What Is a Merger and Acquisition Process?

The phrase mergers and acquisitions (M&A) refers to the consolidation of multiple business entities and assets through a series of financial transactions. The merger and acquisition process includes all the steps involved in merging or acquiring a company, from start to finish. This includes all planning, research, due diligence, closing, and implementation activities, which we will discuss in depth in this article.

Motivations and Considerations for an M&A Deal

Companies choose to pursue a merger or acquisition for a variety of reasons — most commonly to achieve economies of scope or scale, to diversify, to transfer resources, or to cross-sell a different product or service to an existing customer. Other motivations include uniting common products (that often perform in different markets), gaining market share, or in the case of international M&A, entering a foreign market.

For more information about the motivations and strategies behind M&A, read this article.

Considerations for Executing M&A

You must take many factors into consideration when deciding not only if you’re going to pursue a merger or acquisition, but also how you’re going to execute the deal. M&A can be an extremely laborious and involved process, so ensure you spend adequate time and resources exploring the following:

- Financing the Deal: Will you pursue a stock or asset deal? Also, think about additional costs, such as tax implications (which will differ based on the type of deal you pursue), capital expenditures, comparative ratios, and replacement costs.

- Rival Bidders: As the buyer, don’t assume that you are the only party interested in the target company. As the target company, you should explore multiple bids rather than accept the first option.

- Target Closing Date: Keep your ideal timeline in mind. The deal will inevitably take longer than you anticipate, but tracking against a general schedule can help expedite processes and limit stalling. Each party should be aware of the other’s timeline as well.

- Market Conditions: Outside forces, such as trends in your product marketplace (or the larger economy), will undoubtedly affect the success of a merger or acquisition. Spend time on product and market forecasting — and consult outside experts when necessary — to improve your chances of executing a worthwhile and financially valuable deal.

- Laws: Understand the relevant corporate and antitrust laws, as well as securities regulations, when moving through your M&A deal. Additionally, be aware of any exclusivity agreements as you move through the process.

How Long Does the M&A Process Take?

The length of the M&A process can take anywhere from six months to several years, depending on the complexity of the deal. While it can be helpful to draft a timeline and target a closing date for tracking purposes, understand that delays are inevitable, so build in time for change.

Roles and Responsibilities in the M&A Process

Most mergers and acquisitions involve a standard slate of characters. Below is a list of the critical roles and responsibilities in a typical M&A deal:

- CEO: Ultimately, the CEO signs off on the deal and is responsible for making the decision based on demonstrated risks and rewards.

- CFO: The CFO is arguably one of the most critical actors in any M&A deal. The CFO is responsible for evaluating the financial risks, liabilities, and rewards of the deal, managing the due diligence process, and reporting this information to the CEO.

- External Consultant: Many companies involve a third-party consultant to help with the due diligence and valuation processes. An external evaluation can remove any emotional bias from the equation, so you can face the numbers objectively.

- Investment Bankers: In M&A, investment bankers act as financial advisors and represent either the buyer or seller during the process.

- Legal: Most companies seek external legal help to guide them through the deal and ensure that they meet all legal parameters.

The Benefits of M&A

When you execute a merger or acquisition strategically and intelligently, you enhance your company’s competitive position in the market and improve its financial credit. In addition, the M&A allows you to enhance business relationships, expand your offering of products and services, heighten brand recognition, and increase capacity at a lower cost.

What Are the Steps in the Merger and Acquisition Process?

In this section, we’ll walk you through the critical steps in the M&A process for both the buy and sell sides.

For additional help navigating the process of M&A, you can find 20 of the most useful merger and acquisition templates — for everything from planning to valuation to integration — in this article.

Steps on the Buy Side of an M&A

- Develop an acquisition strategy. The first thing a buyer needs to do is strategize about how they will pursue an acquisition. Define what you hope to accomplish by purchasing another company, and take into consideration the current market conditions, your financial position, and future projections.

- Set M&A search criteria. Once you’ve defined your M&A goals, make a profile of your ideal merger or acquisition. What should this company provide? Consider company size, financial position (profit margins), products or services offered, customer base, culture, and any other factors pertinent to your position as a buyer. You will further scrutinize all of these factors during the valuation and due diligence phases, but it’s important to set general criteria at the outset, so you don’t waste time entertaining suboptimal candidates.

- Search for potential target companies. After you’ve set your criteria, you can begin your search for ideal companies. At this stage, with the information available, you should perform a brief evaluation of the potential target companies.

- Start acquisition planning. Now is the time to make initial contact with your candidates (typically only one or two). As the buyer, you should send a letter of intent (LOI) or teaser, in which you express interest in pursuing a merger or acquisition and provide a summary of the proposed deal. (At this point, any proposal should be very high-level, as it’s subject to change.) In addition to kicking off the conversation with the target company, sending an LOI is also a good way to get more of the information that you will use in valuation.

- Perform valuation. This is one of the most critical steps in the M&A process. Here, the target company provides the buyer with important information about its business — namely, financials — so the buyer can evaluate its value, both as a stand-alone company and as a potential merger or acquisition. In addition to financial analysis, you must also consider culture fit, external conditions that might affect the success of the deal, timing, and other forms of synergy. Ideally, you should produce multiple valuation models that can help you decide whether or not to pursue a deal. It’s common to hire outside counsel to perform (or assist with) valuation.

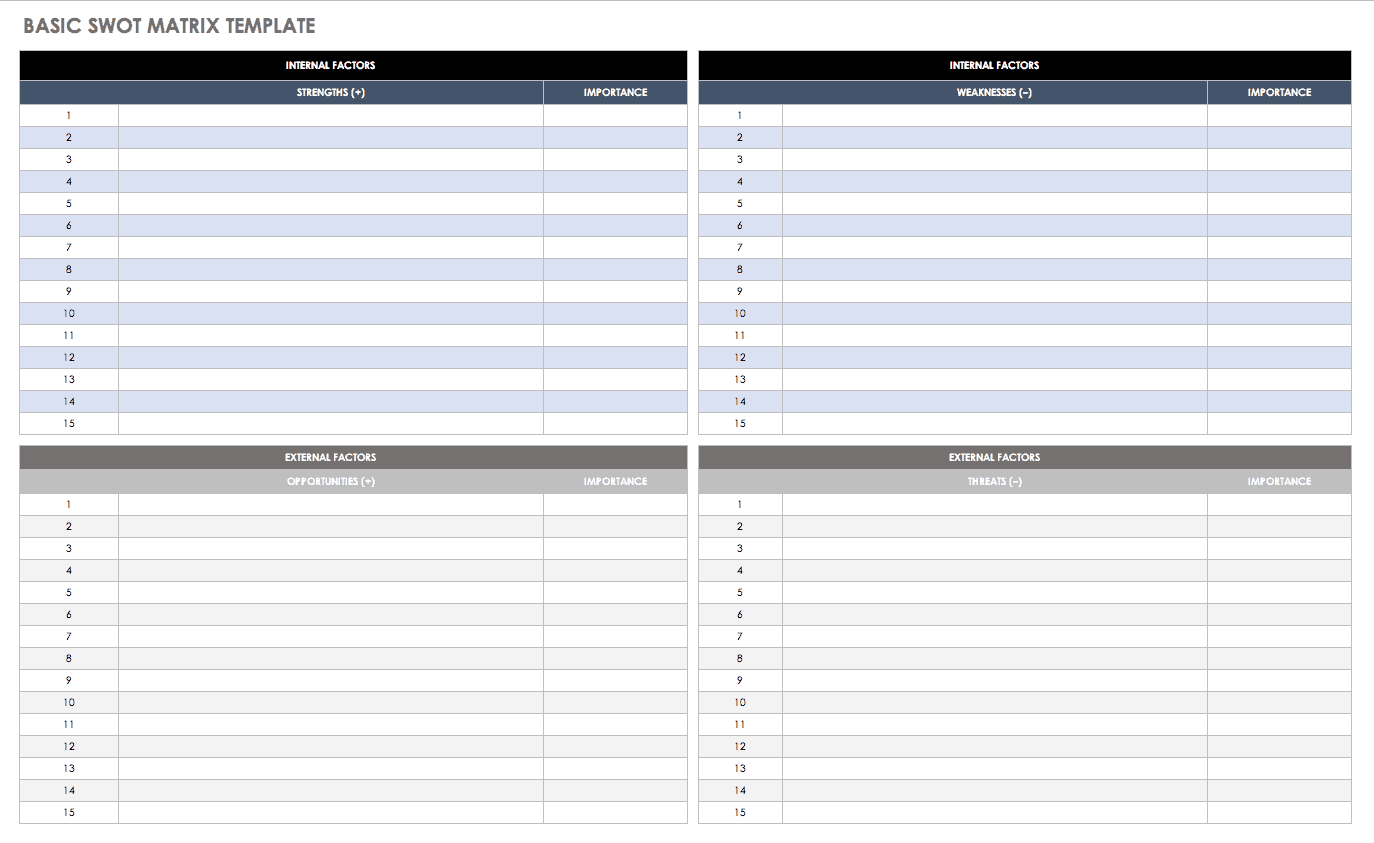

You might also consider performing a SWOT (strengths, weaknesses, opportunities, and threats) analysis for the target company. Use the basic SWOT analysis template below to document all the factors affecting your decision, and find more tailored SWOT analysis templates here.

Download Basic SWOT Matrix Template

- Negotiate and sign the deal. This is the point where you make a “go/no go” call. Use the products of your valuation models to create an initial deal, then present that deal to the target company. Next, you’ll enter a period of negotiations; the deal is finalized once both parties agree to and sign the deal.

- Perform due diligence. In M&A, due diligence refers to the evaluations you perform to ensure every detail is in order before you finalize a transaction. At this stage, the buyer should create financial modeling and operational analysis, as well as assess the culture fit of the two firms. The LOI should provide a ballpark for the timeline of due diligence (typically 30-60 days), but the schedule will vary depending on the firm. To get started, check out this comprehensive list of free due diligence templates.

- Create purchase and sale contracts. Once you’ve completed due diligence — assuming you haven’t uncovered any major issues — you write the final purchase and sale contracts, including the type of purchase agreement you are entering (i.e., a stock or asset sale). Once all relevant parties sign these contracts, the deal is considered closed.

- Create the final financing strategy. While you’ll already have conducted analysis and created a strategy around finances at this point, you may still have to make adjustments when the final purchase and sale contracts are signed.

- Begin integration. Once you’ve finalized the deal, you can begin the work of integrating the two firms. This takes planning on all fronts — finances, organizational structure, roles and responsibilities, culture, etc. — and is an ongoing effort that you should continually monitor and evaluate for many months (and even years) to come.

Steps on the Sell Side of an M&A

It helps to organize sell-side processes into larger phases:

Phase One: Prepare for the Sale

- Define the strategy. As the seller, you must know your goals when entering a potential sale — even if you don’t end up getting acquired. The executive team, along with any outside counsel you solicit, should define the objectives of pursuing a sale and identify your ideal buyers (or buyer qualities). Be realistic and allow your company’s financial and market decisions to help drive your strategy.

- Compile the materials. Once you’ve committed to pursuing a sale, you need to make a comprehensive kit that formally presents your company to potential buyers. If you are working with investment bankers on the sale, they will prepare a confidential information memorandum (CIM), a 50-plus-page document that includes information about your company’s financials, market position, and products and services. (A CIM is also called an offering memorandum or information memorandum.) From there, you can extract information from the CIM to create shorter pieces of documentation, such as a teaser, marketing materials, or an executive marketing plan, which you can share with potential buyers.

Phase Two: Hold Bidding Rounds

- Make contact with buyers. This can happen one of two ways: the buyer contacts you, or you contact them. Be strategic about who you select — of course, you want to make contact with more than one potential buyer, but don’t overwhelm yourself with options or waste time on unlikely candidates.

- Receive starting bids. Once you’ve made initial contact and the potential buyers have reviewed your materials, you’ll start receiving bids. Don’t settle for the first offer, and be shrewd about what deeper information you provide bidders at this point.

- Meet with interested bidders. Conduct management meetings with interested bidders to learn more about these companies’ intents, needs, and proposed offerings.

- Receive the LOI: Those still interested will send you a letter of intent, in which they explicitly express interest in pursuing a merger or acquisition and provide a summary of the proposed deal. You may receive multiple LOIs from multiple bidders.

Phase Three: Negotiate

- Negotiate with all buyers who submit bids. Once you’ve received bids from all interested companies, negotiate. Refer to the strategic intent you laid out at the beginning of the process, and invoke external expertise. Also, by this time, be sure you have all the financial information that’s available, should you move forward with a deal.

- Draft the definitive agreement. Buyers and sellers work together to draft a final deal.

- Enter into an exclusivity agreement. You are now locked into an exclusive deal with the buyer — you can’t pursue further negotiations or solicit interest from other potential buyers.

- Help facilitate the buyer’s due diligence. It can take more than two months for the buyer to complete their due diligence evaluations, but you, as the seller, can help expedite the process. Prepare all documentation ahead of time, and stay in close contact throughout the process, so you can swiftly handle issues as they arise.

- Get final board approval. When the buyer has completed due diligence and plans to move forward, solicit final board approval.

- Sign the definitive agreement. Once you sign the final agreement, the deal is closed — you have either merged with or been acquired by another company, and integration begins.

What Is an M&A Process Letter?

Also known as a bid process letter or bid procedure letter, an M&A process letter accompanies the confidential information memorandum (CIM) in an M&A auction. The process letter typically provides information on the M&A auction schedule, instructions, and contact information for all future communication, as well as any terms that the bidders must include if they make an offer.

M&A Best Practices

M&A is a complicated process that relies on deep analysis, attention to detail, and compromise. Below is a list of additional best practices, in approximate chronological order:

For the Buy Side:

- Approach the target company diplomatically. Understand the company’s position before initiating contact, and be sensitive to how it might receive your offer.

- Find and retain experienced leadership/advisors.

- Keep culture fit in mind — from first contact through integration.

- Develop trust between the intermediary and seller (if you’re using a third-party consultant or legal team). Keep communication open among all parties throughout the process.

- Create a transition plan, so you don’t head into integration blindly.

- Continually monitor the success of the merger or acquisition over time.

For the Sell Side:

- Don’t jump at the first offer. Know the strength of your position, and involve outside advisors if you need help with this analysis.

- Find and retain experienced leadership/advisors who will have your best interests in mind.

- Engage in conversations with real-world buyers rather than relying on analysis. Doing so will strengthen your position and savvy; it will also present an opportunity to bolster business relationships.

- Bring multiple buyers to the table to increase value.

Throughout the process, issues are bound to arise on both the buy and sell sides. Both parties should resist the urge to get too emotional or latch onto highs and lows — instead, solicit help when you need it, and keep communication open and honest.

Once you progress to the integration phase, be sure to perform periodic reviews on personnel, products, and operations. Successful integration relies on continually paying attention to what is and isn’t working and finding ways to compromise rather than set hard and fast rules for how the business will continue as one entity.

The Role of Automation in M&A

Automated software can be useful to the M&A process in a number of ways, including the following:

- Automated software can help with management: scheduling, timeline, collaboration, etc.

- Automated software can help with data transfer/integration.