Benefits of Sales and Operations Planning

Sales and operations planning, sometimes called aggregate planning, started in the 1980s as a way to manage problems caused by overproduction or underproduction, including wasted resources, poor customer service, and the hit on a company’s bottom line. Before the 1980s, companies tended to rely on more siloed approaches, focusing planning efforts on the product level. Today, major companies such as Coca-Cola, Procter and Gamble, Eli Lilly, and Dow Chemical use sales and operations planning.

At its best, S&OP offers distinct benefits that old-school business plans can’t achieve:

- Better data and collaboration between departments allow for frequent adjustments in the supply chain, which better balances supply and demand.

- Companies can better optimize resources, which reduces waste and increases efficiency.

- In turn, this newfound efficiency enables companies to maximize their profitability continuously.

- Improved inventory and backlog management allows for more timely customer service.

- As companies stagnate, S&OP can fuel a resurgence by finding ways to adjust to changing internal or external conditions.

- Unbiased, more actionable data can lead to better Key Performance Indicators (KPIs) for each department, tying in directly with the company’s KPIs.

- As data flows more seamlessly between departments, it is more timely and accurate - this allows the company to operate off one set of numbers rather than siloed, disputable data. You may hear people in the field refer to “one set of numbers to run the business.”

Keep deals moving forward with sales pipeline management in Smartsheet

Smartsheet is a cloud-based platform that allows sales teams to effectively manage pipelines by creating one location to track and manage efforts, surface open and at-risk opportunities, and provide real-time visibility to improve forecasting. See Smartsheet in action.

Approaches to the Sales and Operations Planning Process

While approaches vary among industries and companies, they typically focus on a monthly S&OP planning process with a long-term planning horizon ranging from 18 to 36 months. The annual overall business plan ties in with all other company plans, which are regularly reviewed for alignment. Consistent, structured meetings (that require participant preparation), are held. These are often weekly meetings to prepare for the monthly S&OP executive meeting, where the big decisions are made; therefore, it’s essential to have the right people present. During the meeting, attendees review tactical plans in every area to ensure alignment with the company’s business plan. These typically include the sales, production, human resource, engineering, marketing, new product development (NPD), inventory/backlog, strategic initiatives, and financial plans. The meeting participants represent the various departments and are empowered to make decisions then and there, as is necessary for the process to work.

Companies may use top-down planning or bottom-up planning. In top-down planning, a single sales forecast drives the process: managers create tactical plans and divide resources based on that. Bottom-up planning is used when the manufacturing schedule isn’t stable: instead of operating from the top with a sales forecast, they work from the bottom by analyzing what is needed to produce various products or product families.

Once that work is complete, companies solidify production plans, which can be level, chased, or mixed. In level, production remains constant, usually to increase cost-efficiency and keep the cost of holding inventory low. In chased, production always chases demand. It’s used when the cost of gearing up is relatively low and/or when the inventory storage cost is high. In mixed production, a custom plan takes the best advantage of the various factors in different situations.

Step-by-Step Practices for the Sales and Operation Process

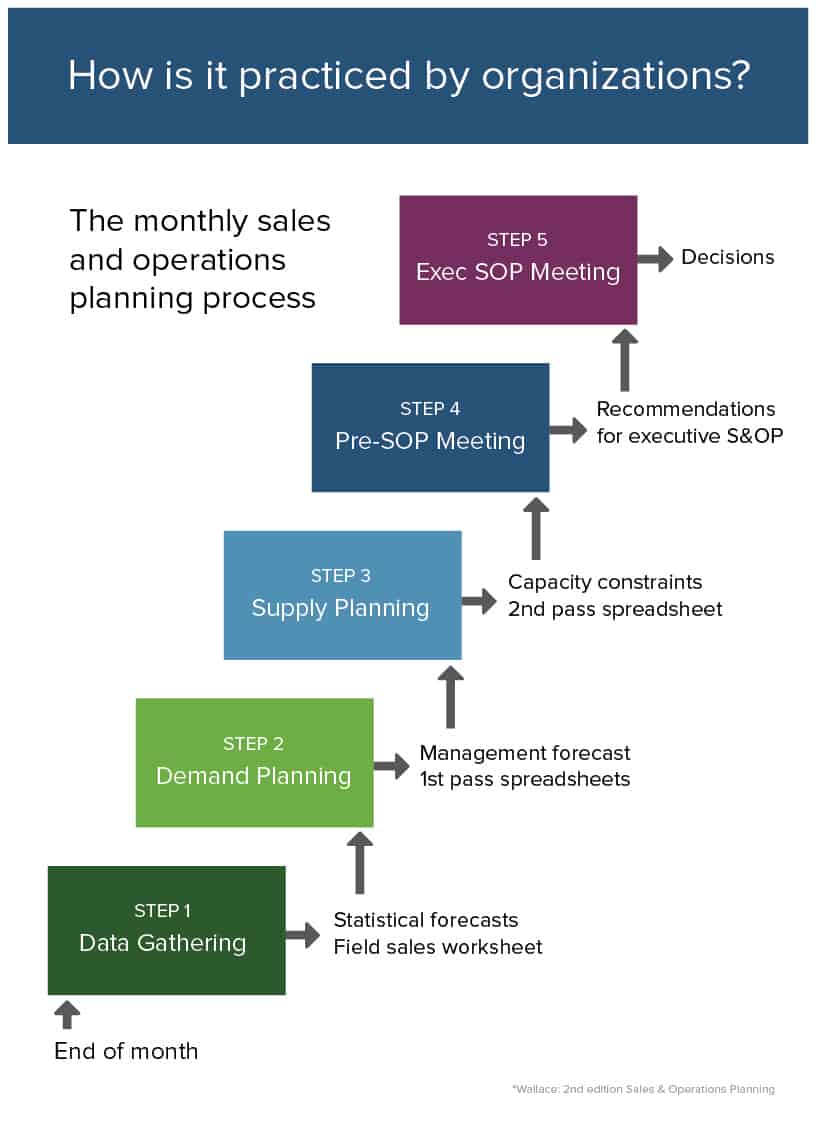

A company might follow one of a few slight variations of the step-by-step S&OP process. The accompanying graphic shows a monthly five-step process: data gathering, demand plan, supply plan, pre-S&OP, and finally the executive S&OP meeting, where decisions are made.

Sales and Operations Planning Tips from the Pros

He has been implementing S&OP best practices for more than 20 years in Asia and the U.S., previously with retailers such as Levi Strauss and Ermenegildo Zegna, and retail consultancy Kurt Salmon Associates. He advises focusing on people, process, and practice:

- People: “Ensure that the implementation is heavily cross-functional and that different functions are bringing different perspectives to the table. Ensure that people are engaged in the process by clarifying roles and accountabilities, fostering an environment for open discussions, and helping people understand that their most important role is in making sure that you smoothly hand off your finished product to the next person in the process.”

- Process: “Clearly define the end-to-end process steps, and delineate who is Responsible, Accountable, Consulted, Informed (RACI). Finally, develop a calendar so that activities are done timely, and make sure someone is facilitating that calendar.”

- Practice: “Make sure people understand that a well-executed S&OP process does not happen overnight, that it takes practice, and that it is OK to make mistakes along the way. Instilling a culture of continuous improvement is key.”

- “First, make sure a diverse group of people across the organization are able to participate in the process. S&OP is not just about balancing supply with demand, it is about aligning the organization. And without including people from across the organization, it’s easy to end up with a great plan that never gets executed.

- Second, if alignment is a key component of S&OP, there has to be something to align to, and this should be the high-level strategy for the organization. Effective S&OP isn’t a stand-alone effort, it really is the bridge between the strategy of the organization and operational execution. When strategy and S&OP are disconnected, you end up executing perfectly on all the wrong things.

- Third, as part of the plan, try to assume and predict where it will fail and build mitigation plans. This way, when challenges to the plan surface, the organization isn’t caught off guard. Rather, they anticipated them and already know what to do about them.”

- “Never lose sight that the goal is to increase profitable revenues. Too many companies morph this planning process into a new department, a new set of procedures, bureaucratic stuff that strangles selling.

- Cross-selling between business units is hard for lots of reasons. Everyone who isn’t in the field thinks it’s easy. There are lots of legitimate barriers. Do not expect a guy in Unit A to sell products made by Unit B. That is never going to happen. Incentives must be such that the guy in Unit A is encouraged to get his customer to buy something from Unit B. This incentive can be a finder’s fee, a referral fee, or something else. And Unit B has to teach Unit A, not how to sell, but how to recognize opportunities for Unit B (and vice-versa). Have low expectations. Even though it is the Holy Grail for many multi-product, multi-division companies, success is elusive.

- One good objective … is to design a product forecasting system that overlays Units A and B. Forecasting is tough, but doable. A good forecasting model helps balance inventory, directs supply chain managers, and impacts sales compensation. A good management technique is to establish a three-month task force to get it done, and include salespeople on the task force. If it goes past three months, it is doomed.”

- Make sure different departments are speaking the same local language. Take the time to be clear. Many times, they’re using terms differently. “I don’t think sales and operations necessarily understand each other. … It boils down to communication.”

- To do a good sales forecast, account for changing circumstances. Historical data needs to be placed in the context of what’s happening now. At a smaller company, a top seller’s personal problem, such as a divorce, could even have a large impact. “Base your forecast off of real events.”

Here’s a quick look at more sales and operational planning tips and best practices:

- Be aware that the biggest factors affecting a business are often external, so create S&OP initiatives to deal with them. External factors include the actions of your customers, partners, and competitors, among other things.

- Leaders need to step in to get beyond department conflicts that can otherwise drag down the whole company.

- Use technology, including S&OP dashboards and spreadsheets, to communicate key company information.

- Integrate supply data with demand data. Too often, various spreadsheets and systems don’t “talk” to each other effectively, which results in siloed data.

- Don't get lost in data. Focus on what really matters with KPIs, both within teams and company-wide.

- Use S&OP to deal with an unconstrained demand for products. Too often, companies don’t temper their sales goals with a realistic view of what they can supply, especially in the short term. S&OP helps balance supply and demand.

- Use a phased, incremental approach to developing S&OP. Remember, it doesn’t happen overnight.

How to Know if Your Sales and Operation Plan Is Successful

Here’s how you know when you’re succeeding, says Dalai: “At a simplistic level, people are not blaming each other; rather, they are admitting mistakes, praising good efforts, and lending help to other people on the team when needed. When most of the conversation is about what the other person or function did wrong, it is a good indication that S&OP is not working well. More technically, there are KPI’s related to how well the sales and operation plan is working; for example, in retail, KPIs would be:

- High stock fill rates or low stock-out rates

- Good inventory turns and high sell-throughs

- Timely execution of inventory flows from the factory to distribution center to the shop.”

As Dalai notes, different industries and companies will have their own KPIs to measure S&OP success.

As the Choice Group’s Brost explains, “To know if your plan is succeeding requires answering two questions. First, did we execute the plan we had in place? And second, did we achieve the results we hoped for? The first question has to be answered first because it is your leading indicator. You can never know if the plan was successful until you know if you actually executed the plan. Once you know if you executed the plan, then you can ask if it delivered the desired results; these desired results should have been defined as part of the plan. For example, what ROI can we identify from our investment of resources in various parts of the plan?, and what ROI do we require to justify those investments?”

Understanding Sales and Operations Planning Terms

Terminology can get confusing, as different people often have differing interpretations. Here are answers to frequently asked questions regarding S&OP-related topics and organizations.

- How does a sales plan differ from a sales operations plan? A sales plan typically sets sales goals and describes tactics to achieve them. A sales operations plan may refer to either a sales operations department plan, or to the entire concept of sales and operations planning (S&OP).

- What is aggregate planning? This term is sometimes used interchangeably with sales and operations planning (S&OP). More specifically, it may refer to production planning that gives executives a view into necessary resources and their costs.

- What is integrated business planning? This is similar to sales and operations planning in that it involves planning throughout the supply chain. Some may use the term interchangeably with S&OP, while others say it’s an extension of S&OP (or a more mature version of it).

- What is an operational plan? A detailed plan that specifies how a team or department will contribute to the company’s goals.

- What does AOP mean? The annual operations plan (AOP) lays out the company’s targets for sales and supply.

- What is Enterprise Resource Planning? Enterprise resource planning (ERP) is the system or process by which a company (usually a manufacturer) integrates its various departments. ERP software tries to incorporate key pieces of information from the departments or teams.

- What is the Institute for Supply Management? It is a nonprofit, educational organization for people employed in the supply management profession.

- What is the Supply Chain Council? In 2014, the Supply Chain Council merged into the American Production and Inventory Control Society, or APICS. The council is now known as the APICS Supply Chain Council.

- What is the SCOR planning model? The Supply Chain Operations Reference (SCOR) model is endorsed by the Supply Chain Council. It’s a cross-industry, standard diagnostic tool for supply chain management.

- What is SOP vs. S&OP? SOP is completely different. It stands for standard operating procedure, and is a set way of performing tasks in a given organization.

Common Challenges in Sales and Operations Planning

Challenges in sales and operations planning are common. A 2013-14 survey by Supply Chain Insights found that only 43 percent of companies say their S&OP process is effective. Here’s what the experts say about the most common difficulties in sales and operations planning today:

Suresh Dalai: “It [the challenge] is in the quality of the collaboration among functional team members. Each member has to know their role, be accountable, and make sure that each member communicates well so that the next person in the process understands what the person before him/her has done. And when mistakes occur, team members need to be able to come together and openly discuss what/who came up short and learn from it. In fact, a process does not have to be great. The people - and how well they work together - can make it great.”

Kyle Brost: “The reality of S&OP is that it’s a process heavily reliant on historical data, which very likely doesn’t predict the future. Recognize going into the process that a number of market and organizational factors will influence the success of your sales and operations plan. The biggest challenge is being able to identify patterns and draw connections between internal and external factors that may influence supply/demand and your S&OP process. Because this is challenging, too many organizations default to just relying on the historical supply and demand data that they have. Additionally, recent sales and operations experiences often get weighted more than they should, because they are fresh in people’s minds. Try to avoid making big decisions based on a single recent experience.”

Ali Mirza: Sales forecasting remains a frequent problem. It’s often arbitrary, such as a five percent sales growth being based more off of where the company wants to be than what it can realistically achieve. “Sales managers are expected to grow their territory, so they forecast a growth goal. … Nine times out of 10, the forecast is incorrect,’’ Mirza says. People in sales will often say that it’s not arbitrary, that they do have a rationale behind the forecast, but “typically, the rationale and logic is also flawed.” They need to consider the various changing factors at play and not just look at the historical data.

Here’s an overview of other common S&OP difficulties:

- Sudden changes in supply and demand (such as with a new product)

- Lack of executive support

- Inadequate engagement between departments

- Focusing on a single target number instead of a range

- Too many numbers and not enough focus

- Conflicting numbers

- Lack of documentation (which leads to repeating history)

- S&OP software that requires organizational change for effective use

- Organizational change required by the process itself

- An S&OP leader who doesn’t act as the necessary profit center manager

- Executives who fail to understand supply chain complexity

- Translating the planning process to effective execution

What Does the Future Look Like for Sales and Operations Planning?

Two experts weighed in on the future for sales and operations planning.

Dalai sees people as being key to the future. “Increasingly sophisticated technologies and analytics will continue to be released to improve the S&OP process and effectiveness. However, at the end of the day, it is the cross-functional collaboration - people understanding what they have to do and trusting that other people will do their part - that drives success in S&OP. And this cannot be achieved by technology or analytics,” he says.

Brost foresees S&OP having a growing relationship with Organizational Network Analysis, a structured way of visualizing how information and decisions flow in an organization. “I see S&OP and Organizational Network Analysis merging in time. The best business decisions are usually arrived at by combining quantitative data with qualitative data - S&OP is the quantitative piece and Organizational Network Analysis is the qualitative piece,” he says. “Also, executing on the sales and operations plan requires strong insight about how work is actually done in the organization, not just how the processes are mapped on paper. When organizations can combine these two approaches, the result will be a much more powerful plan that factors in the nuances of the organization itself.”

Effectively Manage Sales Operations Planning with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.