What Is Discounted Cash Flow?

Discounted cash flow (DCF) is a method that values an investment based on the projected cash flow the investment will generate in the future. Analysts use the method to value a company, a stock, or an investment within a company.

People use DCF to compare similar, or even different, types of investments. In fact, as long as analysts can project likely future cash flows from each investment, they can use discounted cash flow to make apple-to-apple comparisons and assessments concerning a wide variety of investments.

To learn more about cash flow analysis, visit “The Basics of Operating Cash Flow: Tips, Formulas, and Examples.” To learn more about how to determine cash flow for a specific project, visit “How to Master Project Cash Flow Analysis.” To learn how to create a cash flow forecast and to download templates that can help, visit “How to Create a Cash Flow Forecast, with Templates and Examples.” And to download other templates for a free cash flow forecast, check out “Free Cash Flow Forecast Templates.”

What Is Discounted Cash Flow Analysis or a Discounted Cash Flow Model?

The terms discounted cash flow analysis, discounted cash flow model, discounted cash flow technique, and discounted future cash flow are all synonymous with discounted cash flow, and all refer to valuing an investment based on future cash flow.

When to Use Discounted Cash Flow

Analysts use discounted cash flow in investment finance, real estate development, corporate finance, and a range of other industries and areas. You might use it to compare the value of two companies or to determine the value of a stock.

You can learn more about when to use discounted cash flow and the strengths and limitations of the analysis by visiting “The Advantages and Limitations of Discounted Cash Flow Analysis.”

Discounted Cash Flow Formula

Analysts most often perform discounted cash flow analysis by inserting a company or investment’s cash flow-related numbers and projections into a spreadsheet of detailed formulas. Below is a simpler, more basic version of those detailed formulas.

Basic discounted cash flow formula: DCF = CF1 /(1 + r)1 + CF2 /(1 + r)2 + CF3 /(1 + r)3+ CFn /(1 + r)n

CF = The cash flow in a given year (CF1 is year one. CF2 is year two. CFn is the last year in the forecast.)

r = The discount rate

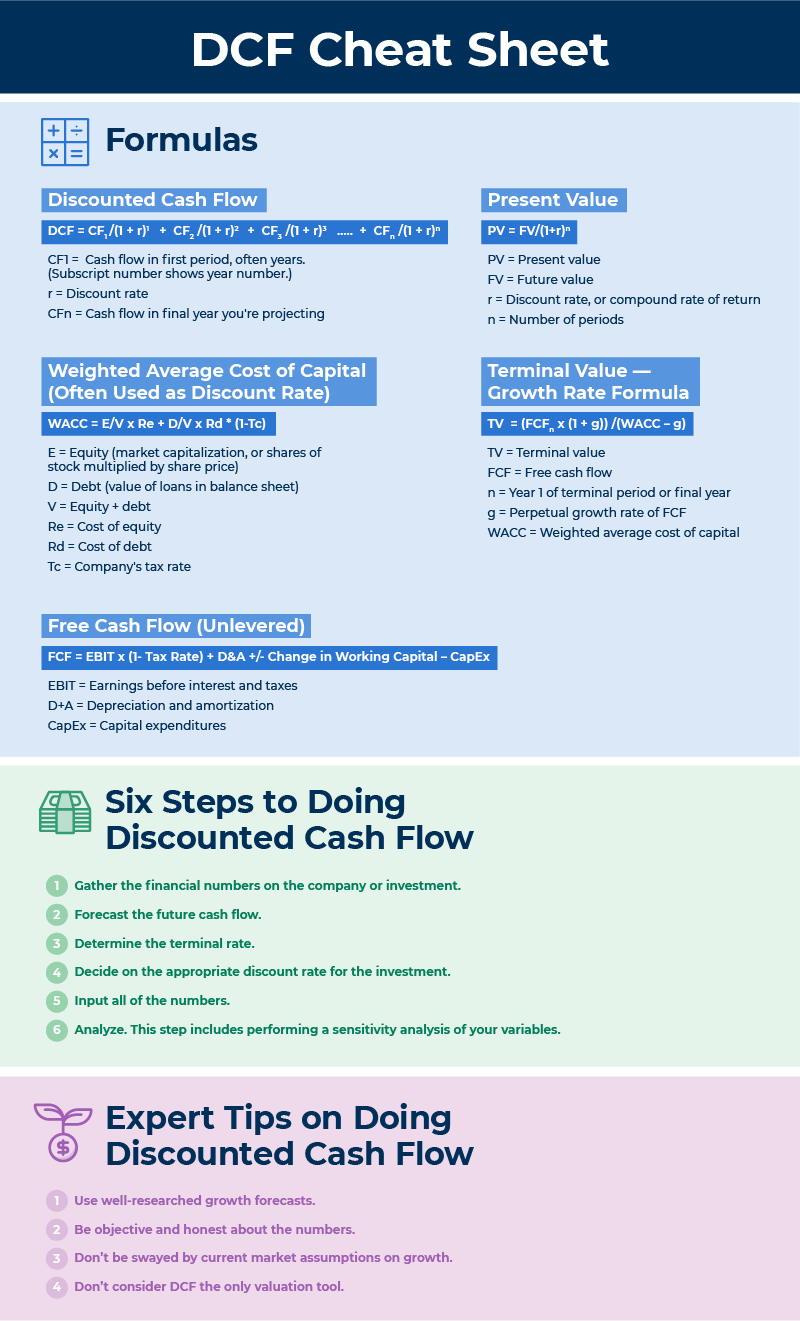

Discounted Cash Flow Cheat Sheet

The cheat sheet below includes important discounted cash flow formulas. It also offers steps for performing discounted cash flow, along with expert tips.

How to Calculate Discounted Cash Flow

You need a range of financial data and projections to perform discounted cash flow on a company, stock, or investment. That data includes current and projected cash flow, cost of capital, and other figures.

Here are other variables that are vital to discounted cash flow analysis:

- Discount rate

- Growth rate

- Levered or unlevered cash flow

- Terminal value

- Weighted average cost of capital (WACC)

What Are Some Examples of Discounted Cash Flows?

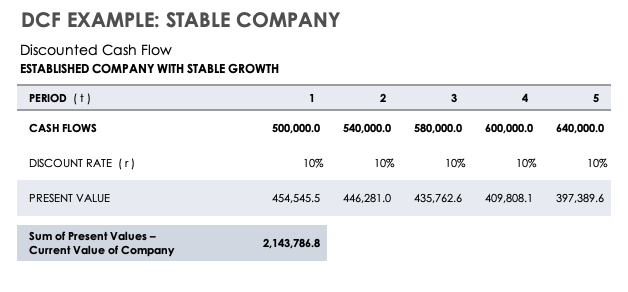

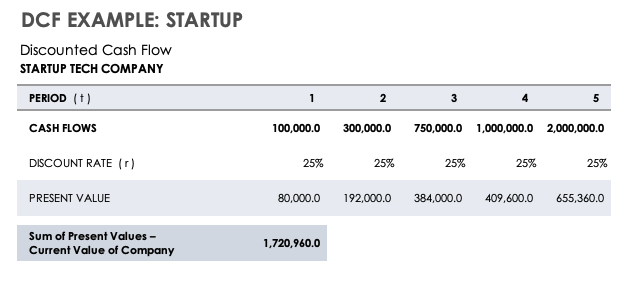

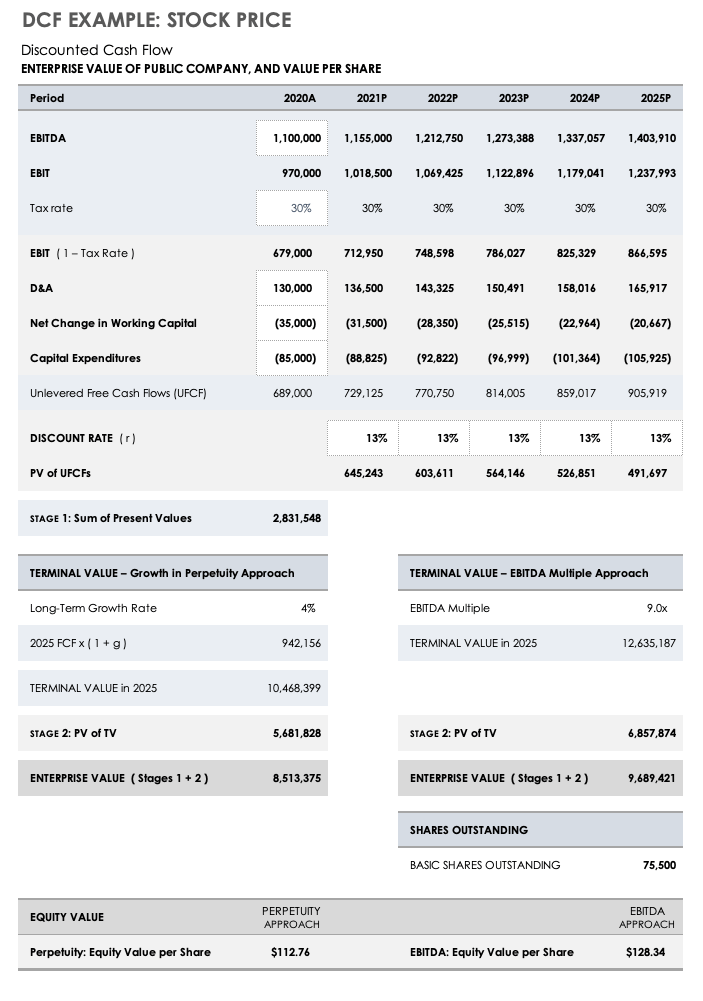

You can perform discounted cash flow analysis on a wide range of companies and investments. Below, you’ll find three hypothetical examples of how discounted cash flow analysis can work.

Discounted Cash Flow Analysis for Stable Company Template

Download Discounted Cash Flow Analysis for Stable Company Template - Microsoft Excel

You can use this template to determine the value of an established and stable company based on discounted cash flow analysis. You can change the assumed cash flows and discount rate to see how those factors alter the estimated value of that company.

Discounted Cash Flow Analysis for Startup Company Template

Download Discounted Cash Flow Analysis for Startup Company Template - Microsoft Excel

You can use this template to determine the value of a startup company based on discounted cash flow analysis. You can change the assumed cash flows and discount rate to see how those factors alter the estimated value of that company.

Discounted Cash Flow Analysis for Public Company Stock Template

Download Discounted Cash Flow Analysis for Public Company Stock Template - Microsoft Excel

You can use this template to determine the enterprise value and share value of a public company based on discounted cash flow. You can insert your own numbers for certain variables and see how the estimated enterprise and stock values change.

Discounted Cash Flow Templates

Discounted cash flow templates can help you estimate a company’s intrinsic value by using your financial data and projecting future cash flow. They can also show you how the value estimate shifts based on changing variables.

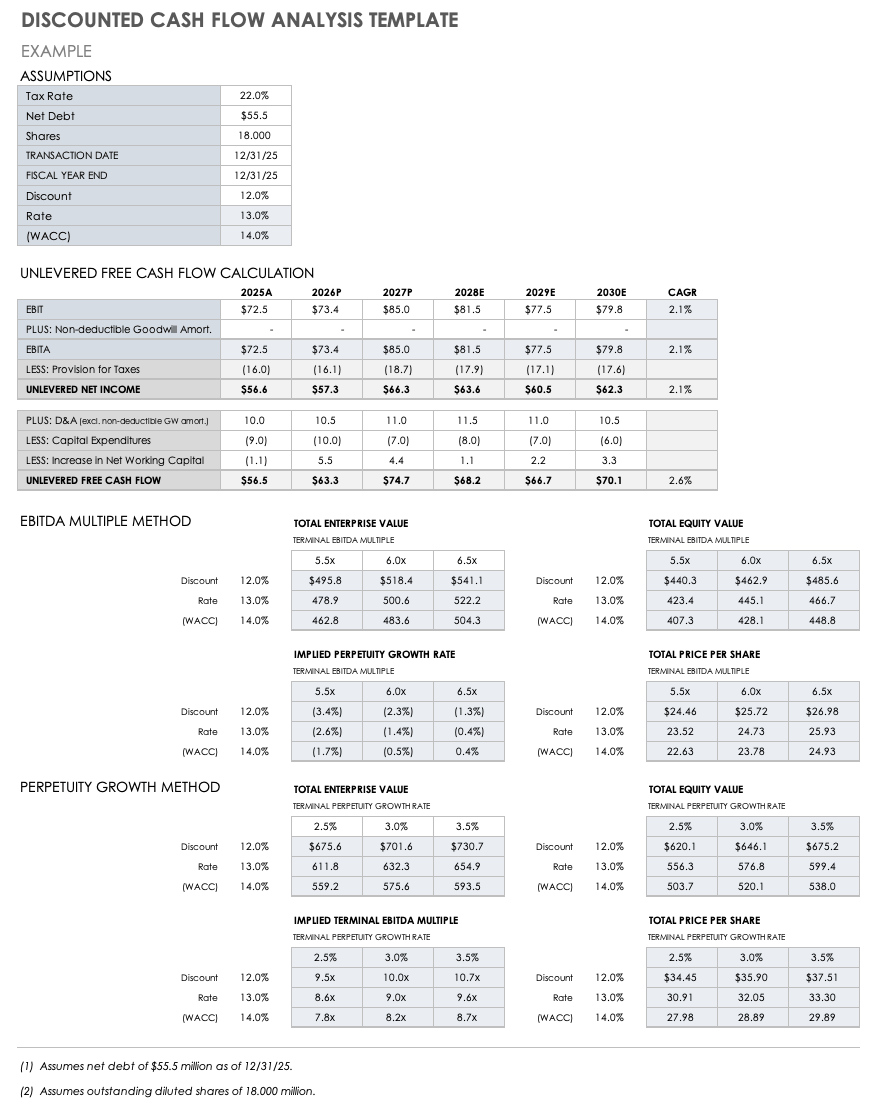

Discounted Cash Flow Analysis Template

Download Discounted Cash Flow Analysis Template - Microsoft Excel

This discounted cash flow template helps you estimate your company’s intrinsic value versus its market value.

The template uses both a multiples method (based on the concept that similar holdings sell at similar prices) and a perpetual growth method (based on the concept that an asset will continue to generate cash flows at a constant rate in perpetuity) to help you determine enterprise value.

You can download a range of other discounted cash flow templates by visiting “Download Free Discounted Cash Flow Templates and Examples.”

Tips for Performing Discounted Cash Flow Analysis

Experts offer a number of tips for executing good discounted cash flow analysis. Most important, you must research and gather reliable numbers and be realistic about projections of future cash flow.

Here are some expert tips for executing good discounted cash flow analysis:

- First, Make Sure You Do One:

“First tip: Always do one,” says Ryan Maxwell, a former financial analyst with Deutsche Bank and now Chief Financial Officer at FirstRate Data, a boutique financial data firm. “To be honest, it has fallen out of favor. It’s not the favored investment valuing tool that it was 10 to 20 years ago.”

But Maxwell and other experts say that when you can gather the necessary data, it is often worthwhile to perform discounted cash flow analysis in order to assign a value to a company or potential investment. You may carry out other value analyses as well. But always make sure to implement discounted cash flow analysis. - Use Well-Researched Growth Forecasts: Your growth forecasts and projections for future cash flow should be well researched and sophisticated. “Forecasting is a huge component of creating DCF — and what you usually find is that the valuation is extremely sensitive to the forecast assumptions,” says Ray Wyand, a former vice president of structured finance at Citibank and the current CEO of gini, which offers machine learning tools to help businesses improve the quality of their cash flow forecasting. “In general, forecasting methodology is getting much more sophisticated. And over the next five to 10 years, I think we are going to see a shift away from crude linear free cash flow growth forecasts and a move toward something more correlation driven.”

- Be Objective and Honest About the Numbers: “Numbers just reflect reality, but they don't change it,” says Wyand. “Sometimes, you see people and they're spending days fiddling with the numbers. It doesn't change the business. And as bankers, we're very guilty of this. Sometimes you're like, ‘I'll change this assumption (in discounted cash flow analysis).’ And the reality is, people usually have a price in mind. And they almost work backward.

“I think one of the key things is to be honest with yourself. If DCF is not giving you the numbers you like, don't overengineer it and keep working it until you get the numbers you like.” - Don’t Be Swayed by Current Market Assumptions on Growth: Good economic times can lull people into believing solid growth will continue indefinitely. Bad economic times can do the reverse. Assuming either the former or the latter can hurt discounted cash flow analysis.

“It's meant to be a form of fundamental analysis,” says Wyand. “But what happens is…the market starts to have very optimistic growth assumptions. The economy may be doing really well, a lot of big companies may be doing well, and there may be a lot of growth coming. And you say, ‘Maybe that will last for the next 10 years.’ But in a recession, everyone's like, ‘It's terrible. And maybe that’ll last for 10 years.’ People tend to forecast whatever the mood of the market is. They tend to extend that out in the forecast.”

That’s a bad thing to do in discounted cash flow analysis, Wyand says. “The reality is, you don’t want to factor in market sentiment when your goal is to create a fundamental model.” - Don’t Consider DCF as the Only Valuation Tool: While you should perform discounted cash flow analysis in many cases, you should not consider it the only valuation tool you can use. In many cases, you want to use discounted cash flow along with other valuation methods in order to get a sense of what each of the methods is telling you about an investment’s value. (See below for alternatives to using discounted cash flow.)

“It’s one of many tools,” says Christian Brim, a certified public accountant and CEO of Core Group, which helps small businesses grow profitably with better financial information. “It’s not the (only thing) you should make a decision on.”

Wyand points out a reality of all valuation tools: they can be part of your negotiations in buying or selling an investment — depending on the results they provide.

“In practice, DCF is a negotiation tool,” Wyand says. “You should use it when the valuation favors you and try to come up with an alternative valuation methodology when it doesn’t.”

History of Discounted Cash Flow

A form of discounted cash flow calculations may have been used when people began lending money thousands of years ago. Research shows that ancient Egyptians and Babylonians assessed future cash flows to determine the current value of an asset.

Industry in the 1700 and 1800s used the concepts behind discounted cash flow. Economists began writing about the idea of valuing stocks in the 1930s, after the 1929 stock market crash. The U.S. court system began using the concept widely in the 1980s.

Discounted Cash Flow vs. Net Present Value

Discounted cash flow and net present value deal with essentially the same concept: you must discount future cash flows to arrive at a value of an investment today. Experts use a significant part of each concept when executing either analysis.

But a net present value analysis uses one more final piece of math that discounted cash flow doesn’t; it subtracts the initial cost of the investment from the discounted cash flow value to help you decide whether the investment is worthwhile.

Here’s a simple example to illustrate the two concepts.

Company A expects cash flows of $300,000, $400,000, and $500,000 for the next three years. After that, the product will become obsolete and the company will go out of business.

If you assume a discount rate of 8 percent in the discounted cash flow formula — based on the costs to finance company operations and risks associated with the company — the discounted cash flow analysis would look like this:

DCF = CF1 /(1 + r)1 + CF2 /(1 + r)2 + CF3 /(1 + r)3

Company A can use this formula:

DCF = $300,000/(1+.08) + $400,000/(1 + .08)2 + $500,000/(1 + .08)3

As a result:

DCF = $277,778 + $342,936 + $396,920

Finally:

DCF = $1,017,634

The current value of the company, based on discounted cash flow analysis, is about $1.02 million.

Net present value takes the value derived through that analysis and decides whether it’s a worthwhile investment based on the purchase price. All else being equal, a positive net present value means it’s a worthwhile investment; a negative net present value means it’s not worth the purchase price.

If the company was on sale for $950,000, its net present value would be a positive $67,634, and it would be worth buying at the price. If the company was for sale for $1.1 million, it would have a negative net present value of $82,366, and it would not be worth buying at that price.

Role of Internal Rate of Return in Discounted Cash Flow

The internal rate of return tells you what discount rate produces a net present value for an investment of exactly 0. You can determine the compound annual rate you will earn (the discount rate) on the company or investment given the cash flows and other variables in the formula.

Analysts figure the internal rate of return so they have an estimate on the rate of return they could get from an investment. They can then compare that rate of return to those of alternative investments.

Or they may compare it to their company’s hurdle rate, which is the minimum rate of return the company expects from investments of a specific type and specific risk level. If the company can’t get that rate, it won’t buy the investment. It instead will pursue other investments where it can get that rate.

Using a formula to figure the internal rate of return manually can be very complicated. You can most easily figure the internal rate of return by using the IRR or XIRR function in Excel. Or, in a simplified analysis, you can also determine the internal rate of return through trial and error.

Let’s say your friend wants to borrow $10,000 from you to buy an investment and promises to pay you $15,000 when she sells the investment in three years.

You can use a simplified version of a discounted cash flow analysis. Use a simple present value formula of PV = FV/(1+r)n. In the formula:

PV = Present value

FV = Future value

r = Discount rate or compound rate of return

n = Number of periods

If you think you want at least 12 percent annual interest on the loan, plug that interest rate into the formula:

PV = $15,000/(1+.12)3

PV = $10,677

When you subtract your initial $10,000 investment from the present value, you get a positive net present value of $677. That means the interest rate must be higher in the formula (and thus you would get a higher interest rate in the deal with your friend) to reach a net present value of 0.

Instead, input 16 percent as the discount or interest rate:

PV = $15,000/(1+.16)3

PV = $9,610.

After subtracting your initial $10,000 investment, that yields a net present value of -$390.

Next, try a number between 12 and 16 percent, but closer to 16 percent. Try 14.5 percent:

PV = $15,000/(1+.145)3

PV = $9,993

When you subtract your initial $10,000 investment from that present value, you get a net present value of -$7. You’re getting very close to 0, which means your internal rate of return for this investment is very close to 14.5 percent.

Alternatives to Using Discounted Cash Flow

You can use other ways to value a company or investment aside from discounted cash flow.

The two primary alternatives are comparable company analysis and precedent transaction analysis. Here are details on those valuation methods:

- Comparable Company Analysis: In this analysis, experts consider financial results and financial ratios for similar public companies and use them to set a value on a company or stock. Financial ratios that experts use for public companies include price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and the ratio of enterprise value to earnings before interest taxes, depreciation, and amortization (EV/EBITDA). Experts often call these ratios multiples. That’s why some experts call this a multiples analysis.

“It’s a much simpler and quicker way to do it,” Maxwell, from FirstRate Data, says of using this analysis to value companies. Using a hypothetical example, Maxwell, says: “With Facebook, you pay 20 times earnings. Compare that to Google, which might be 35 times earnings. Facebook is cheap, then — assuming Google is priced right.” - Precedent Transaction Analysis: In this analysis, experts consider past mergers and acquisitions of similar companies to put a value on the company. Experts often call this a precedents analysis. Experts especially use this method when trying to value a company that might be part of a merger or acquisition. Experts in investment banking and private equity often use this method.

Other Methods for Valuing Companies

Certain industries use other methods for valuing companies. If you derive your profits from online users, experts may value your company based in part on the number of users and the average revenue generated from each of those users.

But even when using alternative valuation methods, analysts still frequently perform discounted cash flow analysis.

“There’s no valuation of a company that doesn't include DCF,” says Maxwell. “Whenever there’s an IPO, DCF will be done. It’s always done. It’s used extensively.”

Maximize Your Discounted Cash Flow Analysis with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.