What Is Project Cash Flow?

Project cash flow refers to how cash flows in and out of an organization in regard to a specific existing or potential project. Project cash flow includes revenue and costs for such a project.

Below are some basic principles of project cash flow:

- It is a crucial part of financial planning concerning a company’s current or potential projects that don’t require a vendor or supplier.

- Experts sometimes call project cash flow relevant cash flow, which refers to when a company is still deciding whether a project is worth its time. In order to calculate the relevant cash flow of a project, a company analyzes the cash inflows and outflows that would occur if it decided to take on the project. When performing a project cash flow analysis, be sure to exclude all ongoing and non-relevant costs, like office rent or regular salaries.

- Your project cash flow forecast should include at least monthly increments in order to show project-related costs and revenue, as well as when you will realize those costs and revenue.

- As mentioned above, a project cash flow analysis is less important if you’re not using outside vendors or suppliers — without external contracts, a project incurs no outside costs. Still, even a project without contractors can benefit from a project cash flow analysis, as the process can help your company quantify the resources it is using for the project.

- Company leaders should approve a project cash flow and cost benefit analysis before a company decides to take on a project.

- Periodically, the project manager should compare a project’s cash flow projections with its actual results. Then, you should adjust the plan accordingly.

Project management that adapts to your needs

Work with flexibility and security—from small projects to large-scale processes and entire portfolios.

Smartsheet helps you break down projects into tasks, track progress, and manage resources, budgets, and workflows—all in one unified platform for seamless collaboration and delivery.

How to Calculate Project Cash Flow

You can calculate your project cash flow using a simple formula: the cash a project generates minus the expenses a project incurs. Exclude any fixed operating costs or other revenue or costs that are not specifically related to a project.

To learn more about creating overall cash flow statements for a business, visit “The Basics of Operating Cash Flow: Tips, Formulas, and Examples.”

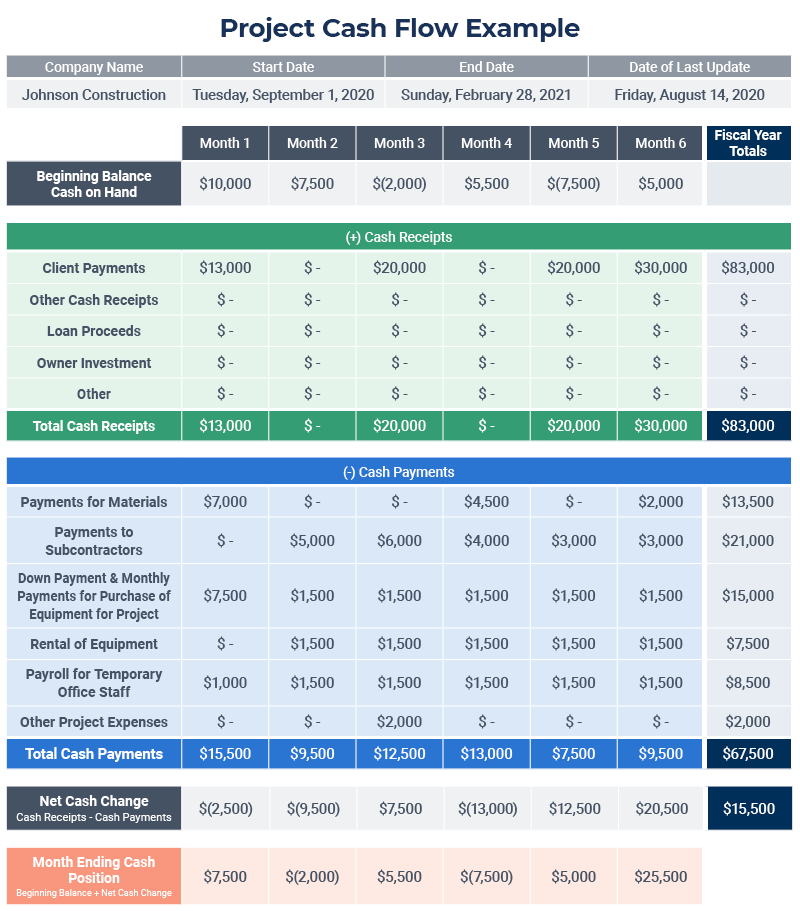

Project Cash Flow Analysis Example

In order to craft your own project cash flow statement, it can be helpful to see an example. Here is an example of a project cash flow statement for a hypothetical project.

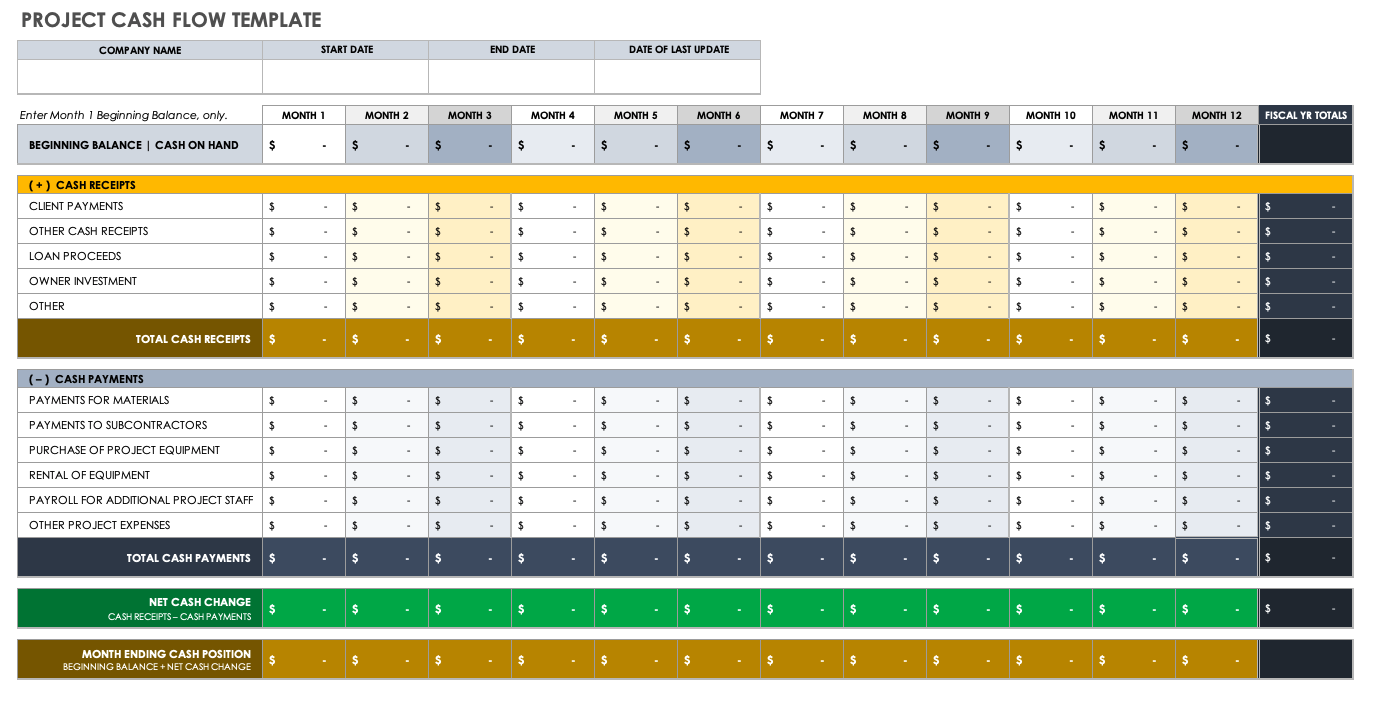

You can use the following template to create a project cash flow statement. The template includes space to list revenue and expenses, and allows you to track cash flow for a project over 12 months. The template is free to download and can be customized to fit your needs.

Download Project Cash Flow Template

Project Cash Flow Forecast

A project cash flow forecast includes cost estimates for a project, as well as a schedule of when you will incur those costs. This forecast also displays the project’s revenue and a schedule of when you will receive that revenue.

Here are some helpful recommendations for tracking project expenses:

- Create a Forecast Calendar: Organize your forecast according to the various phases of a project, and then fill in the particulars about your work breakdown structure (WBS) for each phase. In addition, be sure to include project codes for each cost.

- Include Payment Due Dates: Be sure to input the due dates for payments to suppliers or vendors.

- Use Supplier/Vendor Terms as a Guide: A supplier’s contract terms will clearly state a payment due date. Use this information for your calendar.

- Show the True Cost of a Project: You should also include a project’s payroll and other estimated costs in order to obtain a more accurate picture of that project’s total cost.

For the revenue side of your project, you should follow similar practices. For example, be sure to input the dates indicating when a client payment is due to your company. To learn more about cash flow forecasting for an entire business (rather than just for a single project), visit “Cash Flow Forecasting 101.”

Project Cash Flow Analysis

A project cash flow analysis allows you to look closely at the cash inflows and outflows associated with an existing or potential project. The analysis also addresses opportunity costs (i.e., the amount of money your company loses by embarking on a project).

Here are some details to consider when performing a project cash flow analysis:

- Sunk Costs: These are costs that your company incurs whether you take on a project or not. Sunk costs generally refer to the fixed costs you incur by running your business, such as rent, overall payroll, research and development, and other expenses.

- Initial Investments: These investments refer to the cash outlays for the equipment and other assets that you need to execute a project.

- Relevant Cash Flows: These are the revenue and costs that occur due to a project. They include the following:

- Incremental Cash Flows: These refer to all the cash inflows and outflows that result from a project, including payments to suppliers and equipment leases.

- Terminal Cash Flow: This term refers to proceeds from the equipment that you buy and use specifically for a project.

- Opportunity Costs: This refers to the amount of money your company loses by embarking on a project. For example, participating in a year-long project might require an investment of $50,000 for new equipment. If investing that money otherwise would net you $10,000, then your opportunity costs include that $10,000.

Benefits of Project Cash Flow Analysis and When It's Especially Important

A project cash flow analysis can help a company gain an understanding of the potential cash flow issues associated with taking on a project. Among other things, the analysis can alert you to the possibility of overextending yourself (i.e., taking on too many expenses before a project’s revenue comes in).

The primary benefits of a project cash flow analysis include the following:

- It helps your company avoid overextending itself, particularly regarding large projects (like construction projects), wherein your cash outlay often precedes your expected revenue by a significant period.

“If you know you have to bid a million-dollar job, and it’s going to require 400,000 to half a million dollars of materials, you need to ask yourself, ‘Do I have enough in the pipeline to fund those materials?’” says T.J. Liles-Tims, Partner and Co-Founder of BVFF Partners, a business valuation and financial forensics firm in Oklahoma City. “Or, do I need to go to my bank and get a line of credit to fund my materials purchase?”

Tracey Bissett, President of Toronto-based Bissett Financial Fitness, works with entrepreneurs to help them understand and use various financial statements. She says that recognizing these cash flow issues is especially important for new companies.

"Cash flow issues are a serious consideration, especially when someone is initially starting a business,” she says. “A project with numerous cash flow issues can take a company down."- An analysis can help you avoid using other company revenues to pay for a project’s expenses.

"People will overextend themselves and price things too low. Then, they’ll use a new customer's money to pay for the expenses on another project," says Courtney Barbee, COO and Owner of The Bookkeeper, a North Carolina-based accounting and consulting firm. She continues, “Doing that can create major cash flow problems as well as legal trouble.”- A project cash flow analysis can also help you with project contracts that include large upfront payments. “We see that [kind of upfront commitment] in large marketing contracts, wherein a company may be on the hook for ad buys for its client or for outsourced work to a subcontractor," says Barbee.

- An analysis can also assist you regarding projects that pay less frequently. "We see this [problem] in a lot of government bids. A company wants to put in the lowest bid, so it gets the work. But, the government does not pay until 45 days after it receives an invoice. So, a business is on the line for a lot of cash” Barbee says.

- An analysis can increase confidence and reduce stress. Bissett says that you can do even a simple pencil-and-paper analysis to put yourself at ease: "We're not trying to replace accounting with a project cash flow forecast. We're not creating highly accurate financial records. We're trying to look into the future. It's our best guess… and it allows people to sleep better.

“It brings the stress level down to where a client can say, ‘Now, I can quantify my potential problem and deal with it before it hits.’ That's pretty priceless.”

Bissett adds that when clients begin to understand the benefits of doing a cash flow analysis and a quick project cash flow analysis, “They begin to change the way they think about their business. Their lens becomes completely different.”

Issues that a Project Cash Flow Analysis Can Highlight

A project cash flow analysis can highlight potential issues and give you time to deal with them. Issues might include having too many bills due simultaneously or needing clients to pay sooner.

Here are the major ways that a project cash flow analysis can help you adjust to potential issues:

- Change Your Inventory Buying Schedule: The analysis can help you spread out your inventory purchases over a longer period of time, so you can avoid paying large amounts all at once.

- Stagger Other Purchases or Bill-Paying Requirements: A cash flow analysis allows you to stagger other bills, so they are spread out over several months.

- Stagger Other Large Payments: It also allows you to stagger other large payments that are due (e.g., quarterly taxes or annual insurance).

- Show You the Need for Upfront Payments from Clients: A cash flow analysis can indicate when your project needs a larger down payment from a client. It can also show cases in which subsequent payments should be due sooner. Barbee says that requiring down payments or other types of upfront financial commitments is “a good way of setting your expectations for a client.” How a client responds to such requirements can also reveal how serious and committed they are. “If they don't want to put something down, that could be a red flag,” she says.

- Change Your Buying Terms: It can give you the opportunity to change the buying terms for some materials, thereby spreading out payments over a longer term.

- Alert You to the Need for a Loan: The analysis can show you when cash is low and give you time to secure a loan on favorable terms.

Tips and Best Practices for Project-Based Cash Flow Analysis

Experts recommend a number of best practices for performing effective project cash flow analyses, including making sure that you identify project-specific expenses and revenue.

Here are some best practices for creating a project-based cash flow analysis:

- Identify and Separate the Variable Expenses Related to a Project: Many organizations aren't careful enough about separating the expenses associated with a specific project. "Organizations have a heavy predilection toward commingling the cost of goods with overhead expenses,” says Barbee. When you commingle the two, you “can’t distinguish between variable costs and fixed costs. You have to untangle those first.”

- Ensure You Understand the Five Stages of Project Cost: For the purposes of a project cash flow analysis, a cost is only a real cost when you’ve paid for it. There are four earlier stages for that type of expense: when you’ve budgeted for the expense; when you’ve committed to making the purchase; when you’ve actually made the purchase and had materials delivered to you; and when you’ve been invoiced for the purchase.

- Practice Incremental or Milestone Billing: This means invoicing clients for a portion of work as you reach various project milestones. By doing this, you receive smaller, more frequent payments throughout the project, thereby increasing your cash flow.

Practicing this type of billing also means identifying and tracking the hours your staff devotes to a project. Even when your company doesn’t owe an outside supplier for project-related work, you should still understand the hours your employees are spending on a project. Barbee says that you should track those employee hours “even if you’re only charging a flat rate for a project. That way, you can get the analytics.” - Assign Loans and Grants to a Project: You might get loans or government grants to do work on a project. Make sure you assign that revenue, and any interest on the loans, to that particular project’s revenues and costs.

- Make an Accurate Estimate Regarding Expected Staff Hours: Bissett says company owners or project managers with deep expertise in an industry can often perform certain tasks much more quickly than other company staff can. Consequently, owners or project managers might underestimate how long it will take their staff to complete such tasks for a client.

“If the owners are excellent at what they do and it takes them an hour to do something, they'll forecast an hour of their team's time,” Bissett says. “But, generally the team is not as strong, so leaders underestimate how long it actually takes to do the job.”

Project Cash Flow Analysis in Project Management

Project cash flow analysis is a crucial component of project management. The process allows you to understand (and, to some degree, orchestrate) when you will have the cash you need to complete the various phases of a project.

Master Project Cash Flow Analysis with Smartsheet for Project Management

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Any articles, templates, or information provided by Smartsheet on the website are for reference only. While we strive to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, articles, templates, or related graphics contained on the website. Any reliance you place on such information is therefore strictly at your own risk.

These templates are provided as samples only. These templates are in no way meant as legal or compliance advice. Users of these templates must determine what information is necessary and needed to accomplish their objectives.