Free Downloadable Due Diligence Templates and Checklists

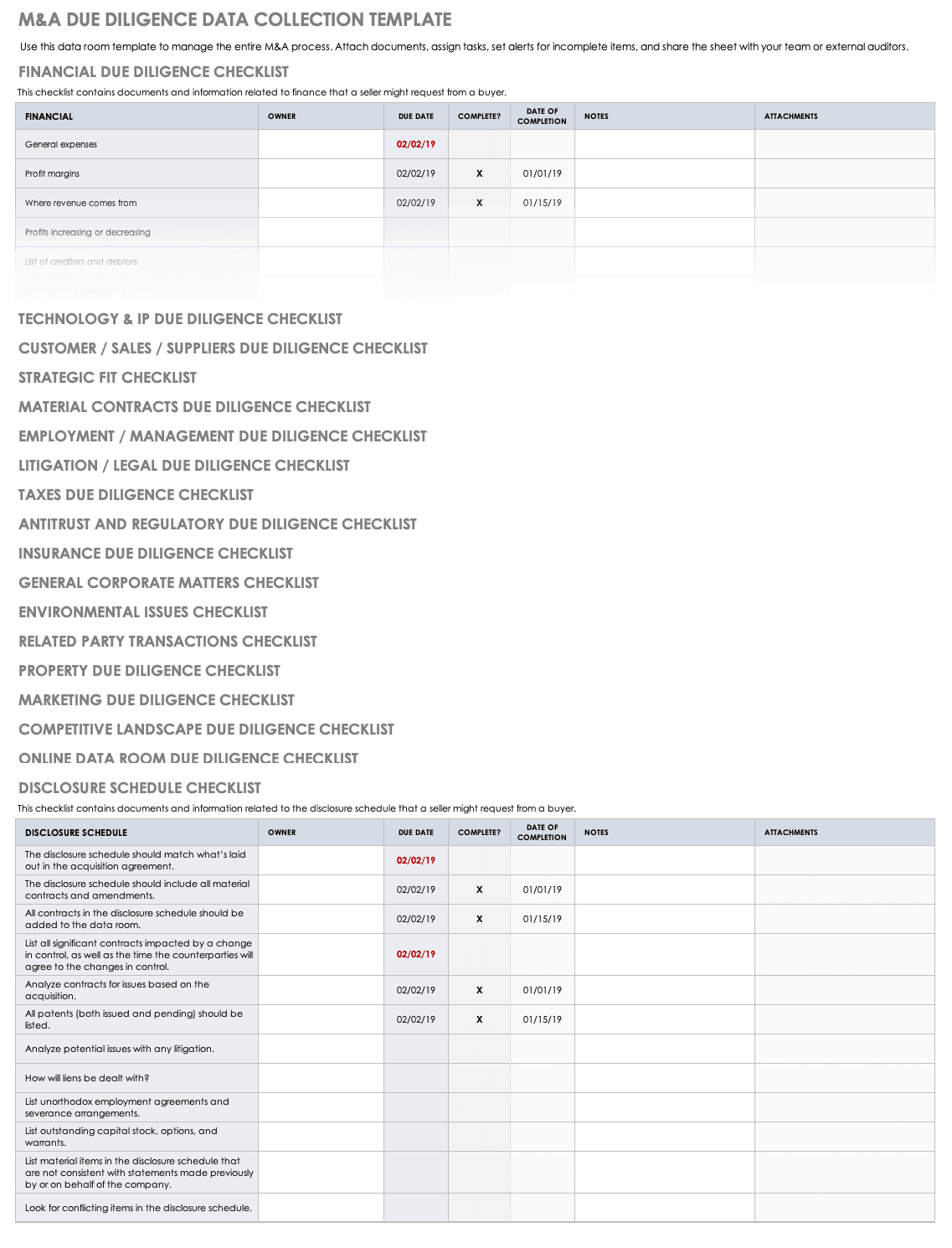

M&A Due Diligence Data Collection Template

Download this free virtual data room template to manage the entire M&A process. Attach documents, assign tasks, set alerts for incomplete items, and share the sheet with your team or external auditors.

Download M&A Due Diligence Data Collection Template - Excel

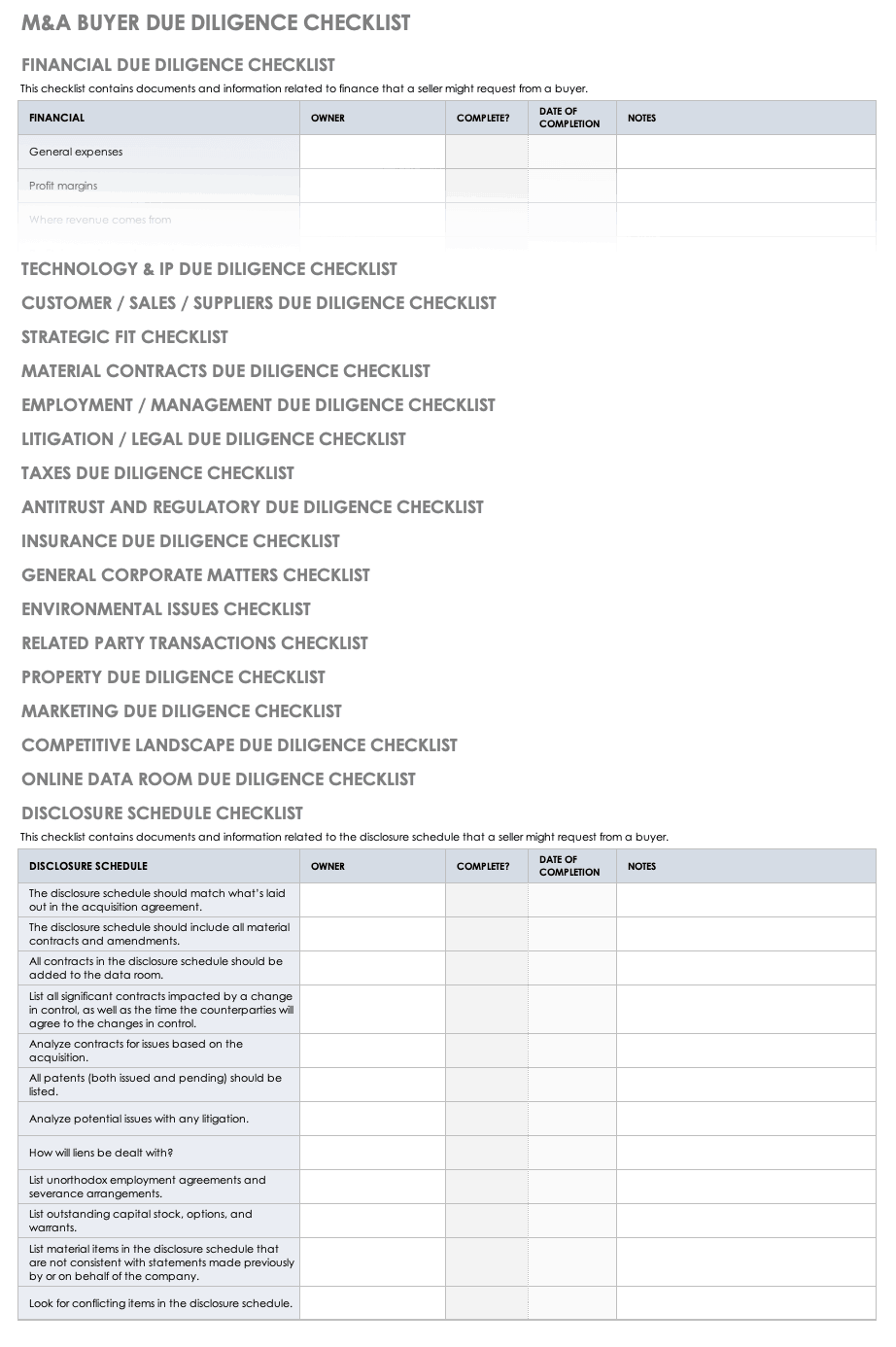

M&A Buyer Due Diligence Checklist

Before buying a company, you must thoroughly investigate several aspects of the business. Use this free Excel checklist to determine what information specific to what areas you should request from the target company.

Download M&A Buyer Due Diligence Checklist

Excel | PDF | Smartsheet

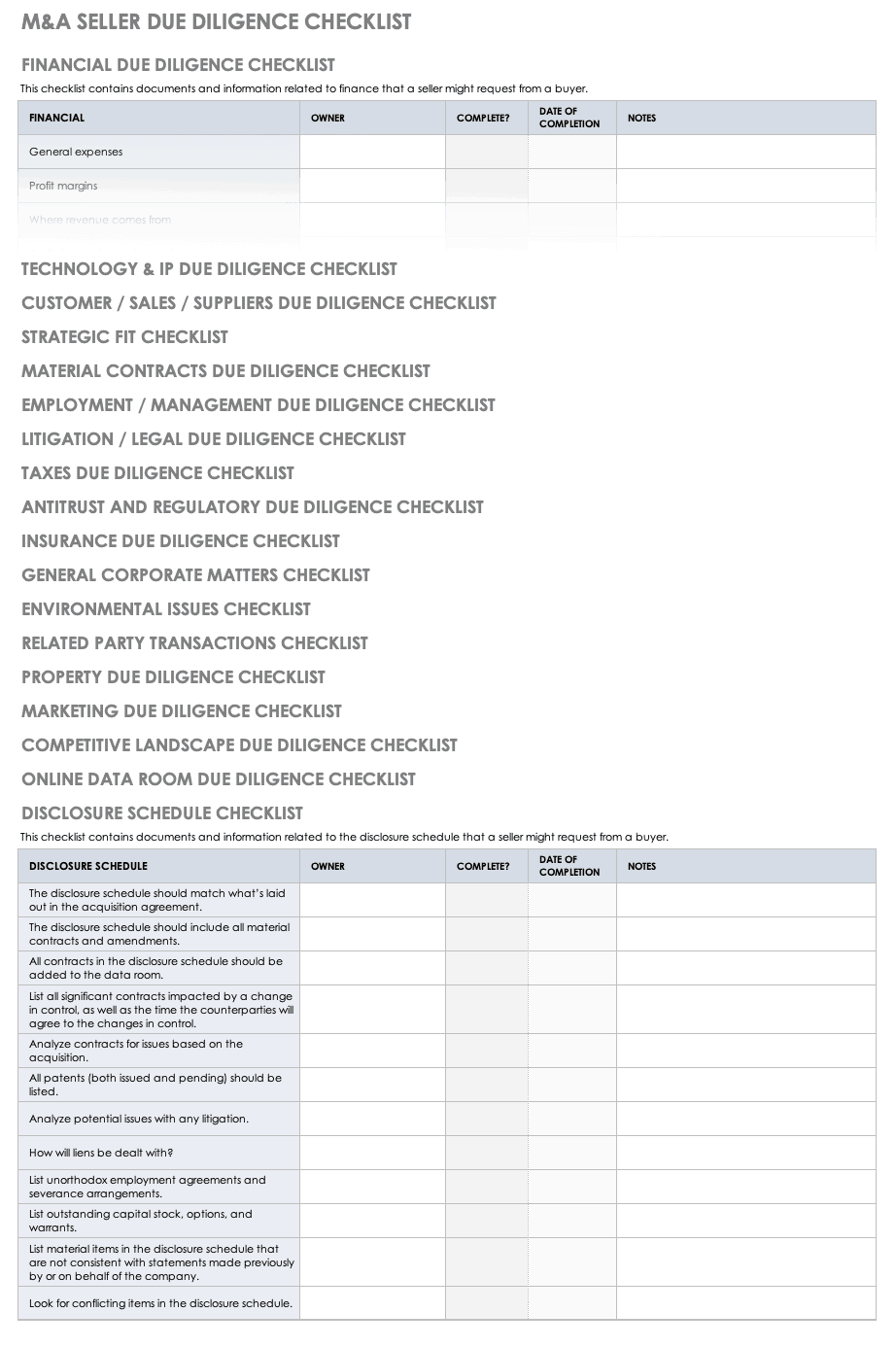

M&A Seller Pre-Due Diligence Checklist

To increase the efficiency of the due diligence process, sellers should prepare documents and information before signing the non-disclosure agreements (NDAs). Use this Word document to track which documents are easily available and which need to be prepared.

Download M&A Seller Pre-Due Diligence Checklist

Excel | PDF | Smartsheet

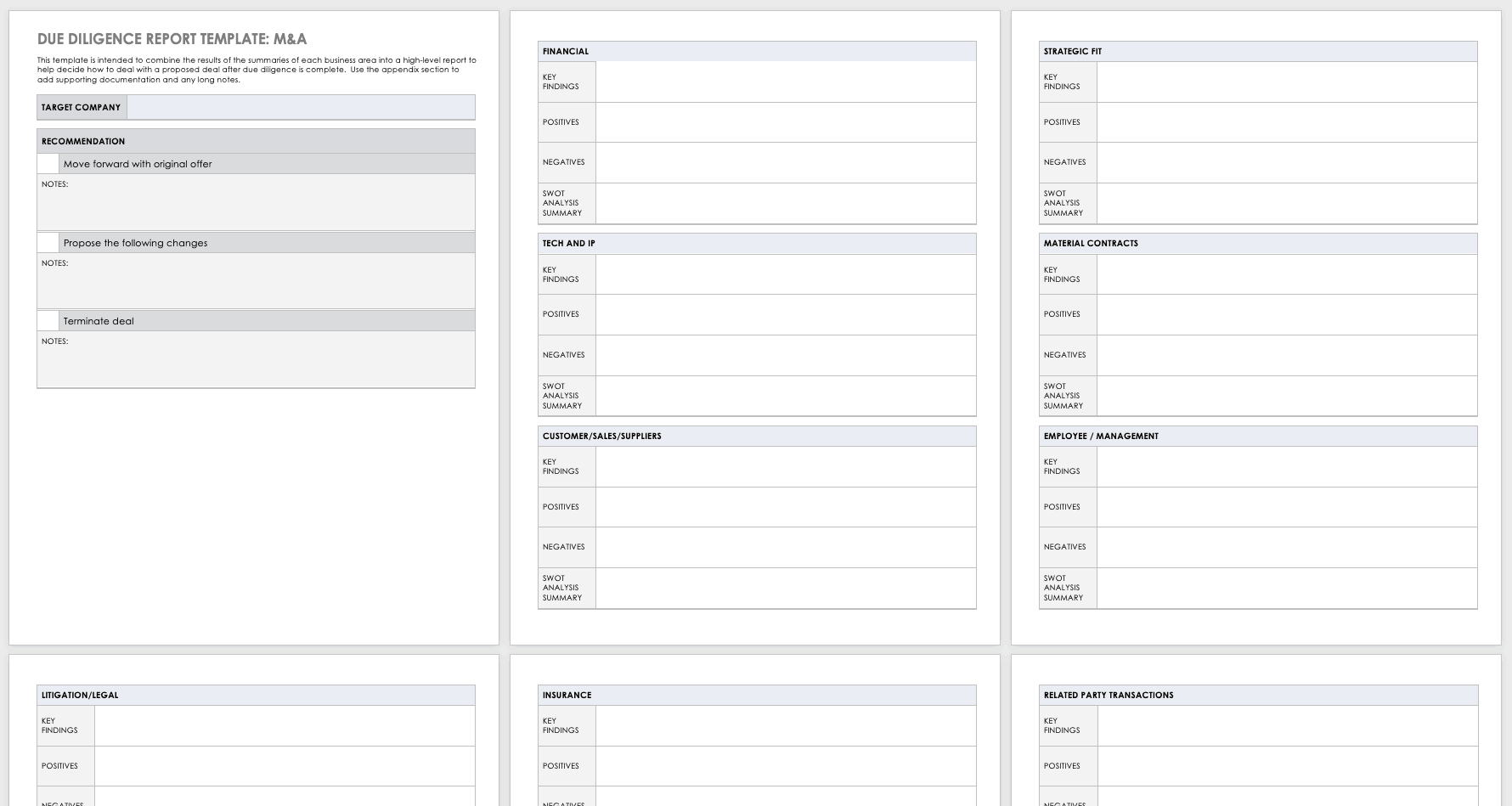

M&A Due Diligence Report Template

After you’ve completed due diligence, you need to analyze the results and gather them into a report that summarizes the key discoveries. From there, you can make recommendations on how to proceed. This template can help you organize your findings for that report.

Download M&A Due Diligence Report Template

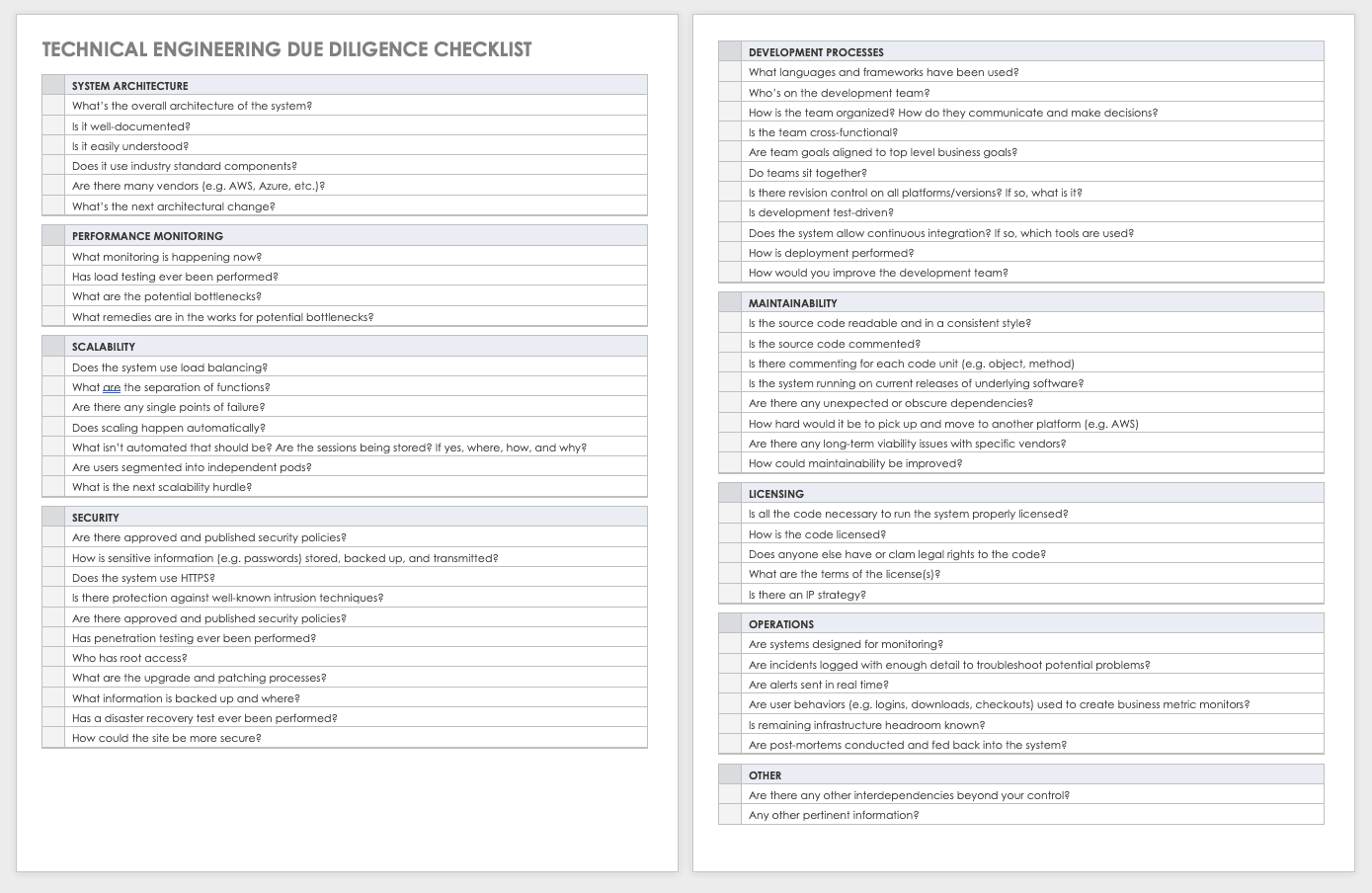

Technical Engineering Due Diligence Checklist

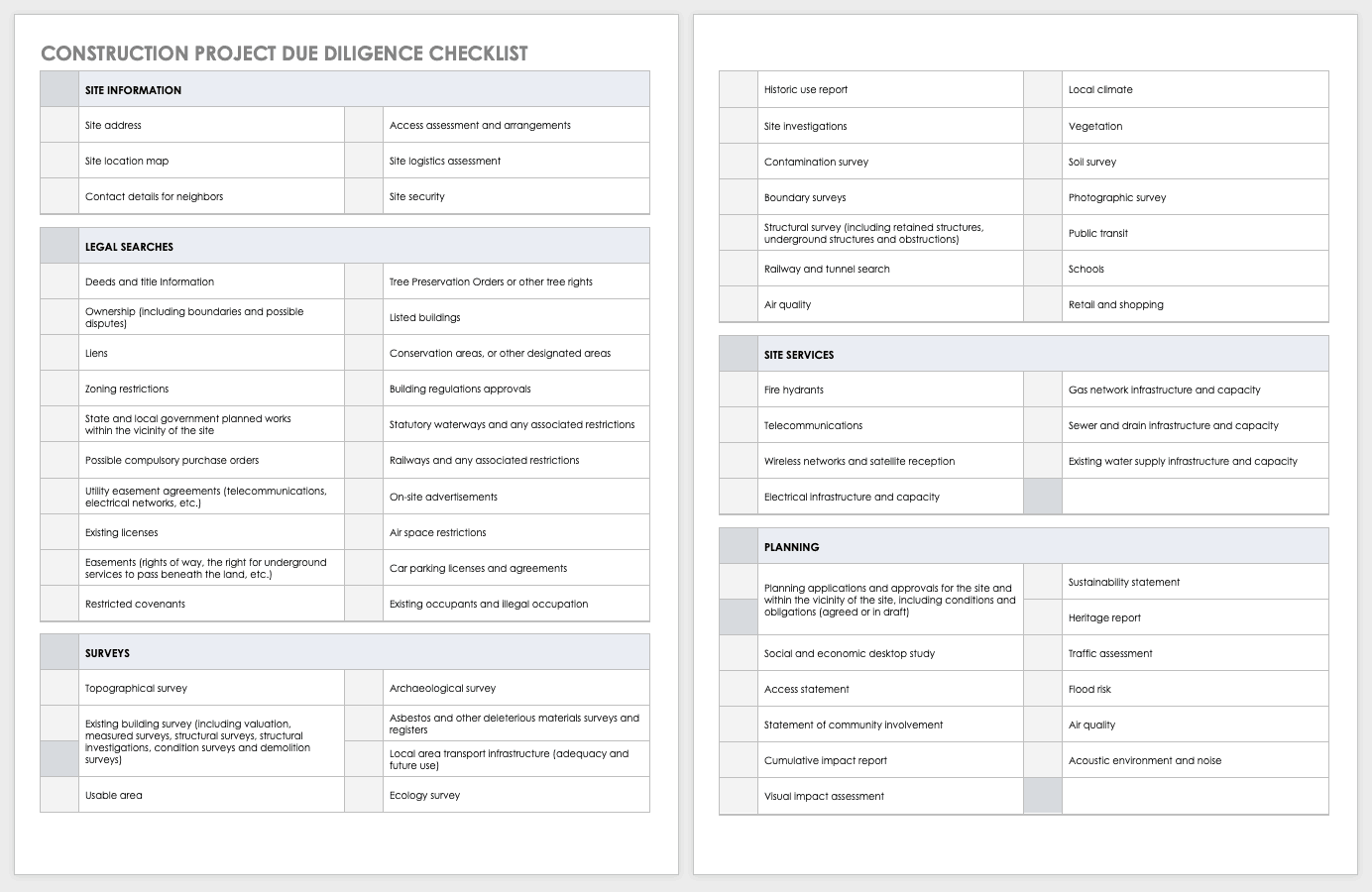

Construction Project Due Diligence Checklist

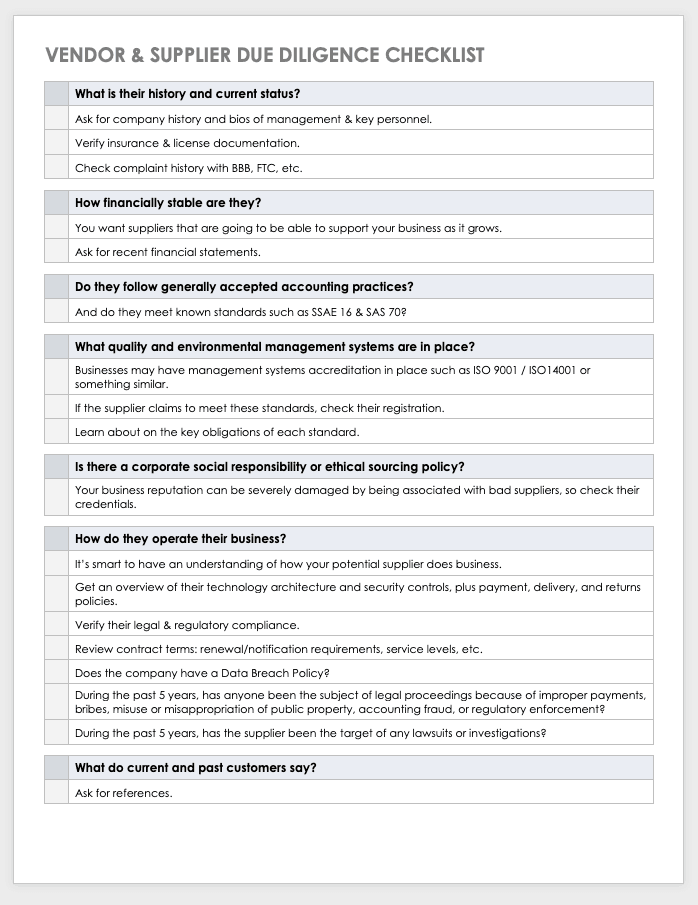

Vendor and Supplier Due Diligence Checklist

When establishing a long-term business relationship with a new vendor or supplier, due diligence helps you make sure the supplier can meet your expected needs and has similar business values. This checklist, available in Word, can pin down the questions to ask of your potential vendor or supplier.

Download Vendor and Supplier Due Diligence Checklist

Tax Preparation Due Diligence Requirements Checklist

The phrase due diligence requirements can come up in many fields, but is most common in tax preparation. Paid tax preparers must verify that they’ve met certain requirements when submitting tax returns on behalf of their clients, per Section 6695(g) of the Internal Revenue Code. Tax preparers can use IRS Form 8867 as a checklist.

Merger and Acquisition Due Diligence

Merger and acquisition due diligence is the process in which a potential buyer investigates the details of the target company, starting after they sign purchase documents. The operational and financial information that the seller provides to the buyer ensures that they overlook no details (such as litigation risks and liabilities) and that the claims about the state of the business are true. You will need data about several operational areas, including HR (which may be a separate process), IP ownership, customers and sales, contracts, and taxes. Note that a merger is where two companies join into a new company, and an acquisition is where one company buys another (this can be a stock transaction or an asset transaction).

After confidentiality agreements (like NDAs) are in place, the buyer requests documents and information from the seller and performs site visits. The buyer uses what they learn to analyze the target company’s situation.

Every situation is unique, so no single process works for all transactions — rather, each has to be customized to meet the demands of the specific transaction. A buyer will usually bring in third parties, such as attorneys, accountants, MBAs, and other analysts, as well as rely on internal experts like a CFO. By using a third party to manage the process, the executives can continue to run the business and not be deluged by document requests.

If the buyer determines the target is a good fit, it can use the information gained from due diligence to finalize the details of the transaction, including the purchase price.

Although not as common, the seller of the company can also perform due diligence on the buyer. This may be called reverse due diligence.

M&A Due Diligence Best Practices and Challenges

Due diligence is a complicated and demanding process that aims to protect both buyers and sellers. Follow these best practices to help the process flow better and ultimately come to a stronger conclusion:

-

Create concise status reports and document receipt templates (place any long sections in appendices or separate documents).

-

Use a numbering system to organize documents and information. The numbering system should be flexible enough to account for multiple transactions.

-

Every item on the document receipt tracker should have a status.

-

Use a secure, well-organized online file sharing site to exchange data and store documents. You should set up the system as early as possible, and it should be simple to use.

-

Communicate often and fully. Remember: More communication is better than less.

-

If the target company has unwritten agreements, ensure that you include them in the due diligence process.

-

Perform site visits to look beyond the data and get a deeper insight into the target business.

-

If the target company has subsidiaries, request the same documents from the subsidiaries as for the parent company.

Like any process, due diligence has its challenges. Here are a few mistakes that you should avoid:

-

Not performing the due diligence process as thoroughly as possible

-

Not clearly communicating information flow expectations to the target company

-

Not seeking expert advice

-

Relying on unverified financial or management information

-

Skipping assessment of short term forecasts

M&A Due Diligence Key Steps for Buyers

When performing due diligence, begin with the following steps. While the list is not complete (and changes with every transaction), it’s a good place to start. For a full breakdown of M&A processes, read this article.

-

Establish a file sharing site to exchange documents.

-

Use a due diligence template to prepare and organize the data room.

-

Have signed confidentiality agreements before exchanging documents.

-

Enable access to the data room for everyone on the team who will provide or examine documents.

-

Store and categorize all incoming information.

-

Continually update your checklist(s) as information comes in.

-

Closely examine all documents and records.

-

Ask questions as they arise during the examination of the documents.

-

Perform site visits and talk to the staff and management to get a fuller picture of the target business.

-

Compare sales and customer lists to make sure the business has all the clients it claims.

-

Check the business’s expansion plans.

-

Verify property ownership.

-

With an attorney, examine documents covering current or past lawsuits.

-

With an attorney, examine documents that might potentially incur liability (e.g., sales and purchase agreements).

-

Record discrepancies between what the company has reported and your actual findings.

-

Look at both future projections and past performance.

-

Check references.

-

Prepare a report to summarize your findings and help make your buying decision.

Venture Capital

When startups and other companies decide to raise funds from venture capital (VC) firms, they are subject to due diligence. This allows the VC to analyze the company, verify the accuracy and quality of the financial information, and ultimately gain insight into whether the company is worth the investment. The process helps finalize the transactions details, including how much the VC invests and what percentage of the company it owns.

The process begins after the term sheet is signed. The company will then provide the documents and information requested by the buyer, stored in an online data room. The timeline varies from deal to deal, but the company seeking capital should promptly provide feedback; this helps keep due diligence from dragging on. For even greater efficiency, if the company doesn’t have a requested item, they should verify that it’s necessary before creating it.

Larger investments and investments at later stages require enhanced due diligence. If the VC decides not to fund a company, remove their access to the data room.

Other Business Areas That Require Due Diligence

The term due diligence is common in many areas of business. Though it generally refers to a comprehensive assessment before closing a deal, it can have a different meaning depending on the practice. Below are some examples:

-

Annual Reports and Audited Financial Statements: Review the document to ensure that all facts and figures are accurate, and it includes all required information.

-

Financing Transactions (Public and Private): An underwriter performs due diligence to manage risk exposure.

-

Joint Ventures/Limited Partnerships: The organizations perform due diligence on each other before beginning their partnership.

-

Banking and Finance: Called customer due diligence in these industries, this is the assessment of a potential customer to ensure they are not involved in terrorist financing, money laundering, or other financial crimes.

-

IPOs: Similar to the VC process, in an IPO, the company's statements are examined and verified to make sure the business is sound enough to become a public company.

-

Real Estate (Commercial and Residential): A buyer and agent perform due diligence on a property on which they’ve made an offer to make sure it doesn't have any hidden defects.

-

Tax Preparation: Paid tax preparers must perform due diligence when preparing tax returns. If certain requirements are not met, they could be fined.

Individuals can also apply due diligence in their lives — for example, doing research before buying a product like a car or a mobile phone.

Step Up Due Diligence with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.