What Is a Cash Flow Projection?

A cash flow projection is an estimate of a business’s future cash inflows and outflows over a specific period, such as a month, quarter, or year. It helps businesses predict cash shortages, plan expenses, and ensure they have liquidity to cover operating costs.

“A cash flow projection is a simple spreadsheet that you use to predict how much money you or your business will have in your accounts at a given time in the future,” says Charles Reinhardt, Principal at Advice Party. “You calculate those amounts by inputting the money you expect to receive (inflows) and spend (outflows) over a specific period of time. These can be income, loans, outside investments, equipment spending, and even payments to yourself.”

Cash flow projections fall under the larger umbrella of financial forecasting and planning, which you can learn about in our guides to operating cash flows and project-based cash flow analysis.

How to Do a Cash Flow Projection

To create a cash flow projection, start with your beginning cash balance, then estimate incoming cash from sales, investments, or other sources. Next, list all expected expenses, including fixed and variable costs. Subtract total outflows from inflows to determine your projected cash balance. Update regularly for accuracy.

Here is a step-by-step guide to building a cash flow projection, with advice from seasoned experts:

- Choose Your Cash Flow Projection Timeframe

Start by selecting the right projection time frame based on your business’s needs. Most businesses will choose monthly projections that cover a three- to 12-month period.

“You should start off by deciding on the time interval you need,” says Reinhardt of Advice Party. “Most businesses use monthly cash flow projections, but you can do weekly or quarterly. Typically, the shorter the time interval, the more sensitive the cash situation. A weekly cash flow is often used by companies practicing cash management — i.e., paying bills only when they come due, to ensure they have enough cash to cover them. Since most bills are monthly, weekly cash flows can be a bit more complex and detailed, but they are very useful.”

- Start With Your Beginning Cash Balance

Every cash flow projection starts with your beginning cash balance, or the amount of cash your business has on hand at the start of the projection period. This includes the total funds available in your business checking accounts, as well as petty cash and other liquid assets.

If your business has savings accounts, you might choose to exclude those amounts from your cash flow projection as they are not for regular operational use.

- Gather Historical Financial Data

To create an accurate cash flow projection, collect historical financial data. This includes past sales, expenses, and payment trends. To help identify patterns in cash inflows and outflows, review at least 12 months of financial records.

For established businesses, this means looking at sales reports, expense statements, accounts receivable, and accounts payable to estimate future cash movement. The more precise your data, the more reliable your projection will be.

For newer businesses, this step can be a little trickier. “A new business will have limited historical data, if any,” says Anthony Bonacio, Lead Accountant at Bonacio Management. “This means that a new business will have to rely more on assumptions about sales, pricing, and expenses. Market research and industry benchmarks are key here. There is more inherent uncertainty. You do not know if your product or service will be well received. This is why it is best to focus on short-term projections, then revisit and revise them frequently as more data is gathered.”

- Enter Expected Cash Inflows and Outflows

Using the historical data you’ve gathered, estimate your cash inflows and outflows based on expected amounts.

Reinhardt recommends starting with the basics. “Enter the simplest information you have. Focus on recurring or predictable income (your salary or average monthly revenues) and expenses (payroll, rent, utilities),” he says. “Once those are in, you can start being creative, and try to imagine one-off deposits or expenses that you know will take place at specific times in the future.”

For example, you might anticipate closing a major deal in a few months or seeing a spike in sales around certain holidays. On the other hand, you may need to invest in new software, building renovations, or equipment upgrades. “These are really important, because these individual financial events can cause big fluctuations or even a cash crunch, regardless of the business’s health,” says Reinhardt.

Remember, cash flow projections are just that: projections. They won’t be 100 percent accurate, but the more granular and realistic your estimates are at this stage, the better you can anticipate and mitigate shortfalls.

- Calculate Opening and Closing Balances for Each Period

Next, calculate your opening and closing balances for each period using the following formulas:

Opening balance = Previous period’s closing balance

Closing balance = Opening balance + cash inflows – cash outflows

Using a cash flow projection template or accounting software can help automate these calculations and ensure accuracy.

- Calculate Net Cash Flow

To determine your net cash flow for each period, subtract your total cash outflows from your total cash inflows:

Net cash flow = Cash inflows – cash outflows

A positive net cash flow means you’re bringing in more money than you’re spending, while a negative net cash flow indicates that expenses exceed income.

Note that some months may have a negative cash flow, and that’s okay. Fluctuations are normal in business. That’s what cash flow projections are for: They ensure there’s enough funding to cover expenses, even when revenue dips or expenses increase.

- Build Your Contingency Plan

Now that you know your estimated net cash flow for each period, you can spot potential shortfalls before they happen. If you notice in February that your forecast shows you running out of cash in August, you now have months to plan ahead. You might find ways to reduce expenses, create an additional revenue source, or secure a loan in June or July to bridge the gap.

Learn all about building a financial safety net in this guide to contingency planning.

- Implement a Rolling Forecast

Regularly update your projections by adding a new period as each one passes. For example, if you create a 12-month cash flow forecast in January, you would update it in February to extend through the following January.

“It’s a good idea to revise the projection regularly as you learn more about your business and as events diverge from your initial expectations,” says Reinhardt. This approach allows you to continuously refine your projections based on actual performance, market trends, and any unexpected changes in revenue or expenses.

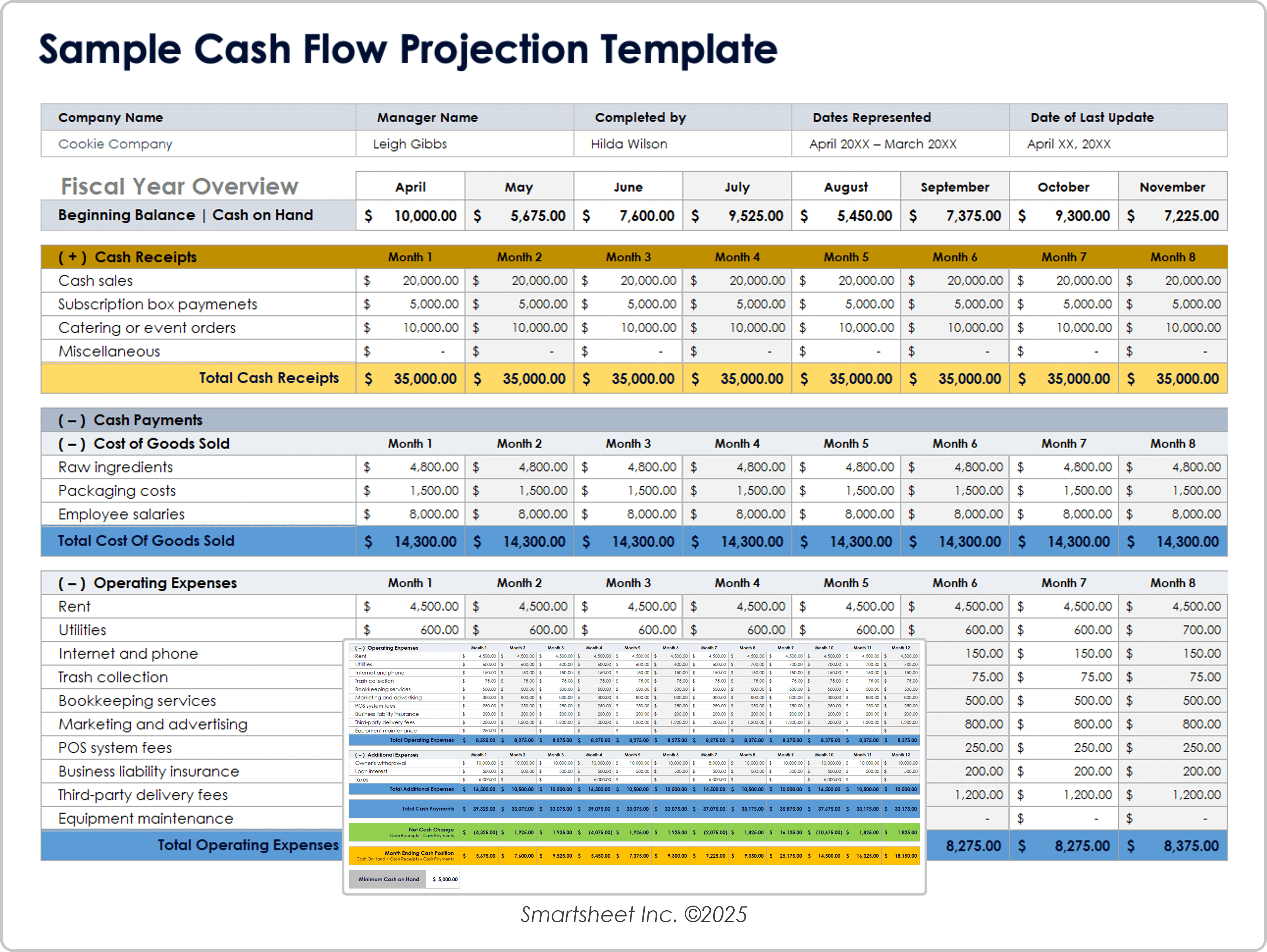

Sample Cash Flow Projection Template

Download Blank and Sample Versions of a Cash Flow Projection Template for

Excel

| Google Sheets

Use this straightforward monthly cash flow projection template to anticipate cash shortages and keep your business financially stable. The example tab demonstrates how a cookie manufacturer structures its cash flow projection, highlighting key factors such as annual expenses and seasonal sales trends. For instance, this business owner predicts a spike in December for the holiday season, as well as a dip in January as customers focus on new diet goals.

The template includes a minimum cash balance feature, allowing you to set a threshold that you don’t want your cash reserves to fall below. In this example, the business owner has set a $5,000 minimum. Anticipating a shortfall in November, the owner planned to reduce their regular monthly withdrawal in October to maintain stability. Other solutions could have included taking out a loan or cutting expenses.

Play around with the example version — or start entering your own data — to get a sense of how cash projections work.

1-Year vs. 3-Year Cash Flow Projections

A one-year cash flow projection is a common tool for predicting a company’s cash inflows and outflows, helping with immediate budgeting and financial planning. A three-year cash flow projection is not common, but in some cases it can support strategic decision-making and investment planning.

“I’ve never seen a three-year projection except when one gets rolled out for investors, who know that it’s based on assumptions and should not be taken literally, but merely needs to be reasonably credible,” says Reinhardt. “I wouldn’t recommend doing a cash flow for more than one year if it’s intended to be actually usable.”

A one-year cash flow projection is better suited for short-term budgeting, managing operational expenses, and ensuring liquidity.

“A one-year projection would be focused on short-term operational planning, budgeting, and cash management,” says Bonacio. “It would be more detailed and broken down monthly, sometimes weekly, and this cash flow would be more accurate, as there is a better grasp on near-term factors. Best-use cases for a one-year cash flow would be annual budget prep, tracking progress against goals, and identifying short-term cash flow gaps.”

Learn about accurate financial forecasting in this guide to cash flow forecasting, and start strengthening your business’s finances with this collection of cash flow forecast templates.

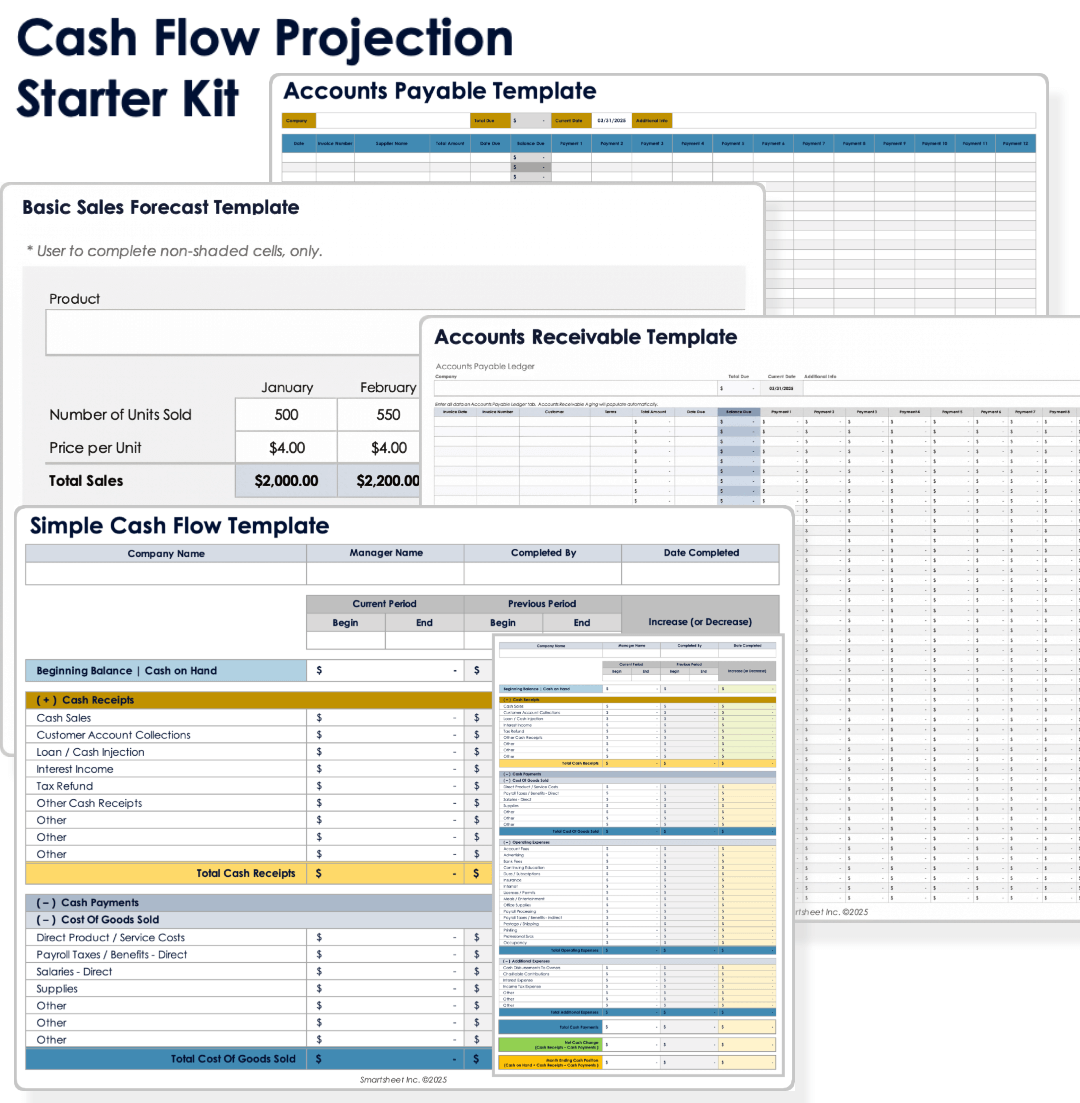

Cash Flow Projection Starter Kit

Download the Cash Flow Projection Starter Kit

Use this free starter kit, which includes a cash flow statement template and a sales forecasting template, to gather everything you need to do your cash flow projection.

In this kit, you’ll find:

- A cash flow projection template for Excel to help you forecast your monthly cash flows over the next year

- A simple cash flow statement template for Excel to help you start tracking your actual cash inflows and outflows and make more accurate forecasts

- An accounts payable template for Excel to help you track upcoming bills, due dates, and payment statuses

- An accounts receivable template for Excel to help you monitor outstanding invoices, payment due dates, and customer balances

- A basic sales forecasting template for Excel to help you estimate future revenue based on historical sales data

The Difference Between Cash Flow Projections for New vs. Established Businesses

Unlike established companies, startups must rely on industry benchmarks and early operational insights to refine their expectations.

“The biggest difference between a new business and a more established one is that a new business doesn’t have any information,” says Reinhardt. “You should be careful, with a new business, to keep revising expectations as they come into contact with reality. In most cases, a new business will have higher upfront costs and slower sales growth. You can research benchmarks for your industry or sector, but I think it’s best to start making your projections once you’ve been operating for a little while, or have done a few experiments.”

Try one of these free cash flow statement templates to keep track of all your business’s funds.

Mistakes to Avoid in Your Cash Flow Projections

Avoid being overly optimistic when predicting your revenue or expenses for your cash flow projections. This means assuming invoices will be paid on time, failing to account for emergencies, only reviewing projections sporadically, or neglecting tax obligations. Learn from experts to avoid some common cash flow projection mistakes.

Here are some common mistakes to avoid:

- Being Too Optimistic: Overestimating revenue or underestimating expenses can lead to inaccurate projections and financial shortfalls. “One of the most common pieces of advice is to be conservative, and it’s true,” says Reinhardt of Advice Party. “It’s better to have a pragmatic cash flow projection than an overly optimistic one.”

- Ignoring Payment Delays: Assuming all invoices will be paid on time can create unrealistic cash flow expectations. “A crucial part of the projection is to account for timing differences,” says Bonacio. “Revenue is not always collected immediately and expenses are not always paid right away. Factor in payment terms and potential cash collection delays.”

- Not Accounting for Emergencies: Lacking a contingency plan for unexpected disruptions can leave a business financially vulnerable.

- Failing to Update Projections Regularly: Cash flow forecasts should be reviewed and adjusted frequently to reflect real-time changes. “Use a spreadsheet, either in Google Sheets or Excel, as it allows you to easily adjust assumptions,” recommends Bonacio.

- Neglecting Tax Obligations: Forgetting to account for taxes can result in surprise expenses that strain cash reserves.

- Getting Too Complicated Too Fast: “For someone attempting a cash flow projection for the first time, I would start simple and not try to project everything at once,” recommends Bonacio. “Begin with a short-term projection (three to six months) and focus on the most significant income and expense items. Complexity can be added later.”

How Emergencies Impact Cash Flow Projections

Emergencies such as economic downturns, natural disasters, supply chain disruptions, or sudden regulatory changes can significantly impact cash flow projections. Businesses might face higher operational costs, delayed payments, or reduced customer demand. To mitigate these risks, companies should incorporate contingency planning, set aside emergency reserves, and stress-test different financial scenarios.

Start planning ahead with these free contingency plan templates to help you resume regular operations after unforeseen events.

Discover a Better Way to Manage Your Cash Flows and Finance Operations With Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.