What Is Sales Forecasting?

When you produce a sales forecast, you are predicting what your sales or revenue will be in the future. An accurate sales forecast helps your firm make better decisions and is arguably the most important piece of your business plan.

A sales forecast contrasts with a sales goal. The former is the realistic representation of what you believe will occur, while the latter is what you want to occur. Forecasts are never perfectly accurate, but you should be as objective as possible when creating a sales forecast. Goals, on the other hand, can be based on optimistic or motivational targets.

Because the sales forecast is critical to business planning, many different stakeholders in a company (beyond sales managers and representatives) rely on these estimates, including human resources planners, finance directors, and C-level executives.

In this article, you’ll learn about different sales forecasting methods with varying levels of sophistication. The most basic method is called naive forecasting, which uses the prior period’s actual sales for the new period’s forecast and does not apply any adjustments for growth or inflation. Naive forecasts are used as comparative figures for more robust methods.

What Is Sales Planning?

A sales plan describes the goals, strategies, target customers, and likely hurdles for your sales effort. The sales plan defines your sales strategy and the method of execution you will use to achieve the numbers in your sales forecast.

Overview of Sales Forecasting Steps

Your sales forecasting model can ultimately become very sophisticated, but to grasp the basics, you should first gain a high-level understanding of what is involved. There are three primary steps to getting started:

- Decide which forecasting method or technique you will use. Also, determine the time period for your forecast. Later in this guide, we will review different methods of forecasting sales, including how to know which is best for your business.

- Gather the data to plug into your forecast model. The data points will vary by method, but will almost always include your actual past sales and current growth rate.

- Pick a tool to support your forecasting effort. For learning purposes, you can start with pencil and paper, but soon after, you’ll want to take advantage of digital solutions. Common tools include spreadsheets, accounting software, and customer relationship management (CRM) or sales management solutions.

As you get going, remember not to be overly focused on complex formulas. Do regular reality checks to make sure your sales forecasts accord with common sense. Bounce forecasts off sales reps to get realistic feedback, and revise.

You will likely achieve greater accuracy if you build your forecasts based on unit sales wherever possible, because pricing can move independently from unit sales. Use data if you have it.

Benefits and Importance of Sales Forecasting

Sales forecasting helps your business by giving you data to make decisions concerning allocating resources, assigning staff, and managing cash flow and overhead. Using this data reduces your risk and supports your growth.

Your sales forecast enables you to predict both short and long-term performance and customer demand for your product. In the short term, having a sales forecast makes it easy for you to spot when actual sales are not meeting estimates and gives you an opportunity to make corrections early in the period.

The forecast guides how much you spend on marketing and administration, and the projections generate your sales reps’ objectives. In this way, sales forecasts are an important benchmark for gauging the performance of your sales reps.

Sales forecasts also lead to better management of inventory levels. With a good idea of how much product you will sell, you can stock enough to meet customer demand without missing any sales and without carrying more than you need. Excess inventory ties up capital and reduces profit margins.

In the long term, sales forecasts can help you prepare for changes in your business. For example, you might see that within a few years, your company will require more manufacturing capacity to meet growing sales. To expand capacity, you may need to build a new factory, so now you can start planning how you will pay for it. Predictive sales forecasting is a critical part of your presentation if you are seeking equity capital from investors or commercial loans for expansion.

In short, sales forecasting helps your business avoid surprises, so you aren’t making decisions in a crisis environment. Companies with trustworthy sales forecasts see a 10 percentage point greater increase in annual revenues compared to counterparts without, according to research from the Aberdeen Group.

What Makes a Good Sales Forecast?

The most important quality for a sales forecast is accuracy. But, the benefits of accuracy must be weighed against the time, effort, and expense of the forecasting technique.

Useful sales forecasts are also easily understood and often include visual elements, such as charts, graphs, and tables, to make important trends visible.

Ideally, you can quickly build a highly reliable sales forecast with simple, economical methods. The ultimate forecast method would automatically (i.e., without manual intervention) fetch the relevant data and make predictions using an algorithm finely tuned to your business.

In reality, the forecasting process is more time consuming and subjective. Sales forecasts often depend on reps’ assessments of how likely their prospects are to close, and perceptions vary widely. (A conservative rep’s 60 percent probability may be understated, while another rep’s 60 percent may be overly optimistic.)

Sales managers, who are usually responsible for forecasting, spend a lot of time factoring in these nuances and other market factors when calculating forecasts.

Surprisingly, spending more time on forecasting does not always improve accuracy. According to research from CSO Insights, sales managers who spend 15 to 20 percent of their time producing their forecast had win rates for approximately 46.5 percent of deals. But, when they spend more than 20 percent of their time on forecasting, the win rate declined by more than two percentage points.

An axiom of forecasting is that accuracy is highest during time periods that are close at hand and lowest during those that are far into the future. Short-term forecasts draw upon the following: deals that are already in the sales pipeline, the current economic environment, and actual market trends. So, the data underlying short-term forecasts is more reliable.

Forecasting for distant time periods requires bigger guesses about opportunities, demand, competitor activity, and product trends, so it makes sense that the forecast becomes less accurate the further into the future you go. (This concept applies to many companies, especially those that are young and growing; the concept becomes more relevant for all businesses at three years and beyond.) Bear this thought in mind when you look at your sales forecast in order to make long-term decisions.

Sales Forecasting Methods: Qualitative and Quantitative

Sales forecasting methods break down broadly into qualitative and quantitative techniques. Qualitative forecasts depend on opinions and subjective judgment, while quantitative methods use historical data and statistical modeling.

Qualitative Methods for Sales Forecasting

Sales forecasting often uses five qualitative methods. These are based on different ways of generating informed opinions about sales prospects. Creating and conducting these kinds of surveys is often expensive and time intensive. These five qualitative methods include the following:

- Jury of Executive Opinion or Panel Method: In this method, an executive group meets, discusses sales predictions, and reaches a consensus. The advantage of this method is that the result represents the collective wisdom of your most informed people. The disadvantage is that the result may be skewed by dominant personalities or the group may spend less time reflecting.

- Delphi Method: Here, you question or survey each expert separately, then analyze and compile the results. The output is then returned to the experts, who can reconsider their responses in light of others’ views and answers. You may repeat this process multiple times to reach a consensus or a narrow range of forecasts. This process avoids the influence of groupthink and may generate a helpful diversity of viewpoints. Unfortunately, it can be time consuming.

- Sales Force Composite Method: With this technique, you ask sales representatives to forecast sales for their territory or accounts. Sales managers and the head of sales then review these forecasts, along with the product owners. This method progressively refines the views of those closest to the customers and market, but may be distorted by any overly optimistic forecasts by sales reps. The composite method also does not take into account larger trends, such as the political or regulatory climate and product innovation.

- Customer Surveys: With this approach, you survey your customers (or a representative sample of your customers) about their purchase plans. For mass-market consumer products, you may use market research techniques to get an idea about demand trends for your product.

- Scenario Planning: Sales forecasters use this technique most often when they face a lot of uncertainty, such as when they are estimating sales for more than three years in the future or when a market or industry is in great flux. Under scenario planning, you brainstorm different circumstances and how they impact sales. For example, these scenarios might include what would happen to your sales if there were a recession or if new duties on your subcomponents increased prices dramatically. The goal of scenario planning is not to arrive at a single accepted forecast, but to give you the opportunity to counter-plan for the worst-case scenarios.

Quantitative Methods for Sales Forecasting

Quantitative sales forecasting methods use data and statistical formulas or models to project future sales. Here are some of the most popular quantitative methods:

- Time Series: This method uses historical data and assumes history will repeat itself, including seasonality or sales cycles. To arrive at future sales, you multiply historical sales by the growth rate. This method requires chronologically ordered data. Popular time-series techniques include moving average, exponential smoothing, ARIMA, and X11.

- Causal: This method looks at the historical cause and effect between different variables and sales. Causal techniques allow you to factor in multiple influences, while time series models look only at past results. With causal methods, you usually try to take account of all the possible factors that could impact your sales, so the data may include internal sales results, consumer sentiment, macroeconomic trends, third-party surveys, and more. Some popular causal models are linear or multiple regression, econometric, and leading indicators.

Sales Forecasting Techniques with Examples

In reality, most businesses use a combination of qualitative and quantitative methods to produce sales forecasts. Let’s look at the common ways that companies put sales forecasting into action with examples.

Intuitive Method

This forecasting method draws on sales reps’ and sales managers’ opinions about how likely an opportunity is to close, so the technique is highly subjective. Estimates from reps with a lot of experience are likely to be more accurate, and the reliability of the forecast requires reps and managers to be realistic and honest.

This method can be especially helpful if you do not have historical data or if you are assessing new prospects early in your funnel. In these cases, a rep’s gut feeling after initial contact can be a good indicator. If you are a manager, you will review reps’ estimates with an eye for any outliers and work with those reps to make any necessary adjustments.

Here is an example of the intuitive method in action: You manage a team of four sales reps. You go to each one and inquire about the leads they are nurturing. You ask each rep which opportunities they believe they will win in the next quarter and how much those sales will be worth. John, your strongest rep, tells you $175,000. Alice, another strong performer, says $115,000. Bob, who is in his second year at your company, reports $85,000. Jennifer, a recent college graduate, projects $100,000. You calculate the total of those forecasts and arrive at an intuitive forecast of $450,000. However, you suspect Jennifer’s forecast is unrealistic, because she is inexperienced, so you ask her more questions. Based on what you learn, you decide that only half of Jennifer’s deals are likely to close, so you reduce her contribution to $50,000 and revise your total quarterly forecast to $400,000.

Scenarios Method

Scenario forecasts are qualitative and involve you projecting sales outcomes based on a variety of assumptions. This process can also be a helpful business planning exercise, because once you identify major risks or uncertainty for your company, you can develop action plans to deal with these circumstances if they arise.

Scenario forecasts require an in-depth knowledge of your business and industry, and the quality of the forecast will vary with the expertise of the person or group who prepares the estimate.

To create a scenario forecast, think about the key factors that affect sales, external forces that could influence the outcome, and major uncertainties. Then, write a narrative and numerical description of how the scenario would play out under various combinations of these key factors, external forces, and uncertainties.

Here is an example of the scenarios method in action: Your company sells components for military vehicles. You notice that the most impactful things your sales reps do are meeting with procurement officers in the defense departments of major nations and holding factory tours and product demonstrations for them. These are your key factors.

The external forces are the number of tenders or requests for proposals that military procurement departments announce, and the value of those items. The risk of conflict in various parts of the world, scarcity of your raw materials, and trends in budget authorizations for defense by major countries are your critical uncertainties.

You look at how your key factors, external factors, and major uncertainties might combine. One scenario might entail the outcome if your reps increased the number of meetings and product events by 20 percent, the value of U.S. tenders launched rose by six percent, and France decreased defense spending by two percent.

Under this scenario, you might forecast a six percent increase in unit sales resulting from the following:

- Having more in-person sales contacts should boost sales by five percent based on past performance.

- You can increase revenue by three percent due to greater U.S. tender opportunities and your current market share.

- Major customer France will not purchase anything, reducing sales by two percent.

Sales Category Method

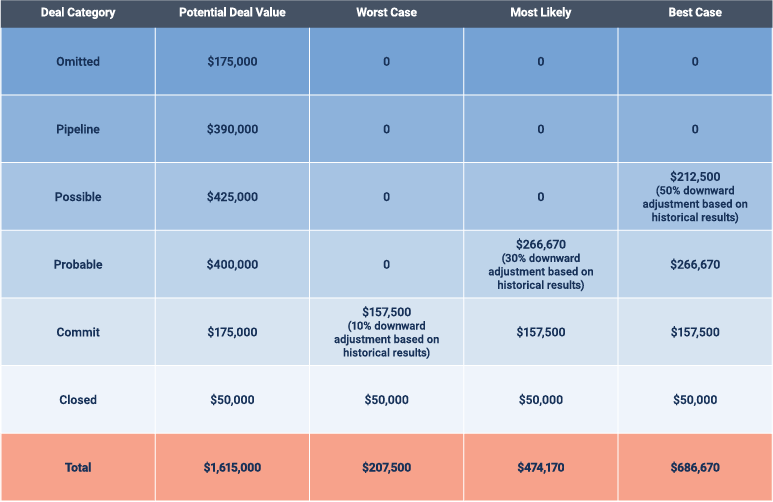

The category forecasting method looks at the probability that an opportunity will close and divides opportunities into groups based on this probability. The technique relies somewhat on intuition, as does the intuitive method, but the sales category method brings more structure and discipline to the process.

The categories that each company uses vary widely, but they correspond broadly to stages in the sales pipeline. These are some typical labels and definitions:

- Omitted: The deal has been lost or the prospect is no longer engaging.

- Pipeline: The opportunity will not realistically close during the quarter.

- Possible, Best Case, Upside, or Longshot: There is a realistic possibility that the deal could close at the projected value in the quarter if everything falls into place, but this is not certain. Overall, fewer than half of the opportunities in this group end up closing in the quarter at the planned value.

- Probable or Forecast: The sales rep is confident that the deal will close at the planned value in the quarter. Most of these opportunities will come to fruition as expected.

- Commit or Confident: The salesperson is highly confident that the deal will close as expected in this quarter, and only something extraordinary and unpredictable could derail it. The probability in this category is 80 to 90 percent. Any deal that does not close as forecast should generally experience only a short, unanticipated delay, rather than a total loss.

- Closed: The deal has been completed; payment and delivery have been processed; and the sale is already counted in the quarter’s revenue.

To compile your forecast, look at the combined value of the potential deals in the categories under three scenarios:

- Worst Case: This is the minimum value you can anticipate, based on the closed and committed deals. If you have very good historical data for your sales reps and categories and feel confident making adjustments, such as counting a portion of probable deals, you may do so, but it is important to be consistent and objective.

- Most Likely: This scenario is your most realistic forecast and looks at closed, committed, and probable deal values, again with possible adjustments based on historical results. For example, if you have tracked that only 60 percent of your probable deals tend to close in the quarter, adjust their contribution downward by 40 percent.

- Best Case: This is your most optimistic forecast and hinges on executing your sales process perfectly. You count deals in the closed, commit, probable, and possible categories, with adjustments based on past performance. The possible category, in particular, requires a downward adjustment.

As the quarter or period progresses, you revise the forecast based on updated information. This method can quickly get cumbersome and time consuming without an analytics solution.

Here is an example of the sales category method in action: You interview your sales team and get details from the reps on each deal they are working on. You assign the opportunities to a category, then make adjustments for each scenario based on past results. For example, you see that over the past three years, only half the deals in the possible category each quarter came to fruition. Here’s what the forecast looks like:

Top-Down Sales Forecasting

In top-down sales forecasting, you start by looking at the size of your entire market, called the total addressable market (TAM), and then estimate what percentage of the market you can capture.

This method requires access to industry and geographic market data, and sales experts say top-down forecasting is vulnerable to unrealistic objectives, because expectations of future market share are often largely conjecture.

Here is an example of top-down sales forecasting in action: You operate a new car dealership in San Diego County, California. From industry and government statistics, you learn that in 2018, 112 dealers sold approximately 36,000 new cars and light trucks in the county. You represent the top-selling brand in the market, you have a large sales force, and your dealership is located in the most populous part of the county. You estimate that you can capture eight percent of the market (2,880 vehicles). The average selling price per vehicle in the county last year was $36,000, so you forecast gross annual sales of $103.7 million. From there, you determine how many vehicles each rep must sell each month to meet that mark.

Bottom-Up Sales Forecasting

Bottom-up sales forecasting works the opposite way, by starting with your individual business and its attributes and then moving outward. This method takes account of your production capacity, the potential sales for specific products, and actual trends in your customer base. Staff throughout your business participates in this kind of forecasting, and it tends to be more realistic and accurate.

Begin by estimating how many potential customers you could have contact with in the period. This potential quantity of customers is called your share of market (SOM) or your target market. Then, think about how many of those potential customers will interact with you. Then, make an actual purchase.

Of those who do purchase, factor in how many units of your product they will buy on average and then how much revenue that represents. If you aren’t sure how much your customers will spend, you can interview a few.

Here is an example of bottom-up sales forecasting in action: Your firm sells IT implementation services to mid-sized manufacturers in the Midwest. You have a booth at a regional trade show, and 3,000 potential customers stop by and give you their contact information. You estimate that you can engage 10 percent of those people in a sales call after the trade show and convert 10 percent of those calls into deals. That represents 30 sales. Your service packages cost an average of $250,000. So, you forecast sales of $7.5 million.

Market Build-Up Method

In the market build-up method, based on data about the industry, you estimate how many buyers there are for your product in each market or territory and how much they could potentially purchase.

Here is an example of the market build-up method in action: Your company makes safety devices for subways and other rail transit systems. You divide the United States into markets and look at how many cities in each region have subways or rail. In the West Coast territory, you count nine. To implement your product, you need a device for each mile of rail track, so you tally how many miles of track each of those cities have. In the West Coast market, there are a total of 454 miles of track. Each device sells for $25,000, so the West Coast market would be worth a total $11.4 million. From there, you would estimate how much of that total you could realistically capture.

Historical Method

The historical sales forecasting technique is a classic example of the time-series forecasting that we discussed under quantitative methods.

With historical models, you use past sales to forecast the future. To account for growth, inflation, or a drop in demand, you multiply past sales by your average growth rate in order to compile your forecast.

This method has the advantage of being simple and quick, but it doesn’t account for common variables, such as an increase in the number of products you sell, growth in your sales force, or the hot, new product your competitor has introduced that is drawing away your customers.

Here is an example of the historical method in action: You are forecasting sales for March, and you see that last year your sales for the month were $48,000. Your growth rate runs about eight percent year over year. So, you arrive at a forecast of $51,840 for this March.

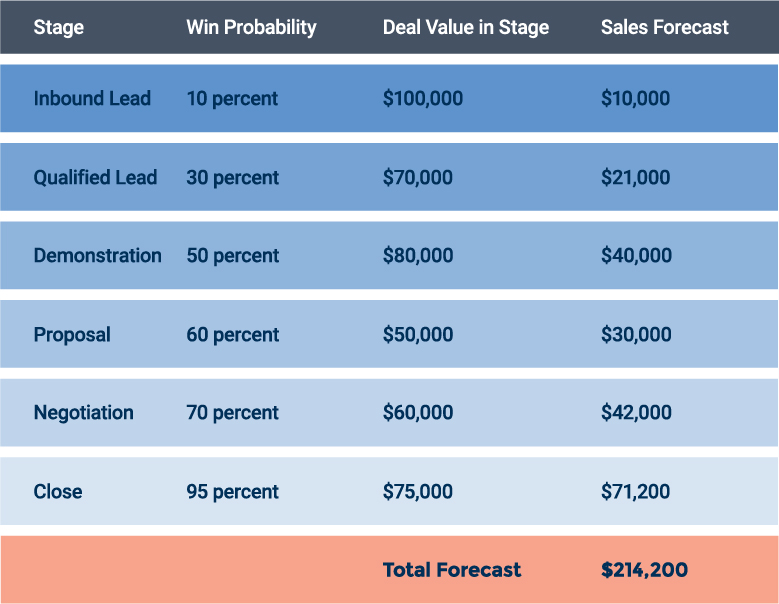

Opportunity Stage Method

The opportunity stage technique is popular, especially for high-value enterprise sales that require a lot of nurturing. This method entails looking at deals in your pipeline and multiplying the value of each potential sale by its probability of closing.

To estimate the probability of closing, you look at your sales funnel and historical conversion rates from top to bottom. The further a deal progresses through the stages in your funnel or pipeline, the higher likelihood it has of closing.

The strong points of this method are that it is straightforward to calculate and easy to do with most CRM systems.

But, opportunity-stage forecasting can be time consuming.

Moreover, this method doesn’t account for the unique characteristics of each deal (such as a longtime repeat customer vs. a new prospect). In addition, the deal value, stage, and projected close date have to be accurate and updated. And, the age of the potential deal is not reflected. This method treats a deal progressing quickly through the stages of your pipeline the same as one that has stalled for months.

If your sales process, products, or marketing have changed, the use of historical data may make this method unreliable.

Here is an example of the opportunity stage method in action: Say your sales pipeline comprises six stages. Based on historical data, you calculate the close probability at each stage. Then, to arrive at a forecast, you look at the potential value of the deals at each stage and multiply them by the probability.

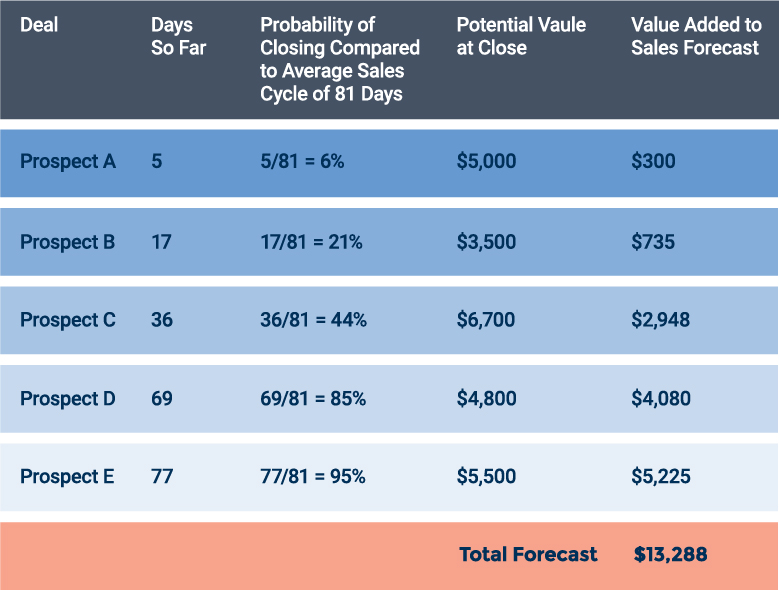

Length-of-Sales-Cycle Method

This is another quantitative method that shares some similarities with the deal stage method. However, this model looks at the length of your average sales cycle.

First, determine the average length in days of your sales process. This figure is also known as time to purchase or sales velocity. Add the total number of days it took to close all of the past year’s deals and divide by the number of deals. Then, calculate the probability of new deals closing in a certain period of time as a percentage of the average sales cycle length.

With this method, the biases of individual reps are less of a factor than with the deal stage model. Also, with this technique, you can fine-tune the probabilities for different lead types. (For example, prospects referred by current customers may close in an average of 27 days, while prospects who make contact after an online search need an average of 62 days.) But, this technique requires you to know and record how and when prospects enter your pipeline, which can be time intensive.

Here is an example of the length-of-sales-cycle method in action: You review the 37 deals your company won last year and see that they took a total of 2,997 days to close. To calculate the average length of the sales cycle, you divide 2,997 by 37 and see that the average sales cycle lasted 81 days. You then look at the five deals currently in your pipeline.

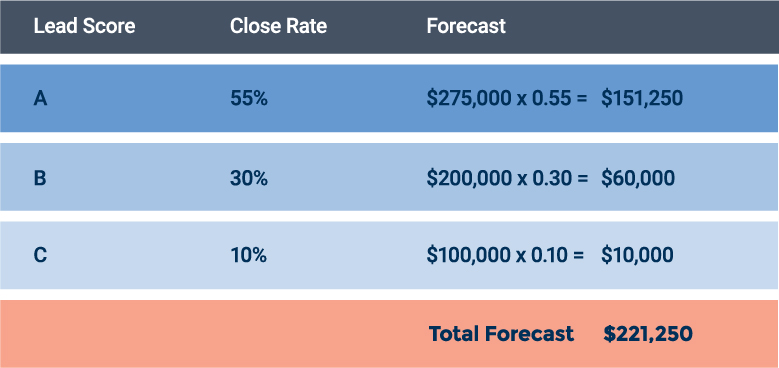

Lead Scoring Method

This technique requires you to have lead scoring in place. With lead scoring, you profile your ideal customers based on attributes (like industry, size, and location) as well as behavior (such as whether they have recently raised capital or whether the contact person has requested a demonstration of your product).

You then classify future leads based on how closely they match your ideal customer. You can label the categories with distinctions such as A, B, or C or hot, warm, or cold, or you can assign numbers up to one hundred using formulas that add and subtract points for different attributes and behaviors. (For example, “They requested a demo, which adds 15 points, but they are not in your ideal industry, which subtracts 10 points.”)

To create your forecast, you then look at the historical close rate for leads in each category and multiply that by the value of the opportunities currently in the group.

Here is an example of the lead scoring method in action: Your company sells textbooks for advanced math and science. Your ideal customer is a university with at least 25,0000 students that has an engineering school and is located on the east coast. These are your A prospects. B prospects have at least 10,000 students. C prospects have at least 10,000 students, but are located elsewhere in the country.

You then look at the close rates and potential deal values for each lead score. Finally, you multiply the close rate by the potential value of the deals in the category or by your average sales value.

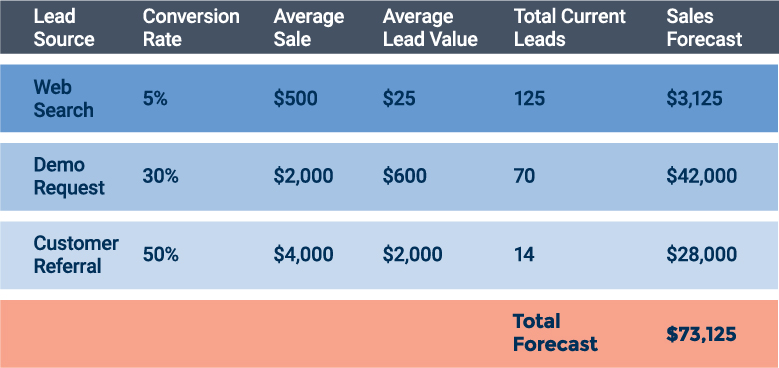

Lead Source Method

This model forecasts future sales based on how you acquired the lead, using the behavior of previous leads as a benchmark.

For example, say your company sells a software application. Some leads come from search traffic to your website; some originate with demonstration requests at conferences, and some are referrals from existing customers.

Look at your historical data to track the percentage of leads who converted to sales for each lead source. In addition, calculate the average value of a sale for each source. Then, by using the conversion probability and sales values, you can forecast the sales that the leads at the top of your funnel are likely to generate.

Here is an example of the lead source method in action: Based on source, you compile your historical data and discover the following conversion rates and sales value for leads.

One advantage of this sales forecasting method is that you can project how many leads of each type you would need to generate in order to hit a target. Suppose you have a conference coming up where participants will be able to request demonstrations of your product, and you would like to win an additional $30,000 in sales from the demo leads. Based on the average lead value of $600, you know you will want to generate 50 leads who request demos at the conference.

One drawback to lead source forecasting is that the method does not account for potential differences in the length of the sales cycle for the lead types. That makes it difficult to pinpoint the period in which the revenue will occur. Therefore, you should do a separate analysis of time to purchase in order to allocate sales to the right period.

Another challenge is that sometimes you may not be sure of the lead source. For example, suppose that another customer has recommended your product to a contact and that that contact decides to first check you out on your website. You might very well assign a lower lead value to this prospect, assuming they will behave like our web-originated leads, when, in reality, they will probably behave more like the customer referral leads.

Lastly, remember that this method won’t account for changes in your marketing or pricing that influence conversion rates and customer behavior.

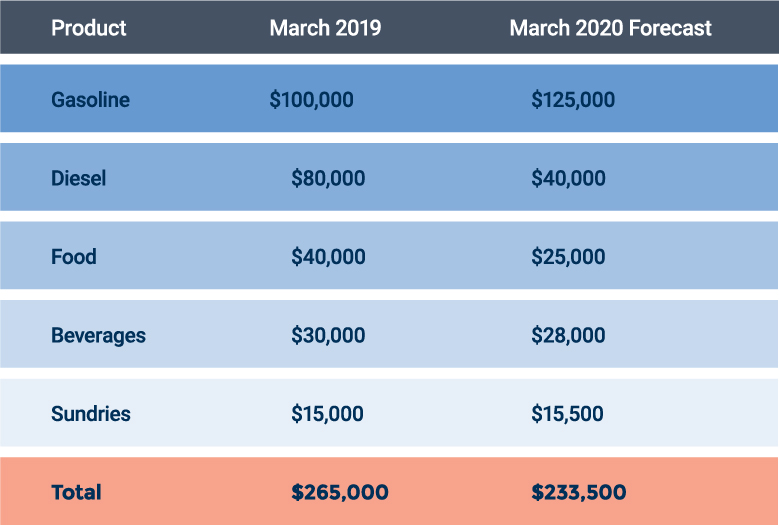

Sales by Row Method

This method is a good fit for small businesses that sell different products or services. Rather than forecasting sales for each individual product type, you project sales for categories.

Each row in your forecast will cover different physical products (such as pick-up trucks, heavy trucks, and delivery vans) and service units (such as hours of labor or service types like replacing a faucet, unclogging a drain, or installing a toilet).

You can employ this method to forecast units and then factor them by average prices to arrive at revenue. Or, you can look exclusively at revenue. If you sell a subscription service, you can calculate recurring revenue for each product type.

For each row, you would look at how much you sold in the same period a year earlier and then adjust for factors such as inflation, organic growth, new products, increased workforce, or special circumstances.

Here is an example of the sales by row method: You operate a combination fuel station and mini-market. Your forecast would cover the broad categories of your business, such as sales of gasoline, diesel, food, beverages, and sundries.

For March’s forecast, you take into account that the new housing development near your business, which was under construction last year, is now almost completely sold and that there are many more commuters filling up. Your gas sales have been growing by almost 15 percent year over year. Also, in March, there will be a special event at the nearby fairgrounds that could draw thousands of additional vehicles to your area.

On the downside, a new retail complex with a full-service grocery store has opened nearby, so your sales of food and drinks have slipped. Also, increased congestion in the neighborhood has caused some long-haul truckers who used to stop for fuel to reroute.

Regression or Multivariable Analysis Method

Regression or multivariable analysis is one of the most sophisticated forecasting methods, and allows you to build a custom model combining any factors that you feel are relevant to your sales.

For regression analysis, you need accurate historical data on all the variables under consideration, expertise in statistics, and, for practical purposes, an analytics solution or application that can perform the analysis.

Because this method incorporates a multitude of influences on your sales, the resulting forecast is the most accurate. But, the costs tend to be high because of the data collection, expertise, and technology requirements.

Regression analysis looks at the dependent variable (the factor that you are trying to predict, in this case, the amount of future sales) and independent variables (the factors that you believe affect sales results, such as opportunity stage or lead score).

In a simple example, you would create a chart, plotting the sales results on the Y axis and the independent variable on the X axis. This chart will reveal correlations. If you draw a line through the middle of the data points, you can calculate the degree to which the independent variable affects sales.

This line is called the regression line, and, by calculating the slope of the line, you can use numbers to represent the relationship between the variable and sales. The equation for this is Y = a + bX. Excel and other software will perform this analysis and calculate a and b for you. In more sophisticated applications, the formula will also include a factor for error to account for the reality that other variables are also at work.

Going further, you can look at how multiple variables interplay, such as individual rep close rate, customer size, and deal stage. Making these kinds of calculations becomes increasingly difficult with simple charts and demands more advanced math knowledge.

Remember that correlation is not the same as causation. Bear in mind that while two variables may seem closely related to each other, the reality may be more subtle.

Here is an example of the regression method in action: You want to look at the relationship between the amount of time a prospect has progressed in your sales cycle and the probability of the deal closing.

So, plot on a chart the probability of close for past deals when they were at various stages of your sales cycle, which lasts an average of 100 days. Deals early in the sales cycle have a low probability of closing compared to those that occur in the later stages of negotiation and contract signing on day 85 and up. (Be sure to eliminate any prospects that stall or disengage at any stage.)

By drawing a line through those points (i.e., the intersection between the sales close probability and the percentage of the average sales cycle), you can see that there is a nearly one-to-one relationship between percentage point increases in time elapsed relative to the average sales cycle and percentage point increases in the probability of closing.

This calculation becomes more complex when you consider multiple variables. Let’s say you have two sales reps working with prospects. Gloria, your best closer, is giving a product demonstration to a new Fortune 500 account. Leonard, a strong performer, whose close rate is a little lower than Gloria’s, is negotiating with a repeat customer, a mid-sized company.

Your multivariable analysis of these situations could take into account each rep’s average close rate for an opportunity, given the following factors: the specific stage; deal size; time left in the period; probability of close for a repeat customer versus a new customer; and time to close for an enterprise customer with more than 10 people involved in decision making versus a mid-sized business with a single decision maker.

Time Horizons in Sales Forecasting

Choosing the time period for your sales forecast is an important step. Depending on your business, the purpose of your forecast, and the resources you can devote to making forecasts, the time frame you target will vary.

A short-term forecast will help set sales rep bonus levels for next quarter, but you need a long-term forecast to decide whether you should plan to build a new factory. A startup that has been doubling revenue every year will have more difficulty making a 20-year forecast than a century-old concern in a mature industry. Here are the three time frames for forecasts:

- Short-Term Forecasts: These cover up to a year and can include monthly or quarterly forecasts. They help set production levels, sales targets, and overhead costs.

- Medium-Term Forecasts: These range from one to four years and guide product development, workforce planning, and real estate needs.

- Long-Term Forecasts: These extend from five to 20 years and inform capital investment, capacity planning, long-range financing programs, succession planning, and workforce skill and training requirements.

Getting Started with Sales Forecasting: What You Need to Know

Regardless of the sales forecast method you use, you generally need to have certain pieces of information and conditions in place. These include the following:

- Well-Documented and Defined Sales Process: You need to understand your customer journey and have an established sequence for nurturing each prospect. Without this, you cannot predict which opportunities are getting closer to purchasing. This structure creates accountability.

- Consensus on Pipeline Stages: Your sales team needs to have a clear and shared understanding of what you mean by lead, prospect, qualified, possible, probable, committed, and other relevant terms.

- Definition of Success: Communicate clearly what your sales team is striving for in terms of sales quotas or goals; include these quotas and goals for each individual rep, for the team as a whole, and for conversion through each stage of your pipeline.

- Historical Data: You require benchmarks for data points, such as average time to close, conversion rates, average deal size, lifetime customer value, win-loss ratio, and seasonal sales trends. These sales metrics and KPIs are often critical pieces of your forecast.

- Current Status: Up-to-date knowledge of your pipeline is essential, including how many opportunities are at each stage and the potential value of these sales.

- Forecasting Tools: This will almost always include a CRM application and may also include financial management or accounting software, analytics solutions, and spreadsheets.

Influences and Assumptions in Sales Forecasting

Sales forecasting should not happen in a vacuum. Take into account changes in the business environment and question assumptions, such as that past growth will continue. Also, be sure to factor in your ideas about global economic trends and competitor behavior.

Here are some common factors to consider regarding your sales forecast. Many of these can have either a positive or negative influence on sales. For example, changing reps’ account assignments may reduce sales, because members of your team will have to familiarize themselves with customers that are new to them. However, sales could increase if your new hotshot gets your biggest opportunity.

- Economic Trends: Inflation, growth, consumer sentiment, risk appetite, and purchasing power

- Regulation: Trade policies such as tariffs, duties, and quotas; health, safety, and environmental rulings on products or processes; court decisions; intellectual property disputes; and competition policy

- Seasonal Trends: Cyclical demand fluctuation, production patterns, and variation in raw material availability

- Competitor Behavior: New product innovations, pricing changes, and market entries and exits

- Business Economics: Selling prices, direct prices, unit costs, gross margins, and the impact of accrual versus cash accounting on when you can book a sale

- Staffing and Compensation: Hiring or firing new reps, changes in leadership, policies on commissions and bonuses, and training

- Territory Management: Redrawing of territories and changes in account assignments

- Products and Services: Product lifecycle, new products and services, user experience, defects, ticket resolution, changes in distribution, and market entries and exits

- Marketing: Demand generation, advertising, pricing, special campaigns, social media activity, and prospecting

Sales Forecasting for New Businesses and Products

If you are starting a new business or launching a new product, your sales forecasts are crucial because they will determine how much you can spend in order to break even. However, when dealing with a new entity, you lack the advantage of historical data, which you need for almost every forecasting technique.

If you don’t have historical data, you can use industry benchmarks from trade publications, industry associations, and consultants. For example, if you are launching a new recipe app, look at market research on how other cooking apps have performed.

Dining establishments can look at number of tables, hours of service, and menu prices to estimate average order amounts and table turnover. Retail outlets use square feet, foot traffic, and average selling prices to forecast sales.

If you are adding a new product to your line, you can forecast sales by looking at how your most similar existing product performed at launch. Then, you can make tweaks based on other relevant information, such as that the new product is harder to master than its predecessor, that it is a later entrant into a crowded space, or that it already has a backlog of orders before launch.

New service businesses can base forecasts on capacity, such as number of staff and service hours and how much to charge for the most popular services. Once you have this data, you can make adjustments accordingly.

Michael Barbarita, President of Next Step CFO, works as a contracted CFO to produce sales forecasts for companies. He likes to tie the sales forecast for service businesses to a metric called sales per direct labor hour, which you can calculate this by dividing sales by the working hours of people in the field performing customer work. For example, an electrical contractor would calculate the sales per direct labor hour of its electricians and multiply that figure by the number of electricians and the hours they work.

For instance, you may decide that operating at half capacity is a good estimate for your first six months in business. Then, you may operate at three-quarters capacity for the second six months. Therefore, you would multiply maximum capacity by average revenue and then multiply that resulting figure by 0.50 and 0.75, respectively.

Quick-Start: Sales Forecasting Formulas

If you are eager to dive in and want to generate some simple sales forecasts, you can make use of basic equations. Here are a few easy ones:

- Simple Forecast with No Organic Growth: This formula assumes that this period will duplicate the prior period, except for the impact of inflation.

Revenue Prior Period) + (Revenue Prior Period x Inflation Rate) = Sales Forecast

- Historical Plus Growth: This formula helps you reflect current trends.You look at the prior year and then factor it by your recent growth rate.

(Last Year Revenue x Percentage Growth Rate) + Last Year Revenue = Sales Forecast - Partial Year: In this method, you project the rest of the year based on historical patterns and early results. Imagine that you know your sales for the first two months of the year and that last year these months represented seven and nine percent of your sales respectively and totaled $100,000. Using the formula below, you would forecast sales of $625,00 for the year: ($100,000 x 100) ÷ 16 = $625,000.

(Current Period Revenue x 100) ÷ Percent That Equivalent Period Represented Last Year = Forecast Sales - Pipeline Formula: This formula replicates the opportunity stage method that we discussed earlier. You calculate the value of deals at each stage of your pipeline by multiplying the potential deal value by the close probability and adding up the result for each stage.

(Deal Amount x Close Probability) + (Deal Amount x Close Probability) etc. = Sales Forecast

How to Make a Basic Sales Forecast Step by Step

Here are step-by-step instructions for a manually generated sales forecast:

- Pick Your Time Period: The way in which you will use your forecast determines the most appropriate time interval, whether that be monthly, quarterly, annually, or on an even longer timeline. If you are making your first forecast, estimating on a monthly or quarterly basis for the upcoming year is a good starting point. Experts suggest doing monthly estimates for the first year and then doing annual forecasts for years two through five.

- List Products or Services: Write down the items or services that you sell. If you have a lot of them, group them into categories. For example, if you sell clothing, your rows might include shirts, pants, and shoes. Match these revenue streams to the way you organize your accounting. So, if your books look at women’s and men’s clothing separately, do the same for your sales forecast. That way, you can pair your sales forecast with information on your cost of goods sold and overhead to project profit.

- Estimate Unit Sales: Predict how many units you will sell in the selected time period. If you have historical data, use that and then factor in assumptions about demand for the upcoming period. For example, is your business growing? Is the economy in recession? Did you launch a big promotion? Use the answers to these questions to make downward or upward adjustments to the historical figure. You can also interview some customers to get insights into their likely purchasing plans. Lastly, don’t forget to factor in seasonal fluctuations.

- Multiply by the Selling Price: Multiply the unit sales numbers by the average selling price (ASP). Determine the ASP by analyzing historical sales and adjusting for inflation and other factors. To obtain this figure, you also need to consider discounts, free trials, and unsold inventory.

- Repeat for Each Forecast Period: Go through the same calculation for each category and time interval. As you forecast more distant periods, your estimates are likely to be less accurate, so you may want to make a range of forecasts, such as for best, worst, and average scenarios. As time passes, add the actual values and fine-tune your forecast. For instance, you may see that for the first few months of the year, you underestimated sales by 12 percent. Therefore, you decide to increase your forecasted sales amounts in the upcoming months.

How to Forecast Sales in Excel

Here is a step-by-step guide to building your own sales forecast in Excel:

- Enter Historical Data: Open a worksheet and enter your past date data in the first column. Then, in the second column, enter the corresponding sales values. If possible, make sure you space the dates consistently (e.g., the first day of every month).

- Create Forecast: In the date column, fill out the next date cell with the future date you are forecasting. Select the corresponding sales value cell and in the function field, type: =(FORECAST( A10, B2:B9, A2:A9)), where A10 is the future date cell, B2 to B9 are the historical sales amounts, and A2 to A9 are the historical dates. Hit enter and the forecast sales amount will appear.

- Repeat: Continue the pattern for your remaining future dates. Remember that the formula uses only known variables, so do not add forecasted amounts to the cell ranges. This function is a linear forecasting method.

- Power Up: If you have Excel 2016, you can use the forecast sheet function, which automates forecasting and adds a chart. To use this function, select both data columns, and, on the data tab, click the forecast sheet. In the create forecast worksheet box, select whether you want a line or bar chart. In the forecast end field, choose an ending date and then click create. Excel will create a new worksheet that contains both historical and forecast sales data as well as a visual representation.

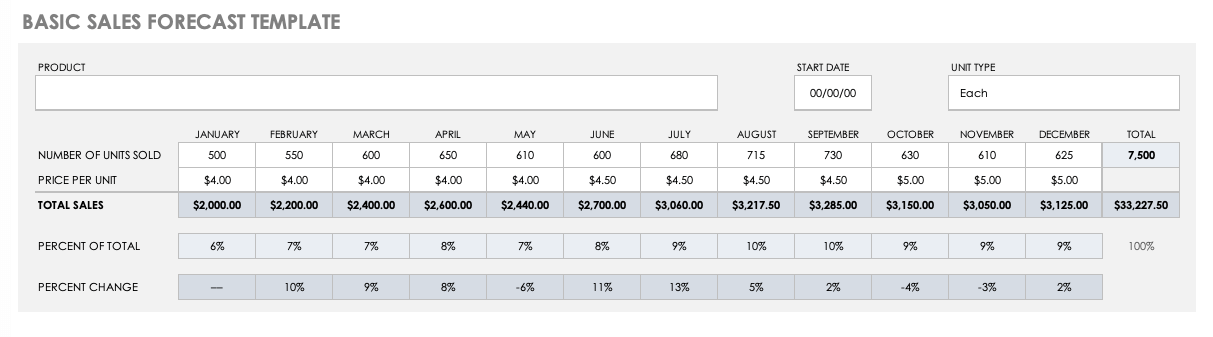

For a pre-made basic sales forecast, download this template that projects product sales with both units and sales amount.

Basic Sales Forecast Sample Template

Excel | Google Sheets | Smartsheet

For a wide range of pre-built sales forecast templates in a variety of formats, see this comprehensive collection.

How to Choose the Right Sales Forecasting Methodology

Your goal is to build the most reliable forecast possible, with the minimum amount of resources you need to be effective. To choose the method that fits best, consider these seven questions:

- What Is the Purpose of the Forecast?

Think about why you need the forecast and what you will do with it. Forecasting methods vary in their accuracy, cost, and ease of execution. If you are using it to set a budget, you will want a high level of accuracy. But, if you are trying to confirm that there is enough demand in a new geographic area to justify entering the market, you do not need as much precision. If the need is urgent, you want a fast technique. If you have time and resources, you may decide your needs are best served by a sophisticated custom model. When you want to model what would happen to sales if you changed one variable, you need a method (such as regression analysis) that can isolate this variable and reliably project the impact.

“Consider the purpose of the model and how the results will be used. For example, major decisions with a high degree of impact and uncertainty require more accuracy than those that are low impact or generally more predictable. You also need to consider the data that will be available and the quality of that data,” says Tyson Nicholas, Senior Director of Analytics at HealthMarkets, a national insurance agency.- Is the Time Frame Short, Medium, or Long Term?

Qualitative methods are a good choice for short-term horizons, but they generally underperform quantitative methods for periods beyond a few months. Similarly, consider where you are in your business or product lifecycle. If you are ramping up or in a high-growth phase, you may be making costly investment decisions, so you need a method with a high degree of accuracy, but also relatively quick production time. When you are in a mature phase of your business, decisions about production and marketing are more routine. - How Much Data Do You Have?

The less data you have, the more likely you will be to select a qualitative technique. If you have limited data, you will turn toward more simplistic models. A company that has collected a lot of data and has great confidence in its reliability can choose sophisticated quantitative models. - How Relevant Will History Be in Predicting the Future?

If your business has undergone big changes, such as launching major new products, experiencing large growth in the sales force, or introducing a different pricing structure, your past results will have less value as a guide to future performance. So, methods that diminish the weight put on historical data and qualitative techniques are a better choice. - In Terms of Time and Money, How Much Does It Cost to Produce the Forecast?

How Does This Cost Compare to the Value of the Potential Benefits?You will need to make tradeoffs between the time and cost to build your forecast and the potential benefits, such as cost savings. Also, consider the potential cost of error. For example, suppose you are contemplating a high-cost sales-forecasting technique (one that takes a lot of data gathering, the creation of a custom model, and expensive staff and technology to produce). The forecast could allow your company to reduce the amount of inventory it holds. Weigh the value of inventory savings against the forecasting cost. If you reduce inventory and the forecast proves inaccurate, what are the potential costs of lost sales — because you did not stock adequately or because you did not cut back enough? - What Degree of Accuracy Do You Need?

Forecast accuracy rises with the cost and complexity of the methodology. Depending on how you will use the forecast, the size of your company, and the variability of your business, you may feel that it’s not cost effective to produce a maximum-accuracy forecast. If you are a giant global company, a fraction of a percentage point error in your sales forecast could represent many millions. So, the bigger the dollar values, the more meaningful every degree of enhanced accuracy becomes. - How Complex Are the Factors That Will Drive the Forecast?

If your sales dynamic is straightforward — the more sunny days there are, the more beach umbrellas you sell at your beach kiosk — then building a sophisticated, AI-driven forecasting model will be overkill. “It's important not to spend time and energy developing a complex model, when a much simpler one will do the job,” says Nicholas.

But when you are facing a subtle and complex interplay of variables, you need a technique that accounts for them. Suppose you have new products, changes in your marketing, and additional sales reps. A sophisticated model would allow you to forecast the net effects and also try out different scenarios in which the variables fluctuated.

Why Accuracy Is Important in Sales Forecasts

According to CSO Insights, 60 percent of forecasted deals do not close and 25 percent of sales managers are unhappy with the accuracy of their forecasts. Inaccuracy in sales forecasts causes problems for businesses and impacts performance.

People throughout your company depend on your forecasts to make a multitude of decisions — from pay raises to real estate acquisitions. Let’s look at some of the important reasons to strive for accuracy:

- Early Warning: Your sales forecast helps you spot trouble early, like when revenues are not materializing as expected; the forecast also allows you to intervene and problem solve before this underperformance becomes a crisis.

- Decision Making: The forecast gives leaders confidence and a sound basis for deciding how much and where to spend or invest. Production planners, HR, and others will use the forecast.

- Goal Setting: You set achievable targets for sales reps when you have an accurate forecast. Goal setting prevents sales reps from getting discouraged by unrealistic expectations. Following this strategy also ensures that your commission and bonus scale are calibrated appropriately.

- Customer Satisfaction: When you are prepared for the right level of demand, your company can improve its record of fulfilling orders on time and in full.

- Inventory Management: You will be more likely to have the right level of inventory if your sales forecasts are accurate. Making accurate predictions allows you to better manage your supply chain and order raw materials or parts in a timely fashion. You also gain more control over your pricing if you have the right amount of inventory. When you have to resort to discounting to get rid of excess inventory, your profitability suffers.

How to Improve Sales Forecast Accuracy and More Best Practices from Experts

Producing high-quality forecasts takes organizational commitment and long-term effort, and best practices will help improve accuracy.

”Sales forecasting is both an art and a science. Where companies tend to go wrong is relying too heavily on one or the other. You need a consistent process and reliable data,” says Charlene DeCesare, CEO of sales training and advisory firm Charlene Ignites.

She emphasizes five best practices:

- Ensure that the pipeline feeding the forecast is accurate. You don't need historical data to predict the future when you have a well-defined sales process.

- Everyone must use the CRM, and should enter notes and coding opportunities in a clear, consistent way.

- Buyer behavior is a much more reliable predictor of future sales than gut feel. Challenge optimism that doesn't align with the applicable stage in the sales cycle or isn't supported by clear, mutually agreed-upon next steps.

- In general, buyer/seller behavior is the leading indicator to rely upon. Too many companies rely on results, which is actually the lagging indicator.

- Sales leadership can have a huge impact. Sales reps must be rewarded for both honesty and accuracy. Sales forecasting must be an individual, team, and company priority.

Rob Stephens, a CPA whose firm CFO Perspective advises businesses on forecasts, adds: “A big planning mistake is spending too much of your precious time trying to find the one right scenario… Start with a range of reasonable forecasts based on solid fundamentals. For example, you may project from historical growth rates, customer indications of future sales, or projections of market growth. A company with a new product may need to extrapolate from existing products or early indications from potential customers. Use a higher-probability scenario as a beginning base scenario, but identify why the future may deviate from it.”

Common Mistakes and Pitfalls in Sales Forecasts

Sales pros say they see the same sales forecasting errors on a regular basis and that these often relate to letting the discipline of the forecasting process lapse.

“The most common operational mistakes are basing forecasts on hope rather than evidence, ignoring repeated close date slippage, failing to take into account the historic forecast accuracy (or inaccuracy) of the salesperson concerned, and failing to hold salespeople accountable for the relative accuracy of their forecasts,” notes Bob Apollo, Founder of Inflexion-Point Strategy Partners, a sales training firm.

“The most common cultural mistake is when sales leaders press salespeople to forecast a target number without any evidence or confidence that it will actually be achieved," he notes.

Evan Lorendo, Director of Revenue Accelerator, which advises service companies on revenue strategies, says he sees companies with monthly recurring revenue (MRR), such as software as a service (SaaS), frequently make mistakes in sales forecasting.

He gives the example of a company with an MRR product that wants to generate $120,000 in revenue a year. How much in new sales do they need each month? “Most of my clients say $10,000/month, but that is wrong. Because a client is paying on a monthly basis, a client that signs up in January is actually paying 12 times during the year. On the flip side, a client signing up in July will make six payments during the year,” he explains.

That means there are a total of 78 potential payment configurations per year, not 12. The customer who buys in January will make 12 payments, but November’s buyer will make two. (12 + 11 + 10 + 9 + 8 + 7+ 6 + 5 + 4 + 3 + 2 + 1 = 78.)

“If you want to know how much you need to sell in new sales each month to hit that $120,000 goal, the answer is $1,539 ($120,000/78). That actually seems much more manageable, doesn't it? Based on poor forecasting, a miscalculation can turn off good salespeople who can't hit their quota,” he says.

KPIs for Sales Forecasting

As your sales forecasting improves, you reap bigger benefits, such as better planning and higher profits. So, you will want to assess and monitor your forecasting effort by using key performance indicators (KPIs).

Below are the main KPIs for sales forecasting. Some of them draw from statistics concepts, such as standard deviation, and computer applications and statistics guides can help you calculate them.

- Bias or Variance: This KPI tells how much the actual results deviated from the forecast over a given period of time. Calculate bias as an absolute number of dollars or units or as a percent of sales. A positive number means sales exceeded projections and a negative number indicates underperformance.

Actual Units - Forecast Units = Bias - Mean Absolute Deviation (MAD): This metric describes the size of your forecast error in total units or dollars. You calculate how much the actual results deviated from the forecast average, add the deviations, and divide the result by the total number of data points.

- Mean Absolute Percentage Error (MAPE): This is similar to MAD, but gives the forecast error as a percent of sales volume.

- Tracking Signal: This is another expression of forecast error and looks at how the error rate varies among forecast values. Normally, you expect all forecast amounts to be wrong by about the same degree. If, from one data point to another, there is a large variation in the error rate, you need to rework your model.

Tracking Signal = Accumulated Forecast Errors ÷ Mean Absolute Deviation - Forecast Value Added: This metric measures how much better the forecast was than simply using unadjusted historical data. If your forecasting effort got you closer to actual than the so-called naive forecast (i.e., using historical figures as your forecast), you have added positive value. You calculate this metric by comparing the MAPE of your forecast to the naive forecast.

- Linearity: This looks at how sales are paced over the course of the period. As your reps seek to meet quota, you might see a flurry of deals at the end of the quarter. Or, deals might be spread evenly across the time period. The most stable situation is a deal cadence or velocity that is constant. If expressed as a trend line, this stable situation would appear visually as a flat line. This pattern is called highly linear.

Application of Sales Forecasting

Your sales forecast obviously gives you an idea of how much you will sell in the future, but sales forecasting has other important use cases. Here are five ways you can apply your forecast to business questions:

- Sales Planning: As noted earlier, your sales plan encompasses your goals, tactics, and processes for achieving your sales forecast. As part of this plan, your sales forecast helps you decide if you need to hire more sales reps to achieve your forecast and if you need to put more energy and resources into marketing.

- Demand Planning: Demand planning is the process of forecasting how much product your customers will want to buy and making sure inventory aligns with that forecast. In ideal conditions, forecast demand and sales would be virtually the same. But, consider a scenario in which your new product becomes the hot gift of the holiday season. You forecast demand of 100,000 units (the number consumers will want to buy). A large shipment turns out to be defective, and the product is unsellable. So, you forecast sales of just 75,000 units (how much you will actually sell.)

- Financial Planning: Your sales forecast is vital to the work of your finance department. The finance team will rely on the forecast to build a budget, manage overhead, and figure out long-term capital needs.

- Operations Planning: The unit-sales numbers in your forecast are also important for operations planners. They will look at the production required to meet those sales and confirm that manufacturing capacity can accommodate them. They will want to know when sales are likely to rise or fall, so they can avoid excess inventory. A big increase in sales will also require operations managers to make changes in warehousing and distribution. Retailers may change the product mix at individual stores based on your sales forecast.

- Product Planning: The trends you foresee in sales will have big implications for product managers too. They will look at products that you forecast as top sellers for ideas about new products or product modifications they should introduce. A forecast of declining sales may signal it is time to discontinue or revamp a product.

Levels of Maturity in Sales Forecasting

Sales forecasts can be simply scribbled-down estimates, or they can be statistical masterpieces produced with the aid of the most sophisticated technology. The style you pursue relates in large part to your level of forecasting maturity (as well as the size and history of your business).

Below is a description of the four levels of the sales forecasting maturity model:

- Level One: In the beginning stages of sales forecasting, the estimates are usually not very accurate and take a lot of time to produce. The forecasting process depends on reps’ best guesses, and sales managers spend a lot of time gathering these guesses by interviewing each rep. Then, they roll them up into a consolidated forecast. Inconsistent data collection and personal bias can skew the results. Sales managers use spreadsheets, which quickly become outdated, and the forecasts often reflect little more than intuition.

- Level Two: As your forecasting culture grows, you are probably still inputting data by hand, and the forecast is often inaccurate or outdated. But, a CRM solution is enabling your team to have a shared repository for contacts, sales activity, and deal status. Reps don’t see value in spending time contributing to the forecast, and quality is weak. Your CRM automatically aggregates those results, so you can start to examine trends and anomalies. But, your system is not very flexible, and forecasting remains unwieldy and resource intensive.

- Level Three: At this point, automation starts to offer radical improvements in sales forecasting. Solutions backed by artificial intelligence automatically bring together data from a multitude of sources, including email, CRM, marketing platforms, chat logs, and calendars. There is no more manual data entry, and sales managers gain increased visibility into the sales pipeline. KPIs become reliable and an important tool for monitoring performance.

- Level Four: Technology ensures sales that data is accurate and timely. AI and machine learning find patterns and correlations in your historical data, and predictive analytics offer robust forecasting. The forecasting model is continually refined. Forecast accuracy rises, and sales managers can focus more of their time on supporting reps and developing opportunities. These tools make it apparent when reps are sandbagging or being too optimistic, and accountability increases.

Advances in Sales Forecasting Methodologies

While sales forecasting has been around as long as private enterprise, the field continues to evolve, and researchers are looking at ways to improve sales forecasting methodologies.

Indiana University Professor Douglas J. Dalrymple performed an influential study in 1987 that surveyed how businesses prepared sales forecasts. He found that qualitative and naive techniques predominated, but that early adopters were reducing errors by using computer analysis. At this time, PCs were starting to proliferate and come down in price.

By 2008, Zhan-Li Sun and his researchers at the Institute of Textiles and Clothing at Hong Kong Polytechnic University were experimenting with an advanced AI-driven technique called extreme learning machine to see if they could improve forecasts for the volatile retail fashion industry by quantifying the influence of factors such as design on sales.

Scholars F.L. Chen and T.Y. Ou at the National Tsing Hua University in Taiwan took this further with a 2011 study. The study documented sales forecasting advances when combining extreme learning-machine, so-called Taguchi statistical methods for manufacturing quality with novel analysis theories that work on variables with imperfect information.

Features to Look for in a Sales Forecasting Tool

Paper forecasts and Excel spreadsheets quickly become cumbersome. Sales forecasting capability is available in CRM software, sales analytics and automation platforms, and AI-driven sales technology. These capabilities often overlap among these applications.

Here are some of the features to look for when evaluating a sales forecasting tool:

- Integrations with other software, such as ERP, CRM, marketing suites, contact management, calendars, and more

- Automated collection of data and sales rep activity

- Real-time reporting

- Robust data security

- Analytics and automated scoring of deals

- Insights on most promising deals

- Scenario modeling

- Lead scoring

- Automated forecast roll-ups or summaries by category and team

- Dashboards and graphic displays of KPIs

- Benchmarking

- Customizable forecasting algorithms

- Forecast auditing and error analysis

Improve Sales Forecasting with Smartsheet for Sales

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.