What Is a Small Business Financial Plan?

A small business financial plan is an outline of the financial status of your business, including income statements, balance sheets, and cash flow information. A financial plan can help guide a small business toward sustainable growth.

Financial plans can aid in business goal setting and metrics tracking, as well as provide proof of profitable ideas. Craig Hewitt, Founder of Castos, shares that “creating a financial plan will show you if your business ideas are sustainable. A financial plan will show you where your business stands and help you make better decisions about resource allocation. It will also help you plan growth, survive cash flow shortages, and pitch to investors.”

Why Is It Important for a Small Business to Have a Financial Plan?

All small businesses should create a financial plan. This allows you to assess your business’s financial needs, recognize areas of opportunity, and project your growth over time. A strong financial plan is also a bonus for potential investors.

Mark Daoust, the President and CEO of Quiet Light Brokerage, Inc., explains why a financial plan is important for small businesses: “It can sometimes be difficult for business owners to evaluate their own progress, especially when starting a new company. A financial plan can be helpful in showing increased revenues, cash flow growth, and overall profit in quantifiable data. It's very encouraging for small business owners who are often working long hours and dealing with so many stressful decisions to know that they are on the right track.”

To learn more about other important considerations for a small business, peruse our list of free startup plan, budget, and cost templates.

Video: Financial Planning Templates for a Small Business

What Does a Small Business Financial Plan Include?

All small businesses should include an income statement, a balance sheet, and a cash flow statement in their financial plan. You may also include other documents, such as personnel plans, break-even points, and sales forecasts, depending on the business and industry.

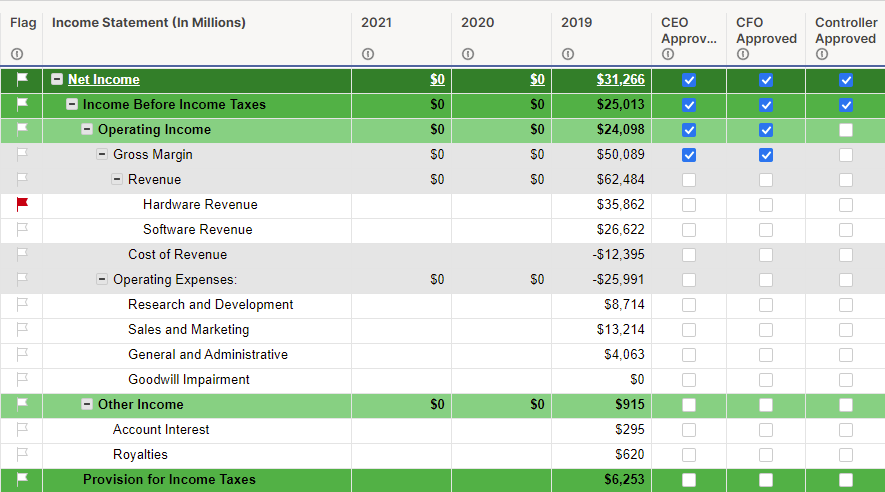

- Income Statement: An income statement includes information on profit and loss, as well as operating expenses for a given time period.

- Ahmet Yüzbaşıoğlu, Co-founder of Peak Plans, describes an income statement as “a summary of your revenue, costs, and expenses that shows your net profit in your business plan. It’s a table that lists all of your revenues and all of your expenditures, and at the very bottom, the total amount of your net profit or loss.”

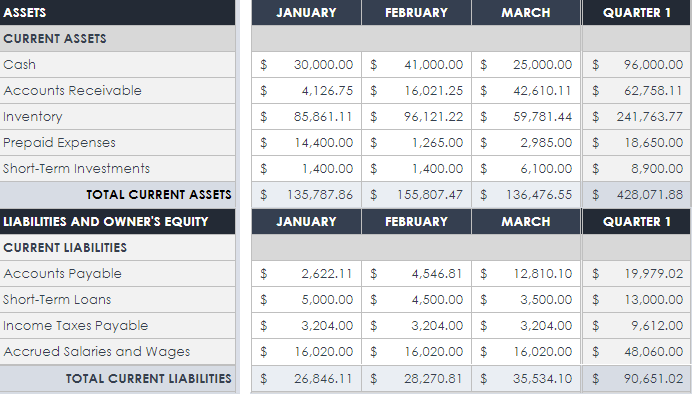

- Balance Sheet: A balance sheet determines the difference between your liabilities and assets to determine your equity. “A balance sheet is a snapshot of a business’s financial position at a particular moment in time,” says Yüzbaşıoğlu. “It adds up everything your business owns and subtracts all debts — the difference reflects the net worth of the business, also referred to as equity.”

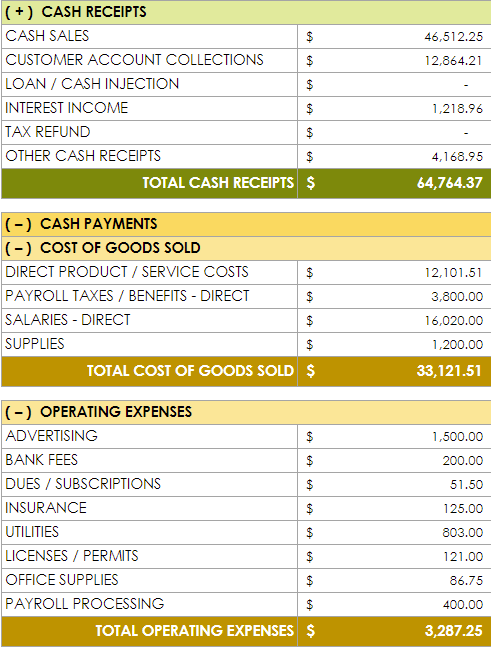

Yüzbaşıoğlu explains that this statement consists of three parts: assets, liabilities, and equity. “Assets include your money in the bank, accounts receivable, inventories, and more. Liabilities can include your accounts payables, credit card balances, and loan repayments, for example. Equity for most small businesses is just the owner’s equity, but it could also include investors’ shares, retained earnings, or stock proceeds,” he says. - Cash Flow Statement: A cash flow statement shows where the money is coming from and where it is going. For existing businesses, this will include bank statements that list deposits and expenditures. A new business may not have much cash flow information, but it can include all startup costs and funding sources. “A cash flow statement shows how much cash is generated and used during a given period of time. It documents all the money flowing in and out of your business,” explains Yüzbaşıoğlu.

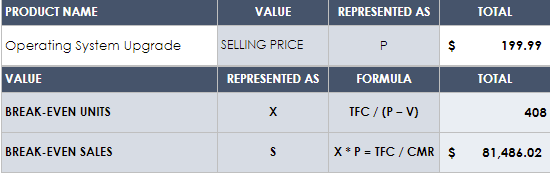

- Break-Even Analysis: A break-even analysis is a projection of how long it will take you to recoup your investments, such as expenses from startup costs or ongoing projects. In order to perform this analysis, Yüzbaşıoğlu explains, “You need to know the difference between fixed costs and variable costs. Fixed costs are the expenses that stay the same, regardless of how much you sell or don't sell. For example, expenses such as rent, wages, and accounting fees are typically fixed. Variable costs are the expenses that change in accordance with production or sales volume.

“In other words, [a break-even analysis] determines the units of products or services you need to sell at least to cover your production costs. Generally, to calculate the break-even point in business, divide fixed costs by the gross profit margin. This produces a dollar figure that a company needs to break even,” Yüzbaşıoğlu shares. - Personnel Plan: A personnel plan is an outline of various positions or departments that states what they do, why they are necessary, and how much they cost. This document is generally more useful for large businesses, or those that find themselves spending a large percentage of their budget on labor.

- Sales Forecast: A sales forecast can help determine how many sales and how much money you expect to make in a given time period. To learn more about various methods of predicting these figures, check out our guide to sales forecasting.

How to Write a Small Business Financial Plan

Writing a financial plan begins with collecting financial information from your small business. Create income statements, balance sheets, and cash flow statements, and any other documents you need using that information. Then share those documents with relevant stakeholders.

“Creating a financial plan is key to any business and essential for success: It provides protection and an opportunity to grow,” says Yüzbaşıoğlu. “You can use [the financial plan] to make better-informed decisions about things like resource allocation on future projects and to help shape the success of your company.”

1. Create a Plan

Create a strategic business plan that includes your business strategy and goals, and define their financial impact. Your financial plan will inform decisions for every aspect of your business, so it is important to know what is important and what is at stake.

2. Gather Financial Information

Collect all of the available financial information about your business. Organize bank statements, loan information, sales numbers, inventory costs, payroll information, and any other income and expenses your business has incurred. If you have not already started to do so, regularly record all of this information and store it in an easily accessible place.

3. Create an Income Statement

Your income statement should display revenue, expenses, and profit for a given time period. Your revenue minus your expenses equals your profit or loss. Many businesses create a new statement yearly or quarterly, but small businesses with less cash flow may benefit from creating statements for shorter time frames.

4. Create a Balance Sheet

Your balance sheet is a snapshot of your business’s financial status at a particular moment in time. You should update it on the same schedule as your income statement. To determine your equity, calculate all of your assets minus your liabilities.

5. Create a Cash Flow Statement

As mentioned above, the cash flow statement shows all past and projected cash flow for your business. “Your cash flow statement needs to cover three sections: operating activities, investing activities, and financing activities,” suggests Hewitt. “Operating activities are the movement of cash from the sale or purchase of goods or services. Investing activities are the sale or purchase of long-term assets. Financing activities are transactions with creditors and investments.”

6. Create Other Documents as Needed

Depending on the age, size, and industry of your business, you may find it useful to include these other documents in your financial plan as well.

- Break-Even Analysis: A break-even analysis can take the cost of investments and help project when those investments will start to pay off. Depending on the type of investment, this may require the inclusion of sales figures, interest rates, training costs, or other considerations.

- Personnel Plan: A personnel plan can help to outline and justify the costs of various employees or departments. You should include the salary costs for each and a line describing their job’s value to the company. You may also consider the cost of training new members of the staff in this section.

- Sales Forecast: Your sales forecast should reference sales numbers from your past to estimate sales numbers for your future. Sales forecasts may be more useful for established companies with historical numbers to compare to, but small businesses can use forecasts to set goals and break records month over month. “To make future financial projections, start with a sales forecast,” says Yüzbaşıoğlu. “Project your sales over the course of 12 months. After projecting sales, calculate your cost of sales (also called cost of goods or direct costs). This will let you calculate gross margin. Gross margin is sales less the cost of sales, and it's a useful number for comparing with different standard industry ratios.”

7. Save the Plan for Reference and Share as Needed

The most important part of a financial plan is sharing it with stakeholders. You can also use much of the same information in your financial plan to create a budget for your small business.

Additionally, be sure to conduct regular reviews, as things will inevitably change. “My best tip for small businesses when creating a financial plan is to schedule reviews. Once you have your plan in place, it is essential that you review it often and compare how well the strategy fits with the actual monthly expenses. This will help you adjust your plan accordingly and prepare for the year ahead,” suggests Janet Patterson, Loan and Finance Expert at Highway Title Loans.

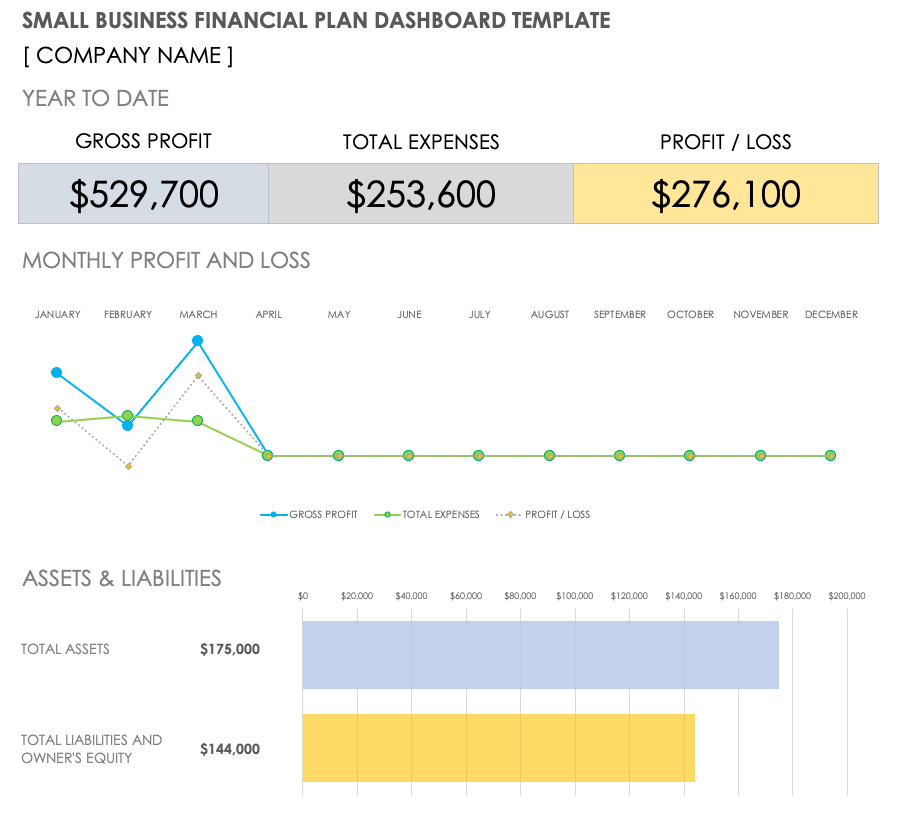

Small Business Financial Plan Example

Download Small Business Financial Plan Example

Excel

| Google Sheets

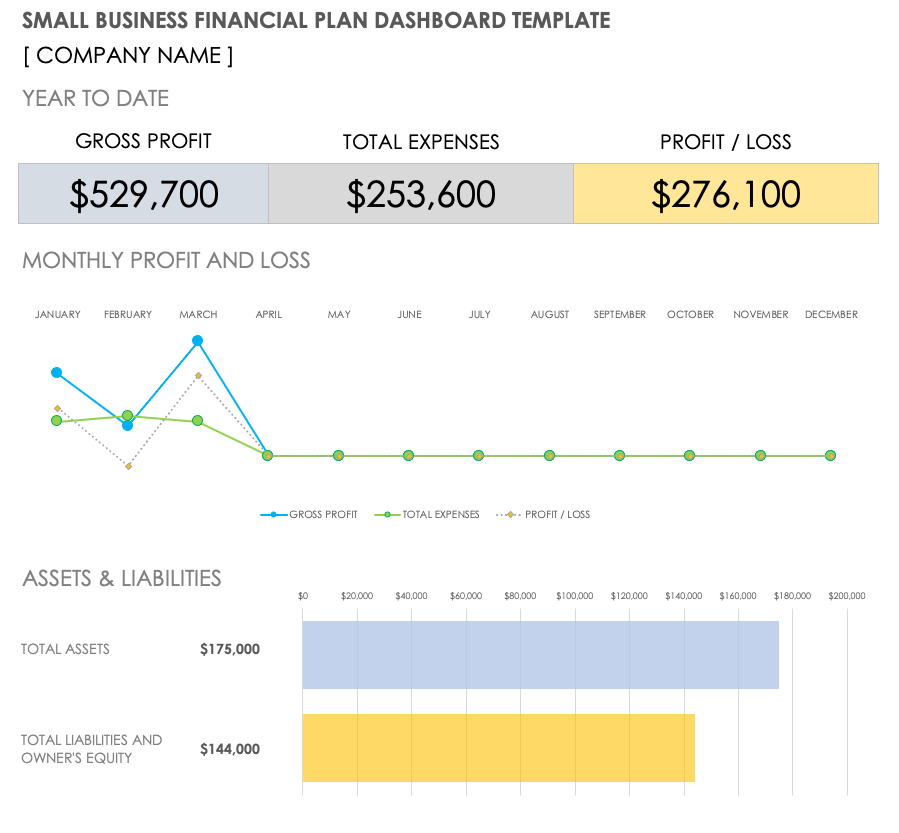

Here is an example of what a completed small business financial plan dashboard might look like. Once you have completed your income statement, balance sheet, and cash flow statements, use a template to create visual graphs to display the information to make it easier to read and share. In this example, this small business plots its income and cash flow statements quarterly, but you may find it valuable to update yours more often.

Small Business Financial Plan Starter Kit

Download Small Business Financial Plan Starter Kit

We’ve created this small business financial plan starter kit to help you get organized and complete your financial plan. In this kit, you will find a fully customizable income statement template, a balance sheet template, a cash flow statement template, and a dashboard template to display results. We have also included templates for break-even analysis, a personnel plan, and sales forecasts to meet your ongoing financial planning needs.

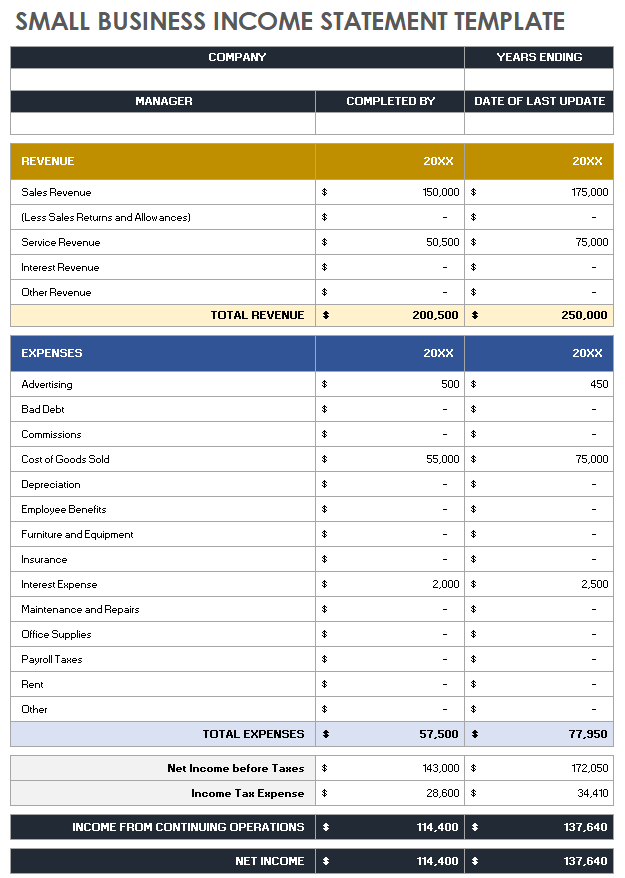

Small Business Income Statement Template

Download Small Business Income Statement Template

Microsoft Excel

| Google Sheets

Use this small business income statement template to input your income information and track your growth over time. This template is filled to track by the year, but you can also track by months or quarters. The template is fully customizable to suit your business needs.

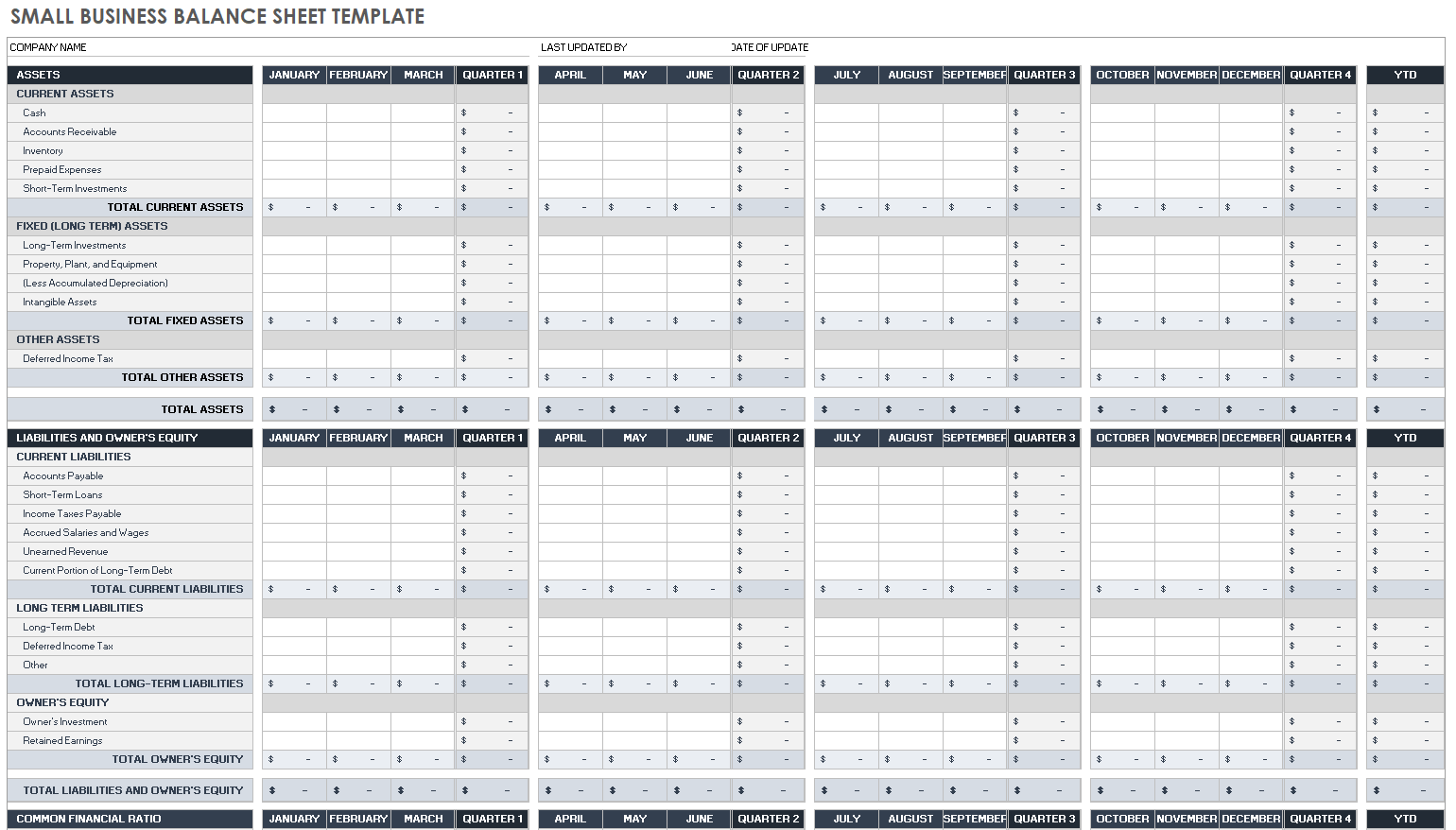

Small Business Balance Sheet Template

Download Small Business Balance Sheet Template

Microsoft Excel

| Google Sheets

This customizable balance sheet template was created with small businesses in mind. Use it to create a snapshot of your company’s assets, liabilities, and equity quarter over quarter.

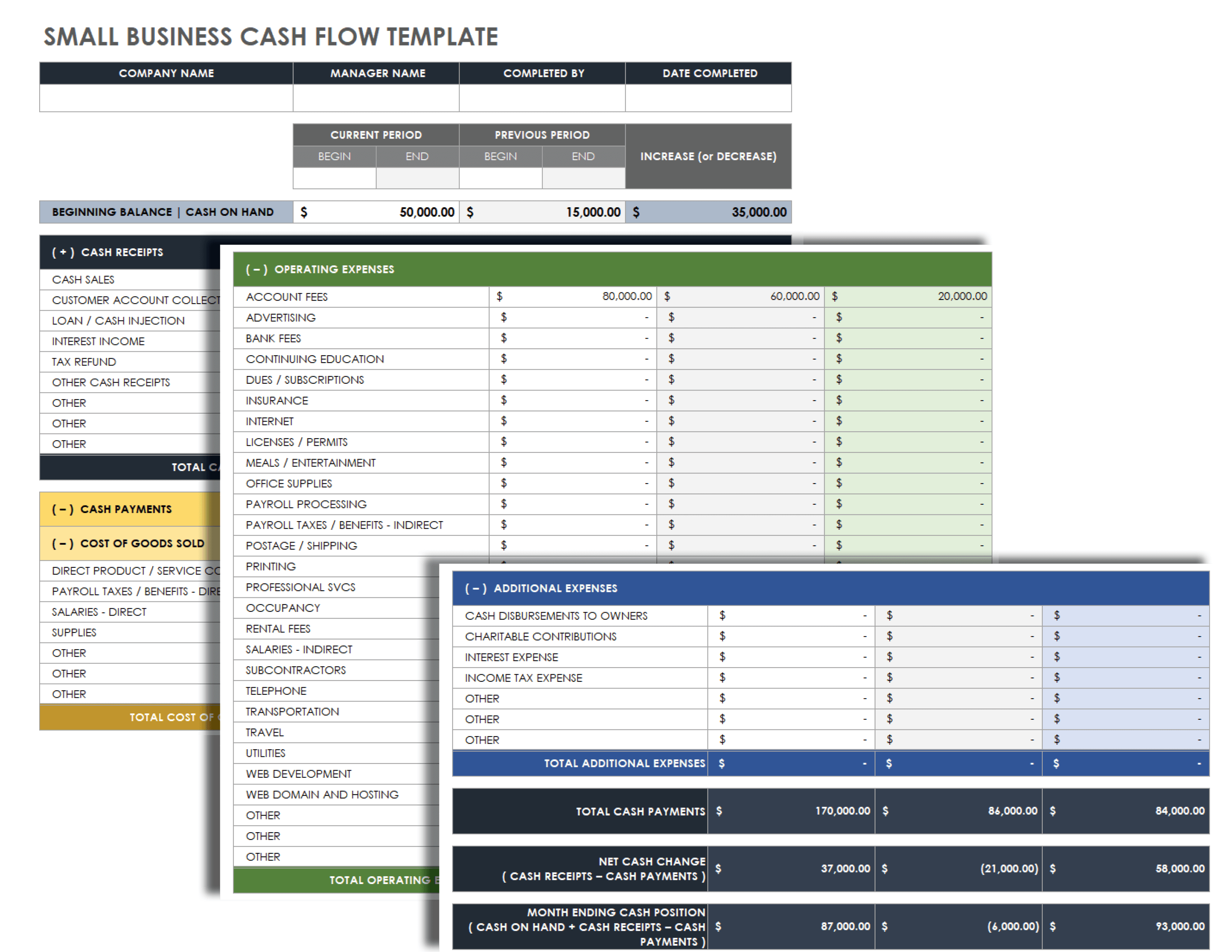

Small Business Cash Flow Statement Template

Download Small Business Cash Flow Template

Microsoft Excel

| Google Sheets

Use this customizable cash flow statement template to stay organized when documenting your cash flow. Note the time frame and input all of your financial data in the appropriate cell. With this information, the template will automatically generate your total cash payments, net cash change, and ending cash position.

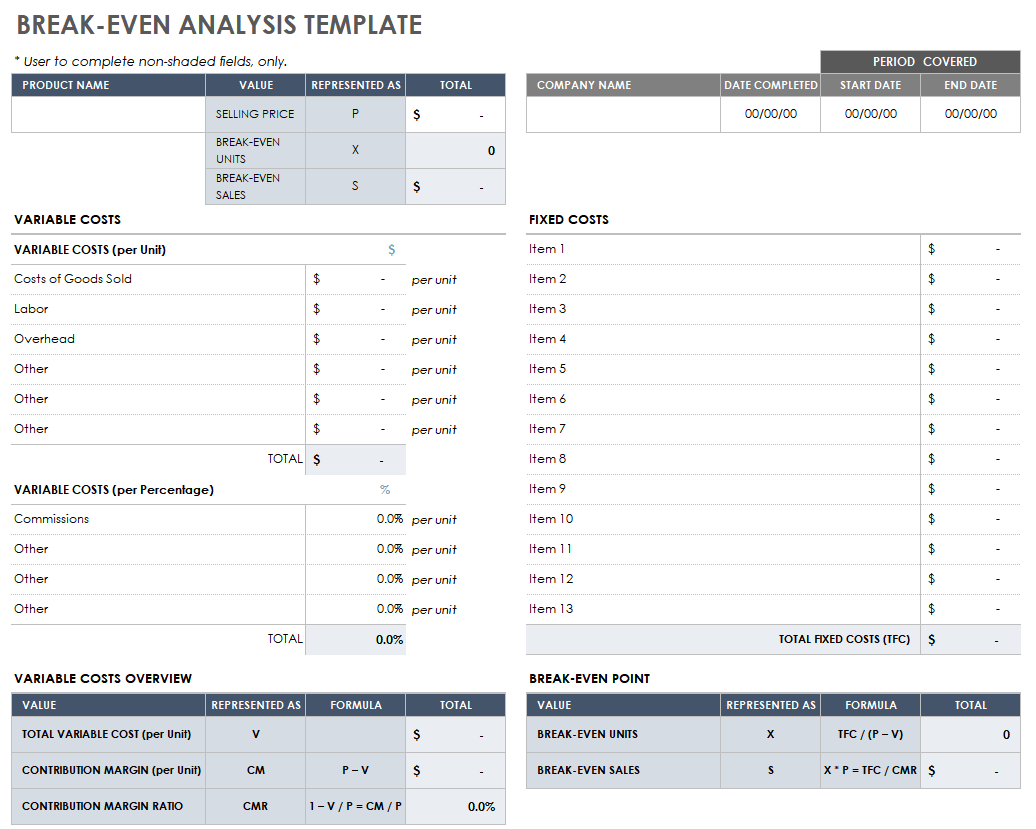

Break-Even Analysis Template

Download Break-Even Analysis Template

Microsoft Excel

| Google Sheets

This powerful template can help you determine the point at which you will break even on product investment. Input the sale price of the product, as well as its various associated costs, and this template will display the number of units needed to break even on your initial costs.

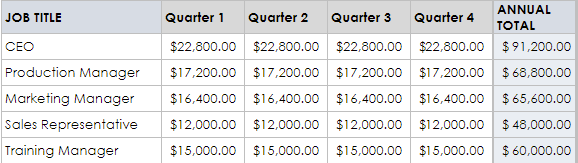

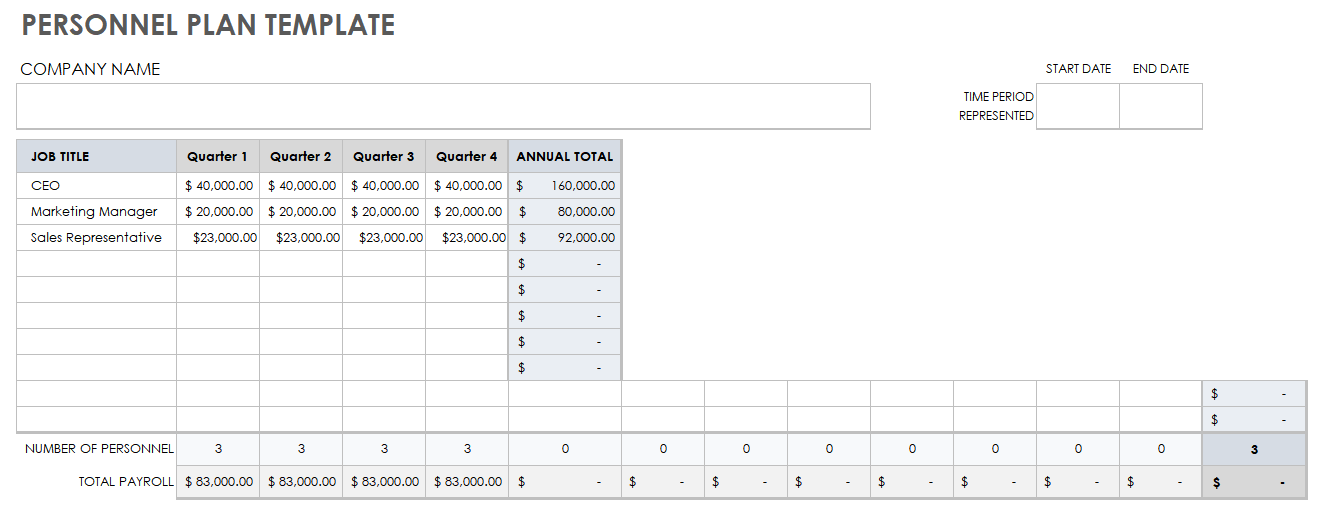

Personnel Plan Template

Download Personnel Plan Template

Microsoft Excel

| Google Sheets

Use this simple personnel plan template to help organize and define the monetary cost of the various roles or departments within your company. This template will generate a labor cost total that you can use to compare roles and determine whether you need to make cuts or identify areas for growth.

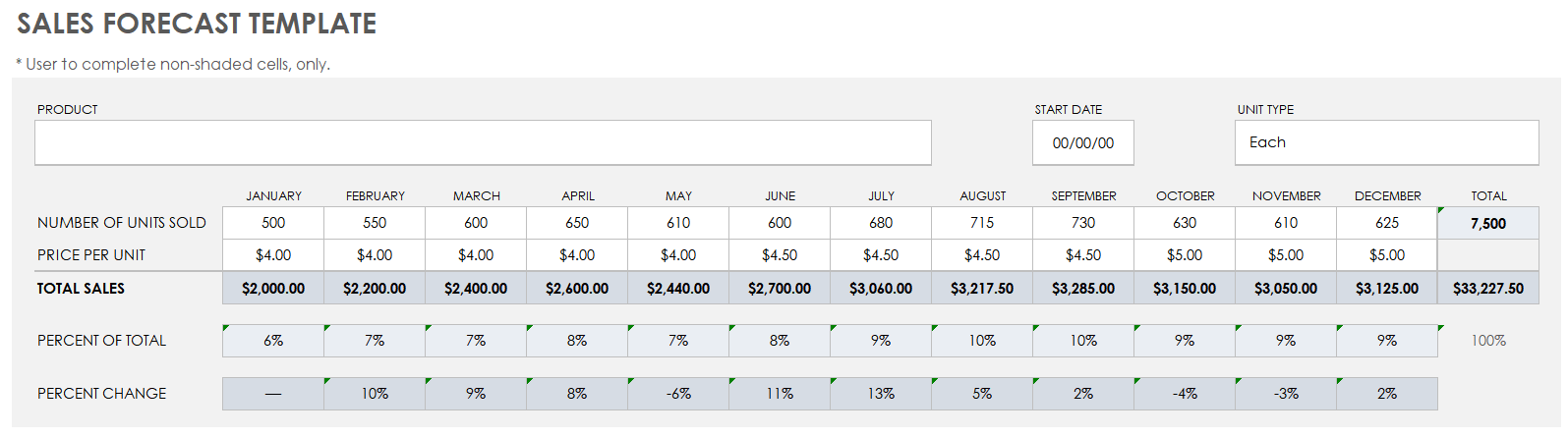

Sales Forecast Template

Download Sales Forecast Template

Microsoft Excel

| Google Sheets

Use this customizable template to forecast your sales month over month and determine the percentage changes. You can use this template to set goals and track sales history as well.

Small Business Financial Plan Dashboard Template

Download Small Business Financial Plan Dashboard Template

Microsoft Excel

| Google Sheets

This dashboard template provides a visual example of a small business financial plan. It presents the information from your income statement, balance sheet, and cash flow statement in a graphical form that is easy to read and share.

Tips for Completing a Financial Plan for a Small Business

You can simplify the development of your small business financial plan in many ways, from outlining your goals to considering where you may need help. We’ve outlined a few tips from our experts below:

- Consider Your Current and Future Credit Needs: Most small businesses end up taking on some kind of loan. It is important to consider your own credit, as well as the level of credit you will need to qualify for the best interest rates. The more you can do in the beginning to keep costs stable and low, the more accurate your financial plan will be over time.

- “You can work with experts to improve financing and investment opportunities. Bankers can help you evaluate your own creditworthiness and will take into account any low credit scores or bankruptcies that may be detrimental to your loan applications. They may also help revise your business plan to fit your business’s focus,” suggests Jesse Thé, the President and CEO of Tauria.

- Outline Your Business Goals: Before you create a financial plan, outline your business goals. This will help you determine where money is being well spent to achieve those goals and where it may not be.

“Before applying for financing or investment, list the expected business goals for the next three to five years. You can ask a certified public accountant for help in this regard,” says Thé.

The U.S. Small Business Administration or a local small business development center can also help you to understand the local market and important factors for business success. For more help, check out our quick how-to guide on writing a business plan. - Make Sure You Have the Right Permits and Insurance: One of the best ways to keep your financial plan on track is to anticipate large expenditures. Double- and triple-check that you have the permits and insurances you need so that you do not incur any fines or surprise expenses down the line.

“If you own your own business, you're no longer able to count on your employer for your insurance needs. It's important to have a plan for how you're going to pay for this additional expense and make sure that you know what specific insurance you need to cover your business,” suggests Daost. - Separate Personal Goals from Business Goals: Be as unbiased as possible when creating and laying out your business’s financial goals. Your financial and prestige goals as a business owner may be loftier than what your business can currently achieve in the present. Inflating sales forecasts or income numbers will only come back to bite you in the end.

- Consider Hiring Help: You don’t know what you don’t know, but fortunately, many financial experts are ready to help you. “Hiring financial advisors can help you make sound financial decisions for your business and create a financial roadmap to follow. Many businesses fail in the first few years due to poor planning, which leads to costly mistakes. Having a financial advisor can help keep your business alive, make a profit, and thrive,” says Hewitt.

- Include Less Obvious Expenses: No income or expense is too small to consider — it all matters when you are creating your financial plan. “I wish I had known that you’re supposed to incorporate anticipated internal hidden expenses in the plan as well,” Patterson shares. “I formulated my first financial plan myself and didn’t have enough knowledge back then. Hence, I missed out on essential expenses, like office maintenance, that are less common.”

Do Small Business Owners Need a Financial Planner?

Not all small business owners need a designated financial planner, but you should understand the documents and information that make up a financial plan. If you do not hire an advisor, you must be informed about your own finances.

Small business owners tend to wear many hats, but Powell says, “it depends on the organization of the owner and their experience with the financial side of operating businesses.” Hiring a financial advisor can take some tasks off your plate and save you time to focus on the many other details that need your attention. Financial planners are experts in their field and may have more intimate knowledge of market trends and changing tax information that can end up saving you money in the long run.

Yüzbaşıoğlu adds, “Small business owners can greatly benefit from working with a financial advisor. A successful small business often requires more than just the skills of an entrepreneur; a financial advisor can help the company effectively manage risks and maximize opportunities.”

For more examples of the tasks a financial planner might be able to help with, check through our list of free financial planning templates.

Drive Small Business Success with Financial Planning in Smartsheet

Discover a better way to connect your people, processes, and tools with one simple, easy-to-use platform that empowers your team to get more done, faster.

With Smartsheet, you can align your team on strategic initiatives, improve collaboration efforts, and automate repetitive processes, giving you the ability to make better business decisions and boost effectiveness as you scale.

When you wear a lot of hats, you need a tool that empowers you to get more done in less time. Smartsheet helps you achieve that. Try free for 30 days, today.