How Do Small Businesses Keep Track of Expenses?

To track small business expenses effectively, start by opening a dedicated business bank account to separate personal and business finances. Use accounting software or a spreadsheet to record all expenses. Keep digital or physical copies of receipts, and regularly review them to ensure that your records are accurate. Staying organized will help with tax preparation and financial planning.

Here is how to track expenses for your small business in seven easy steps:

- Open a Dedicated Business Bank Account

The first step for tracking small business expenses is setting up a dedicated business bank account and credit card.“

One of the most common mistakes I see is the mingling of business and personal expenses,” says Charles Reinhardt, Principal at Advice Party. He and his team manage bookkeeping and back-office operations for growing companies across industries such as fashion, media, and tech, as well as the nonprofit sector and other creative fields. “Not only does this make it hard to track and budget correctly, but it is also incorrect and can cause problems with tax authorities.

”Once you set up the account, avoid using your business card for personal expenses. If you do, however, Reinhardt suggests simply marking the expense “owner’s draw” to prevent misreporting when it comes time for taxes. This distinguishes the expense as a personal withdrawal rather than a business expense.

- Set Up a Clear Expense Policy

A company’s expense policy outlines what does and doesn’t qualify as a business expense. This is especially important if you have employees, as they need to understand what purchases are reimbursable and what documentation is required.

To create an effective policy, outline acceptable expenses, set spending limits, and specify the required proof of purchase (such as receipts or invoices). Make the policy easily accessible, whether in an employee handbook or a shared digital document.

- Save All Receipts and Invoices

Don’t rely solely on your corporate credit card to track expenses. Keep digital or physical copies of every purchase and payment, along with a record of its purpose and how it supports your business. This documentation is especially crucial for expenses such as meals, entertainment, and other less common costs.

“As more and more financial activity occurs digitally, it becomes less necessary to save actual paper receipts for every type of spending. But if you use cash a lot or make expenditures that could be mistaken for personal spending, missing receipts can be a big pain,” says Reinhardt.

If you lose a physical receipt and cannot obtain a copy from the vendor, you should be able to use a credit card statement, a bank transaction record, or an invoice. Just be sure to create a written record detailing the date, amount, vendor, and business purpose of the expense, and keep a log of missing receipts.

- Record and Categorize Expenses

Log each expense in a spreadsheet or in accounting software. “Expenses should be categorized, such as office supplies, marketing, and travel,” says Anthony Bonacio, Lead Accountant at Bonacio Management. “This will help the business owner understand where business expenses are going and makes generating reports for analysis much easier.”

Other common expense categories include employee and contractor costs, professional services, insurance, and operational expenses, such as rent and utilities. If you have trouble figuring out which expense goes into which category, download our free cheat sheet and you’ll never have to guess.

- Use an Expense Tracking Tool

Find the bookkeeping app, accounting software, or simple spreadsheet that meets your expense-tracking needs. “Right now, there are a lot of great expense management tools that can help you keep track of your spending,” says Reinhardt of Advice Party. “Some are used simply for tracking, while the newer platforms actually work as payment processors themselves. All of them have approval features, meaning that employees must append memos and invoices to all their spending before it will be approved, making it much easier to identify and categorize expenses.”

Beyond accounting software such as QuickBooks or Xero, business owners can also use apps to track individual expenses. For example, if you run a delivery service or a rideshare business that needs to track mileage for tax deductions or client reimbursements, you can download a mileage-tracking app such as MileIQ or TripLog.

- Reconcile Expenses

To catch potential errors, regularly compare your recorded expenses — whether in accounting software, a spreadsheet, or another tracking system — with your bank and credit card statements. Look for any discrepancies, such as duplicate charges, missing transactions, or incorrect amounts. If you find errors, correct them in your records, and if necessary, contact your bank or vendor to address issues. Regular reconciliation helps prevent mistakes.

- Review and Adjust

Build time into your schedule to review expenses so you can identify problems early and find ways to save money.

“It may sound obvious, but the most important thing business owners can do to track their business expenses is to schedule a routine for closely examining their spending line by line, whether on a weekly, monthly, or quarterly basis,” says Reinhardt.

“It’s never a good idea to wait until the end of the year to start figuring out what was spent on what. Unexpected expenses and incidental costs can accumulate extremely quickly, and if you have a dynamic business, you run the risk of going way off track before you have a chance to course-correct.”Check out these free small business expense-tracking templates to help you organize your expenditure and maintain accurate records.

Reinhardt also recommends downloading payment records as you go. “Lots of online banking services do not allow you to search very far in the past for vital financial information, such as check images. This can be a big problem if you need to re-examine historical activity from a few years ago,” he says.

You can also download these small business balance sheet templates and small business profit and loss (P&L) statement templates to get a clearer picture of your overall financial health and ensure that your tracked expenses align with your broader financial records.

Common Expense-Tracking Mistakes to Avoid

Common mistakes business owners make when tracking expenses include failing to categorize expenses properly, neglecting receipt storage, overlooking small costs, and not responding to bookkeeping inquiries. According to experts, these errors can lead to missed tax deductions and challenges during audits.

Here is a list of common expense tracking pitfalls according to experts and how to avoid them:

- Overlooking Small Expenses: “It can be tempting to not track small expenses, such as parking fees, office snacks, coffees for client meetings, etc.,” says Bonacio. “But they add up significantly over time. Failing to track these small expenses can also mean missing out on valuable tax deductions.”

Keep track of all your business expenses — big and small — using these free expense report templates in all formats.

- Improperly Categorizing Expenses: “Failing to properly separate and categorize your expenses makes it harder for you when it comes time to calculate deductions based on your company’s activity,” says Haley Stewart, Bookkeeper and QuickBooks Certified ProAdvisor© at Stewart Tax & Bookkeeping, LLC.

“If you haven’t already, look up a sample chart of accounts for your industry,” she recommends. “This will give you a list of standard income, expense, equity, etc., categories for similar businesses. Remember that this is just a starting point — you’ll need to customize these categories based on your specific business model and tax requirements.”

- Storing Receipts Incorrectly: “It’s vital to maintain an organized system for your business receipts,” says Stewart. “Poor receipt management puts you at risk of missing deductions and leaves you unprepared for potential audits. Remember: Stay ready so you don’t have to get ready.”

- Relying on Unsecure or Local Storage: “I would advise against using pen and paper or saving files to your computer’s local storage, as this becomes a liability should anything happen to your files/device,” says Stewart. “Cloud-based software, so long as you properly protect your account, acts as insurance against simple accidents (such as a coffee spill ruining your accounting files) by allowing you to access your information from anywhere in the world.”

- Failing to Answer Questions: “As a professional bookkeeper and fractional CFO, I have to include this one,” jokes Reinhardt. “The worst mistake you can make, both practically — and morally and spiritually — is to fail to respond to your bookkeeper’s questions.”

For even more expense-reporting options, see these roundups of printable expense report templates for Adobe PDF and Google Docs expense report templates.

For other expense-tracking options in spreadsheet formats, see this collection of expense report templates for Excel or these expense-tracking reports for Google Sheets.

How to Keep Track of Small Business Expenses in Excel

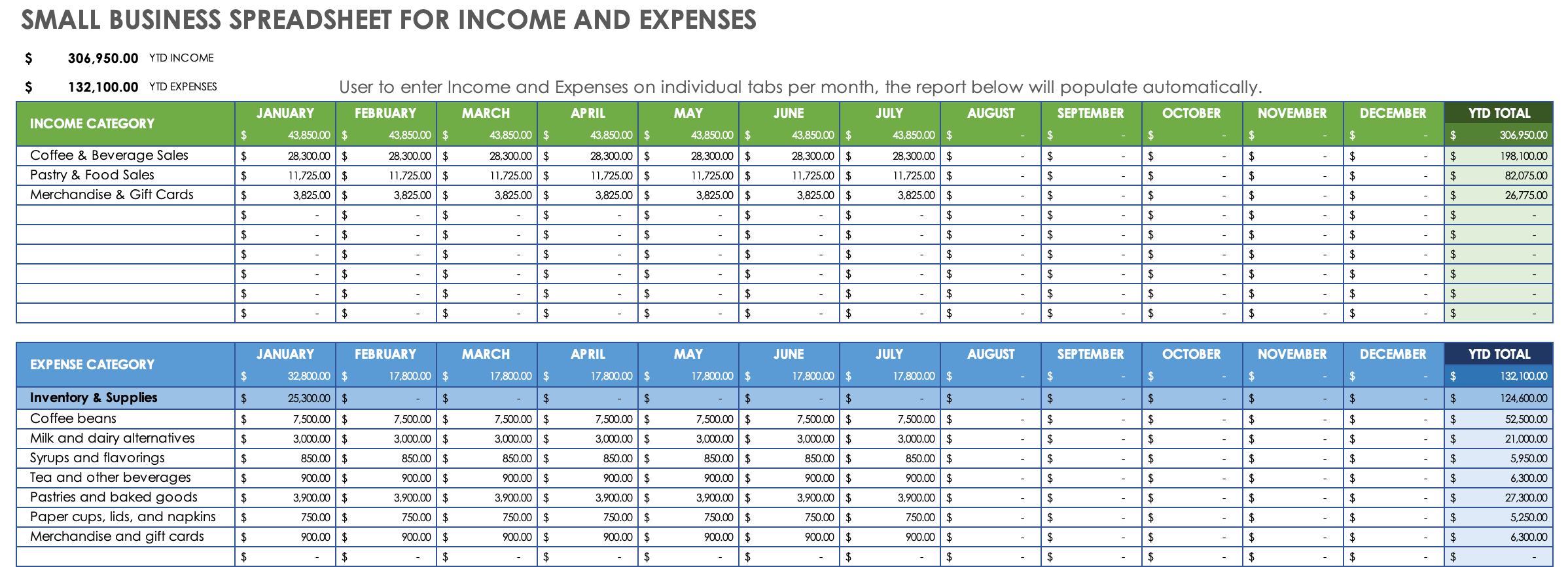

Download an expense-tracking template to manage, track, and record expenses for your small business. Use the following step-by-step guide to download and complete an income and expenses spreadsheet:

- Download the

small business spreadsheet for income and expenses template

.

Open the downloaded template file and save it according to your file naming conventions.

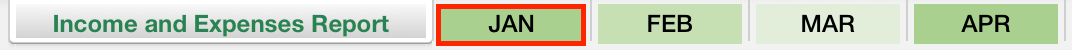

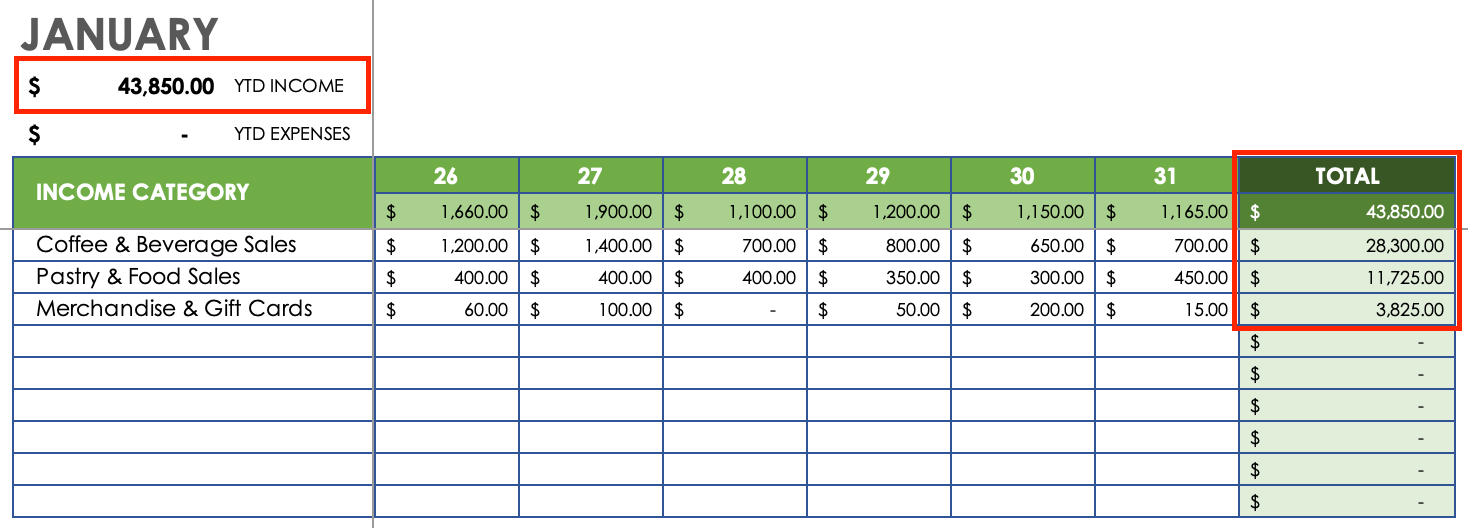

Along the tab selection bar, navigate to the month for which you want to track expenses. In this example, we’ll record expenses for the month of January.

Enter any income sources in the Income Category column. For this example, we’ll enter income sources for a locally owned coffee shop.

Locate the row corresponding to each income source. As you receive income throughout the month, enter the amount received in the appropriate column for the date of the transaction. The template automatically calculates totals, which you can view in the upper-left corner of the spreadsheet or by scrolling all the way to the right.

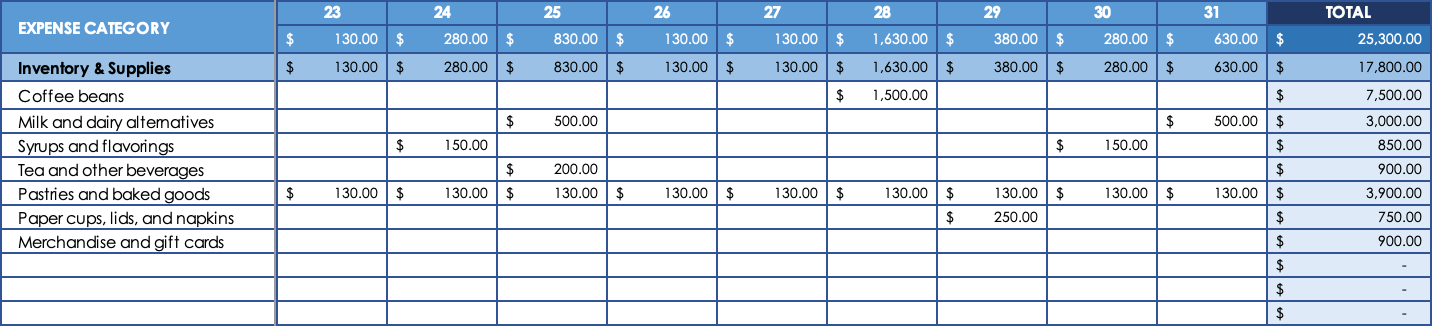

In the Expense Category section, enter your expense categories and related expenses. You can add more expenses as they come up. In this example, the coffee shop owner needed to buy a new blender and pay for a dishwasher repair.

As you did for your income sources, enter the amount spent for each expense in the appropriate column for the date of the transaction.

The template automatically calculates totals, which you can view alongside your income totals.

- Once you’ve added all your expenses, navigate back to the Income and Expenses Report tab to view your totals for the year by month.

Note: The income and expense categories you entered in the monthly tabs won’t transfer to the main Income and Expenses Report tab. Copy and paste your categories into the main tab to see where your money is going.

Try this Smartsheet expense tracking and reporting template set to help your team manage expenses, approvals, refunds, reimbursements, and more.

Common Small Business Expenses to Track by Industry

Small businesses need to track common expenses such as rent, utilities, payroll, office supplies, marketing, insurance, and business travel. Other key expenses include equipment purchases, professional services (such as legal and accounting fees), inventory, and software subscriptions. Tracking these costs accurately helps with budgeting and tax deductions.

You can categorize your expenses in many ways, but here are some common expenses and expense categories for any small business:

Operational Expenses

- Office Supplies: These include everyday essentials, such as paper, pens, and printer ink.

- Office Rent: This refers to the cost of leasing commercial space for business operations.

- Storage Fees: These are costs incurred for renting storage units, warehouses, or other facilities to hold inventory, equipment, or business records.

- Utilities and Internet: These expenses cover electricity, water, heating, and internet services that are essential for keeping the business running.

- Packaging Materials: This includes the costs for boxes, envelopes, and other materials required for shipping products.

- Bank Fees: These are costs associated with maintaining business bank accounts and processing payments.

Employee and Professional Services

- Payroll Expenses: These include wages, salaries, and payroll taxes for employees.

- Legal and Professional Fees: These are payments made to accountants, attorneys, consultants, or other professionals who provide essential business services.

- Contractor Fees: This refers to the compensation paid to freelancers or independent contractors hired for specific projects.

- Recruiting and Hiring Costs: These expenses include job advertisements, background checks, recruitment agency fees, and other costs related to hiring new employees.

Marketing and Advertising

- Advertising Costs: These expenses include digital ads, printed materials, billboards, and other promotional efforts.

- Marketing Campaigns: This covers the budget allocated for SEO, content marketing, social media promotions, and brand awareness strategies.

Travel and Transportation

- Business Travel Expenses: These are costs related to business trips, including airfare, hotels, meals, and transportation. Remember that deductions for travel expenses may be subject to additional scrutiny by the IRS, so it’s important to keep detailed records, including travel itineraries and notes on the business purpose of each trip.

- Vehicle Expenses: These expenses include fuel, maintenance, insurance, and mileage for a personal vehicle used for business purposes.

Insurance Premiums

- Business Insurance: These policies cover general liability, professional liability, property insurance, and workers’ compensation.

- Health Insurance: These expenses refer to the premiums paid for employee healthcare coverage, if provided by the business.

Technology and Software

- Computers and Equipment: These costs include essential business technology, such as laptops, monitors, and office hardware.

- Software Subscriptions: These fees cover business tools, accounting software, customer relationship management (CRM) platforms, and other necessary applications.

- Web Hosting and Domain Fees: These are recurring costs required to maintain a company website and email services.

- IT Support and Cybersecurity: This category includes expenses for maintaining secure IT systems, protecting data, and ensuring tech support, such as cybersecurity software, data backup services, or IT professionals.

Product and Service Costs

- Cost of Goods Sold (COGS): This includes the costs of raw materials, manufacturing, and inventory purchases that are required to produce and sell products.

- Quality and Control Testing: In industries with safety and regulatory standards, businesses may deduct expenses related to testing products for compliance, safety, and reliability before they reach customers.

Taxes and Compliance

- Business Taxes: These expenses include income tax, sales tax, payroll tax, and other required payments to federal, state, and local governments.

- Licenses and Permits: These costs refer to fees for regulatory compliance, business licenses, and industry-specific permits.

Financing

- Loan Payments: This includes interest paid on loans that are used for legitimate business purposes, such as equipment financing, mortgage interest on a business property, and more.

Education and Development

- Professional Development: These expenses cover business courses, training programs, certifications, and industry conferences that help improve skills and maintain competitiveness.

- Research Expenses: This includes funds allocated for market research, customer insights, and product development.

Meals, Gifts, and Entertainment

Meals, gifts, and various forms of entertainment can sometimes qualify as deductible business expenses. However, tax law changes often, so be sure to check the official IRS website before adding any expense to your spreadsheet.

- Business Meals: This refers to food and beverages purchased for or during meetings with clients, partners, or employees. These meetings are for work-related purposes, such as networking lunches, team dinners, or meals while traveling for business.

- Entertainment: These are expenses for business-related entertainment, such as hosting clients at events or team outings.

- Gifts: These are any gifts given to clients, employees, or business partners as a token of appreciation or goodwill.

Expenses for Medical and Healthcare Professionals

If you’re a licensed medical professional thinking of opening your own practice, there are additional expenses related to patient care, compliance, and facility operations to keep in mind. These include medical supplies such as gloves, masks, and syringes, as well as larger investments in diagnostic tools, examination tables, and electronic health records (EHR) software. Professional liability insurance, licensing fees, and continuing education courses are also considered necessary costs, as are expenses for maintaining a clean and safe office environment. Specialized sanitation equipment and HIPAA-compliant technology are considered ordinary and necessary in this field.

Expenses for Content Creators

Content creators — such as YouTubers, influencers, podcasters, and streamers — have unique expenses related to producing and distributing digital content. These include high-quality cameras, microphones, editing software, and computers for video and audio production. Other common expenses include website hosting, social media advertising, travel for collaborations or events, and platform subscription services such as Adobe Creative Cloud. Additionally, props, costumes, and even home office setups used for filming or streaming might be considered business expenses.

Construction and Contracting Expenses

Construction and contracting businesses incur costs for labor, materials, and specialized equipment. Common expenses include purchasing or leasing heavy machinery such as excavators and bulldozers, contractor licenses and permits, and safety gear such as helmets and harnesses. Contractors also need to cover insurance policies, vehicle expenses for transporting tools and workers to job sites, and subcontractor payments. Ongoing training and certifications for industry compliance can also be an essential business cost.

Common Expenses for Creative Professionals

Artists, musicians, writers, and designers have industry-specific costs related to their craft. For example, artists may expense canvases, paints, and digital drawing tablets, while musicians might need instruments, studio time, and sound engineering software. Writers often purchase research materials, such as books, academic journals, subscriptions to online publications, and historical records, while graphic designers require high-performance computers and design software programs, such as Photoshop and Illustrator.

Common Expenses for Hospitality and Food Service Businesses

Restaurants, hotels, and catering businesses face a wide range of industry-specific expenses. These include food and beverage inventory, kitchen appliances, and safety equipment, such as fire suppression systems. Employee uniforms, restaurant décor, and specialized software for reservations and point-of-sale (POS) transactions are also common expenses. Licensing for alcohol sales and health inspections can add to operational costs. For hotels, necessary costs include linens, cleaning supplies, and guest amenities, such as toiletries and Wi-Fi services.

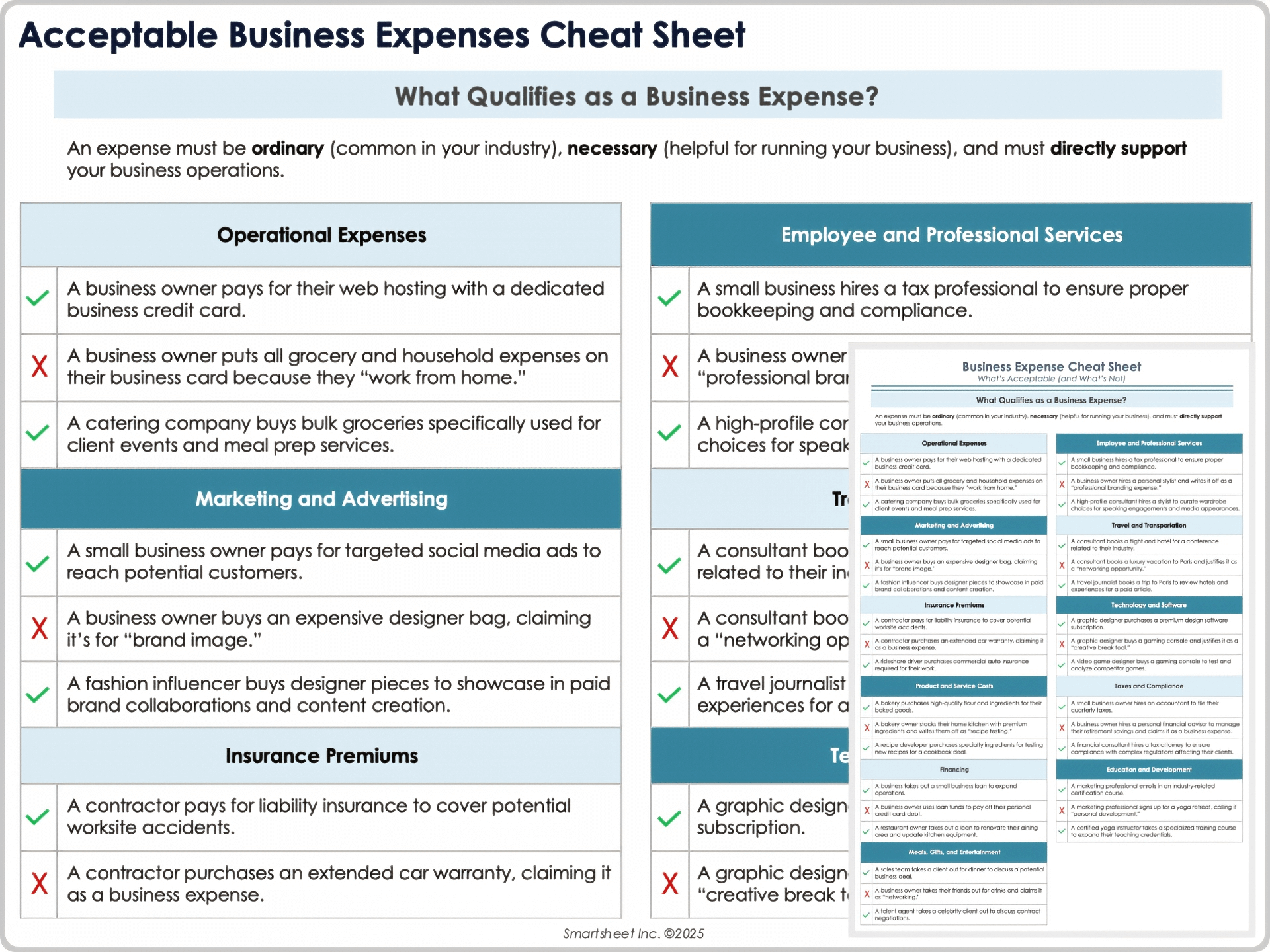

Acceptable Business Expenses Cheat Sheet

At the end of the day, anything can be a business expense. As the business owner, you get the final say on what your business will and will not spend money on. However, that isn’t the case when it comes time for taxes. If you want to claim an expense as a deduction, the IRS requires that it be both “ordinary and necessary” for your specific industry.

According to the IRS, an ordinary expense is “common and accepted” in your line of work. A necessary expense is “helpful and appropriate” for running your business.

While you have flexibility in what you choose to spend money on, only expenses that meet these criteria will qualify as deductible business expenses. We’ve created this handy spreadsheet to help you determine what expenses are and aren’t legitimate.

Download the Acceptable Business Expenses Cheat Sheet for Adobe PDF

This simple document guides you through some questions to help you figure out how to determine what is and is not an acceptable business expense, and how to categorize it. If you’re still unsure, check the official IRS website for additional information, or consult with a tax professional.

And remember: The money you spend on that tax professional — or any tax preparation for your business, from a consultation with a CPA to specialized tax software — is itself a deductible expense.

Stay on Top of Small Business Expenses With Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.