What Is Crisis Management?

Crisis management is the process of preparing for, managing, and limiting damage from unexpected negative events at an organization. This practice includes anticipating threats, developing strategies to minimize harm, and implementing these strategies when a crisis occurs.

Crises share certain attributes regardless of the size or type of organization: A crisis poses a threat to the company, includes some element of surprise, requires action to change the course of events, and demands fast decision-making.

Emergencies can occur suddenly when an event happens that’s beyond the organization’s control, such as an earthquake. Or a crisis can develop over time as a small problem worsens because the organization does not see or fails to act on warning signs. This category of smoldering or creeping crisis includes problems like safety issues.

What Is Business Crisis Management?

Business crisis management is the series of actions that companies take to identify threats, plan potential responses, and minimize disruption or losses to the business and its stakeholders in the event of an actual crisis.

A crisis can stem from internal or external causes and harm a business in multiple ways. The fallout of a crisis often affects more than one dimension. Sometimes, the damage is so great that the company cannot survive. Losses can include the following:

- Customer flight

- Damage to or destruction of assets such as buildings

- Disruption to operations

- Exit of key employees

- Higher expenses

- Legal claims for damages

- Loss of intellectual property and proprietary information

- Loss of key products

- Negative environmental impact

- Physical injury to workers or other stakeholders

- Reduced access to credit or worsening loan terms

- Reduction in sales and profits

- Regulatory scrutiny and enforcement

- Reputation harm

- Weakened competitive position and erosion of market share

- Weakened morale among employees

Crisis Management vs. Risk Management

In business, crisis management overlaps with risk management in that organizations use both to consider what could go wrong and how to address it. But risk management focuses on how to prevent crises while crisis management emphasizes how to react.

Crisis managers put the bulk of their effort into developing action plans for responding to emergencies and executing these plans. Risk managers concentrate on ongoing ways of preventing threats from arising. Risk management also has a broader remit, dealing with any kind of challenge that could impair a company’s ability to meet its strategic objectives.

To learn more about risk management, read “Enterprise Risk Management 101: Programs, Frameworks, and Advice from Experts.”

Four Ps of Crisis Management

The four Ps is a mnemonic that captures the essential elements of crisis management — prevent, plan, practice, and perform. These terms remind companies to minimize threats, develop crisis plans, rehearse these plans, and execute them effectively when needed.

Several variations on this list of Ps incorporate words like prepare, people, and post-event review. A six-word version summarizes crisis management: Proper prior planning prevents poor performance.

Jack Stack, CEO of Illinois equipment company SRC Holdings Corp., writes in his blog that business developed another four Ps to survive the 2009 economic crisis and put these Ps to work again in the 2020 global pandemic.

Those Ps include people (keep every employee informed and lines of communication open), positive cash flow (a critical focus to manage debt), practices (managing with transparency and operating strategically), and positioning (find opportunities to position yourself for growth).

Crisis Management Is No Longer Optional

Many companies historically neglected crisis management, but experts say this became increasingly risky as the landscape changed. Crises today can escalate more quickly, and the survival of the business can be in the balance.

Among the forces at work are the following:

- Globalization: Businesses are more dependent on suppliers and customers far from their home bases and are more likely to have operations and employees at multiple locations and across borders. This type of expansion exposes companies to more complex risks and threats, and a crisis can have a magnified, domino effect.

- Technology: Information spreads almost instantaneously in a wired world, especially as social media becomes a primary source for many people. Negative news and rumors disseminate quickly, giving companies very little time to perform damage control before customers flee, reputations suffer, and sales plummet.

- Rise of Novel Crises: The accelerated rate of change and growing complexity of global systems have given rise to never-before-seen or once-in-a-generation crises. (Think of terrorist attacks, a global pandemic, and wildfires linked to climate change.) These events demand that crisis managers respond agilely with innovative solutions. To prepare for a novel crisis, companies need to develop plans and build relationships, both of which take time.

- Preconceptions Exposed as False: World events are showing corporate leaders that beliefs they used to justify skimping on crisis preparedness are false. These ideas include:

- A crisis won’t happen.

- A well-managed business doesn’t need a crisis plan.

- Insurance will protect the company against a crisis.

- The company doesn’t have the resources to do crisis planning.

- Business challenges deserve all of the company’s attention.

In the last several years, virtually every company found itself affected by a crisis that insurance didn’t cover. Businesses that had not dedicated resources and energy to prepare sometimes found their survival in jeopardy.

Regina Phelps, Founder of crisis management consulting firm Emergency Management & Safety Solutions, recalls that before the 2020 global pandemic, “Executives were comfortable taking on more and more risk without mitigating crisis measures, processes, teams or plans…. Or programs would be established but funding would decrease over time because nothing happened.” In the aftermath of this major disruption, she says support from senior executives for building crisis management capacity is vital and urges leaders to stay the course.

Types of Crisis

Crisis managers must anticipate events, and understanding the major types of crises is a good precursor to developing a threat list. For organizations, categories of crises may relate to the area of operation or the nature of the crisis.

Boston University scholar Otto Lerbinger in his 1997 book, The Crisis Manager: Facing Risk and Responsibility, divided crises into eight categories: natural disasters, technological, confrontation, malevolence, organizational misdeeds, workplace violence, rumors, and terrorist attacks/man-made disasters. Summaries of these and other types of business crises follow.

- Natural Disaster: These crises often stem from weather and environmental conditions, including storms, droughts, floods, and wildfires. Hurricane Katrina in 2005 is a memorable natural disaster

- Technological Crisis: These crises stem from technology issues such as hardware outages, software malfunctions, network problems, data loss and breaches, and computer sabotage. The movement to cloud-based storage and software as a service (SaaS) makes companies vulnerable to technology malfunctions that occur at their vendors. Big outages (such as a satellite or undersea data cable failure) can disrupt many businesses simultaneously. The Experian data breach in 2017, in which hackers stole personal information of about 148 million consumers, is an example of a technology crisis.

- Confrontation: This type of crisis results from conflict between activists with a cause-related agenda and companies or governments. These incidents include boycotts, protests, sit-ins, and other types of civil disobedience. An example is environmental protesters who occupy trees to prevent commercial logging.

- Malevolence: This type of crisis originates with hostile or criminal actions against a company and sometimes has the goal of destroying it. These actions include cybercrime, product tampering, industrial espionage, and executive kidnapping. For example, in attacks known as Night Dragon, hackers broke into the computer networks of five major oil and gas companies to steal proprietary information.

- Organizational Misdeeds: Management causes these crises when it knowingly takes actions that harm stakeholders or important third parties. These actions include deception, misconduct, and moves driven by unethical or short-sighted values. An example of this type of crisis occurs when an executive accepts a bribe to steer a contract to an unqualified bidder.

- Workplace Violence: These crises are attacks by an employee or former employee on other staff members at a company location due to anger related to the attacker’s employment. (Other kinds of violence at company sites against staff members, such as patients attacking healthcare workers, do not fall in this category because the perpetrator is not an employee or former employee.)

- Financial Crisis: A financial crisis can be specific to a company, in which a business has an issue like negative cash flow that impairs its ability to operate. It can also be national, regional, or global, such as an economic recession that depresses sales and causes stock markets to fall. Companies respond to financial crises with short-term measures such as emergency credit lines and longer-term steps like business restructuring, layoffs, and other cost-cutting. The 2008 bankruptcy of Lehman Brothers due to losses incurred in the subprime mortgage market represents a financial crisis.

- Personnel Crisis: These crises are typically triggered by the loss of key staff members, such as a star sales representative or a genius drug scientist. These key people can be poached by rivals, courted by headhunters, and tempted by creative opportunities or promotions. Of course, death and retirement are factors too. Broader personnel crises occur when staff morale suffers, companies go through periods of financial stress, and layoffs leave departments short-staffed. An example of a potential personnel crisis occurred when Apple’s Head of Design Jony Ive left the company in 2019.

- Crisis Based on Organization’s Degree of Fault: Scholar Timothy Coombs developed situational crisis communications and attribution theories in crisis management, which you can learn more about in “Models and Theories to Improve Crisis Management.” Coombs found that the degree of damage to a company’s reputation and business corresponds to the public’s perception of the company’s culpability in the crisis.

- Victim Crisis: This category includes crises that view the company as being a victim of events outside its control. One well-known example is when seven people in the Chicago area died after consuming Tylenol that an unknown criminal tainted with poison. Other examples are natural disasters, workplace violence, and unfounded rumors.

- Accidental Crisis: In an accidental crisis, the company is responsible but did not knowingly or intentionally cause the problem. Outbreaks of E. coli after people consumed meat contaminated with the bacteria at fast food restaurants are good examples of an accidental crisis. Many product issues fit into this type.

- Intentional Crisis: These crises generate the most ill will toward organizations because they result from intentional actions. Events involving malfeasance and negligence usually fall in this category, such as the Volkswagen emissions scandal. Sometimes these crises are labeled preventable because they stem from errors and mistakes.

For more examples and how companies dealt with them, read “The Most Useful Crisis Management Examples: The Good, Bad, and Ugly.”

How Crisis Management Works

Crises never unfold exactly as anticipated, but the planning process develops crisis management skills and a preparedness mindset. That way, you can deal with whatever happens more effectively.

“How to Craft a Strong Crisis Management Strategy” explains the strategic responsibilities of senior leaders in crisis management.

A crisis management team needs to understand all the calamities that could befall their organization, and that requires consulting operational staff, not just top managers. Once the team drafts a crisis management plan, make sure to allocate adequate resources to train responders, acquire staff or material that may be needed, and update the plan regularly.

A major goal of preparation is to keep operations running or resume them as quickly as possible in the event of a crisis. A business continuity plan focuses on this aspect of crisis management. See “Business Continuity Planning: How to Do It Well” to learn more. “Free Disaster Recovery Plan Templates” offers templates for disaster recovery plans at different kinds of organizations and for business needs such as payroll and data.

Importance of Crisis Management

Crisis management is crucial because the practice helps companies prevent or avert catastrophes, minimize damage from those that are unavoidable, and get operations back to normal as quickly as possible.

Events such as the 2020 global pandemic, California’s wildfires, and other disasters have driven home the importance of vigilance and preparation. Being proactive is a basic survival skill.

“Even now only about half of all organizations have any kind of crisis management plan. This dearth of preparedness is simply no longer acceptable in a world where global crises are a painful reality,” notes Deborah Hileman, President and CEO of the Institute for Crisis Management.

Good crisis management is a competitive advantage. The Incident Command System, which originated as a structure to streamline coordination of different agencies fighting California wildfires, is becoming more widely adopted because it enables faster, more efficient responses.

The private sector has enhanced the efficiency of Incident Command System with technology by embedding features such as real-time incident status reports, dynamic organization charts, audit trails of responses, and form generation.

Stages of Crisis Management

A crisis management effort begins with designating a team and a leader. They will work through the phases of identifying risks, developing and documenting response plans, practicing those plans, implementing them when needed, and reviewing the results.

Within these stages fall key tasks such as detecting warning signs, damage control, learning from experience, and updating crisis plans as a result.

Creating a crisis management plan is the most challenging part of your preparation. See “Free Crisis Management Templates” to download templates for management plans, helpful checklists, and tabletop exercises.

For instructions on building a crisis management team, see “How to Build an Effective Crisis Management Team,” and delve more deeply into drafting a plan in “Step-by-Step Guide to Writing a Crisis Management Plan.”

Communication is a vital part of crisis management. Learn how to develop a crisis communications strategy and find the resources you need by reading “Ultimate Tool Kit: Free Communication Strategy Templates, Examples, and Expert Tips.” Use one of our free crisis communications templates to draft communications plans for schools, businesses, social media, and more.

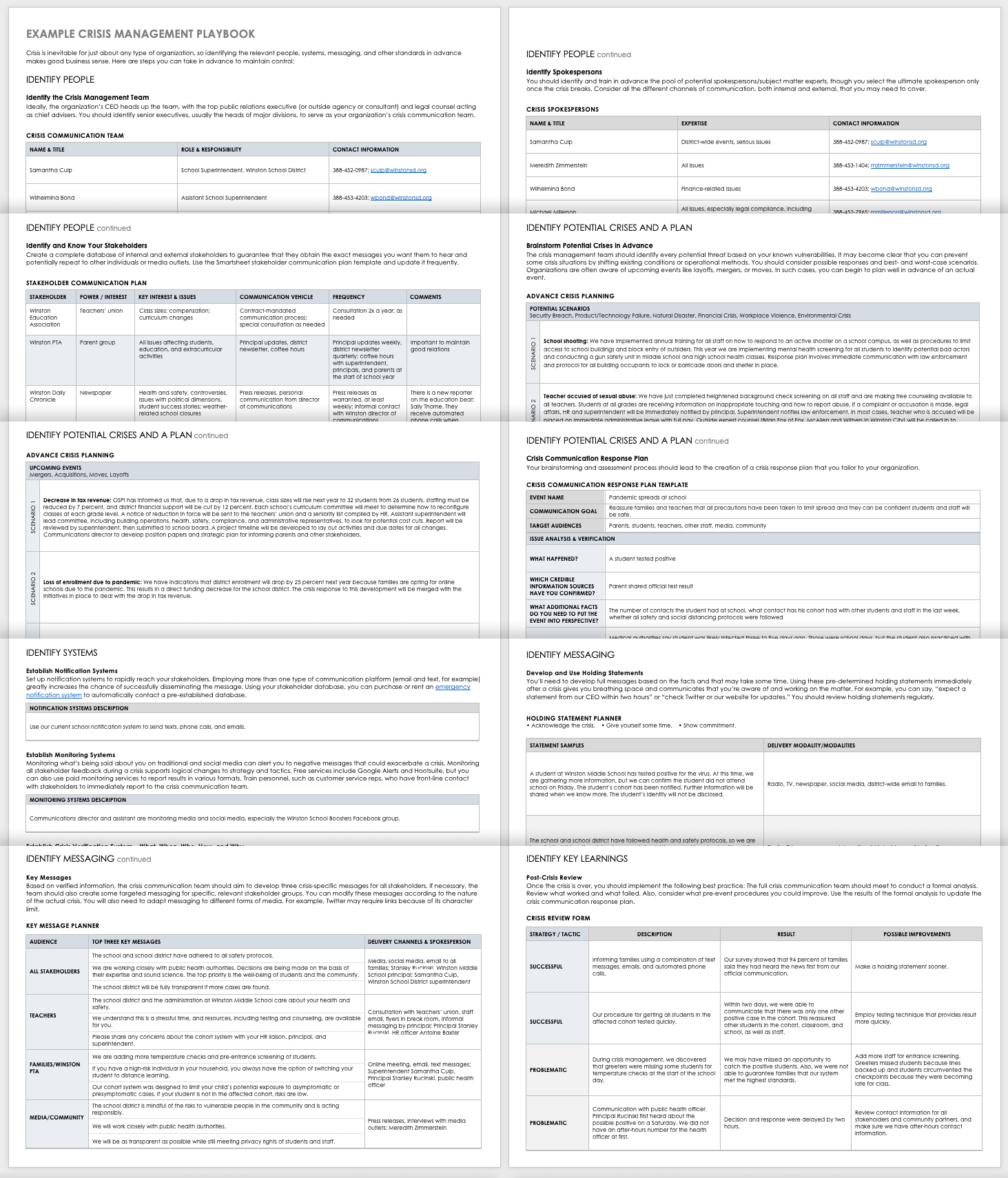

Example of Crisis Management Playbook

In business, a crisis management playbook is a document that enables you to gather details of your response actions, processes, and roles. In some ways, this guide is similar to your crisis management plan, but the playbook is usually more succinct and oriented to the immediate response.

Seeing an example of such a playbook can be helpful. The example of a crisis management playbook below summarizes how a fictional school district intends to respond to its most likely crises. The example goes into more detail on the response to a positive case of an infectious disease among students including how to verify there is a crisis, key messaging points, and post-crisis analysis.

Download Example Crisis Management Playbook

Management by Crisis Process

Although they sound similar, management by crisis is the antithesis of good crisis management. Management by crisis means that your business is in a constant state of crisis response, leaping from one emergency to the next.

When managers are putting out fires all the time, they have no opportunity to plan or take initiative; they are stuck in a stressed-out, reactive mode. Management by crisis can be a hard habit to break because practitioners feel their efforts save the company from disaster. Despite this illusion of productivity, they and the company are not able to operate strategically and perpetuate the conditions that give rise to problems.

Leaders who manage by crisis may also manufacture an atmosphere of crisis with the well-intended goal of getting their teams to exert superhuman efforts. However, the result is ultimately employee burnout, low morale, and turnover. Common moves that contribute to a crisis atmosphere include setting artificial deadlines or shuffling staff.

Golden Rules for Crisis Management

Some pieces of crisis management wisdom are almost universally endorsed by experts and have become unofficial rules. Learning them puts you well on your way to mastering crisis management best practices.

Louis Carter, CEO of the Best Practice Institute, advises, “Accept responsibility. Admit if your company made mistakes… (Then) once the storm has passed, gather the team to discuss lessons learned.”

11 Essential Rules for Crisis Management

- Prepare and make crisis readiness an ongoing process.

- Stay calm and convey confidence to others.

- Gather clear and accurate facts about the crisis as soon as possible.

- Prioritize people over property.

- Don’t make things worse.

- Communicate clearly and quickly, but avoid a knee-jerk reaction.

- Appoint one credible spokesperson and have consistent messaging.

- Never, ever lie.

- Make sure the crisis team has the support and resources it needs.

- Don’t lose touch with your humanity. Recognize people are under stress and may be grieving.

- Learn from the crisis and fix any underlying problems it revealed.

Michael Fagel, founder of emergency response consulting firm Aurora Safety, emphasizes the importance of committing to crisis readiness for the long term. “Emergency planning is not a light switch, and it’s not a magic wand. It’s a process,” he notes.

Improve Crisis Management with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.