What Is M&A Project Management?

The term M&A project management refers to the process of applying the best practices of project management theory to organize pre- and post-merger activities. When you merge two companies or one firm acquires another, you must manage a complex series of steps to execute the deal.

With M&A project management, you use a structured approach drawn from project management theory to achieve the objectives of the deal, which generally include higher value for shareholders and operating synergies.

M&A project management breaks down each activity — for example, combining operations — into phases of initiation, planning, executing, controlling, and finishing the work. This process designates key roles and establishes timelines, benchmarks, and targets. For complete background on project management methodologies and general best practices, see this project management guide.

Why Is M&A Project Management Important?

M&A project management is important because how you handle your deal has a big influence on its success. A merger or acquisition can easily become overwhelmingly complex, and the structured processes of M&A project management will help keep you on track.

M&A success rates illustrate the need for a disciplined framework. Deals fail to achieve their objectives between 50 and 85 percent of the time, depending on the study you consult. Roughly half of the time, failure stems from poor integration, according to industry estimates. When you consider that nearly 36,000 M&A deals valued at more than $3 trillion were announced globally in 2018, according to Boston Consulting Group, failure represents significant wasted resources.

A Deloitte survey of M&A executives cited the following as the most important factors in achieving M&A success: 23 percent effective integration, 18 percent accurate target valuing, 14 percent proper target identification, and 11 percent sound due diligence. M&A project management gives you the tools to optimize all these success factors.

The benefits of robust M&A project management include sounder deal strategies, more realistic pricing, greater alignment in the organization, clearer roles and responsibilities, prioritization of your most important activities, less disruption to the business, better communication with stakeholders, and decreased risk of losing customers, staff, and suppliers.

In big deals, the M&A process can entail as many as a thousand projects, lasting up to three years. In these cases, the acquiring company considers the transaction to be a program under which the individual M&A projects fall. If the acquirer is doing a lot of deals, it will have a portfolio of M&A programs.

Regardless of scale, M&A project management provides a framework to conduct all the steps in the transaction, such as performing due diligence, integrating operations, communicating with stakeholders, and making decisions about staffing and asset disposal for the post-merger organization.

Veteran project managers note that M&A itself is one large project, with a beginning, middle, and end as well as extensive interdependencies. M&A project management contrasts with operations management in multiple respects. Operations are ongoing, involve predictable resource needs, seek to diversify risk, require cyclical reporting, and review performance continuously. For M&A, resource needs are constantly in flux; reporting is done on a one-time basis and is event driven; success is determined from a final review; and managers seek to consolidate risk.

For background on M&A and how it works, see this explanation of M&A terms and the deal process and this guide to business M&A strategies.

When to Use M&A Project Management

Project management techniques are relevant to all types of corporate deals and phases. Deal types include acquisition, asset divestiture, spinoff, and joint venture; phase types include pre-merger, merger, post-merger, and post-deal.

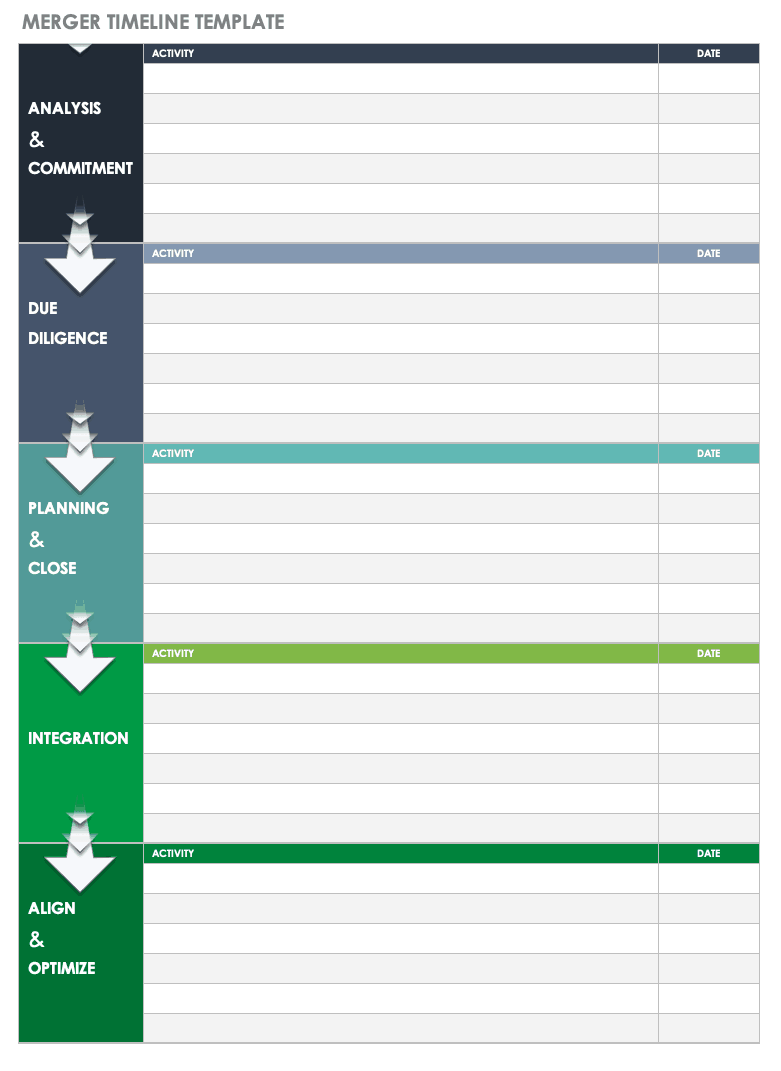

M&A experts recommend using strong project management techniques from the moment you decide to explore potential deals until the time you fully complete any transaction and integrate operations. To get started, the below merger timeline template will give you a date-defined overview of the process from beginning to end.

Download M&A Timeline Template

Integration can span a period of up to three or more years for a company that pursues just one acquisition. A large corporation that continuously seeks deals may roll from one merger to the next, keeping its project management framework and team in place.

Participants at all levels of the deal can benefit from the project management approach, whether they are CEOs and board members who need a high-level view, or project managers and integration directors who must track every incremental development.

Pre-Merger M&A Project Management Fundamentals

By applying M&A project management during the pre-merger phase, you lay a strong foundation for any deal that you pursue. This phase covers such activities as the development of your strategy, the search for potential targets, and efforts to strike a deal.

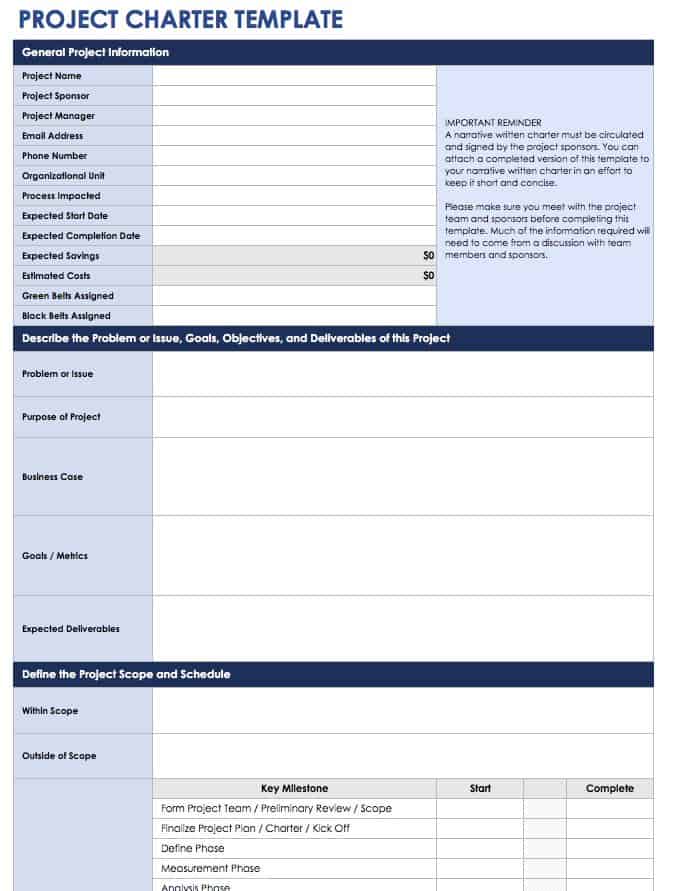

To initiate a project, create a project charter, define your scope, identify your objectives, and bring the relevant stakeholders on board. Next, project planning involves breaking down the work into tasks and subtasks, setting a timeline, defining resources, estimating costs, and assessing risks. This project charter template will help get your planning activities off to a strong, structured start.

Download M&A Project Charter Template

Now, it’s time to execute. Organize your team by assigning roles and responsibilities, and then coordinate the efforts of the team, hold kick-off and status meetings, and communicate with stakeholders. During project monitoring and control, manage risk and track performance. At the end, you close the project, take stock, and record lessons learned.

Download M&A Roles and Responsibilities Template

In the pre-merger phase, M&A project management is commonly used to tackle the following work:

- Strategy Identification and Verification: Determine what you expect to gain from doing a merger or acquisition and check that your reasoning is realistic.

- Candidate Screening: Establish the criteria for potential targets, such as size, location, and product offerings. Look for candidates that match these criteria; then evaluate them.

- Preparatory Work: See if the target company is receptive to a deal. If so, sign a confidentiality agreement and review information on the business. If this review proves favorable, submit a written offer (usually with a price range, rather than a final price).

- Negotiations: Meet to hammer out a deal, including acquiring more detailed information from the seller about the state of the business. When a firm price is reached, both sides sign a letter of intent.

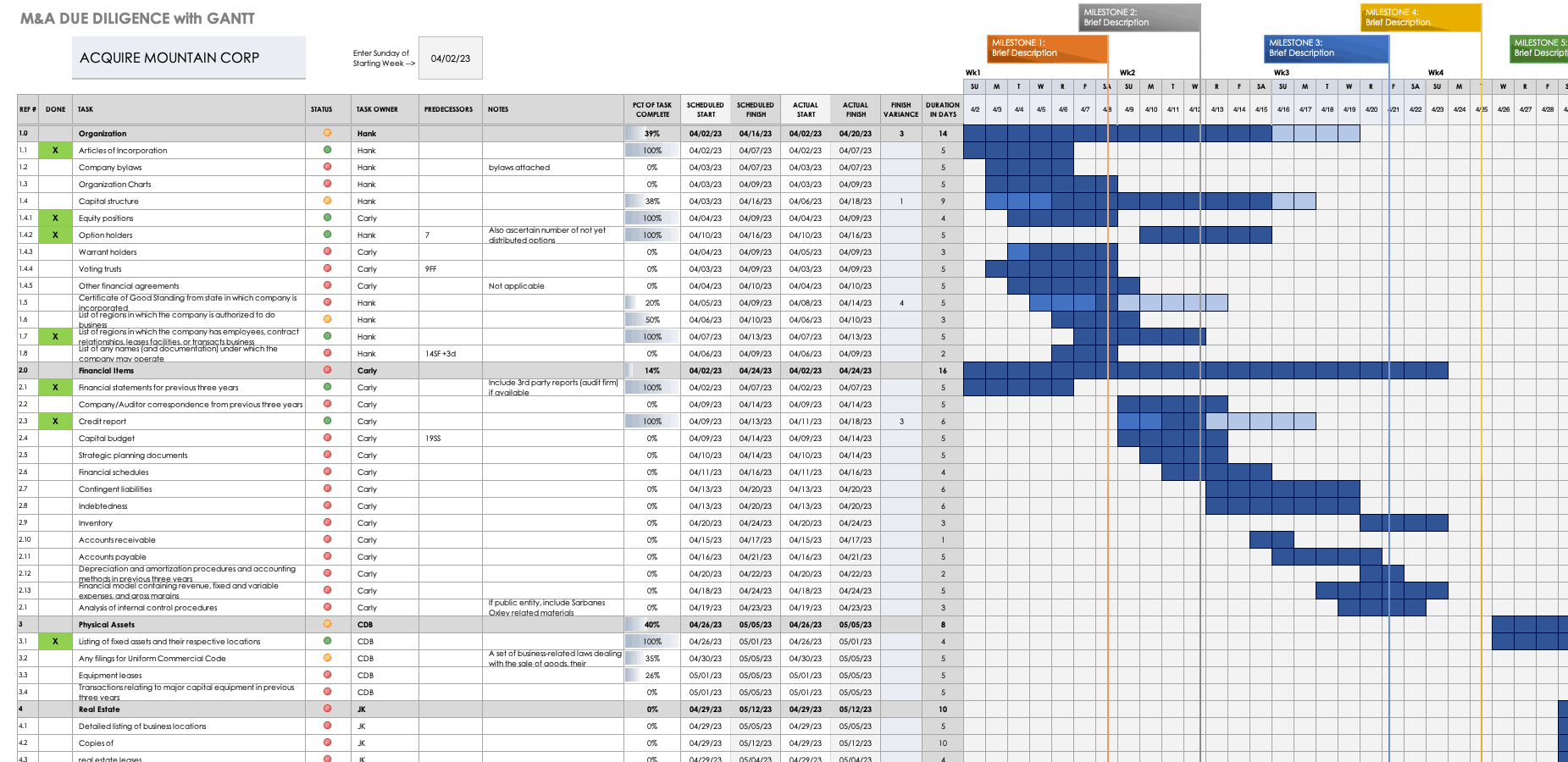

- Due Diligence: You do an in-depth review of the target’s records to verify information and check for unknown liabilities.

- Contract Development: Write and review a final contract for the transaction.

- Financing: Work with your bankers to raise the money you need to pay for the transaction, such as with loans, a debt or a stock issuance, or a combination thereof.

- Closing: Public companies must have shareholder meetings to approve large deals. Representatives of both the buyer and the seller sign contracts, and money is exchanged.

More profitable M&A starts with sourcing better opportunities, says Tyler Fair, CEO of SourceScrub, a maker of M&A deal origination software. “Ingesting a data source and attending conferences are paramount to this. Without either, you're missing out on huge opportunities to make yourself better informed and maximize your network,” he notes.

Fair recommends building a CRM-based pipeline that segments by sector and geography and prioritizes opportunities. Track these elements consistently, assign owners to all opportunities, analyze conversion rates, and adapt your strategy based on the results, he advises.

Best Practices for Pre-Merger Project Management

In the pre-merger phase, M&A experts say that project management best practices generally act to ensure sound decision making as well as effective risk management by making sure important details are not overlooked.

Best Practice: Stage-Gate Process

Using a stage-gate process (also sometimes called a phase-gate process) is a critical best practice for M&A project management. Stage gate is a structure for advancing from one important step to the next.

Acquirers often have to review a hundred or more potential targets to find a deal worth pursuing. So, setting clear criteria for when a target should advance will enable you to maintain focus and discipline. Without defining these parameters, the team may waste resources by developing candidates that do not align strongly with the M&A strategy.

With stage gate, you make a decision about whether to move forward after certain critical phases of activity. In M&A stage gate, there are three important decision points:

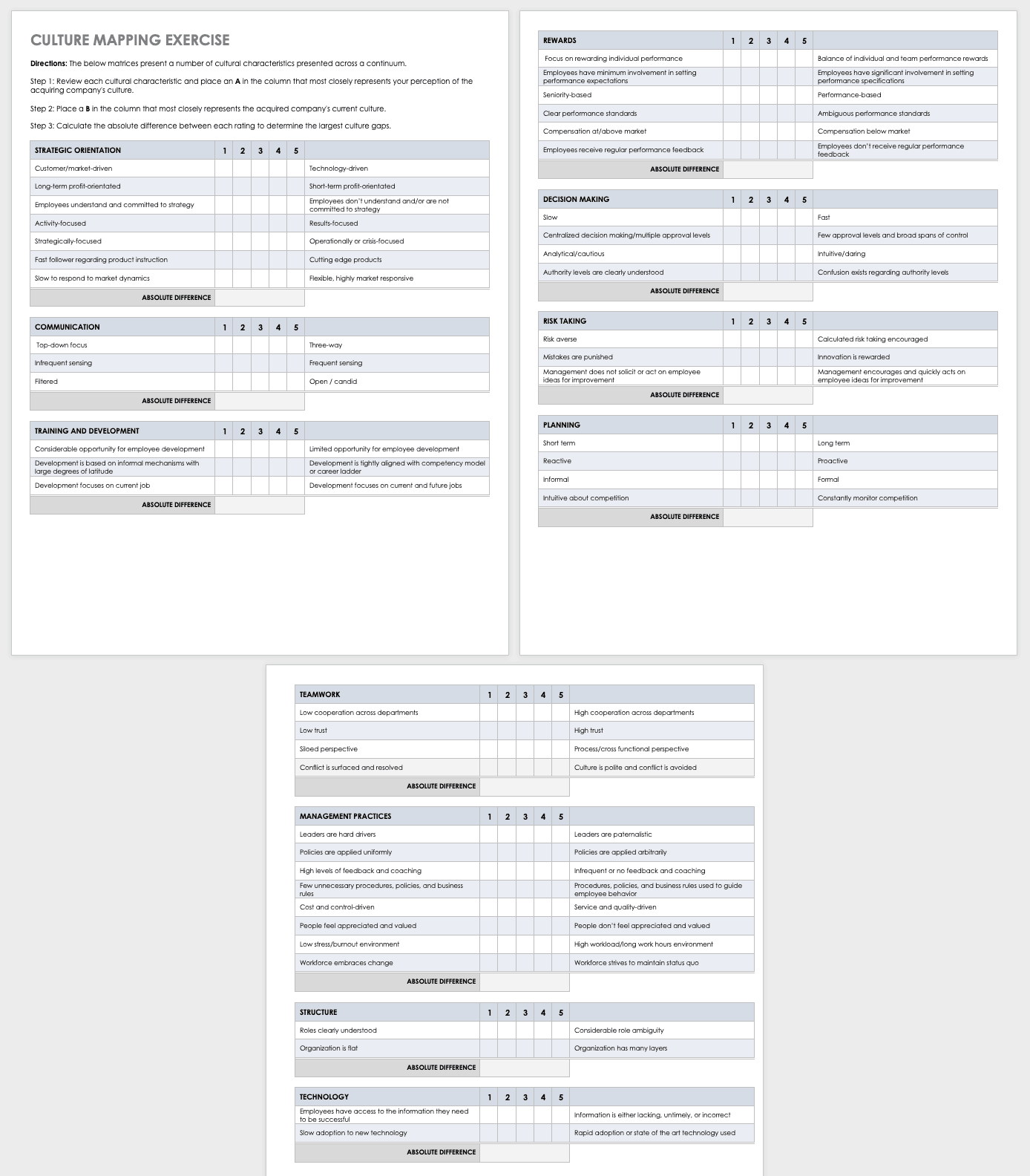

- Strategy Approval: Here, you decide whether a deal candidate fits your company’s M&A strategy. You typically do this based on alignment with value-enhancement objectives, such as percentage gain in market share or increase in revenue. This criterion will become your future state vision for a deal that you pursue. You might look at other markers of compatibility, including manufacturing processes, product line-up, and ease of integration. Affirm that you have support from key stakeholders, such as senior management or your board. The below template walks you through synergy and culture mapping.

Download Synergy and Culture Mapping Template

- Negotiation Approval: After you have done valuation analysis of candidates, you must decide whether to advance to negotiations with any of them. Based on your review of the target’s financial information, you confirm that your original strategic objectives for a deal remain reasonable. At this stage gate, you set a target price for a transaction. The following templates can help you with a variety of actions at this stage.

This due diligence template covers key tasks in major areas such as finance, physical assets, and intellectual property.

Download M&A Due Diligence Template — Excel

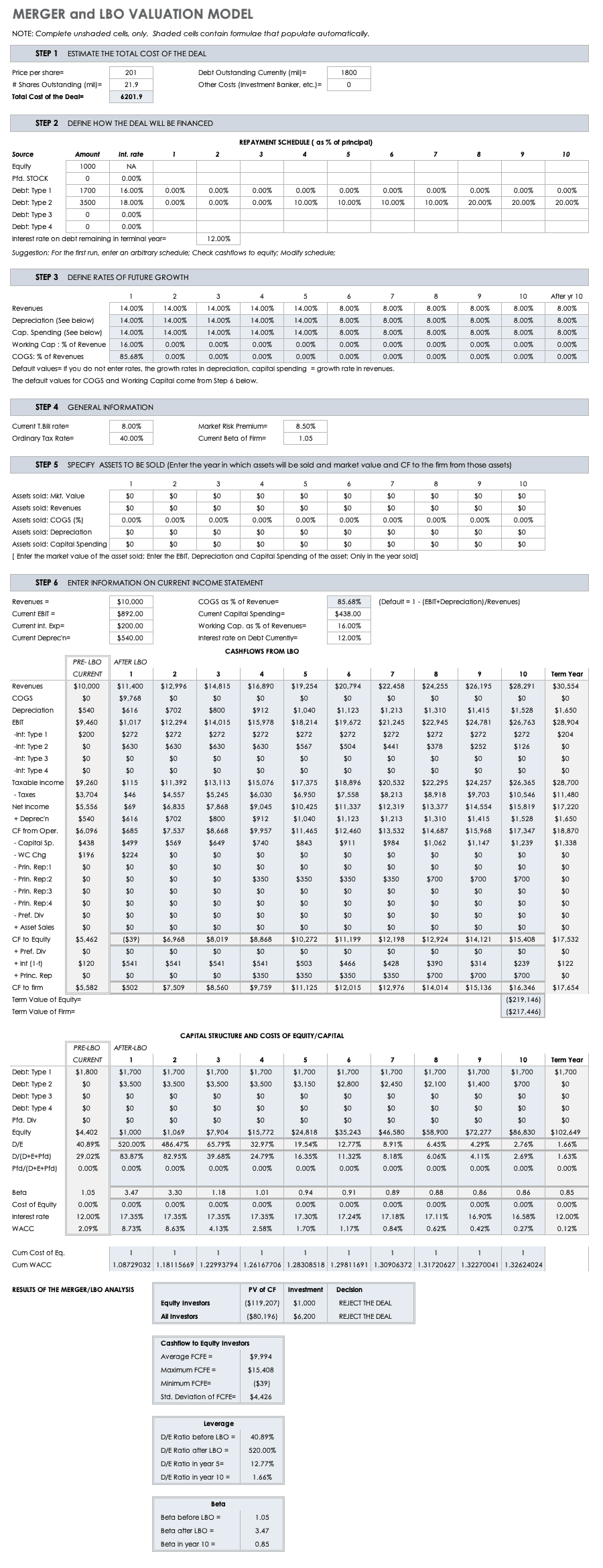

The valuation model template will help you analyze whether you should pursue a merger or leveraged buyout, based on financial variables that you enter.

Download Merger & LBO Valuation Model Template — Excel

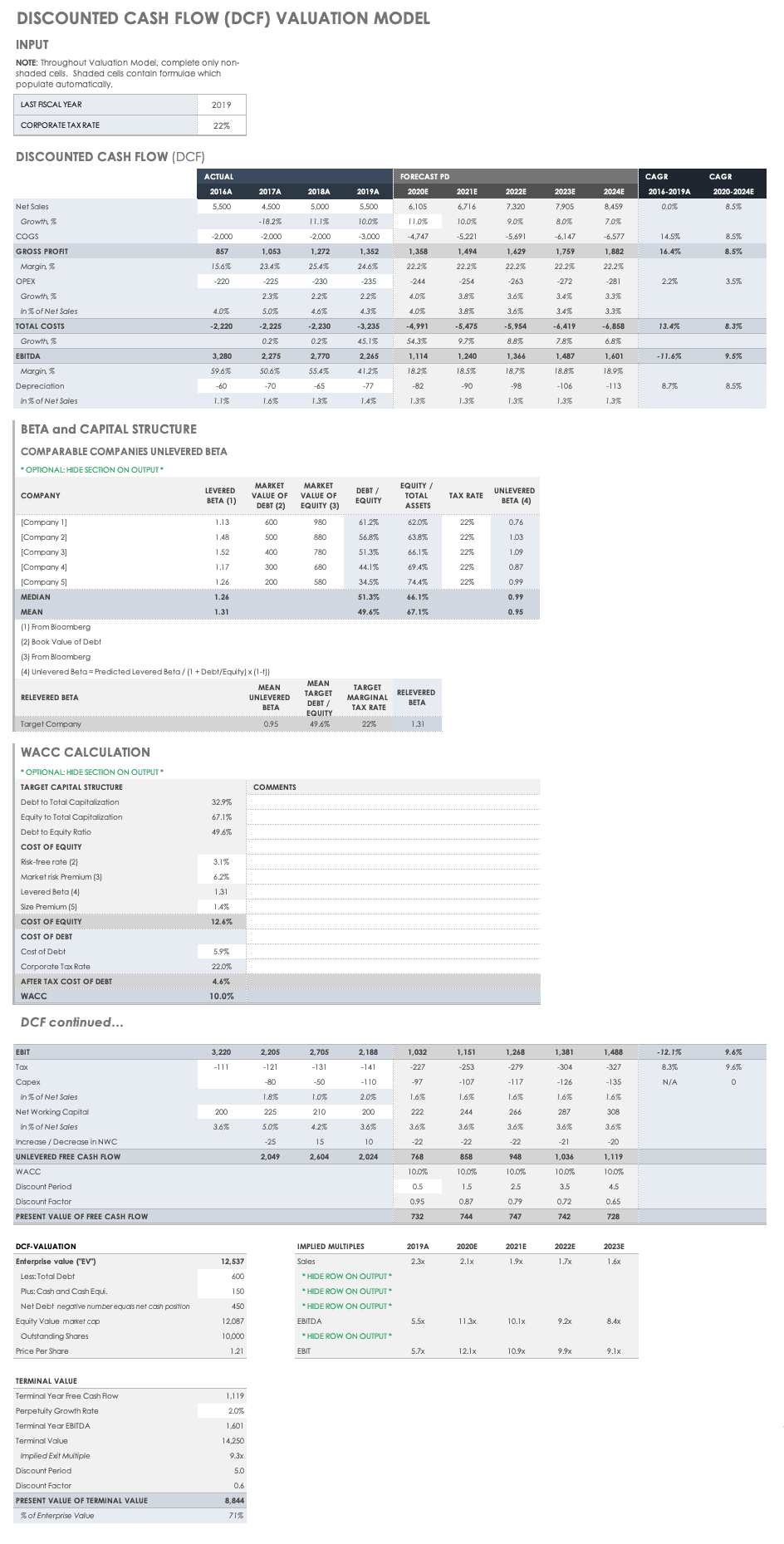

This discounted cash flow (DCF) template models the net present value of a target’s

free cash flow.

Download Discounted Cash Flow (DCF) Valuation Model Template — Excel

- Deal Approval: This decision point is generally your final go/no-go review, and you seek approval of a definitive agreement from your board and leadership. At this stage, you are beyond questions about strategic fit and valuation. Instead, you are seeking approval of the fine points, some of which depend on the nature of your transaction. Small deals by large companies may not need high-level review. In highly regulated industries, you must meet detailed regulatory criteria before advancing.

Other Pre-Merger Best Practices

Other project management practices in the pre-merger stage are similarly aimed at making sure that your deal rationale is sound and that you are putting your resources into deals that will deliver the best returns.

- Clearly Articulate Your Rationale: Have a solid argument for pursuing a merger or acquisition. Consider other alternatives for achieving the same objectives, and make sure a deal is the best way.

- Be Aware of the Thinking Traps: Look out for particular traps that can skew your judgment about M&A, such as confirmation bias. Make sure you consult a diversity of stakeholders and actively seek out dissenting views.

- Bring in Outside Expertise: If you are new to M&A, have a small staff, or want to augment your skills, add outside consultants and advisors to strengthen your process, work on financing, and conduct due diligence.

- Be Diligent about Due Diligence: You don’t want surprises about undiscovered liabilities after the deal closes, so be dogged in the vetting process.

- Coordinate Your Work: Develop your M&A with a focused plan that defines roles, activities, and communication responsibilities for all team members. Keep everyone updated.

- Get High-Level Sponsorship: From inception, make sure senior leaders and board members know and understand the M&A strategy.

- Define the Work That Must Be Done Post-Merger: Do this as you approach the deal closing.

“Frequently, in the weeks leading up to the closing of the acquisition, you spend most of your time negotiating the deal terms and finalizing the legal documents that you need for the transaction,” notes Alec Dafferner, Partner and Head of the San Francisco office at technology investment bank GP Bullhound.

He adds, “In our experience, people spend far too little of this time on joint planning sessions between the operational executives who will be working together after the transaction closes. This time is critical for the buyer to understand exactly what and who they’re buying and for the seller to better understand the criteria for success within the organizational structure of their new owner.”

Post-Merger M&A Project Management Fundamentals

Post-merger M&A project management focuses on the key activities of planning and implementing integration, communicating about the deal to internal and external stakeholders, tracking performance, and realizing the intended benefits of the transaction.

Often, a dedicated project management office (PMO) takes charge of post-merger activities (such as integration), and all integration teams report to the PMO on their progress and problems. The PMO sets standards and defines procedures and workflows. The PMO is also often in charge of change management.

The PMO team provides central management of the following: work streams and project planning; governance and oversight; communication and stakeholder engagement; performance monitoring; and verification that the project stays on time and on budget.

The PMO reports to the owner of the integration project, usually a senior executive at the acquiring company, and they share responsibility for successful execution. Typically, the PMO includes a director as well as program and project managers, along with support staff. Team members work on projects with functional and operational specialists from the business.

Best Practices for Post-Merger Project Management

The post-merger period lays the groundwork for realizing the intended benefits of the deal, and missteps can ruin that potential. Therefore, much depends on successful execution. Strong project management decreases your downside risk.

Best practices for M&A project management in this phase fall into some key categories: project planning, communication, resource planning, people issues, monitoring and measuring performance, day one, and the first hundred days.

M&A Best Practices: Project Planning

Before you begin your post-merger work, it’s crucial that you establish a strong foundation in the form of a robust project plan. Here are some best practices for this work:

- Address Project Organization: You should also address lifecycle and governance in your planning. This means identifying your work framework or structure, defining the end point of the post-merger work, and deciding on the policies and decision makers.

- Get Strategic: Employ organizational design (a method for reorganizing work systems and structures to fit the new post-merger goals) and model cost synergies, so you know where the low-hanging fruit is. Also, have a total rewards strategy that combines growth opportunities, benefits, and compensation to incentivize staff to achieve post-merger objectives.

- Create a Master Plan: The plan should define all the work, breaking it down into unique tasks that specify the measurable units of time and required resources. Articulate dependencies to help highlight resource conflicts. Set key milestones and concrete short-term objectives. You may encounter unanticipated work, but your master plan helps you effectively manage the known tasks and quickly adapt to surprises.

- Proceed Logically: Prioritize your actions in order of their impact on the business. Identify the tasks with the biggest payoff, and seize some fast wins so you can demonstrate the ROI on the M&A, the largest rewards, and the paybacks. Integrate in waves to minimize chaos.

- Use a Matrix: Employ this type of chain of command, so key managers have lines of accountability to both their functional leader and the M&A project leader. The integration director (who comes from the acquiring company) should not represent any functional department and should report to the CEO. Project subteams should include staff from both the acquiring and acquired companies.

M&A Best Practices: Communication

Because your post-merger project is highly complex, strong communication is crucial to avoiding missed opportunities, delays, and staff defections. Follow these best practices for communication:

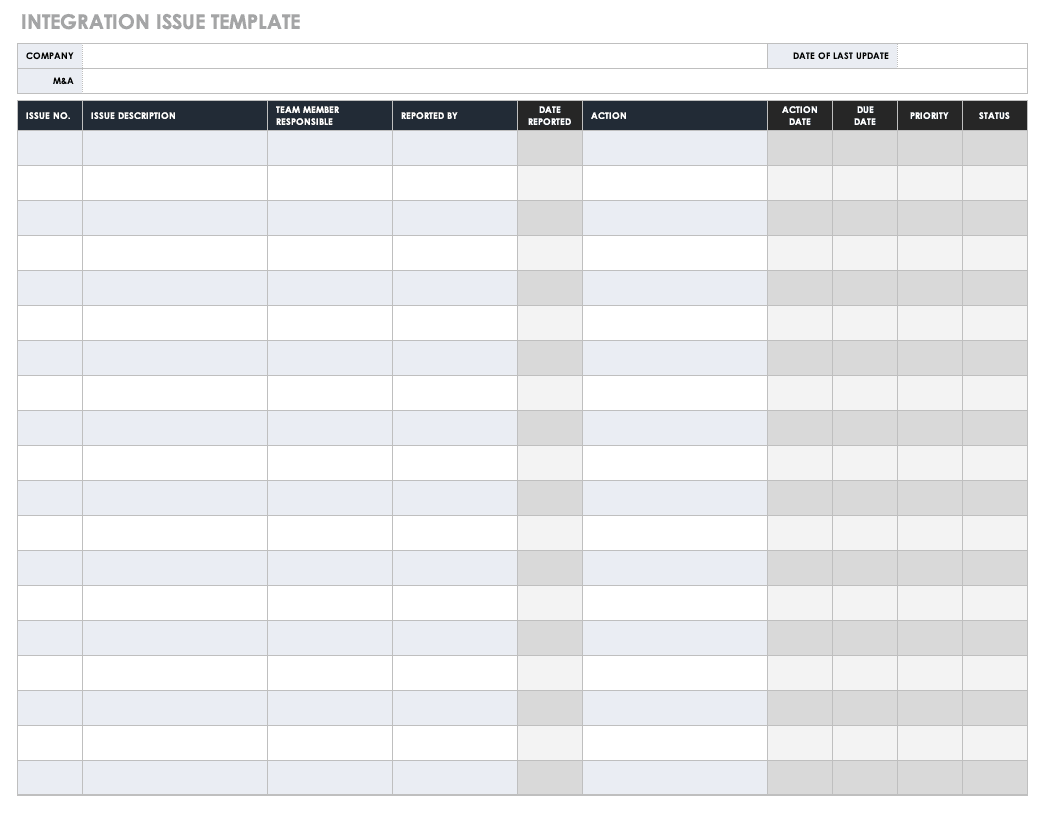

- Maintain a Central Contact Point: This is where you communicate and track all issues. Using this central location, you can make sure that you’re directing your efforts toward the most critical needs. Use the below template to report integration issues, assign responsibility to a team member, and document the actions they take.

Download M&A Integration Issue Template — Word

- Frequent and Full Updates: Providing this information to everyone in both organizations is the cornerstone of a robust communication and change management plan. The M&A project manager should spend 60 to 80 percent of their time communicating with internal stakeholders, M&A experts recommend. Uncertainty breeds worry, which distracts staff, hurts productivity, and leads to defections. Make sure your internal stakeholders understand the deal rationale so that they commit their best efforts to its success.

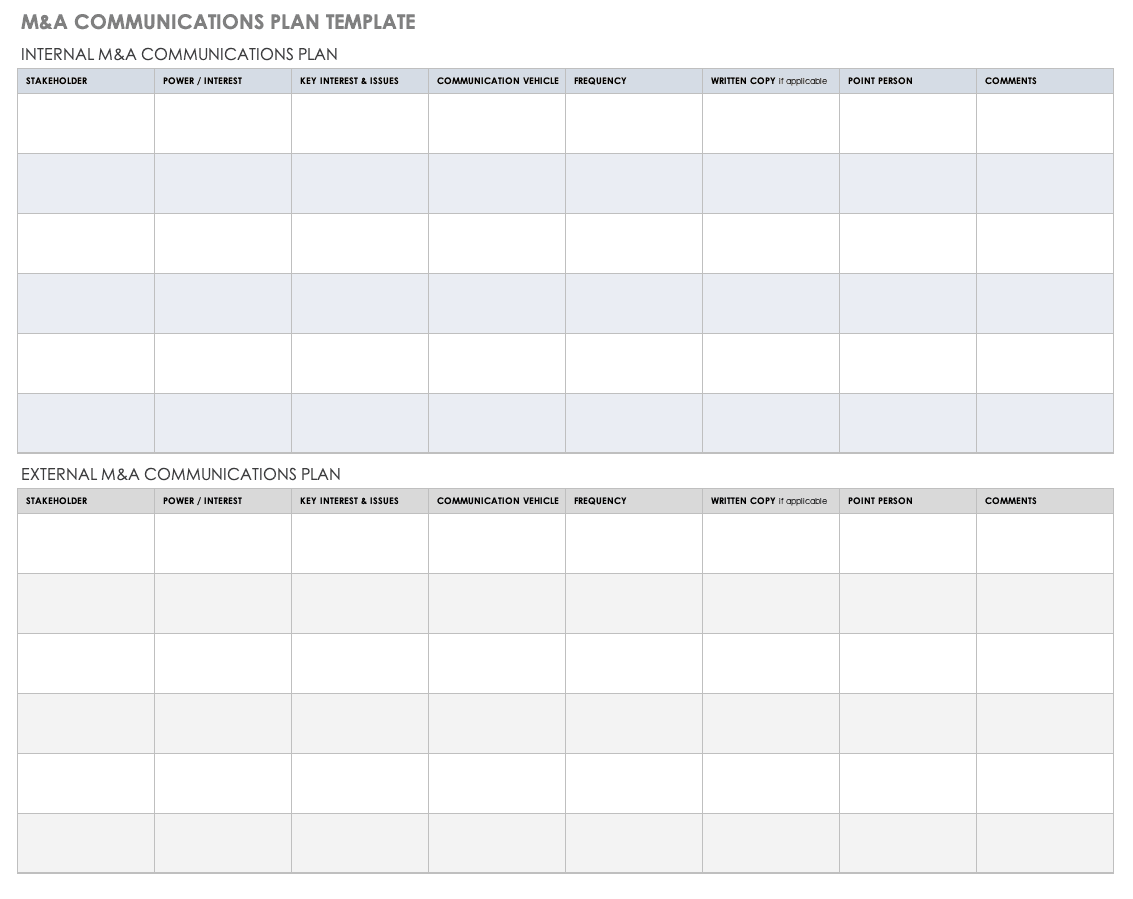

- Make Use of Templates: Templates save time and keep your process consistent. Here are several that are useful for M&A communication.This communication plan template organizes both internal and external communication including frequency, roles, key issues, and stakeholders.

Download M&A Communication Plan Template

This M&A press release template covers all required elements for press releases and their format, including contact information, headline, and background on the merger.

Download M&A Press Release Template

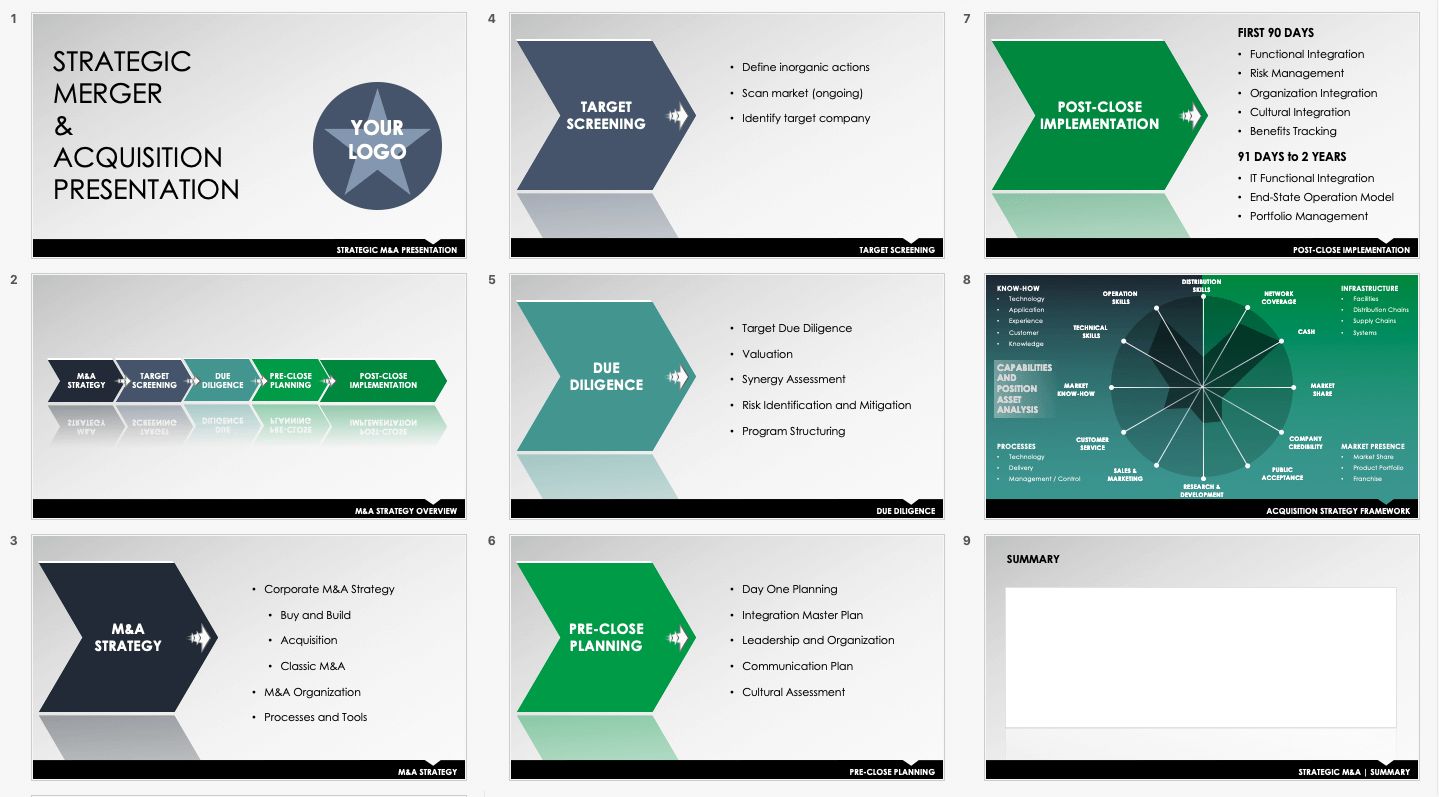

This strategic M&A presentation template conveys your strategy and key information in each aspect of the deal.

M&A Best Practices: Resource Planning

To achieve the cost synergies and value enhancement that you forecast from your deal, you need to bring the post-merger project in on time and on budget. This requires careful resource planning; here are best practices for that effort:

- Employ Strong Estimating Techniques: Do this in order to identify your post-merger resource needs, such as staff, time, and money. View these in the context of your company’s other initiatives, so you can determine the competing demands for internal resources.

- Build Buffer into Your Estimates: This is an essential step because projects often take longer and cost more than anticipated. Do this by adding a variability factor based on past projects. Perform risk analysis using techniques such as Monte Carlo simulation.

- Add Outside Support: Enlist consultants, key new hires, or contracted services. You may lack technical expertise for certain functional areas of the business or want to buttress your project management if your in-house PM tools and methods are weak. Because day-to-day operations continue even as you juggle the transition period, you may encounter leadership gaps as you manage the new combined organization.

M&A Best Practices: People Issues

Resolving the people issues that M&As create is often the most difficult part of the post-merger project. And, culture clashes are one of the most commonly cited reasons for the failure of M&A to achieve its objectives. So, embrace the following best practices:

- Assign a Full-Time Project Leader: Assign this person to the post-merger M&A project, and make sure you have the backing of senior leadership. Know who must sign off on post-merger initiatives (whether it be the senior managers, the CEO, the board, or the event shareholders), and obtain that support.

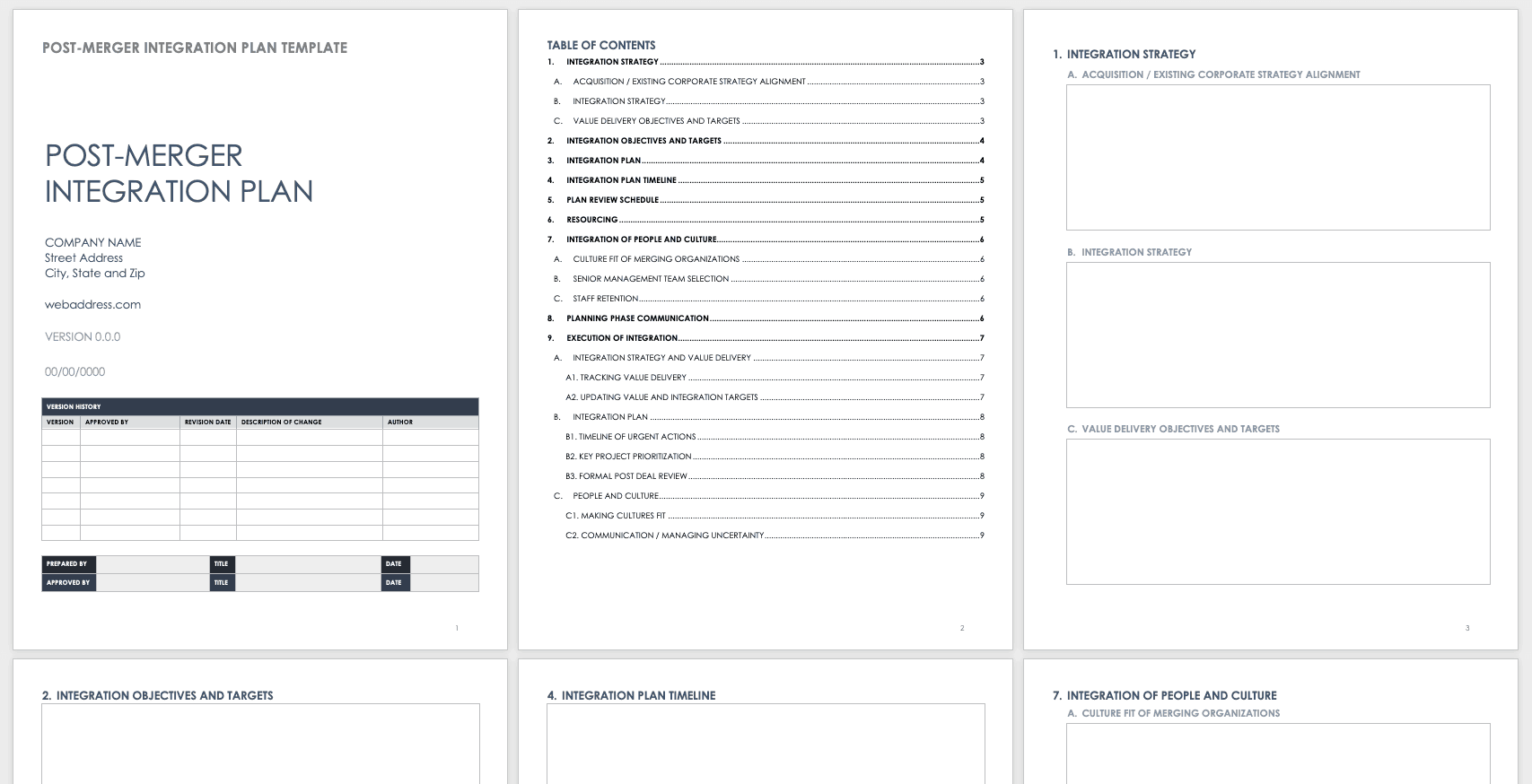

- Do Not Begin Integration until You’re Ready: Don’t begin the integration of two companies until you have worked through all the related staff issues. This means planning for layoffs, a new organizational structure, changes in staff responsibilities, flight risks, and retention needs. Use this post-merger integration plan template to help you create a strong plan ahead of time, so you and your team know what’s coming.

Download Post-Merger Integration Plan Template

- Be Proactive in Managing Fear and Culture: Organizational culture is paramount, so lay out a plan for conveying to members of both companies what the values, mission, and new ways of working together will be. Fear and worry often accompany M&A and cause a dip in productivity. So, address these difficult feelings head on. Listen to employees and communicate as early and as clearly as possible what their new roles will be.

- Use Tools: The Project Management Institute recommends you use tools such as a communication plan, training programs, and surveys and assessments to gather and track feedback. Make sure that the team stays focused on customer needs.

- Do Not Leave It to Functional Managers: These people should not be handling the work of creating joint culture and deciding staff issues, such as forced reductions. Make this work part of the post-merger project under project leaders. Doing so ensures uniformity in the messaging and consistency in the way people are treated across departments, and also insulates functional managers — who must continue to lead their staff after integration — from residual ill will.

Stacy Feiner, a business psychologist who advises corporations, says that companies whose M&A deals fail tend to blame the workforce. “A recurring story gets told that employees are resistant to change, that the managers didn't get buy-in, and that the buyer didn't communicate well. However, this conclusion is misleading. The failure happens as a result of an omission during the deal process,” she contends.

Due diligence should include assessments by industrial and organizational psychologists and related professionals who look at whether the acquiring and acquired businesses are culturally compatible. According to Feiner, they “know the specific human factors that answer questions like, ‘What is the likelihood of a successful integration?’”

M&A Best Practices: Monitoring and Measuring Performance

To meet your objectives, you need to identify key performance indicators (KPIs) and measure their progress. Use these best practices to guide this process:

- Define Success: Find metrics that best align with the strategic goals for the post-merger work, giving highest priority to outcome measures. These will probably include such things as cost savings and headcount, but also incorporate other measures of success, such as staff retention and benefits for customers.

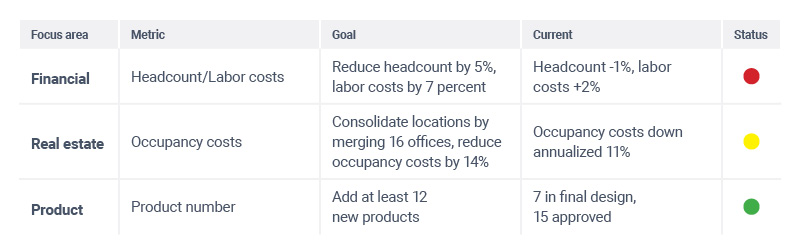

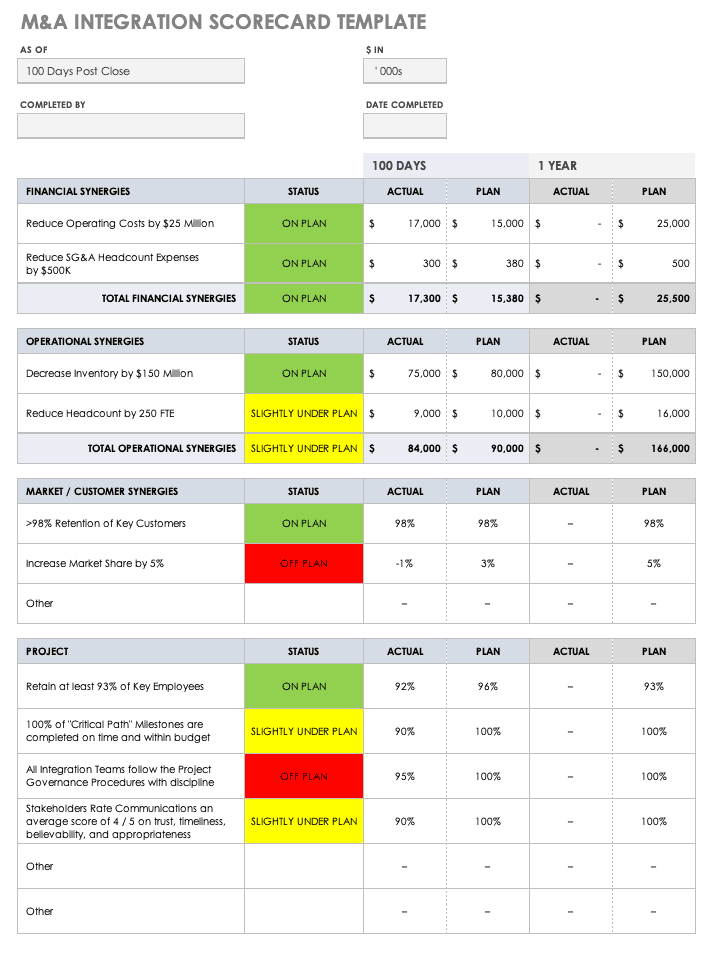

- Use a Balanced Scorecard: A balanced scorecard tracks results against strategic objectives. Additionally, you should build a data dashboard that tells you at a glance where your KPIs stand. Use the below M&A integration scorecard template to track your performance compared to your plan.

Download M&A Integration Scorecard Template

- Quantify Lost Productivity: Major organizational change can result in productivity dropping by 25 to 50 percent, experts estimate. Track lost productivity by assigning it a dollar value.

M&A Best Practices: Day One

The day that a merger or acquisition becomes official represents the culmination of the deal process, but only the start of your post-merger work. This date is often called day one of the new organization and marks the start of an intense sprint to bring two businesses together. Here are best practices for getting the most out of day one:

-

Plan Your Launch Day: The activities should celebrate the changes and inform staff and other stakeholders about what they can expect. This is the right time to convey culture and clearly articulate any new reporting lines.

-

Include PMO Members and Functional Staff: Include both of these groups on your day one team. The post-merger team should already have plans in place and hit the ground running. The day one team disbands when its work is complete.

-

Prioritize Communication and Continuity: To both internal and external stakeholders, communicate your organization’s top priorities: to remain focused on the business and on customer service.

“Have a clear vision for day one,” urges Deepak Lalwani, principal of Deepak Lalwani & Associates, who advises on M&A integration.

“Communicate, communicate, communicate,” he adds. “Identify and manage the key constituencies — customers, employees, regulators, shareholders, partners, suppliers, and competitors. Proactively manage messages and perceptions.”

“The most urgent issues on employees’ minds vary somewhat by location, level, department, and whether they are part of the acquired or acquiring company. The best merger communication programs acknowledge those differences through highly tailored messaging,” says Lalwani.

M&A Best Practices: First Hundred Days

After day one, M&A post-merger project managers put intense effort into the first hundred days, a period when you must accomplish (or at least set in motion) important integration tasks. These are some best practices for project managers during this phase:

- Be Vigilant: A loss of discipline in your project management can easily derail your success. Make sure you continue to use objective criteria to prioritize integration work. Use project management best practices for every initiative, and treat the integration process as a portfolio of individual projects.

- Understand the Value Drivers: Consider these drivers in the context of the enlarged organization. These are the steps that lead to value creation. Map the value drivers in a flow diagram, laying out the chain of activities that will result in strong performance and profitability. Keep aligning your synergy goals with these value drivers.

- Keep Communication Flowing: Remember to include the staff from the acquired company in the work. Provide frequent status reports to all stakeholders (including the staff affected by changes and senior management) concerning all activities.

Core Competencies for M&A Project Managers

M&A project managers need the aptitude and expertise that support the successful execution of the transaction and post-deal implementation. While knowledge of the business and industry is helpful, pros say that strong project managers are often generalists, and functional staff and executives may contribute the needed product as well as industry-specific knowledge.

A successful M&A project manager typically has expertise in the following areas:

- Work Management: This covers strong project management skills and the ability to design effective workflows. It also concerns how to apply technology solutions to more efficiently execute project goals.

- Information Management: M&A due diligence can spiral out of control if there is not a strong process for reviewing and analyzing corporate data. Integration planning and implementation demand that project managers understand where key data lives, that they keep it safe, and that they use it to make data-driven decisions.

- Resourcing: This means knowing how much time, money, staff, and other resources you need to execute the project. It also means having the skill to secure these resources.

- Governance: The project leader needs to know how to structure the management and control processes for running the organization.

- Finance: Even if they’re also doing the hands-on work, the M&A project manager should be thoroughly familiar with the financial engineering alternatives for financing the deal. They should also have expertise in budgeting and managing finances for the post-merger organization.

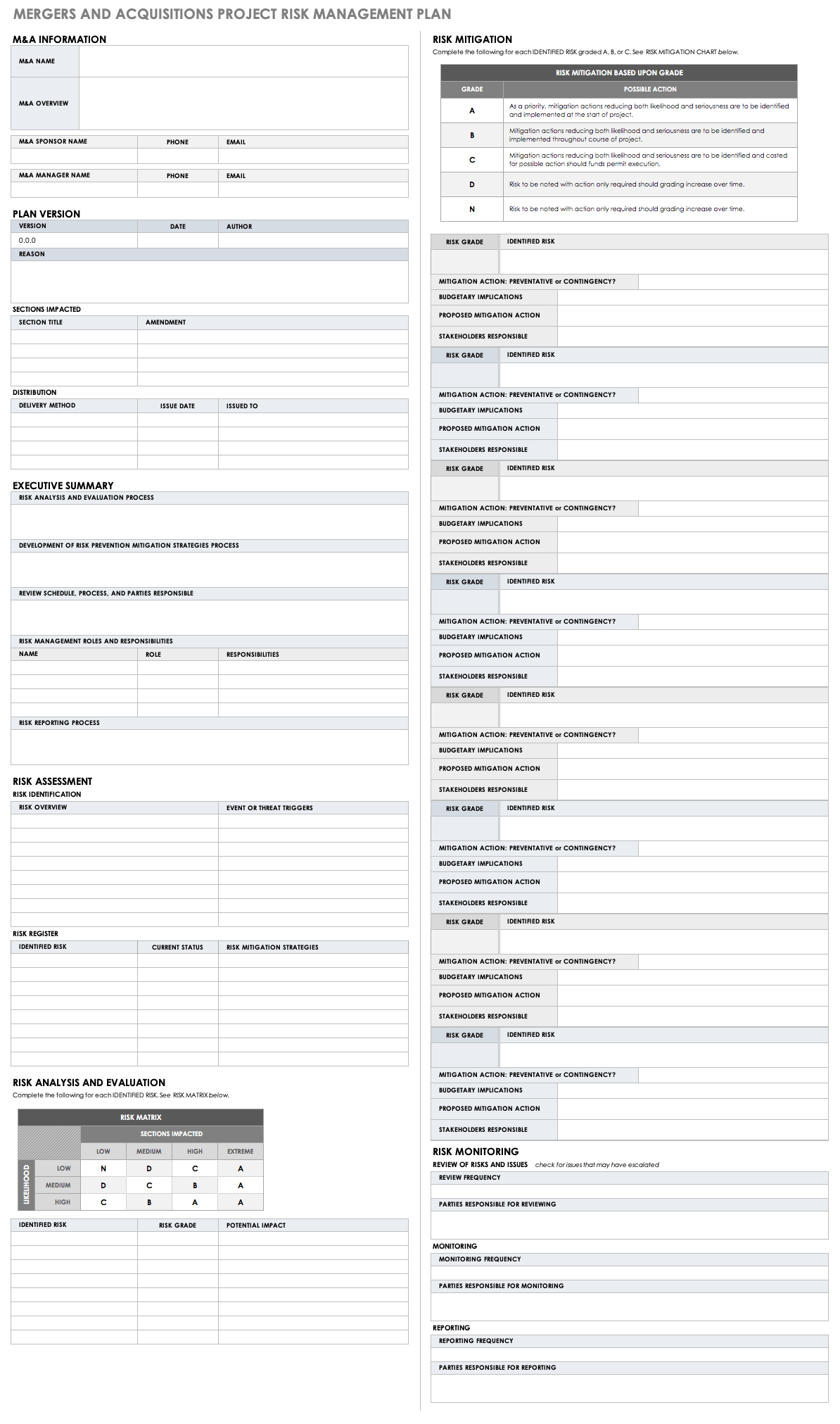

- Risk Management: The M&A project manager strives to achieve the financial goals of the deal and avoid failure and loss. The manager should possess risk-management and opportunity-spotting skills, such as formal training in financial risk management, familiarity with regulation, strategic thinking and analysis expertise, and background in financial markets. The following risk management plan template incorporates analysis and monitoring, numerical calculations, a risk register, and a list of potential risks.

Download M&A Risk Management Plan Template

- Performance Management: Understanding the critical success factors of the post-merger project, developing KPIs that reflect the goals, tracking, and adapting to make sure you meet objectives are all part of the PM’s responsibilities.

- Quality Assurance: The M&A project manager also needs to make sure that the staff is adhering to best practices, that project closeout goes smoothly, and that people are recording lessons learned to improve future M&A projects. A strong PM embraces continuous improvement.

Common M&A Project Management Challenges and Mistakes

As we noted earlier, mergers and acquisitions fail more than half the time. M&A project managers say failure usually stems from common challenges and mistakes, rather than unpredictable issues. Here’s a list of some of the most significant ones:

- Moving Too Fast with an Integration Plan: Rushing an integration plan based on incomplete or premature information results in unrealistic timetables and financial targets.

- Insufficient Attention to Culture: Neglecting culture and communicating inadequately lead to fear, uncertainty, and declining morale among staff, as well as an attrition of top performers. Media scrutiny can compound these failures.

- Poor Management of Relocations and Consolidations: This can result in culture clashes, inefficiencies, and suboptimal performance.

- Weak IT Planning: In the merging of organizations’ architectures, systems, and applications, weak IT planning can result in poor infrastructure, lost opportunities, process inefficiencies, and data disorganization.

- Inadequate M&A Project Management Controls: Inadequate management controls, such as the absence of a clearly designated project leader and the failure to account for dependencies among tasks, leads to the treatment of major deal phases as standalone events.

- Lack of Planning for Heightened Competition: The failure to anticipate the potential for heightened competition and M&A-related productivity decline can erode financial performance.

- Incomplete Effort to Identify Synergies: These things can also affect your bottom line: neglecting to identify the cost cuts and revenue opportunities that the deal will generate; making an inadequate investment in the integration effort; and failing to achieve the anticipated value enhancement.

Acquirers often “quickly push their own ethos and culture without any real transition period. This is typically a recipe for disaster,” notes lawyer Marc Snyderman, who advises on M&A and handled M&A deals as a corporate executive.

“Leave the culture alone; start to learn the business from the inside out. Once you have a real understanding of how things work, develop a strategic plan with actual change management practices that incorporates the acquired company’s leadership into the path forward.”

Using Technology to Aid M&A Project Management

M&A executives and project members must be able to communicate in real time about their activities, manage information flows, and work through deal phases and integration using proven methods. Software tools support these activities.

The simplest tool is spreadsheets, but these quickly fall short when information is changing quickly and many stakeholders need to collaborate.

Cloud-based project management software adds many helpful features and functions, such as templates, work assignments and delegation, reporting, notifications, automations, forms, checklists, analytics, and secure document sharing.

Purpose-built M&A software applications offer deal pipeline modules, virtual data rooms for due diligence, and integration management.

Mark Williams, Chief Revenue Officer, Americas, at Merrill Corp, which offers a virtual data room platform, stresses the need for security and privacy — especially in light of regulations, such as the European Union’s General Data Protection Regulation and the California Consumer Privacy Act.

“Collaboration tools within the due diligence app … are gaining traction as a way to reduce unsecure transmittal practices, make an otherwise messy, manual process organized and on track, and provide a more robust audit trail of deal communications,” he notes.

Moreover, says Williams, “protecting sensitive data from the threat of a security breach without obstructing information sharing is crucial to deal management.” He also recommends that deal participants look for application access controls that offer an array of authentication and permission options.

Improve Mergers and Acquisitions Integration with Smartsheet for Project Management

From simple task management and project planning to complex resource and portfolio management, Smartsheet helps you improve collaboration and increase work velocity -- empowering you to get more done.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.