What Is Crisis Management?

Crisis management refers to the practice of preparing for negative incidents, minimizing their damage and disruption, and getting an organization back on track as quickly as possible. Crisis managers anticipate likely threats and develop strategies to cope with their impact. To read more about crisis management please visit our "The Essential Guide to Crisis Management" article.

Effective Crisis Management Examples

Effective crisis management occurs when an organization employs skillful planning and a proactive response to avert a crisis entirely, limit its severity and duration, or turn it into an opportunity. These examples feature organizations that responded with transparency and agility.

CPG Product Crisis Management Example: Tylenol Product Tampering

In 1982, seven people in the Chicago area died after taking Tylenol capsules poisoned with cyanide. The tampering was believed to have occurred when someone injected the chemical into capsules and returned them to store shelves. The deaths remain unsolved, but the way Johnson & Johnson handled the episode has become a teaching case study for effective crisis management at Harvard Business School and elsewhere. In 2003, Fortune magazine named James Burke, the company’s CEO at the time, as one of history’s greatest CEOs for the way he handled the scare.

Below are some highlights of Johnson & Johnson’s handling of the crisis:

- Fast and Decisive Action: According to a book on the case by Harvard Professor Richard Tedlow, on the afternoon of the first two deaths, the company halted all product advertising, sent 450,000 messages to hospitals, doctors’ offices, and other stakeholders, and established toll-free hotlines for consumers. At a cost of more than $100 million, the company recalled all products from store shelves — one of the first nationwide recalls — even though government officials felt that doing so was excessive. Additionally, Johnson & Johnson issued warnings to consumers not to take its pain reliever.

- Honesty and Integrity: Despite evidence that the poison was introduced via store shelves, Johnson & Johnson did not try to evade blame. As a result, Burke was praised for his honesty. His integrity stood out in the context of the post-Nixon era and the unforthright handling of the Three Mile Island nuclear disaster. The company became a pioneer in developing tamper-proof packaging, and eventually moved away from capsules to a more tamper-resistant caplet. Burke was candid in expressing regret that the company had not done so right away.

In less than a year, Tylenol regained its market share and sales leadership, and according to a BrandSpark study, it continues to rank highly for consumer trust.

For a comprehensive look at crisis management in the Tylenol deaths, see this profile of Burke’s leadership and analysis of Johnson & Johnson communications.

Healthcare Crisis Management Example: Global Pandemic

While the global pandemic that began in late 2019 challenged many organizations, the calamity also highlighted examples of strong crisis management.

The Cleveland Clinic Abu Dhabi operates as a U.S. medical center in the United Arab Emirates. The hospital faced COVID-19 early in its migration beyond China. The clinic responded quickly in order to both expand its emergency capacity and continue providing care for cancer and transplant patients, as well as for those with other complex needs.

Dr. Rakesh Suri, CEO of Cleveland Clinic Abu Dhabi, says that forming a crisis management team (that included individuals from all levels of the organization) was a critical step, as doing so enabled the hospital to act with agility. The medical center also coordinated with other local hospitals to maximize resources and play to each institution’s strengths.

The executive team took extra steps to take care of staff, including talking honestly about their emotional challenges and providing sleeping rooms, meditation space, online workouts, nutritious food, counseling, and childcare.

An in-depth case study on the hospital surfaced several lessons, including the importance of preparing for worst-case scenarios, leaders empowering their teams to solve problems innovatively, encouraging candor, proactively engaging all stakeholders, and taking care of physical and mental well-being.

In business, companies had to pivot quickly as the pandemic changed the marketplace. A 2020 Harvard Business School study of 350 senior executives in China who faced the crisis early found some key commonalities among those who managed effectively, including the following:

- Improve decision-making by moving away from the hierarchical model.

- Collaborate in new ways with customers, suppliers, regulators, and even competitors.

- Support remote work by changing company culture to prioritize trust and results over command-and-control and physical presence.

- Ask employees to self-select for challenging assignments in order to get maximum ownership and motivation.

- Embed new learning and innovative digital strategies that arise in a crisis into your organization’s muscle memory.

Examples of Bad Crisis Management (and What They Teach Us)

In contrast, examples of poor crisis management are usually marked by fundamental errors in preparation or execution of an emergency plan — and sometimes both. Often, these problems compound, which only multiplies the scale of the crisis.

This is especially true in so-called black swan events — incidents that are extremely rare, have severe consequences, and are generally perceived in hindsight to have been obvious to happen. Since the likelihood of a black swan event occurring is low, leaders may dismiss the risk (if they are even conscious of it). But, the grave consequences of black swan events can pose a much larger threat.

Following are real-world examples of weak crisis management and the lessons crisis managers can take from them.

Natural Disaster Crisis Management Example: Hurricane Katrina

In August 2005, Hurricane Katrina hit the U.S. Gulf Coast and flooded New Orleans, causing more than $100 billion in property damage and killing more than 1,800 people. Even though the hurricane began as a natural disaster, the scale of the catastrophe was man-made. Various analyses of the response, including a report by Congress, focused on weak aspects of the crisis management and highlighted the following important lessons:

- Preparation Is Key: In 2006, a study by the Army Corps of Engineers found that the levees built to protect New Orleans from flooding were incorrectly engineered, poorly built, and insufficiently funded. Additionally, government officials who were aware of the storm forecast did not make provisions to evacuate residents who did not have cars or could not afford bus fare, which left tens of thousands of vulnerable people stuck in the city. The government also didn’t position enough emergency supplies in New Orleans ahead of the storm.

- Train Your Crisis Team: The Federal Emergency Management Agency (FEMA) was led by officials who were political appointees and had no experience in disaster management. A congressional review found that agencies handling the response were unsure of their roles and responsibilities. Government agencies failed to learn from a drill of a similar hurricane hitting New Orleans the previous year.

- Simplify Communications and Decision Making: Federal and local crisis managers struggled to communicate due to equipment failure and incompatible technologies. Confusion among different levels of government paralyzed decision making. Ultimately, the crisis plan was too complex — with 29 federal agencies playing a role, duties were unclear and too much red tape hampered efforts.

- Act Quickly but Not Rashly: About $2 billion spent by FEMA in Hurricane Katrina was wasted or fraudulently claimed, according to a New York Times analysis. In many ways, this was a symptom of a poorly planned and executed crisis response. For example, FEMA ordered $100 million in excess ice that truckers shuttled around the country for weeks while the agency tried to figure out where it should go (after storing it for two years, the government melted the ice). Additionally, the agency spent $7.9 million to renovate a former army base as a shelter in Alabama that only 10 people stayed at (the shelter closed within a month). Half of the mobile homes ordered as temporary housing — at a cost of $430 million — went unused.

For in-depth case study of Hurricane Katrina crisis management, see “Katrina and the Federal Emergency Management Agency: A Case Study in Organizational Failure.”

Industrial Disaster Crisis Management Example: Bhopal Gas Leak

In 1984, a toxic gas leak from a Union Carbide India pesticide plant in Bhopal, India killed up to 30,000 people from immediate and long-term effects (according to estimates) and injured about 575,000. The accident is one of the world’s worst industrial disasters.

The leak was caused by the introduction of water into a chemical tank, which resulted in a heat-generating, runaway reaction. Several inquiries found evidence of company negligence, but an internal analysis blamed employee sabotage.

Researchers have written extensively about the accident, and some of the lessons cited are universally helpful in crisis management, including the following:

- Rehearse Emergency Procedures: The plant did not have an emergency plan, and plant operators did not know how to handle an emergency. No effective public warning system or public education about the risks were in place.

- Prioritize Crisis Readiness: The company reduced training and staffing at the plant to save costs. Supplies of gas masks were inadequate, and several plant safety mechanisms were either deactivated or faulty. Additionally, several experts found that there weren’t enough operators for the unit to function safely. On the night of the accident, the supervisor delayed investigating an initial small leak until after a crew break, rather than being proactive.

- Share Information: A U.S. Union Carbide plant found earlier in the year that a runaway reaction in the chemical tank could happen, but they didn’t communicate it to the India plant. When the leak occurred, plant staff did not inform senior managers or local authorities. Most of the information on the chemical involved, including how to treat exposure, was proprietary and was not disclosed. So, public health authorities and hospitals in Bhopal did not know immediately what victims had been exposed to (and therefore couldn’t provide the best antidotes).

For in-depth case studies on the Bhopal accident, see Union Carbide Corp.’s site dedicated to the tragedy, as well as “An Analysis of the Bhopal Accident” and “The Bhopal Disaster and Its Aftermath.”

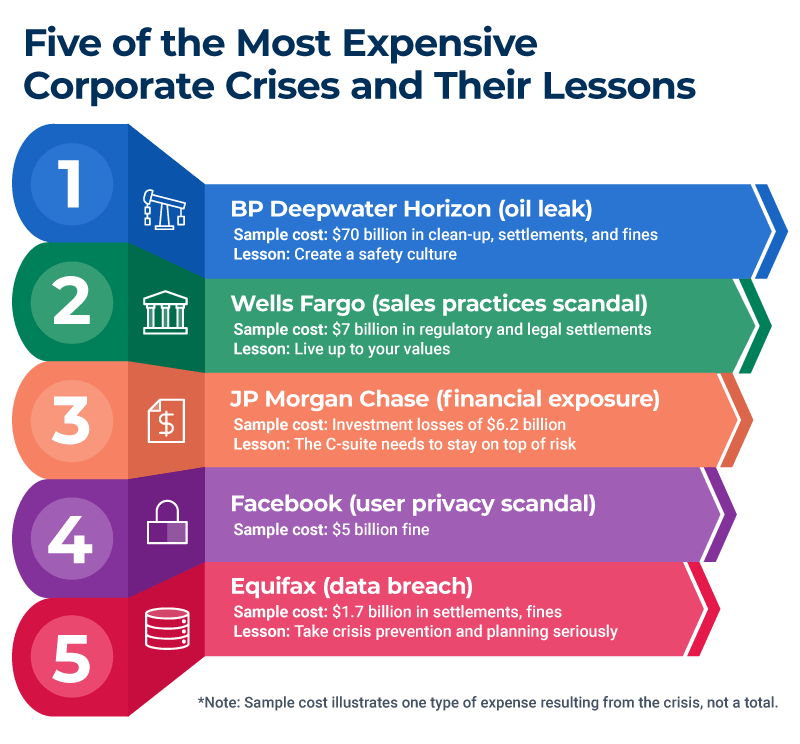

Five of the Most Costly Corporate Crises and Their Lessons

In addition to the human toll, a crisis can also be financially devastating for a company and its shareholders. Aside from direct costs, businesses may face fines, damage claims, legal settlements, damage to brand value, exodus of key revenue-generating staff, competitive disadvantages, and stock price declines.

Social media has compounded these effects. A study by Pentland Analytics that compared corporate crises in 2000 and 2018 found that social media amplified damage, doubling the loss of shareholder value (from a 15 percent to a 30 percent decline in the first year after a crisis).

The most costly crises have multi-dimensional financial impacts. Following are some examples of calamities that caused extensive financial damage to the companies.

1. Example: BP Deepwater Horizon

In 2010, BP’s Deepwater Horizon oil-drilling rig in the Gulf of Mexico exploded, killing 11 employees and causing an oil leak that lasted for three months. This is the biggest oil spill in U.S. history.

The oil spill devastated the environment and tourism. Damage to the environment has been long-lasting — one study valued the impact at $17.2 billion. The spill also caused billions of dollars in negative economic impact on tourism in the region. Meanwhile, the financial toll for the company included the following costs:

- Through early 2020, BP paid about $70 billion in clean-up costs, legal settlements, and fines.

- In the two months after the spill, the company’s shareholders lost $105 billion as its stock price plummeted.

- For a time, the company’s survival was in question. Its bonds crashed in value, and the company had to stop paying dividends for three quarters.

- In the United States, the BP brand faced a backlash from consumers, and BP gas stations saw sales drop 10 to 40 percent in the immediate aftermath of the spill.

- BP had to reduce its business spending for years, which analysis said put it behind competitors such as Shell, whose brand value rose 24 percent that year, according to Interbrand. BP dropped from the second-largest global oil company in 2010 to fourth, where it has remained.

Crisis Management Lesson: Create a Safety Culture

Studies have attributed the accident to a series of human mistakes and technical failures in the context of a high-risk corporate culture and weak regulatory supervision. The studies noted overconfidence on the part of BP, based on many years of not having an offshore well blowout in deep water. They also cite a lack of planning for low-probability, high-impact oil spills.

Operators and managers grew accustomed to normalizing signs of potential trouble and ignored weak signals of looming disaster. Alarm systems on the rig were suppressed, and crucial equipment was not properly maintained. The Center for Catastrophic Risk Management at the University of California Berkeley blamed the absence of a safety culture and shortsighted prioritization of the bottom line. According to the center’s report, BP “forgot to be afraid.”

2. Example: Wells Fargo

For 14 years, until the practice was exposed in 2016, hundreds of thousands of Wells Fargo employees opened customer accounts without consent to meet sales targets and generate fees for the bank. The financial consequences included the following:

- The bank paid more than $7 billion to settle government investigations and private lawsuits.

- Wells Fargo lost business from the state governments of California and Illinois, as well as from the cities of Chicago, Philadelphia, and Seattle, among others who cited the illegal behavior as the reason.

- In response to the scandal, in 2018, the Federal Reserve imposed a limit on the bank’s growth, putting Wells Fargo at a competitive disadvantage and costing it an unknown amount of potential increase in customers and loans.

- The company lost $220 billion in stock market value in the two and a half years after the enforcement action. The stock hit a 10-year low in May 2020, faring far worse than its peers.

- The bank has racked up heavy expenses related to the crisis, including legal fees, investigation costs, and spending on an ad campaign aimed at restoring consumer trust.

Crisis Management Lesson: Live Up to Your Company Values to Avoid Scandals

According to the government, Wells Fargo executives were aware of the abuses as early as 2002, but failed to act despite espousing a culture of integrity. The executives imposed such aggressive sales targets for staff that many employees said they felt they had no choice but to engage in the illegal practices. The government is pursuing some individual executives for their roles.

For an in-depth discussion, you can read the full report issued by the U.S. House of Representatives.

3. Example: Equifax

In 2017, Equifax, a credit reporting bureau, suffered a data breach that gave hackers access to sensitive personal information for 147 million consumers. The incident was the most expensive data security breach to date. In 2020, four members of China’s People’s Liberation Army were indicted in the United States in the breach.

- The company had $1.7 billion in legal settlements, fines, fees for consultants, lawyers, and investigators, and the cost of providing credit monitoring and identity protection to consumers.

- In the week after Equifax disclosed the breach, the company lost $5.3 billion in market valuation as its stock price declined 31 percent.

- For the first time ever, a credit rating agency downgraded its outlook on a company over cybersecurity concerns. A credit rating downgrade increases a company’s borrowing costs. Moody’s dropped its rating on Equifax to negative from stable in 2019, two years after the breach, citing continued high costs related to the hack. Moody’s further projected that the spending would continue to hurt Equifax’s profitability.

Crisis Management Lesson: Take Crisis Prevention and Planning Seriously

A congressional investigation found that relatively basic mistakes at Equifax led to the breach. For example, the attack occurred through a server vulnerability that was a known issue. Equifax had previously notified its system administrators to patch the issue, but the person responsible for the point of entry did not get the message because Equifax’s email list was out of date.

An expired digital certificate allowed malicious network activity to stay hidden. Proper data governance protocols, which limit user access to sensitive information, were not in place — this allowed the attackers to run about 9,000 queries to find the consumer data. The attack lasted about 76 days before it was discovered.

The company’s public response contained many missteps (including directing consumers to a website that had bugs, according to IT experts) and as such, did not inspire confidence. For example, the site asked consumers, who had just had personal information stolen via Equifax, to enter most of their Social Security numbers to find out if they were included in the hack. The company mistakenly tweeted a phishing link for the response website four times instead of the correct URL, according to Wired magazine.

Crisis management experts said Equifax lacked comprehensive prevention and response plans and faulted the company’s slow disclosure. (Equifax discovered the breach in July 2017 but did not reveal it until September 2017.) Given the sensitivity of the information in their database, Equifax should have had much more robust preparation, experts said.

For details on crisis management planning, see “Step-by-Step Guide to Writing a Crisis Management Plan.” You can also use one of these free disaster recovery planning templates to help get your business back on track.

4. Example: JP Morgan Chase

In 2012, a trader in JP Morgan Chase’s London office, nicknamed the London Whale, ran a portfolio of esoteric derivative investments. The trader was part of a team whose mandate was to hedge the bank’s operating risks. But, the whale’s investment strategies turned out to be flawed, and the size of these transactions was so great that they affected world credit markets. The whale’s trades ultimately lost money on a massive scale, and the company sustained the following financial impacts:

- Investment losses of $6.2 billion.

- JP Morgan Chase received fines of more than $1 billion by U.S. and British regulators.

- Senior executives were stripped of $75 million in compensation after an internal investigation.

- The company had to pay one hundred and fifty million to settle a shareholder class action lawsuit.

- A loss in stock market value of $14.4 billion in the two days after disclosing the problem.

- The company’s reputation as a careful risk manager was also damaged. In 2012, research company Interbrand found that the value of JP Morgan’s brand had dropped 8 percent, to $11.5 billion.

Crisis Management Lesson: The C-Suite Needs to Stay on Top of Risk

When he realized the full potential for disaster, the London Whale, whose real name is Bruno Iksil, suggested that the company immediately take a loss on the positions. This move would have resulted in much less financial damage.

But, according to a U.S. Senate report, his managers began to conceal the magnitude of losses. They produced a shadow spreadsheet and hoped the investment positions would turn around, which resulted in mounting losses.

Reviews of the episode found that risk-management practices for the division were less rigorous than for other areas of the bank. First, the bank ignored warning signs from its risk metrics and then changed the risk standards (so the warning signs went away), according to a company report.

Although people internally realized the potential extent of losses, bank management downplayed them in public. In 2012, CEO Jamie Dimon dismissed the incident as a “complete tempest in a teapot,” the Senate report said, a position he would later reverse.

The bank‘s investigation found that there was too little scrutiny of the London activities by its top management. In the aftermath, the bank strengthened risk management and made the review team more independent to address the group-think mentality that limited questioning of the investment strategy, JP Morgan said. The episode sparked calls for tougher regulation.

5. Example: Facebook

In March 2018, a whistleblower told two newspapers that a British firm called Cambridge Analytica had bought data about 87 million users and their friends without their consent from Facebook. The company used the data to build voter profiles that Cambridge sold to election campaigns, including Donald Trump’s presidential run.

The episode sparked a scandal over user privacy at Facebook, the biggest of many. CEO Mark Zuckerberg was called to testify before Congress. The company faced investigations by regulators in the United States and Britain, as well as lawsuits from several jurisdictions.

The financial repercussions included the following:

- The U.S. Federal Trade Commission imposed a $5 billion fine against the company — the largest ever. The FTC said Facebook’s behavior violated a previous consent decree with the agency. The Securities and Exchange Commision fined the company $100 million and British regulators fined 500,000 pounds.

- Engagement on Facebook dropped by 20 percent in the months after the scandal, a metric that affects the company’s ad revenue.

- Facebook users’ confidence in the company dropped 66 percent in the weeks after the scandal broke and Zuckerberg testified before Congress, according to a Ponemon Institute survey. Some users quit Facebook (including 3 million Europeans) in the subsequent months over privacy abuses. The hashtag #DeleteFacebook began trending on social media, and public support for tighter regulation of social media grew.

- Growth in Facebook revenue and users dropped in the quarter after the Cambridge Analytica affair. The company’s stock valuation lost $130 billion in two hours after the news, weakening the social network’s forecast further.

- Facebook sustained a drop in brand value of 6 percent (about $2.9 billion) for the year to $45.2 billion, according to Interbrand.

Crisis Management Lesson: Apologize When You are Wrong

U.S. investigators found that Facebook violated consumer trust by allowing a third party to collect users’ personal data without their knowledge. The data collectors also violated Facebook policies that required deleting the data.

Facebook CEO Zuckerberg was silent for five days before issuing a statement acknowledging that mistakes had been made. Facebook users heavily criticized the response, prompting Zuckerberg later to say, “I’m sorry” in media interviews. IT experts said the response was slow and underwhelming.

Critics faulted Facebook for technical decisions that resulted in app developers being able to access information about users’ friends, saying safeguards were inadequate. Commentators such as Tufts University cybersecurity expert Susan Landau also criticized Facebook for not taking legal action against Cambridge Analytica and for failing to inform users whose data was taken until well after the news broke.

The company placed full-page newspaper ads, made changes to data-handling practices, and implemented other reforms, but consumer trust remained damaged. Analysts said Facebook’s gestures, including its lack of apology, rang hollow and came too late.

Best Crisis Managers Safeguard Their Brands

Protecting your reputation is an important aspect of crisis management, and conveying authenticity and empathy is paramount when anyone is harmed.

Reputation research firm RepTrak found in a 2020 survey of 80,000 consumers globally that corporate responsibility (made up of workplace quality, governance, and corporate citizenship) accounts for 41 percent of its reputation. (For details on how and when to apologize, see “Models and Theories to Improve Crisis Management.”)

Corporate reputation is an important influence on consumer behavior. RepTrak data shows a company with an excellent reputation activates willingness to buy among 79 percent of consumers, compared to 9 percent for companies with poor reputations.

Companies that maintain strong reputations through the decades are typically examples of strong risk and crisis management. But that is not to say they have necessarily avoided all calamities: sometimes, these organizations have faced a pivotal crisis and turned it into an opportunity to achieve long-term reputation strength.

Reputation is the primary determiner of brand value, which is a company asset that can be worth billions. Interbrand found that the value of the top 10 global brands in 2019 was collectively almost $1 trillion.

Top 10 Most Valuable Global Brands*

- Apple: $234.2 billion

- Google: $167.7 billion

- Amazon: $125.3 billion

- Microsoft: $108.9 billion

- Coca-Cola: $63.4 billion

- Samsung: $61.1 billion

- Toyota: $56.2 billion

- Mercedes: $50.1 billion

- McDonald’s: $45.3 billion

- Disney: $44.4 billion

*Source: Interbrand, 2019

Crisis Management Examples by Best Practice

Crisis case studies help illustrate best practices and how companies apply them. The following examples show how crisis management leaders and laggards performed on fundamental best practices in specific situations.

Crisis Management Best Practice: Form a Crisis Team

While you should have a designated crisis management team, you may also need smaller teams focused on particular issues. Cross-functional teams are often especially effective. Free team members from their normal duties while they are handling the crisis, remove constraints, and give them the resources they need, such as specialized external experts. When the crisis is over, review the team’s performance. (For more about crisis management teams, see “How to Build and Effective Crisis Management Team.”

Example: When Volkswagen faced a crisis over its diesel-emissions scandal, Oliver Larkin, group head of investor relations, told IR Magazine that the company “immediately put in place a task force team, with representatives from the communication side but also from the technical side and the legal side evaluating the information as it was coming through – and those people were working 24/7.” The group’s focus was on messaging, VW’s reputation, and relationships with major investors, and other responsibilities were put aside. Specialists, who were situation consultants, also joined the effort.

Crisis Management Best Practice: Have a Plan

Hopefully, your crisis management plan includes a communications plan that you’ve detailed in advance. But if not, or if you overlooked anything relevant to the crisis at hand, do some quick planning at the beginning of the crisis. Make sure to plan for social media, and draft holding statements. To learn how to write a plan, read “Step-by-Step Guide to Writing a Crisis Management Plan.”

Examples: In a case study of what not to do, Amazon faced negative attention around its 2019 Prime Day shopping promotion. Staff around the world protested over alleged poor working conditions and abusive company policies. Actions leading up to and on the day sparked media coverage, calls for legislative action, and late-night TV segments. Amazon did not comment publicly, defying public relations best practices. PR experts speculated the company did not have a crisis communications plan to mitigate the damage.

As an example of strong crisis communications, the American Federation of Government Employees, the union representing 700,000 employees of the U.S. federal government, responded to the coronavirus crisis with a multi-pronged communications plan. The goal was to draw attention to concerns over a shortage of protective gear and testing, policies, and short-staffing.

The union sued the federal government for hazard pay, and then targeted individual agencies by publicizing the plights of their staff to the media with press releases, TV appearances, and a daily newsletter. Internally, the union sent daily email alerts and digital campaigns to local leaders, weekly updates to members, mass texts, and memes to get the word out.

Crisis Management Best Practice: Pick the Right Spokesperson

Choose an individual who has the knowledge and training to address the crisis and is in a position of authority. You can coach the right person on working with the media, but putting a representative who lacks expertise in front of the cameras will backfire: your organization will come across uninformed or incompetent.

Example: During the coronavirus pandemic, Dr. Anthony Fauci, Director of the National Institute of Allergy and Infection Diseases for more than 30 years, brought expertise to his role as explainer in chief to the American public.

He conveyed the importance of citizens staying home with clear and consistent messaging, and he deftly handled complex questions about science from the media. He gave interviews on social media, podcasts, sports shows, digital news sites, as well as traditional media, to reach all demographics, including teenagers.

Crisis Management Best Practice: Be Present

In a serious crisis, leaders should always be on site, either at headquarters or the location that makes the most sense. Cancel business trips, and return from vacations.

Example: In early 2020, wildfires burned more than 20 percent of Australia’s forests and killed 26 people. During the disaster, Australian Prime Minister Scott Morrison faced an outpouring of anger from citizens and intense media criticism after secretly taking a Hawaiian vacation and having his staff deny it.

The prime minister’s representatives refused to disclose his location, igniting a social media storm and dominating media coverage. Then, an Australian tourist shared a photo he snapped with the leader on a Hawaiian beach. The government had to backtrack, which caused huge embarrassment and a scandal about the cover-up.

Crisis Management Best Practice: Respond Quickly

Issue a statement within the first hour of a crisis and publish frequent updates. Keep customers and other stakeholders informed about progress. If you’re unsure about frequency, err on the side of too much communication, rather than too little.

Example: In 2018, after switching delivery companies, Kentucky Fried Chicken (KFC) suffered supply problems that caused a shortage of chicken at its U.K. restaurants. The company was forced to close more than two-thirds of its locations.

Even though the crisis response group initially had little information about the problem, the team quickly acknowledged the issue publicly. Within hours the team explained what had happened, how it was being addressed, and when it would be solved.

“Our instinct was that we had to face the issue head on: a chicken restaurant without chicken. Not ideal,” a spokeswoman for KFC told Raconteur at the time. “We were responding live as we received new information. We acted fast in assessing the issue and working out the best approach.”

In a negative case study, General Motors in 2014 did a series of vehicle recalls due to faulty ignition switches that affected 30 million cars. The company ultimately paid about $4.1 billion in repair costs, victim compensation, and fines.

But perhaps even more damaging was the revelation that the automaker had known about the problem for at least a decade, at one point blaming the fault on short drivers and heavy key chains. The resulting publicity and congressional hearings harmed GM’s reputation, and one senator described the company as having a “culture of cover-up.”

Use a crisis communications strategy template to help you assign important responsibilities and build a process and response plan in the early stages of a crisis. For all other crisis management templates please visit our template article. You can also learn about step-by-step instructions on how to build a strong crisis management strategy, including free templates and tips from experts.

Crisis Management Best Practice: Be Compassionate

Respond empathetically to show that your organization cares about people. Fear of lawsuits often causes companies to resort to carefully parsed legal language or circumspection. While minimizing liability is important, showing your human side goes a long way to winning goodwill and defusing anger, which often is a motivating factor in lawsuits.

Example: In 2019, Boeing responded to news that its 737 MAX airplane had caused two crashes and killed 346 people due to faulty software by insisting the aircraft was safe and that there was no engineering or technical problem.

The CEO blamed poor pilot training. Governments around the world grounded all the planes. Crisis communications experts criticized Boeing’s handling as slow, legalistic, and lacking empathy. Moreover, they noted that Boeing’s stated values include acting with the highest ethical standards, taking personal responsibility, and valuing human life above all else, and that these should have guided its response.

Crisis Management Best Practice: Speak the Truth

Be upfront and transparent, and don’t hide behind euphemisms or jargon. The truth will eventually become clear, and obfuscating will only cause further mistrust and resentment.

Example: In a negative case study, United Airlines forcibly removed a 69-year-old doctor from an overbooked flight leaving Chicago in 2017. Security officers dragged him off the plane. A passenger captured the scene on video and bystanders reported the officers threw the man against an armrest. The doctor later said he lost two teeth and had a concussion and broken nose.

United CEO Oscar Munoz told employees by email the passenger had been “disruptive and belligerent.” In a public statement, he said the airline had to “re-accommodate” the man, a euphemism for the procedure of removing a paying passenger from the flight so an airline employee could have the seat.

The video of the doctor’s rough treatment went viral on social media and showed that the doctor had not acted out as Munoz claimed. United faced a wave of public anger, and its stock lost $1.4 billion in value. Munoz later apologized and promised the incident would not happen again, but his planned promotion to United’s chairman was canceled.

Crisis Management Best Practice: Focus and Move Ahead

Give the crisis full attention, but do not lose sight of your future. Whenever possible, align your crisis response actions with the long-term vision and overarching goals of your organization.

Example: In early 2020, Delta Air Lines (like all carriers) faced a catastrophe as a global pandemic virtually eliminated demand for airline travel. While challenges persisted, the airline began working toward regaining financial stability.

CFO Paul Jacobson, who crafted and led Delta’s financial crisis response to the Sept. 11, 2001 attacks, canceled his announced retirement to help rebuild the airline. To accomplish this task, Jacobson used strategies such as securing emergency government aid and deferring long-term capital spending.

Crisis Management Best Practice: Communicate Clearly

Present information openly and in a way that others can understand. Recognize that personal perspective influences how everyone interprets information. Don’t hide from bad news.

Example: In 1986, the Space Shuttle Challenger disintegrated little more than a minute into flight, killing all seven crew members. Investigations found the cause was the failure of an o-ring seal in a solid rocket booster that allowed pressurized burning gas to escape and cause structural disintegration.

Poor communication and decision-making were determined to be major contributing causes to the disaster. The investigating commission found the launch should not have been approved. They cited a lack of effective communication between the decision-makers and the engineers, the absence of a formal communications channel which isolated management, and selective listening. The panel found the decision to proceed with the launch was based on incomplete and misleading information.

Crisis Management Examples by Type: Social Media, Product Problems, and More

Crisis management case studies are especially instructive when you compare how two organizations coped with relatively similar problems. The following examples are organized around crisis type, including social media crises.

Examples of Social Media and PR Crisis Management

Social media has enabled users to spread negative or embarrassing information about a brand in a nanosecond. Companies need to monitor social media actively and act quickly to address public relations problems. Unflattering episodes can go viral, severely damaging a company’s reputation.

Examples of Good Social Media Crisis Management

The most effective uses of social media to address company crises are typically characterized by speed and, when appropriate, humor — although companies should also address underlying issues.

- Example: Popeye’s

In 2019, Popeye’s debuted a fried chicken sandwich that consumers praised on Twitter, comparing it favorably to rival Chick-fil-A’s offering. Chick-fil-A responded with a tweet promoting its sandwich as “the original.” Popeye’s shot back cheekily, “Y’all good?” The retort ignited the so-called “chicken-sandwich wars,” which Popeye’s won as Americans flocked to its stores. - Example: Red Cross

In 2011, the American Red Cross defused a crisis over a rogue tweet with humor. A staff member mistakenly sent a personal tweet to the organization’s account: “When we drink we do it right #gettngslizzerd.” As the tweet started to spread, Red Cross defused the PR nightmare with this tweet acknowledging the error: “We’ve deleted the rogue tweet but rest assured the Red Cross is sober and we’ve confiscated the keys.” A beer brand mentioned in the original tweet responded by asking its fans to donate to the Red Cross. - Example: Tide

In 2018, teenagers uploaded to social media videos of themselves eating Tide laundry detergent pods, which are poisonous, in the “Tide Pod Challenge.” Rather than trying to ignore the controversy, manufacturer Procter & Gamble swung into action by lobbying social media platforms to remove the videos, mounting a communications campaign, and placing its own video of NFL player Rob Gronkowski urging people not to swallow the pods on social media and broadcast television.

Examples of Bad Social Media Crisis Management

Crises can start or worsen on social media when brands display insensitivity or are slow to react to growing negative engagement. Following are some examples of companies that mishandled social media.

- Example: Gillette

In 2019, razor maker Gillette sought to promote the values of the #MeToo anti-sexual harassment movement with a video that it placed on YouTube and in ads. After a century of promoting men who use its products as alpha males and virile, the company in the video first showed men bullying and mansplaining, and then contrasted them with empathetic men who stop others from bad behavior toward women. Despite some scattered praise, the video got twice as many dislikes as likes on YouTube, and calls for a Gillette boycott arose. Twitter users bashed the company for negatively stereotyping men and shaming its customers. - Example: Tinder

In 2015, dating app Tinder responded to a negative article about it in Vanity Fair magazine with a 31-tweet rant. The tweets were defensive, included profanity, and a claim that the app had helped people in North Korea meet dates. The overreaction made Tinder the butt of jokes and drew negative attention to the company. - Example: Applebee’s

In 2013, a waitress at restaurant chain Applebee’s posted a customer’s receipt on Reddit (with the name visible). The customer had written a critical comment about an automatic 18 percent tip added to the bill for a big party. Applebee’s said on Facebook, “We wish this situation hadn’t happened.” Thousands of negative comments flooded in every hour. The story went viral, and Applebee’s response was panned by PR experts as pouring gasoline on the fire. The company’s social media team answered Twitter comments by copying and pasting its corporate policy statement, which users perceived as a snarky response. Then, failing to keep up with the flood of reaction, the company disabled user posts on its Facebook page. Next, the team posted an update with the corporate statement, hiding the previous statement and more than 20,000 comments. Users perceived the tactic as deleting their posts, which enraged them.

Examples of Crisis Management Involving Product Problems

Product crises can be especially damaging for companies because their sales and brand are likely to suffer. Effective crisis management can ensure that the fallout is minimized. Poor crisis management can make it worse.

Examples of Good Crisis Management of Product Problems

Companies that manage crises caused by faulty products well show concern for customers, take responsibility for the issues, and respond decisively with improvements.

- Example: Mattel

In 2017, toy maker Mattel recalled nearly 2 million toys that were tainted with outlawed lead paint. The act angered parents and attracted regulator attention. The problem stemmed from a contract manufacturer that used paint not authorized by Mattel. Within a few days, Mattel identified the factory, halted production, and launched an investigation. The company voluntarily expanded its review and made two more product recalls, even adding an unrelated problem. The company imposed stringent new tests on products before they could be sold, changed suppliers, and put its own staff in contract manufacturing plants. Mattel communicated consistently and repeatedly apologized. The company won praise for its swift and honest response, and the company now enjoys a reputation of trustworthiness. - Example: Samsung

In 2016, Korean electronics company Samsung faced a crisis when its Galaxy Note 7 smartphones exploded due to a battery problem. Sales slumped as airlines banned passengers from carrying the phone on board. Samsung responded by immediately taking accountability, being transparent about not immediately knowing the cause, and vowing to determine the problem. The company put 700 engineers on the problem and opened the research to third parties. When the problem was identified, the company communicated the issue clearly and introduced quality assurance and safety features. Samsung also launched a campaign aimed at tying its brand image to a larger purpose and improving its culture. In the next year, Samsung’s brand value rose 9 percent, according to Interbrand, and its Galaxy S8 yielded record profits the following year.

Examples of Bad Crisis Management for Product Problems

Examples of poor crisis management by companies over product issues are often marked by slow acknowledgement or even denial.

- Example: Takata

Japanese auto parts maker Takata produced car airbags that exploded and were linked to at least 14 deaths. Governments recalled some 70 million airbags by 2017. Studies of the problem found design and engineering flaws. Before the extent of the problem became clear, Takata did not want to face embarrassment or prosecution. A senate report found that the company manipulated test data and did not adequately address safety concerns. The report concluded the company’s safety culture was broken. Takata ultimately went bankrupt with an estimated $15 billion in liabilities for recall and other costs. - Example: Nike

In 2019, U.S. star college basketball player Zion Williamson sprained his knee when his Nike shoe broke, little more than 30 seconds into a highly anticipated game. The crisis quickly gained the name “shoegate” in the media. The company’s stock dropped $1.1 billion the next day, social media buzzed with jokes and jabs, and commentators described the incident as a brand failure. While the incident did not inflict long-lasting damage on the company, Nike was panned for waiting for three hours to issue a response. They stumbled by minimizing it as an “isolated incident,” while media reports pointed out four other recent similar shoe malfunctions.

Improve Your Crisis Management Tactics with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.