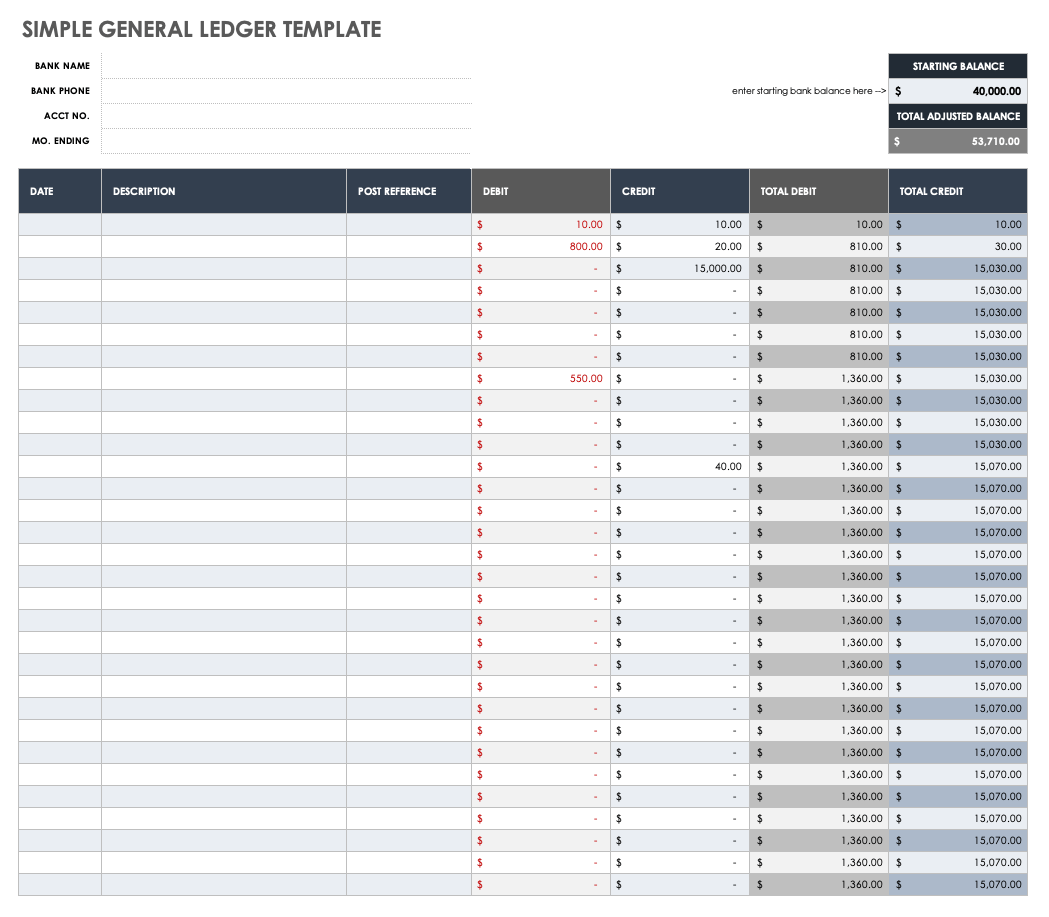

Simple General Ledger Template

Download Simple General Ledger Template

Microsoft Excel

|

Microsoft Word

| Google Sheets

Use this simple general ledger template to gain insight into your business’s financial data and debit and credit accounting records. Add the account name and number, item date and details, and post reference, such as asset, liability, or revenue for each transaction. Then, enter the debit or credit figures so that you can account for every transaction and determine your bottom line.

See our free small business income-related resources for additional small business income tools.

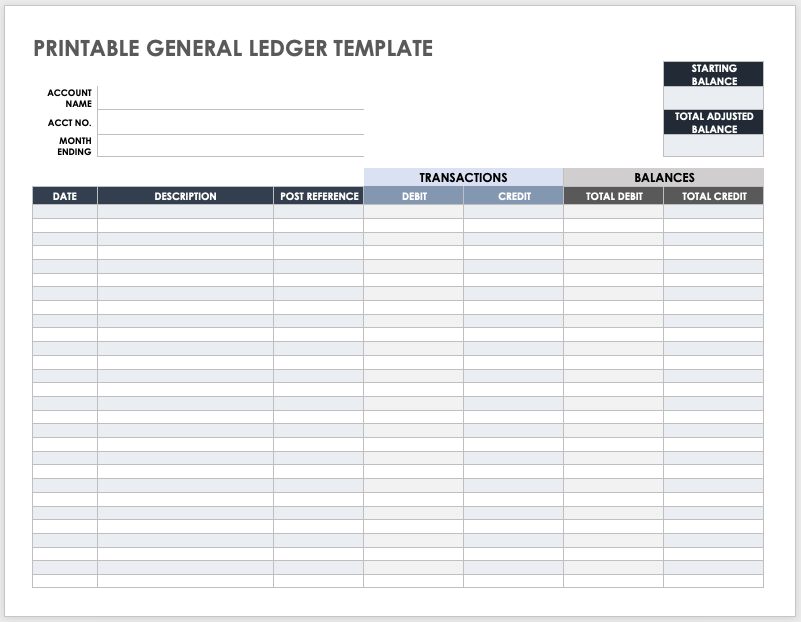

Printable General Ledger Template

Download Printable General Ledger Template

Microsoft Excel

|

Microsoft Word

|

Adobe PDF

| Google Docs | Google Sheets

Track your business’s overall financial status with this printable general ledger template, which includes space to add line-by-line transactions for all account types, such as assets, liabilities, owner’s equity, revenue, and expenses. Enter transaction date, description, journal reference, transaction amount, and debit and credit balances for insight into individual transaction variances. This shareable template is the perfect tool to help you meet your budget-balancing goals.

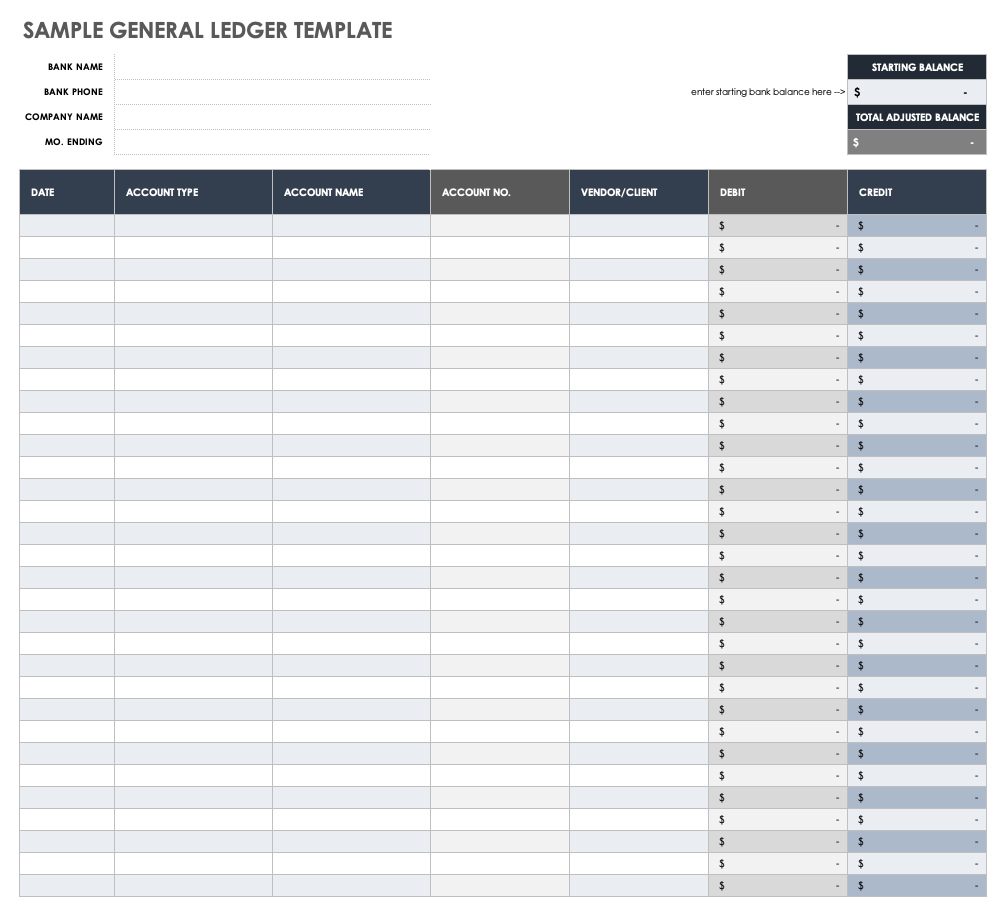

Sample General Ledger Template

Download Sample General Ledger Template

Microsoft Excel

| Google Sheets

Use this sample general ledger template with example text and figures to track financial transactions. Enter each transaction date, account type, general ledger account name and number, vendor or client name, and debit or credit figures. View transactions in a month-by-month, quarterly, or annual view for easy and accurate financial reporting.

For additional general ledger-related resources, see our comprehensive list of profit and loss (P&L) templates for small business.

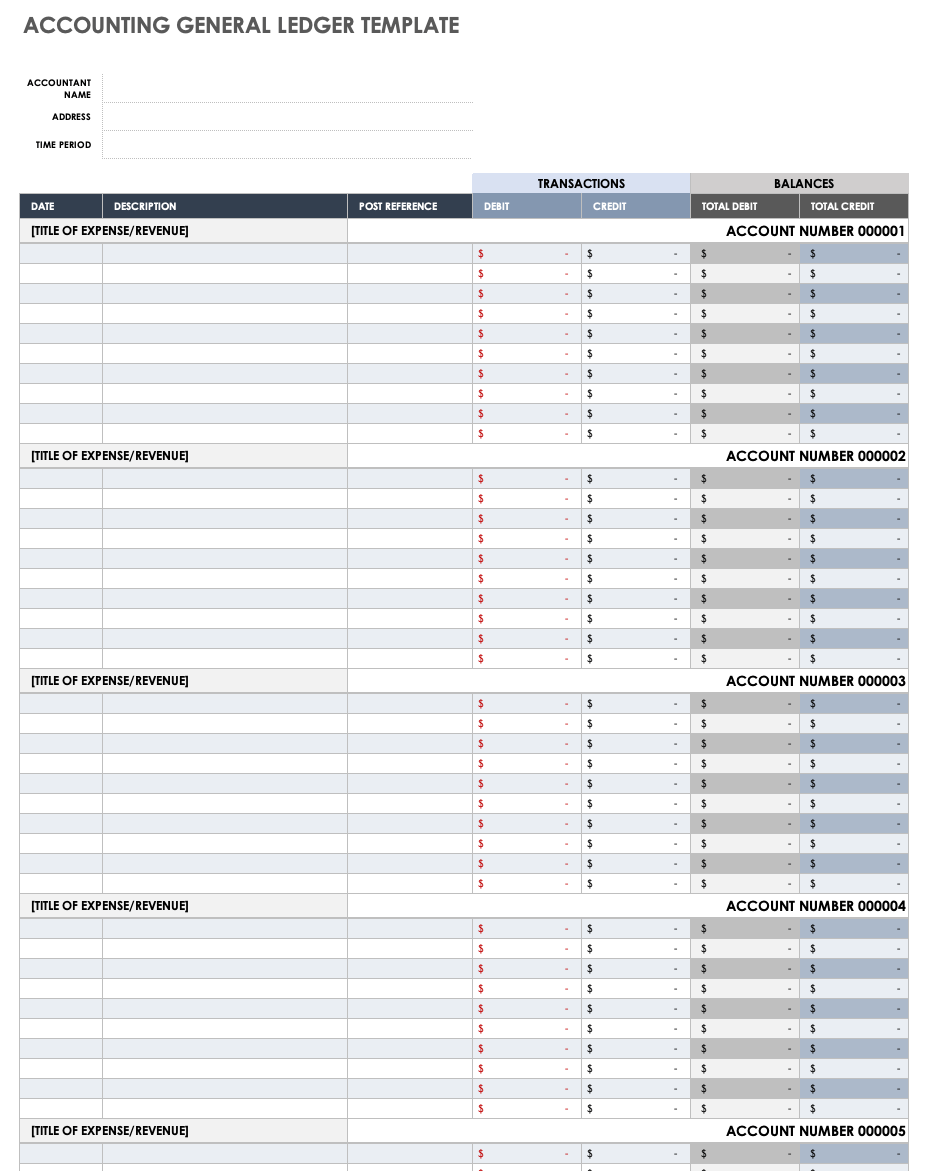

Accounting General Ledger Template

Download Accounting General Ledger Template

Microsoft Excel

|

Adobe PDF

| Google Sheets

This template is ideal for accounting team members who need a comprehensive record of all financial transactions. Use this template to ensure an accurate record of all line-item transactions for any journal entry or transaction type. Save this accounting general ledger template as a one-off file, or share it as a template with your accounting team to standardize financial reporting practices.

See our collection of Excel accounting templates for additional accounting resources.

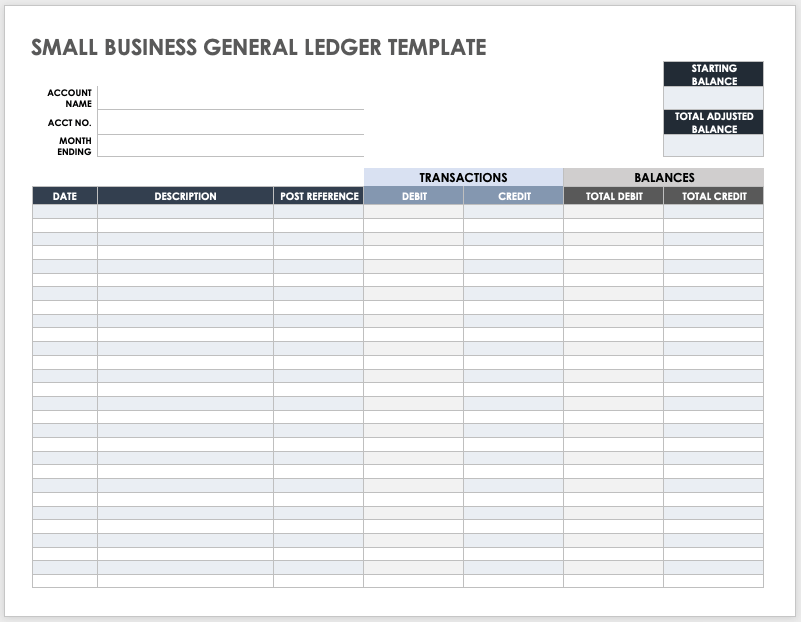

Small Business General Ledger Template

Download Small Business General Ledger Template

Microsoft Excel

|

Microsoft Word

| Google Sheets

Use this small business general ledger template to oversee transactions and track your small business’s overall fiscal health. At the top of the ledger, enter the account information and reporting period. For each transaction, record the date, details, post reference, and debit and credit figures to keep an accurate record of all transactions.

See our free small business bookkeeping resources for additional bookkeeping tools.

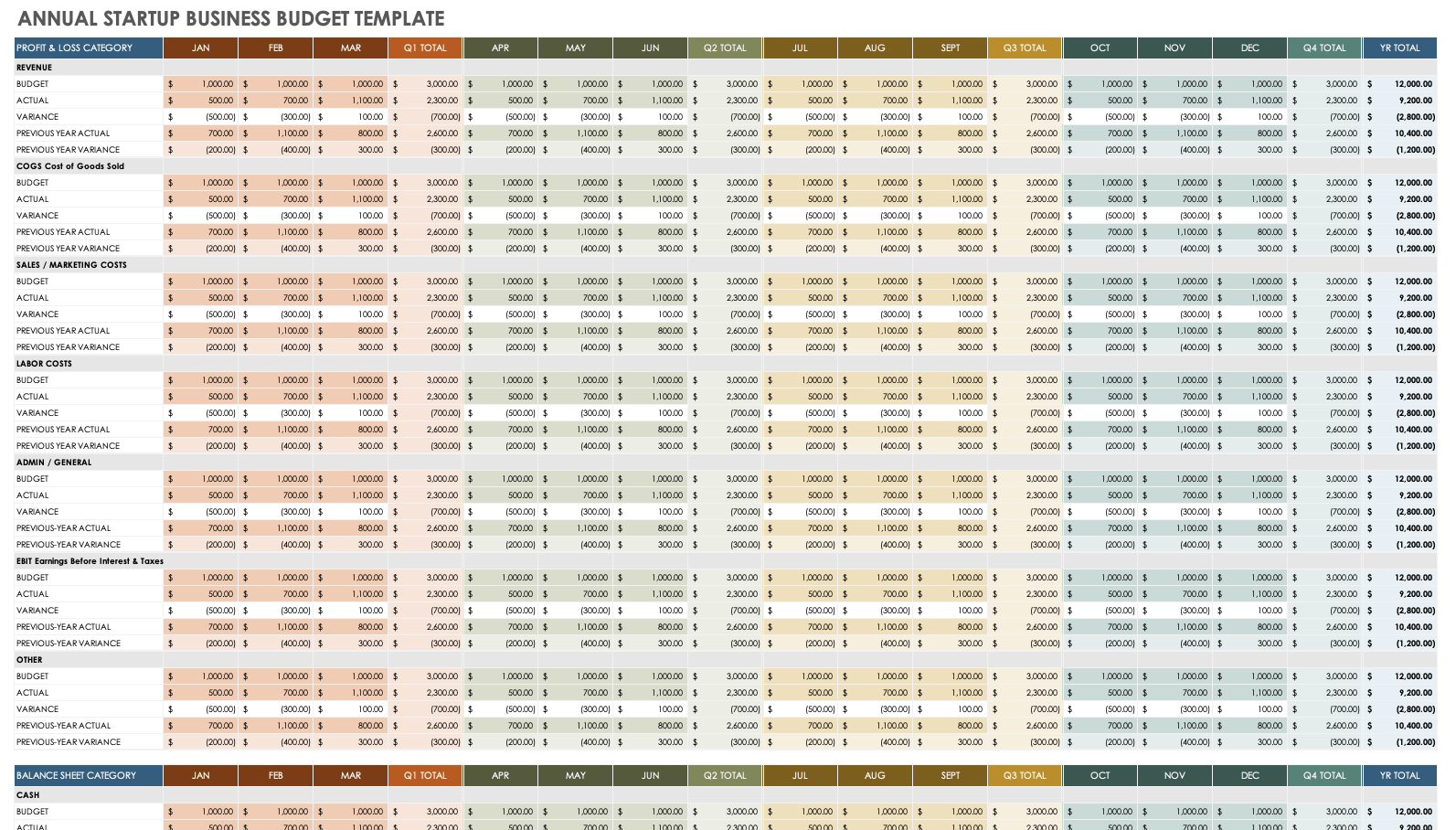

Annual Startup Business Budget Template

Download Annual Startup Business Budget Template

Microsoft Excel

| Google Sheets

Compare your startup’s revenues and expenses on a month-by-month, quarter-by-quarter, and year-over-year basis with this startup business budget template. Enter expenses, such as wages or operational and marketing costs, and revenue sources, such as commissions, sales, and investments. A dynamic Summary tab provides a dashboard view of budgeted expenses compared to revenue so that you can easily review and share key financial information.

For more small business budgeting and balance sheet resources, see our list of downloadable small business balance sheet templates.

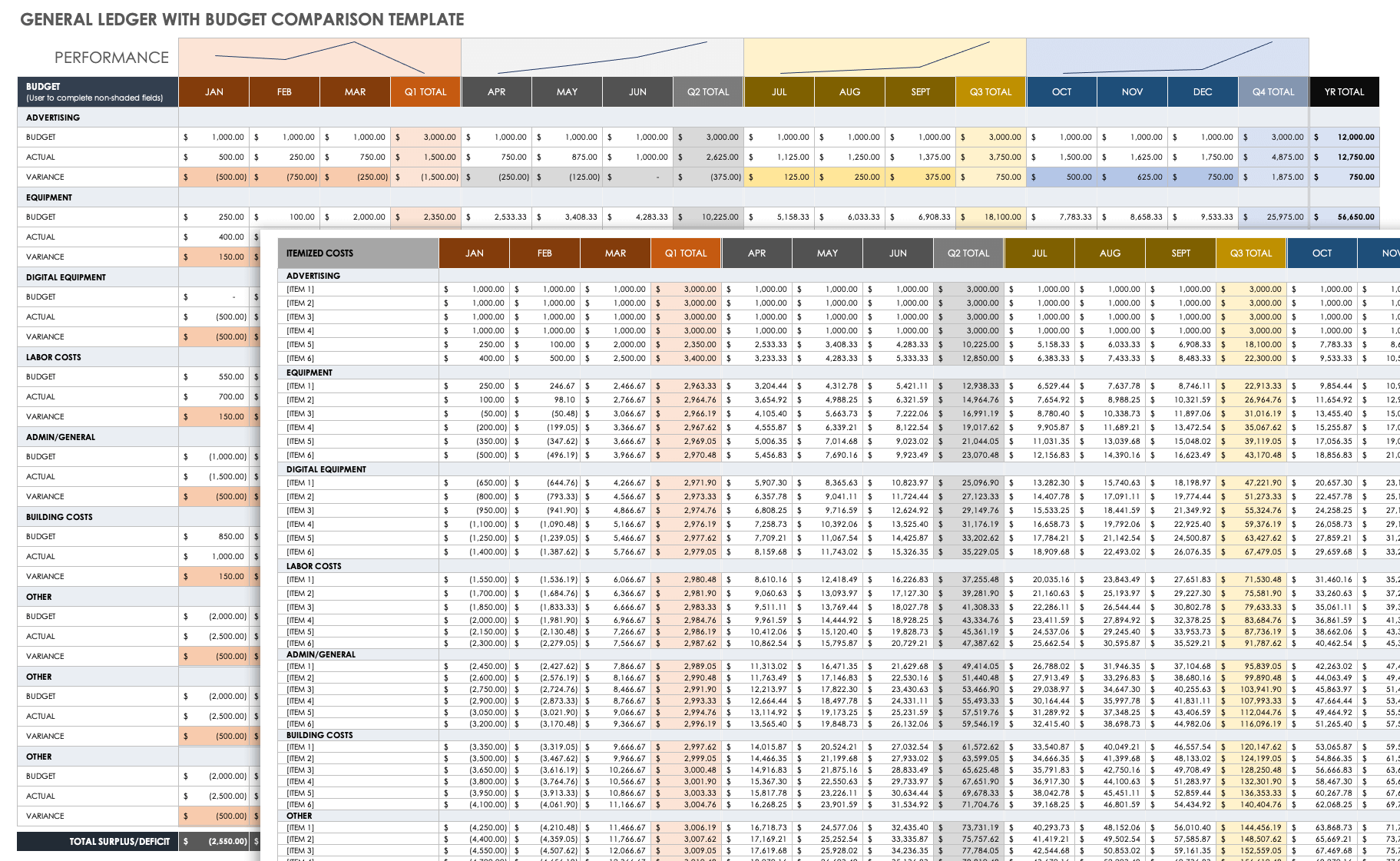

General Ledger with Budget Comparison Template

Download General Ledger with Budget Comparison Template

Microsoft Excel

| Google Sheets

Capture important insights on the overall financial health of your company with this dynamic general ledger template with budget-comparison capabilities. This template includes a year-to-date (YTD) budget summary sheet for recording the budgeted and actual amounts of transactions. A Monthly Expenses Summary tab enables you to add general ledger codes for each monthly expense.

To find more templates and advice on tracking small business expenses, see our comprehensive list of small business expense templates.

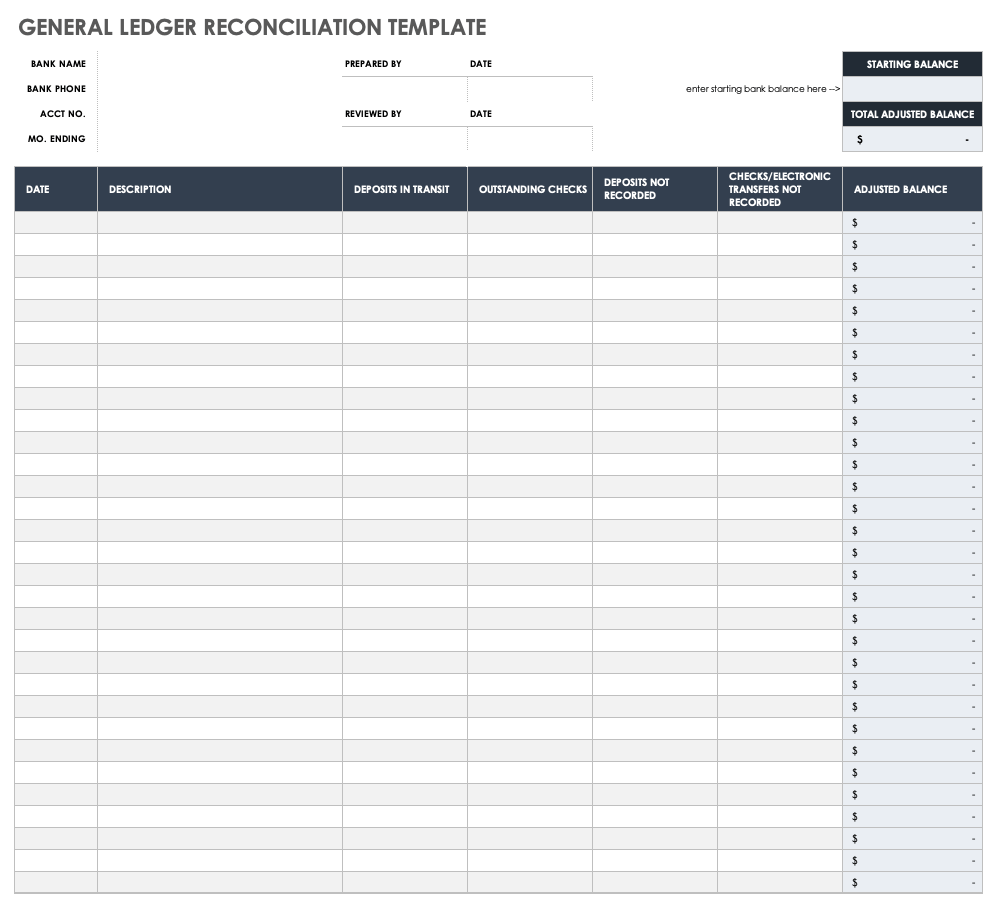

General Ledger Reconciliation Template

Download General Ledger Reconciliation Template

Microsoft Excel

| Google Sheets

Use this general ledger reconciliation template to record your company’s financial data and reconcile all accounts. This template enables you to enter the balance from your bank statement or subledger and from your general ledger to determine whether you need to adjust amounts. This template is the perfect tool to help you verify the accuracy of your company’s account balances compared to bank figures and ensure the integrity of your general ledger.

Find more account reconciliation templates in our comprehensive collection.

What Is a General Ledger Template?

A general ledger template is a record of the income and expenses that affect your company’s bottom line. A general ledger template can help you record and monitor your financial data to ensure your debits and credits reflect your budget.

Using a general ledger template provides insight into your business’s financial health by helping you track debit and credit transactions and compare assets and liabilities. A general ledger is the centralized document for all details relating to your company’s financial status, including liabilities, assets, owner’s equity, expenses, and revenue. To balance your general ledger, your credits and debits must be equal.

The general ledger includes data from subledgers, such as accounts receivable, accounts payable, fixed assets, cash management, and purchasing, to help you determine whether your company’s assets are sufficient to meet operating costs, or if you need to increase revenue to cover expenses.

To ensure that your company accounts for all of your debits and expenditures, a general ledger template should include the following details:

- Account Name: The name of the account for the line-item credit or debit figure.

- Account Number: The unique account number for the line-item credit or debit figure.

- Balance: The total credits minus the total debits.

- Credit: The increase in liability, equity, and revenue or the decrease in expenses, assets, or dividends for each transaction line item, also called a CR.

- Debit: The increase in assets or the decrease in liabilities for each transaction line item, also called a DR.

- Item Date: The date the line-item debit or credit figure was entered into the general ledger.

- Item Details: A description of the line-item debit or credit figure.

- Post Reference: The location or subledger name where each transaction was recorded, sometimes called a PR or journal reference.

- Report Date: The date the general ledger was created or updated.

Stay on Top of Small Business Finances with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.