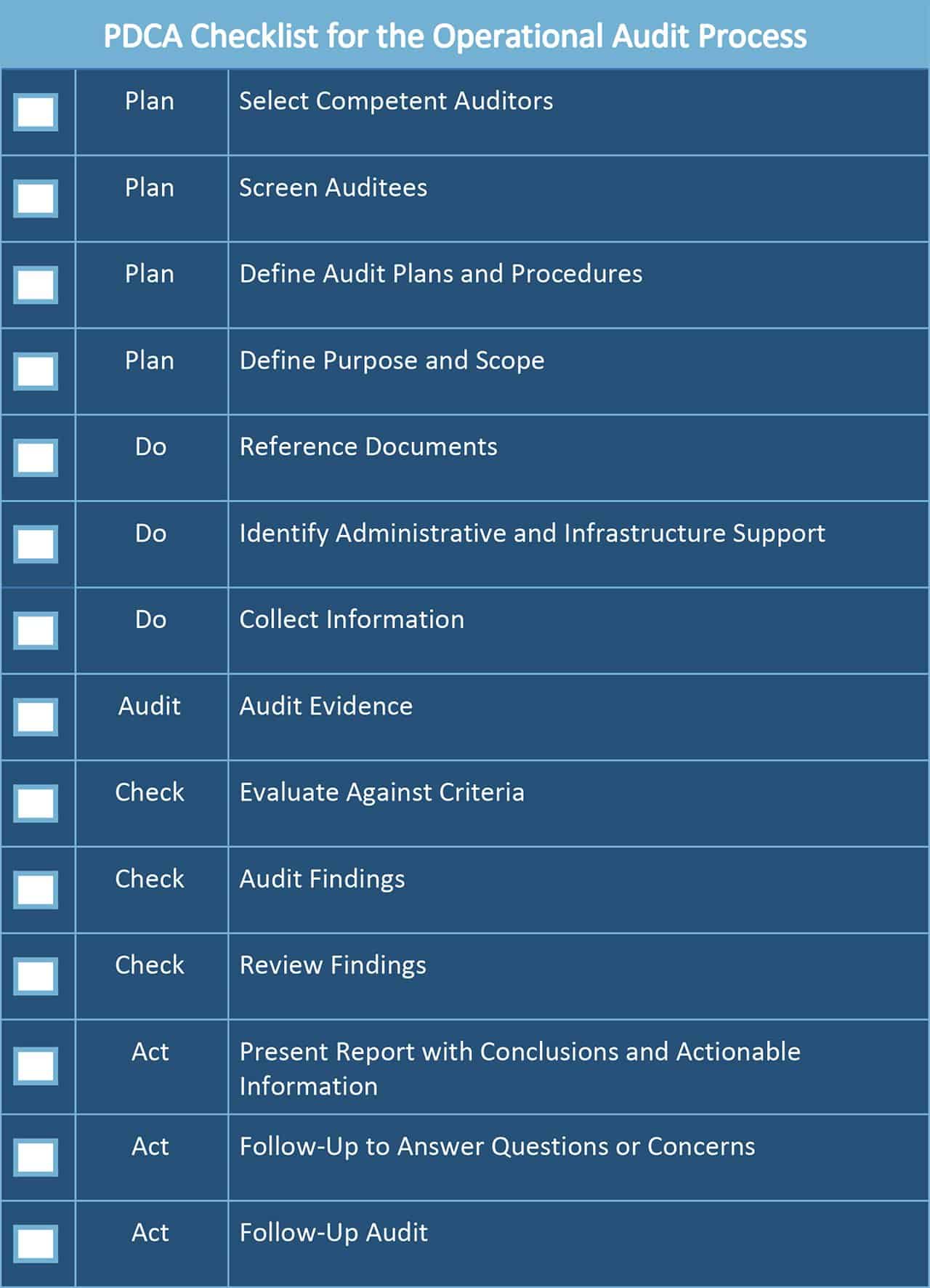

When asked about using checklists, Kandarpa explains, “Checklists vary based on the purpose, audit type, and audit criteria. However, the audit process and auditing principles remain constant.”

Here’s a checklist that you can use as a framework. Each part of the checklist will likely need to be broken down into separate activities - plan, do, check, and act - based on the size and scope of your particular operational audit. To help organize more granular activities, you’ll find downloadable templates later in this article.

Download PDCA Checklist for the Operational Audit Process

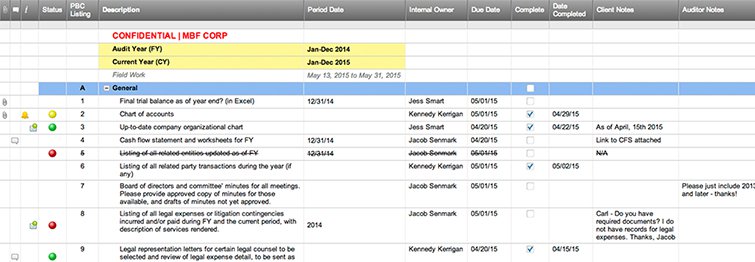

Audit PBC Checklist Template

Whether you have an internal or external auditor, the entire process is much easier when you’re prepared. Based on the goal of the audit, the checklist can be a valuable guide to gathering needed documents, clarifying objectives to the team, and keeping key stakeholders in the loop. This template helps manage and track the pre-audit, and you can share it with your auditor in real time to generate comment threads, attach documents and track status with RYG alerts.

Download Audit PBC Checklist Template

Operational IT Audit Guide

If you’re preparing for an IT audit, this complete guide for IT managers, security officers, systems engineers, developers, or help desk managers provides information to maximize efficiency of your audit, ensure security, and create repeatable processes.

Operational Audit and Audit Plan Examples

To see what operational audit processes and documentation looks like in practice, we’ve included some examples.

Government Audits: For entities of any size - from cities to the United States federal government - the documentation is made available to the public in the interest of transparency.

Non-Government Audits: By definition, audits are proprietary, internal processes that an organization’s management uses for its own improvement. They are released for public viewing based on the organization’s discretion.

Financial audits: This type of audit provide an opinion about whether or not financial statements are true based on accounting standards for the benefits of tax authorities, customers, investors, and regulators. To learn more specific about financial audits, read Financial Audit Manual: Processes, Requirements and Checklists.

- City Operational Audit Examples - El Paso, Texas: Like most cities, El Paso Texas reports each fiscal year on multiple operations, functions and services, such as community and human development management, capital improvements, and other specific areas it governs. The internal audit for Fiscal Year 2017 is available in multiple downloadable sections. The reports focus on different areas each year, as well. Review El Paso Internal Audit for Fiscal Year 2017 and El Paso Internal Audit for Fiscal Year 2016.

- State Operational Audit Plan Example - Indiana Office of Management & Budget: Deloitte & Touche performed an audit for the for the Indiana Department of Revenue for its oversight agencies in 2012. You can review the full results in its Controls and Performance Audit.

- Hospital Operational Audit Plan Document Example - University of Texas (UT): The Office of Internal Audit for UTHealth North conducted a risk-based audit which reviewed equipment leases, acquisitions, maintenance, and warranties. You can examine the full 27-page document at Capital Equipment Operational Audit.

- University Internal Audit Plan - University of Colorado: Operational audits evaluate whether university processes are adequate and function in a manner that helps ensure achievement of objectives. They review operations to see what can be improved, conduct investigations into suspected or reported irregularities, assess programs and initiatives, consult with stakeholders, and provide feedback to ensure sound business practices. You can review the current University of Colorado Department of Internal Audit 2018 Audit Plan.

- Public Facilities - The Port of Seattle: Airport public parking operation management controls were reviewed to ensure that transactions were handled correctly in the Seattle-Tacoma International Airport garage and to ensure facilities were well-managed. Examine The Internal Audit Report: Comprehensive Operational Audit Airport Public Parking Operation to see the results.

- Credit Union - Sample Credit Union Report on Operations: This is a reporting template credit unions follow to comply with National Credit Union Administration (NCUA) standards for operations and management review. Examine the 22-page format in Sample Credit Union Report on Operations.

- Non-Profit/International Relief - United Nations (UN) Audit: The United Nations performed an audit to track how logistical support was hampered in its African Union-United Nations Hybrid Operation in Darfur from January 2008 through 2010. Review the Audit of Logistic Operations in UNAMID full report.

- Intellectual Property - World Intellectual Property Organization: A 2015 operational report examined the effectiveness and efficiency of essential business processes including organizational structure, risk management, and controls. Review the Audit of the Management of WIPO Customer Services.

- Pharmaceutical Manufacturing - Univar: Univar is a leading global distributor of chemistry and related innovative products and services. Labtopia, a consulting firm, created a sample audit report for suppliers to use to report on operations. Review the 18-page template Audit Report.

- Manufacturing - Factory Audit Report (Asia): Asian Inspection provides the means for its customers to conduct operational audits. The format for a report includes workflow charts, system management, labor, hygiene and social responsibility sections. View the 33-page Factory Audit Report.

Free Operational Audit Templates

By nature, operational audits are about identifying the details that reveal the strengths and weaknesses of an organization’s day-to-day business practices. These downloadable, customizable checklists and templates help organize and document the necessary fact finding that are part and parcel of operational audits.

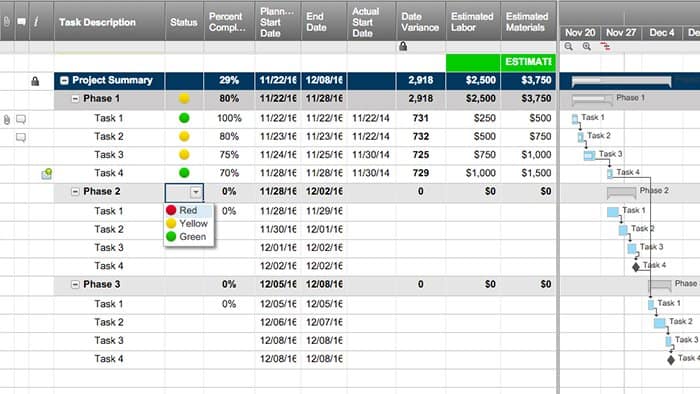

Audit Project Plan Template

This customizable template includes budget, variances, Gantt chart with dependencies, and status summaries. An audit project plan makes it easy to compare costs for materials, labor, and any other important estimated and actual labor and other expenditures in a single page.

Create an Audit Project Plan in Smartsheet

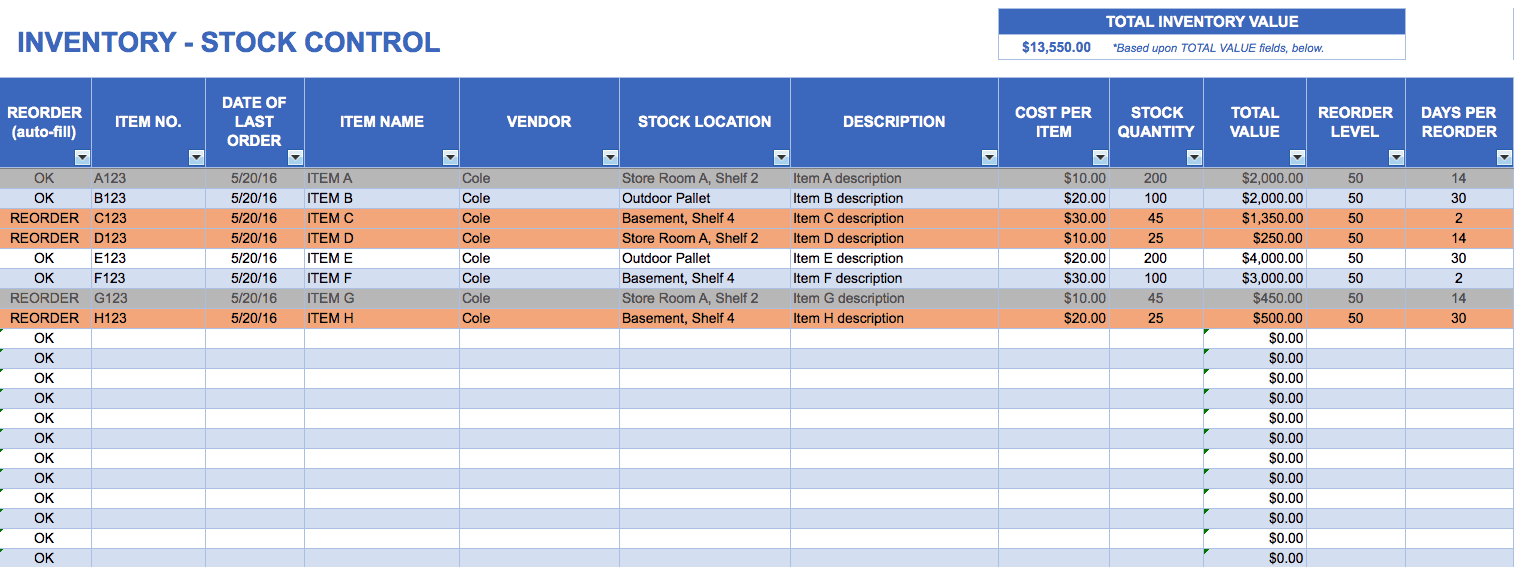

Stock Inventory Control Template

You can modify this stock inventory control template to identify stock levels, reorder frequency, excess inventory, and information about key suppliers. View the entire stock lifecycle to discover audit information to determine if your stock procedures need to be refined.

Download Stock Inventory Control Template

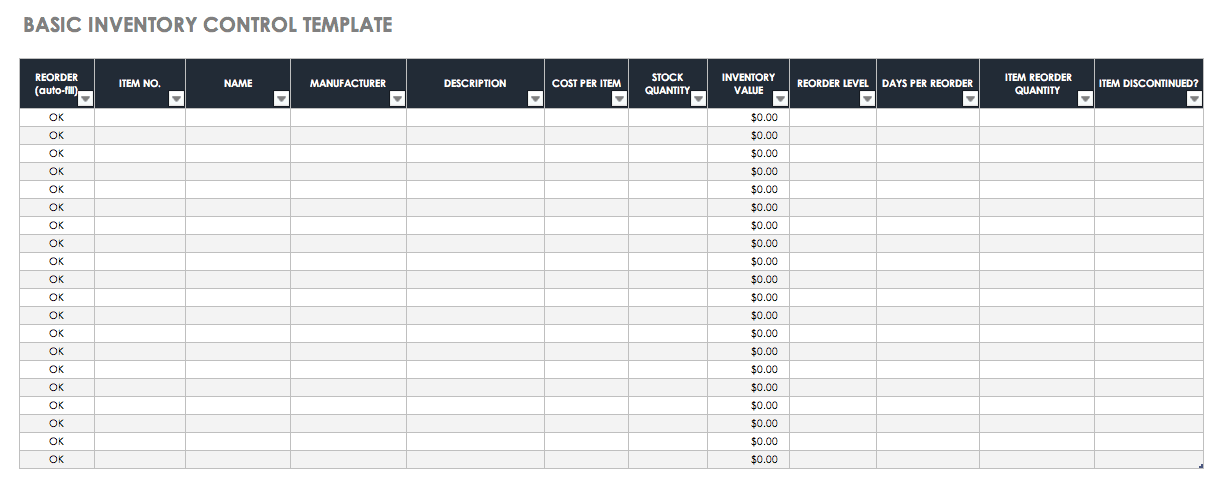

Basic Inventory Control Template

For a small business or an organization that only needs a simple inventory management system, this template is ideal — and a solid auditing tool. Check inventory in a variety of ways: description ID number, unit price, or name. Track the value and quantity of current inventory, reorder dates, and discontinued items.

Download Basic Inventory Control Template

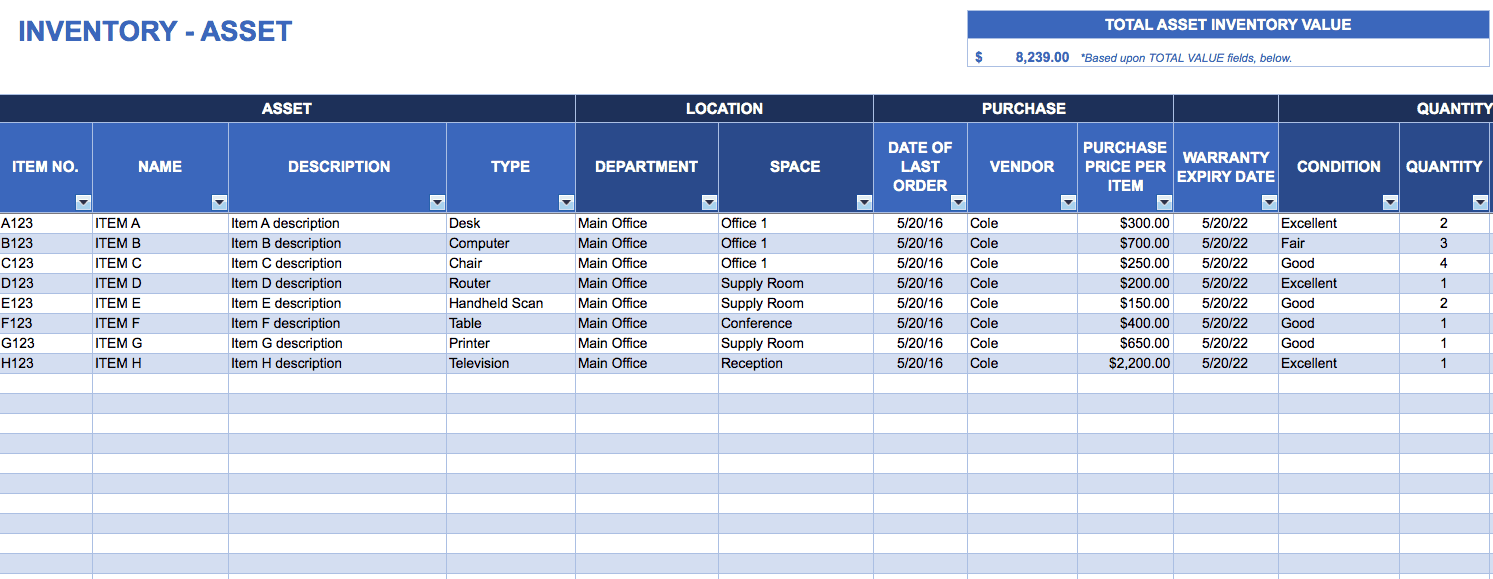

Asset Tracking Template

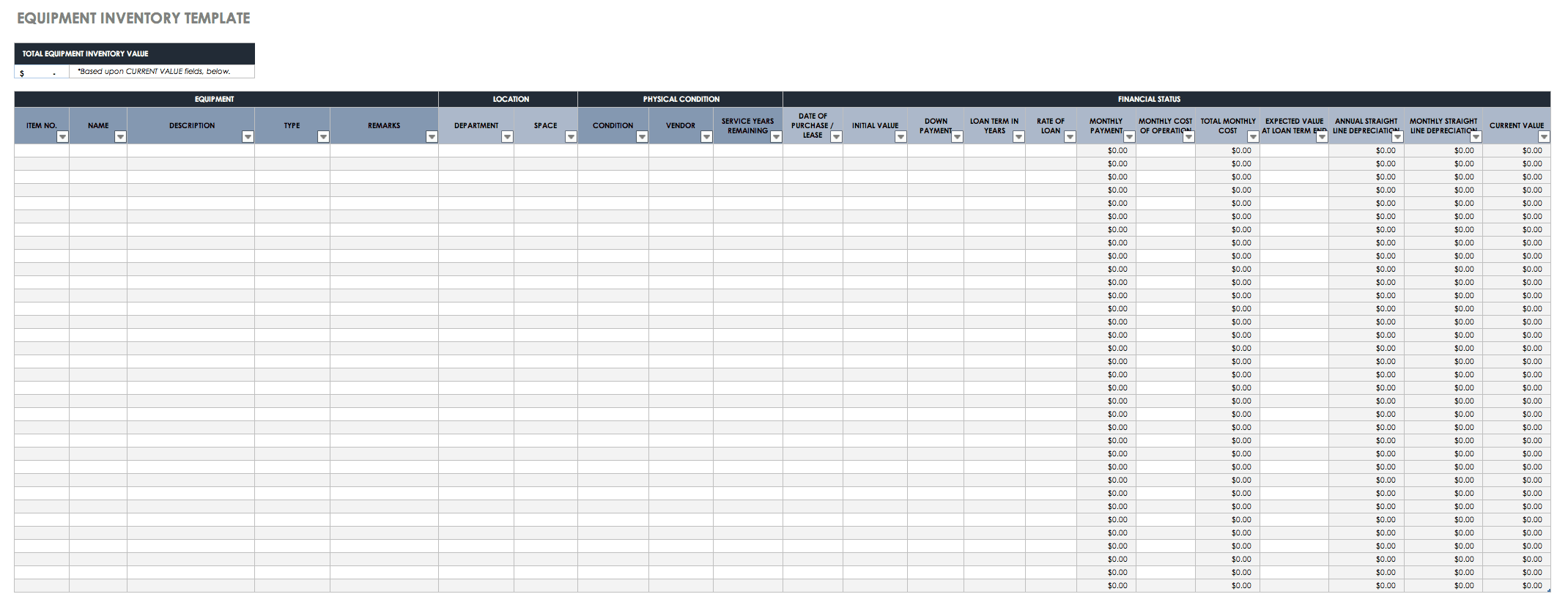

Equipment Inventory Tracking and Management Template

Download Equipment Inventory Tracking and Management Template

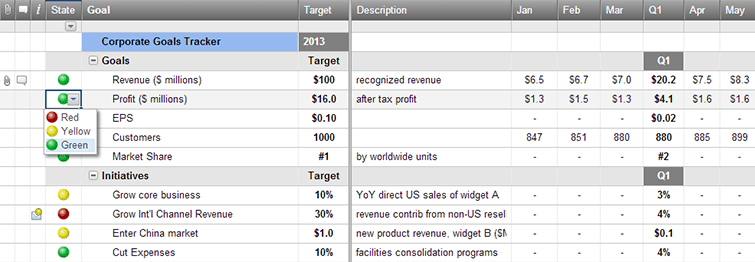

Company Goals Tracker Template

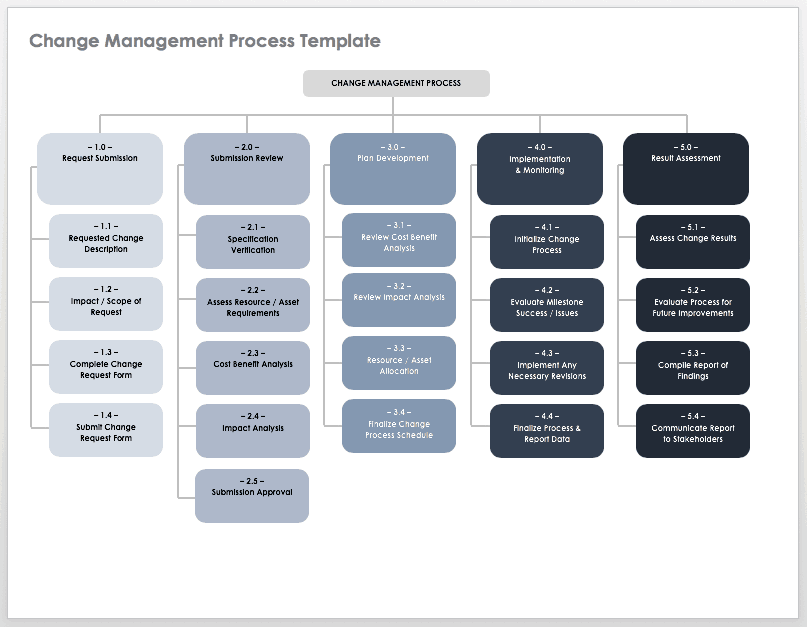

Change Management Process Template

Download Change Management Process Template

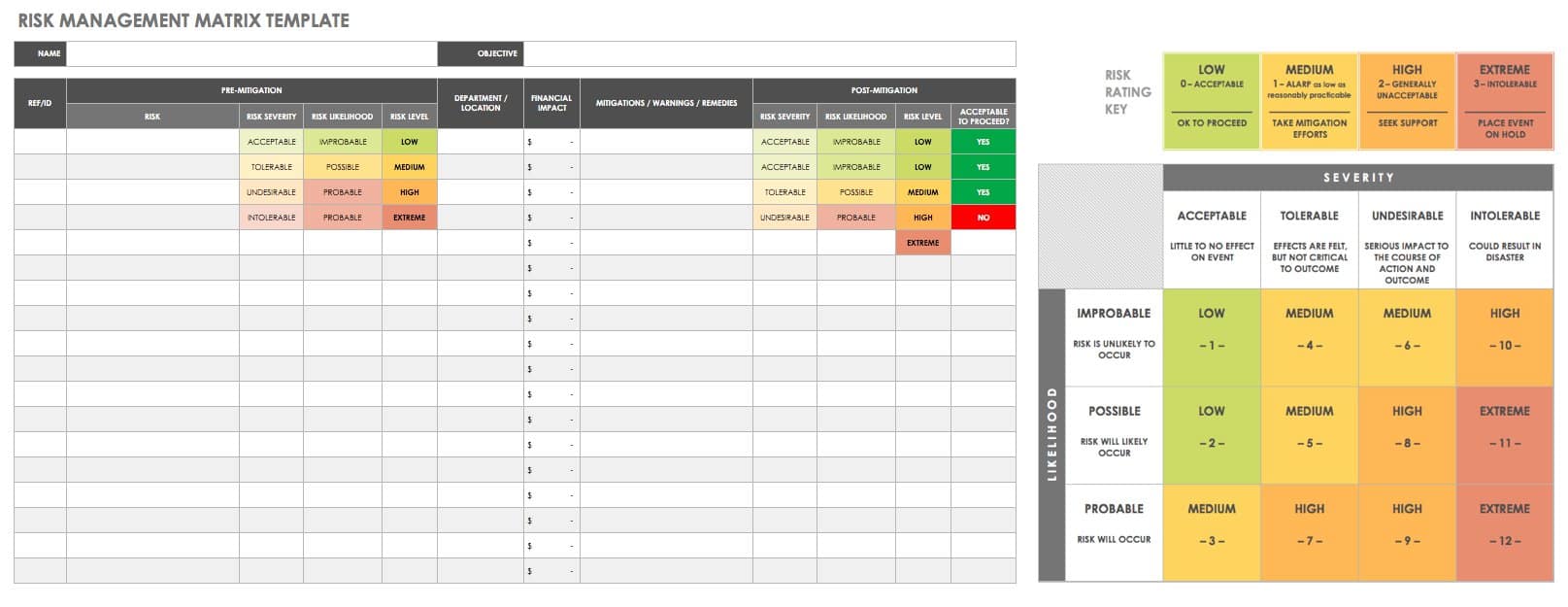

Risk Analysis Matrix Template

For some smaller projects, you may only need to use a risk management matrix (rather than create a lengthy management plan). With this matrix template, you can organize vital information in a single spreadsheet and create a detailed plan. In this risk analysis template, you’ll find risk ratings, mitigation strategy descriptions, a management matrix for identifying and assessing risks, and a list of monitoring control efforts.

Download Risk Management Matrix

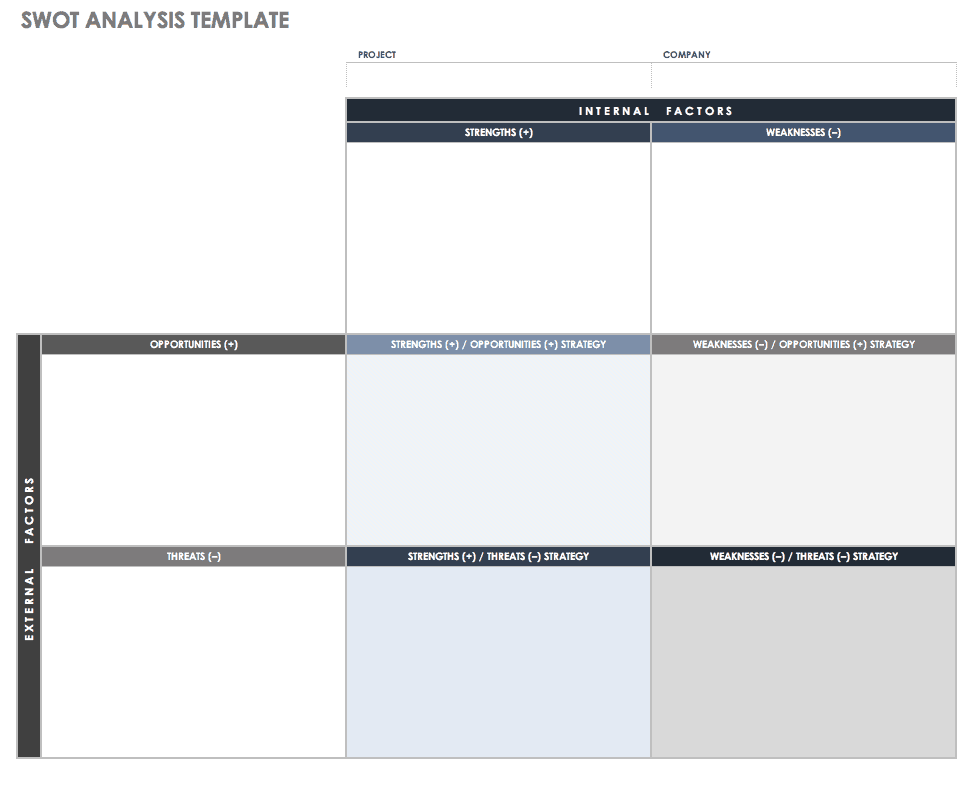

SWOT Analysis Template

When conducting an operational audit, you’re likely to uncover part of your company that isn't performing to expectations. A particular division’s ROI may be plummeting, or your marketing might not have traction. Perform a SWOT analysis to clarify strengths and weaknesses, as well as identify opportunities and threats. This SWOT matrix template provides a two-by-two layout for an easy-to-read analysis view. It also includes a column for measuring the significance of each item in your SWOT categories to quickly see how different elements in your analysis measure up to each other and which areas require the most attention.

Download Basic SWOT Matrix Template

Excel | Word | PDF | PowerPoint | Smartsheet

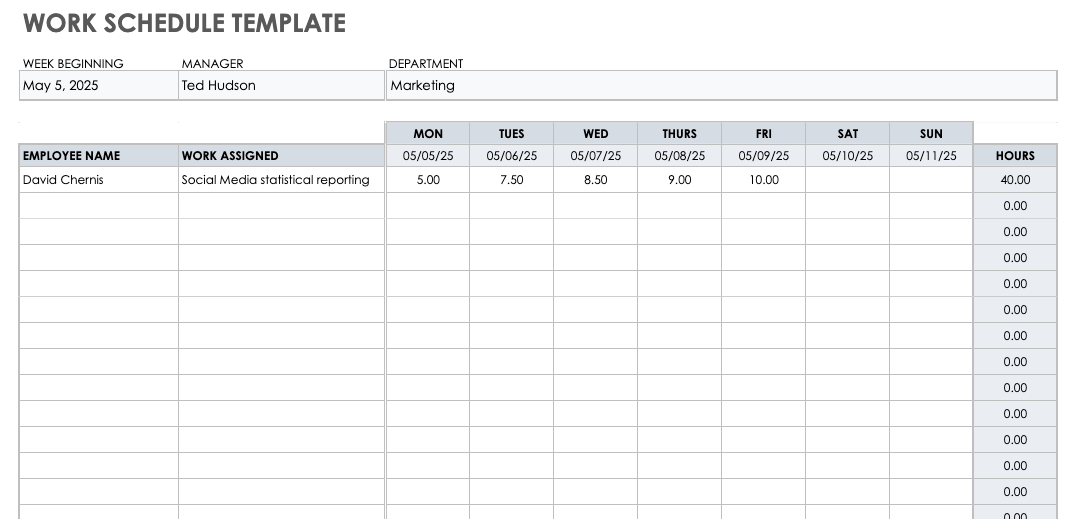

Work Schedule Template

Organize departmental schedules and individual assignments. You can modify this template to schedule audit tasks, or organize team members post-audit for greater day-by-day efficiency. Plus, you can specify which department the schedule is for, and customize workflows for the week.

Download Work Schedule Template

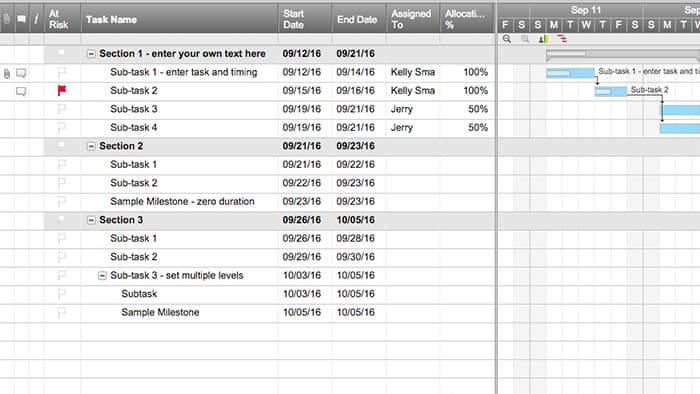

Project Management Template

This online Gantt chart gives you control of your project and visibility into team availability. At a glance, you’ll know who’s assigned to which task(s), and which tasks are at risk of affecting the project’s schedule. Use this information to inform decision making.

Create a Project Management Template in Smartsheet

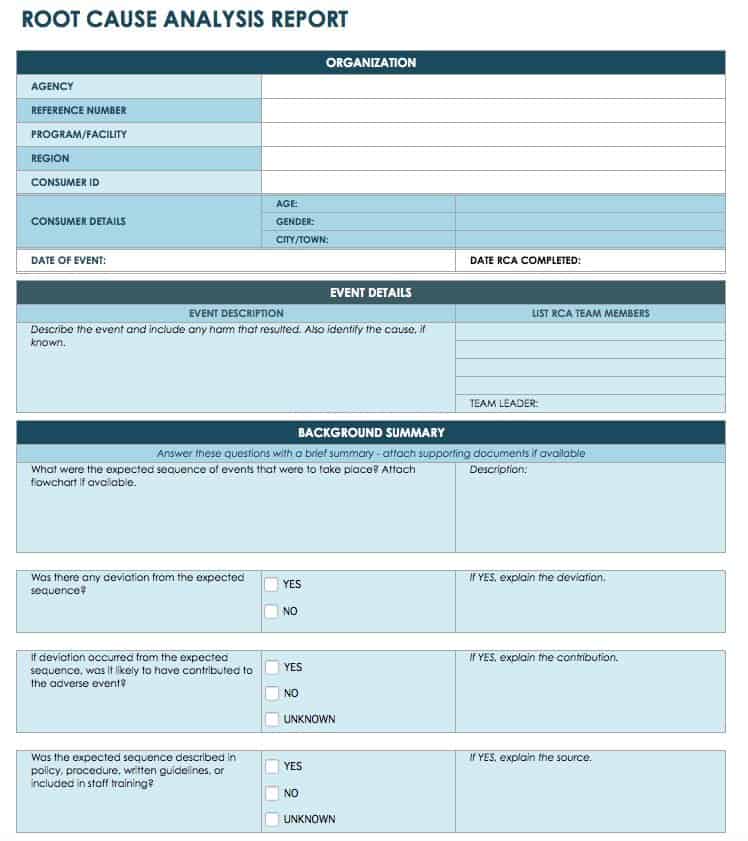

Root Cause Analysis Template

Because operational audits identify what is and isn’t working in an organization, it’s important to determine the cause of these matters in order to remedy the situation. This template supports detailed examination of specific events. Use it to record information on contributing factors, findings related to the cause, and actions to take or use to reduce future risk.

Download Root Cause Analysis Template

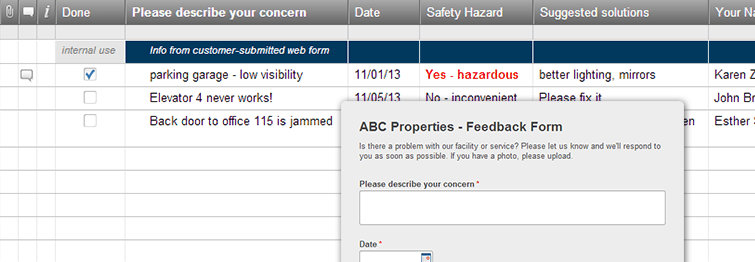

Information Gathering Template /Marketing Survey Webform

Get the information you need with this online suggestion box and web form. Customize the form to gather intelligence for your audit, and then add it to emails and webpages for employees or management to submit answers to queries or suggestions. The form is fully customizable to suit your auditing needs.

Improve Operations with Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.