What Is Project Cost Management?

Whether you are developing a new product, designing a facility, or changing a key process, it’s challenging to forecast and manage project costs effectively.

In fact, the job is so challenging that half of all large IT projects massively blow their budgets, running on average 45 percent over budget and seven percent over time, according to consultants McKinsey & Co. and the University of Oxford. For projects in other sectors, the news is no better. The Project Management Institute (PMI) reported in 2016 that companies were completing only 53 percent of projects within their original budget. However, strong cost management helps you avoid that fate. So what exactly is cost management?

Cost management refers to the activities concerning planning and controlling a project’s budget. Effective cost management ensures that a project is completed on budget and according to its planned scope. Since you assess the success of a project at least in part by its cost performance, cost management is a prime determinant of project outcome.

Cost management activities are conducted throughout the project life cycle, from planning and budget allocation to controlling costs during project execution and assessing a project’s cost performance upon completion.

Although cost management includes a whole ensemble of activities, it is sometimes referred to in terms of more specific functions, such as spend management, cost accounting, and cost transparency. Cost managers sometimes use these terms as loose synonyms for the broad cost management function.

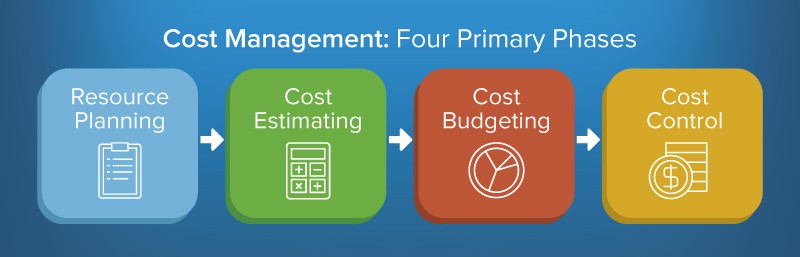

Cost Management: Four Major Steps

The Project Management Body of Knowledge (PMBOK), the bible of project management theory, says cost management is made up of four processes. These generally adhere to the sequence that follows — as a project goes from the planning board to reality.

- Resource Planning: Part of the initiation stage of a project, resource planning uses a work breakdown structure — a hierarchical representation of all project deliverables and the work required to complete them — to calculate the full cost of resources needed to complete a project successfully. Managers typically determine required resources for each work breakdown structure component and then add them to create a total resource cost estimate for all project deliverables.

- Cost Estimating: Cost estimating is an iterative process that uses a variety of estimating techniques to determine the total cost of completing a project. Cost estimating techniques vary widely in their approaches to computing project costs, and stretch from conceptual techniques that draw mainly from historical experience and expert judgment to determinative techniques that estimate costs on a component-by-component basis. We will discuss these techniques in detail later, as they vary in their levels of accuracy. Determinative techniques are the most accurate; however, while the estimator’s job is always to create the most accurate estimate possible, determinative estimating techniques are only an option if you’ve reasonably finalized a project’s scope and deliverables. As such, you use the less accurate estimating techniques during the earliest stages of project planning, and then revise and update estimates as the project continues to be defined. To learn more about cost estimating, read The Ultimate Guide to Project Cost Estimating.

- Cost Budgeting: Once you’ve created satisfactory estimates, you can finalize and approve the project’s budget. Cost managers typically release budgeted amounts in stages according to the level of a project’s progress. These allocations include contingencies and reserves.

- Cost Control: Cost control is the practice of measuring a project’s cost performance according to cost and schedule baselines that provide points of comparison throughout the project life cycle. The specific requirements for effective cost control are set out in the project management plan. The individual in charge of cost management investigates the reasons for cost variations - if they deem cost variations unacceptable, corrective action is likely. Cost control also includes other related responsibilities, such as ensuring that updated project budgets reflect changes to a project’s scope.

Key Components of the Cost Management Plan

The cost management plan guides these four processes. Created during the project planning phase, the cost management plan is a document that defines how you manage, control, and communicate a project’s costs in order to complete the project on budget.

Among other things, a cost management plan identifies the individual or group responsible for cost management, details how you will assess a project’s cost performance, and sets rules for how to communicate cost performance to project shareholders. It also establishes the methodologies by which you will control project cost variations.

While you can customize a cost management plan to fit your organization’s needs, they generally follow a standard format. Sections often include the cost variance plan, the cost management approach, information on cost estimation, the cost baseline, cost control, and reporting processes, the change control process, the project budget, and approvals. You may also want to include the spending authority levels for key project personnel, specifying which roles can approve costs up to specific thresholds.

Let’s look at the sections in greater depth:

- Cost Variance Plan: Cost variance is when the actual amount differs from the budgeted amount. In your cost management plan, you’ll need a section that details the actions you should take, including who is held responsible in the case of a cost variance. The size of the variance usually necessitates different action: a cost variance of less than five percent might result in an explanation of that variance, while a 95-percent-or-greater variance could force the project to be abandoned. To learn how to calculate cost variance, read Hacking the PMP: Studying Cost Variance. For a more detailed template on tracking schedule and budget variances, see this template:

- Cost Management Approach: This section outlines the approach a manager uses for cost management. The level of rigor can vary, but this describes how to establish a cost baseline and how to compare actual costs. You usually track and report costs through control accounts, where you roll up costs of subtasks. This often occurs at the third level of the work breakdown structure, a tool that breaks a project into small components or chunks of work to determine the resources needed to complete a job or project. However, the point at which you track and report depends on the scope of the project.

- Cost Estimation: Here you will define the methods used for estimating project costs, the levels of variation, and the expected precision, accuracy, and risk.

- Cost Baseline: This has a specialized meaning in project management and represents the authorized, time-phased spending plan against which you measure cost performance. It’s the sum of the estimated project cost and contingency reserves.

- Cost Control and Reporting Process: This section establishes how you measure costs and their key metrics during the project. We’ll provide greater detail on this later.

- Change Control Process: This describes the process for making changes to the cost baseline and how to approve those proposed changes.

- Project Budget: The budget builds on the cost baseline by totalling the cost of executing the project (including contingencies for possible risks). It also adds in management reserves, which is an amount to cover unanticipated risks or unidentified events that may arise. An organization will usually set a policy for this, and the amount is often five to 15 percent of the total budget.

Cost Management Activities: Essential Functions at Each Phase

Cost management includes a number of activities conducted at different phases during the project life cycle. It’s important to include the cost management function while developing project plans so that you build solid financial controls into the project structure. Here are some key terms and stages relevant to cost management:

Planning: Using the work breakdown structure to determine the resources needed to complete a job or project.

Estimating: The act of calculating or predicting the expected total cost of completing a project.

Budgeting: The authorization of a budget based on a cost estimate to complete the project. You typically authorize budgets in tandem with schedules, so you can assess cost performance at specific points.

Financing and Funding: The process of requesting, authorizing, and receiving money for a project.

Cost Management: The general practice of overseeing project expenditures and making cost-related decisions throughout the project life cycle.

Controlling: Addressing cost variations to avoid cost overruns.

Job Control: Controlling project expenditure by comparing costs predicted by the cost estimate and costs actually being incurred.

Scheduling: You can determine a project’s cost performance by using a schedule that compares the expected expenditure to the actual costs the project is incurring at any point in time.

Accounting: The practice of recording expenditures and reconciling transactions.

How Accurate Project Cost Estimating Aids Cost Management Efforts

The first step towards robust cost management is having a clear idea of your project’s likely costs. However, it’s futile to track and control costs if you base your spending on unrealistic estimates.

Project estimating considers several variables, including the method you use to create the estimate, the stage at which you build your estimate, and the types of cost you include.

The first variable is the method you employ. You can produce cost estimates using a variety of estimating techniques, depending on the extent to which you define a project and the type of information you have access to. Here are some common estimation techniques:

Analogous Estimating: This uses historical data from similar past projects to create estimates for new projects. This method works if you have experience with projects of the same type.

Parametric Estimating: This method estimates time and cost by multiplying per unit or per task amounts by the total number expected in the project. The rates are often standard or publicly published rates and can be expressed in hours of work, amount of data entered, or the number of units of a product manufactured. This technique has a reputation for good reliability, but it’s less relevant when output isn’t uniform, such as when writing computer code. Some projects have widely varying or unprecedented tasks, so they do not lend themselves to this method.

Bottom-Up Estimating: This is a determinative estimating technique that estimates costs for work breakdown structure components and adds them together to create a cost estimate for an entire project. The project team members help create the estimate. Since the people who are going to be doing the work are engaged in estimating, professionals consider this method highly accurate, as well as a team commitment builder.

Three-Point Estimating: This is a PERT-related statistical method that uses the optimistic (lowest), pessimistic (highest), and most likely cost estimates to create expected values and standard deviations for project expenditures.

Software-Based Estimating: You can use software-based estimating techniques, such as Monte Carlo simulation, to model the effects of risk events on project costs.

Another factor influencing the cost estimating is the stage at which you build your cost estimate. As a project progresses, you discover more variables and actual costs, so project estimates become more refined. You can classify cost estimates based on how well you define the project scope at the time of estimation and on the type of estimation technique you use - the latter generally determines the accuracy of an estimate. In order of accuracy, the main classes of cost estimates are:

Order of Magnitude Estimates: These are very rough cost estimates based on expert judgment and on adjusting the costs of the current project to reflect the costs of similar, past projects. Created before fully defining projects, they are only used in high-level project screening.

Preliminary Estimates: A preliminary estimate uses somewhat-detailed scope information to form estimates based on unit costs. These estimates are accurate enough to use as the basis for budgeting.

Definitive Estimates: Created when you’ve fully defined a project’s scope, a definitive estimate uses deterministic estimating techniques, such as bottom-up estimating. Experts agree that definitive estimates are the most accurate and reliable.

The final variable affecting project estimation is the type of cost included. Of course, your project budget must include all the relevant costs for labor and materials, but whether you include a portion of your organization’s indirect costs depends on the policies of your organization and the type of project. Here are the terms experts use to distinguish between various types of costs:

Direct Costs: Direct costs are those which you can directly associate with a specific cost object. They are billable to specific projects.

Indirect Costs: You cannot associate indirect costs with a specific cost object, and you typically incur indirect costs by a number of projects at the same time. They are not billable to specific projects.

Fixed Costs: Fixed costs are costs you incur during manufacturing that are not associated with the volume of produced output.

Variable Costs: Variable costs are costs you incur during manufacturing that are directly associated with the volume of produced output.

Sunk Cost: A sunk cost is an expense you cannot recoup once it is incurred.

Opportunity Cost: When selecting a course of action, its opportunity cost is the loss of potential benefits from all alternative courses of action.

Costing Techniques Determine How to Account for Project Costs

A costing technique is the way in which you compute the total cost of producing a product or performing a task. Depending on the activity or activities being costed, you may use a variety of techniques. Here are some commons ones:

Job Costing: Managers use job costing, also called job-order costing, to determine the cost of a product that is unique or dissimilar to other products. In industries such as construction, it’s extremely rare for two jobs to be identical. Job-order costing uses a unique job-cost record that compiles total labor and resource costs, as well as applicable overheads, for each task or activity completed as part of a task to determine total expenditures for the job. The job-cost record includes both direct and indirect costs.

Process Costing: You use process costing to determine costs for products or tasks that are identical. Unlike job costing, it does not compute the total cost of a product by summing up the costs of all tasks and activities that go into creating the product. Instead, process costing looks at the processes included in the mass production that creates products. By dividing the total cost of a process by the number of units output, it is possible to determine the cost per unit of each process. After this, you may total the costs per unit of every process involved in the eventual manufacturing of the product. In this way, you compute the cost per unit of each product on a process-by-process basis.

Activity-Based Costing: Activity-based costing (ABC) is an approach to assigning overhead costs to products. Since overhead cost allocation based simply on the number of machine hours needed may be misleading, this costing technique looks at the activities focused on creating a product — testing, machine setup, etc. — and then assigns portions of their costs to all products created using these activities. Products that were not created via these activities do not have shares of these activities’ costs added on.

Direct Costing: Direct costing, also called contribution costing or variable costing, is a technique that only assigns variable manufacturing costs to the cost of a product. You do not add fixed manufacturing costs to the cost of creating a product but instead associate those costs with the time period during which you incur them.

Life-Cycle Costing: Life-cycle costing is a comparative analysis technique that involves summing the total costs incurred during the life cycles of project options in order to choose the best option. Since starting capital costs may not be an accurate representation of how much a project will eventually cost, life-cycle costing includes all costs associated with ownership — including maintenance and disposal costs — to enable better decision making.

Measuring Project Performance With Cost Management KPIs

Once your budget is approved and your project is under way, you’ll want to benchmark your progress relative to your cost management plan. First, there are some key metrics and performance indicators to understand:

Project Cost Performance: A project’s cost performance is an assessment of how actual expenditure on a project compares with planned expenditure as detailed in the project budget. The project manager communicates a project’s cost performance to the project stakeholders, and it may serve as the basis for preventative or corrective actions to avoid cost overruns.

Earned Value: Earned value is a method of measuring project cost performance. It is based on the use of planned value (where you allot specific portions of a project’s budget to the project tasks), and earned value (where you measure progress in terms of the planned value that is earned upon completion of tasks). You may contrast the earned value with the actual cost - the expenditure you actually incur up to a certain point in the project schedule - to see how actual project costs compare to expected project costs.

Cost Performance Index (CPI): This is a measurement of how earned value compares to actual cost. This ratio measures a project’s cost efficiency at a given point in time by expressing earned value in proportion to actual cost. To calculate CPI, divide earned value by actual cost. A result of 1 means the project is exactly on budget; a number above 1 means it is under budget.

To learn more about KPIs in project management, read All About KPI Dashboards.

How to Control Costs

Effective cost control means performing a number of related activities that all begin by monitoring costs — since you can’t know if costs are greater than planned unless you are tracking actual expenses. Then, project managers need to decide how to respond to cost variances. Here are some key steps and concepts that inform the cost control process:

Monitoring Cost Performance: A project manager routinely monitors a project’s cost performance by creating performance reports that summarize current performance and forecast whether you will complete the project on budget. You provide project stakeholders with information about a project’s cost performance.

Reviewing Changes: You must amend the cost baseline to reflect all cost-related changes, and you should inform the project shareholders about all changes.

Actual Costs versus Budgeted Costs: Upon milestone and entire project completion, you examine the variances between actual costs and budgeted costs. Responses to the cost management plan will depend on the magnitude of the variance and the stage of the plan - this could range from a discussion to changes in the project scope that reduce costs.

Reserve Analysis: Use reserve analyses to allocate contingency reserves to projects based on the likelihoods and magnitudes of risk.

Cash-Flow Analysis: Used in financial reporting, cash-flow analyses detail cash inflows and outflows over a given period of time, and provide starting and ending balances.

Learning-Curve Theory: The learning-curve theory applies to the relationship between the time spent producing a unit and the number of units produced. According to the theory, the time spent on each unit should decrease as workers gain experience and therefore produce units faster.

Cost Management vs. Strategic Cost Management

While cost management reduces expenses regardless of their cause or purpose, strategic cost management is a sub-discipline that strives to manage cost while also making the organization stronger.

Robin Cooper, Professor of Management at Claremont’s Peter F. Drucker Graduate Management Center and Regine Slagmulder, Professor of Management Accounting at Tilberg University in the Netherlands, define strategic cost management as the “application of cost management techniques so that they simultaneously improve the strategic position of a firm and reduce costs.”

Strategic cost management centers on the idea that cost reduction initiatives can affect an organization’s strategic position. Strategic cost management emphasizes considering the strategic and financial impact of cost management techniques.

Cooper and Slagmulder classify cost management initiatives as one of three types based on how the initiative affects the organization:

Strengthen: An example of an initiative that strengthens competitive positioning is a taxi service that replaces its phone booking system and team of booking agents with an app that allows people to book taxis using their mobile devices. An initiative like this both reduces costs and gives a company a strategic advantage, as it makes it easier to book taxis on short notice.

No effect: An initiative that has no effect on competitiveness might concern a publishing house that outsources proofreading tasks to international freelancers who accept lower wages. While this increases the company’s profitability, it does not affect its strategic positioning.

Weaken: Finally, an initiative that actively harms competitive positioning might involve the taxi company decreasing the frequency of regular vehicle maintenance, a move which, while saving costs initially, will result in cars breaking down more often.

Strategic cost management also comprises a number of important strategies:

Relevant Cost Strategies: Use relevant cost strategies to compare and decide between alternative courses of action. Relevant costs are costs you can reduce by adopting a particular course of action. They are different from sunk costs (which you cannot recoup once spent) and fixed overhead costs (which are the same for all potential courses of action). When you make decisions, a relevant costs strategy focuses only on costs that vary among options.

Evaluating Opportunity Costs: Evaluating opportunity costs is a more holistic approach to decision making that considers not only all the monetary aspects of alternative courses of action, but also all the intangible aspects. For example, a company providing vehicle repair services might have to decide between two qualities of engine oil, taking into account both that one is more expensive than the other and that the more expensive engine oil also preserves engine health in the long term.

Balanced Scorecard Strategy: A balanced scorecard strategy allows businesses to assess the impact of cost management initiatives across four key areas: financial results, customer impact, internal business processes, and employee growth and development. It provides a framework for thorough consideration of the impacts of cost management initiatives.

Getting Into the Details: Cost Accounting in Project Cost Management

Cost accounting involves the recording and classification of costs associated with a project. It is an internal practice that supports managerial decision making and is a primary discipline concerning cost management.

Cost accounting is different than general financial accounting. Financial accounting concerns reporting an organization’s past financial performance and does not delve into extensive detail. Since you carry out cost accounting for a specific area of activity within a company — such as a particular project or geographical region — it focuses on more granular aspects and may include projections of future costs.

Cost accounting involves preparing reports for an organization’s management (these reports are not distributed externally). By contrast, financial accounting deals with standardized reports that may be distributed to a variety of stakeholders and regulators.

As such, you typically perform cost accounting on an as-needed basis, such as during a strategic project, and it does not follow a mandated format. Financial accounting, on the other hand, is a mandated and regulated formal process, and you must create financial reports according to international financial reporting standards.

There are a few commonly used cost accounting approaches:

Standard Cost Accounting: This is based on the concept of efficiencies, or ratios that compare the time and resource costs of actually completing an activity with the costs of completing the activity under standard conditions. Variance analysis is a core element of standard cost accounting. However, since the idea of efficiencies is based on a paradigm in which labor costs contribute substantially to manufacturing — which is no longer the case — standard cost accounting is somewhat outdated.

Activity-Based Costing: This is an approach to assigning overhead costs that examines activities that provide a service, execute a task, or create a product, and then assigns portions of their costs to output.

Resource Consumption Accounting (RCA): This approach emerged around 2000, and assigns costs based on the consumption of resources. It uses a German cost management system known as GPK and activity-based costing, a cost allocation method.

Throughput Accounting: This is an accounting approach that aims to maximize profitability by increasing the rate of production of goal units and minimizing operating expenses and investment costs.

Life-Cycle Costing: This is a method of analyzing project alternatives that focuses on total costs of ownership and selecting the most cost-effective option based on more than simple capital costs.

Environmental Accounting: Reporting the environmental costs incurred by a company or project’s activities.

Target Costing: This uses a predetermined market price and preferred profit margin to determine how much money can be used to create a product or service. The target cost is the maximum amount you can spend on production without affecting the profit margin.

Cost Coding: To make cost accounting easier, most organizations have adopted a method of identifying costs with a code, usually a number. The root of the code usually represents the type of expense, cost center, or business unit involved. This makes it easier to group and find related expenses in financial reports. Individual projects may be assigned their own code.

A common structure in an enterprise or very large organization is a top-level, four-digit code that relates to the accounting entity (for example, a subsidiary company). The next numbers pertain to department, followed by a number for the cost, which can be a cost center, profit center, work-breakdown-structure element, fund, or internal order. This facilitates the cost management process by aligning the cost codes with the work breakdown structure, which makes it easier to calculate financial performance.

In addition, costs in cost accounting may be classified by:

- Traceability: Direct and indirect costs

- Behavior: Fixed or variable costs

- Controllability: Controllable or uncontrollable costs

- Time Incurred: Historical or predetermined costs

- Normality: Normal or abnormal costs

- Functions: The organizational function by which you incur a cost

Cost accounts make it easy to identify cost overruns in specific sectors that might otherwise be lost in a budget overview. However, managing a large number of cost accounts — up to several hundred accounts and sub-accounts on larger projects — comes with its own challenges. It demands a higher degree of organization in accounting, for one, and classifying costs becomes more time consuming.

In addition, the system of categorization you use for a project’s cost accounts may not match up with the system of categorization you use for an organization’s cost accounts. This complicates the creation of a project budget from a final cost estimate, and is likely to happen when you create cost accounts using a system of categorization different than the performing organization uses.

Aside from recording historical expenditure, project managers must also forecast expected activity costs to ensure that they remain under control. Managers can do this through the use of tables that classify costs for individual cost accounts and cost modeling techniques that indicate whether work associated with a particular activity is due to be completed on budget.

Software’s Role in Project Cost Management

Cost management software simplifies and expedites project cost management activities. This can ease the burden on project cost managers and make it easier to extract insights, such as the cost performance index. Some of the common functionalities include:

Project-Tree Building: A visual representation of a work breakdown structure. This can be useful when employing deterministic estimating techniques.

Cost Estimation: Cost management software can provide powerful estimation capabilities such as using project trees to record activity costs, or running regression analyses to determine cost-estimate relationships in historical data.

Project Cost Management Templates: For projects that are similar, cost management ]templates can expedite cost management activities.

Budgeting: Cost management software can make it easier for project managers to conduct budget planning activities and allocate funding.

Keep Projects On-Budget Using a Cost Management Template

One tool that can help with project cost management is Smartsheet, a collaborative work management and automation platform. As a cloud-based platform, you can share and collaborate on your cost management activities with internal and external stakeholders, and access the information from anywhere, on any device.

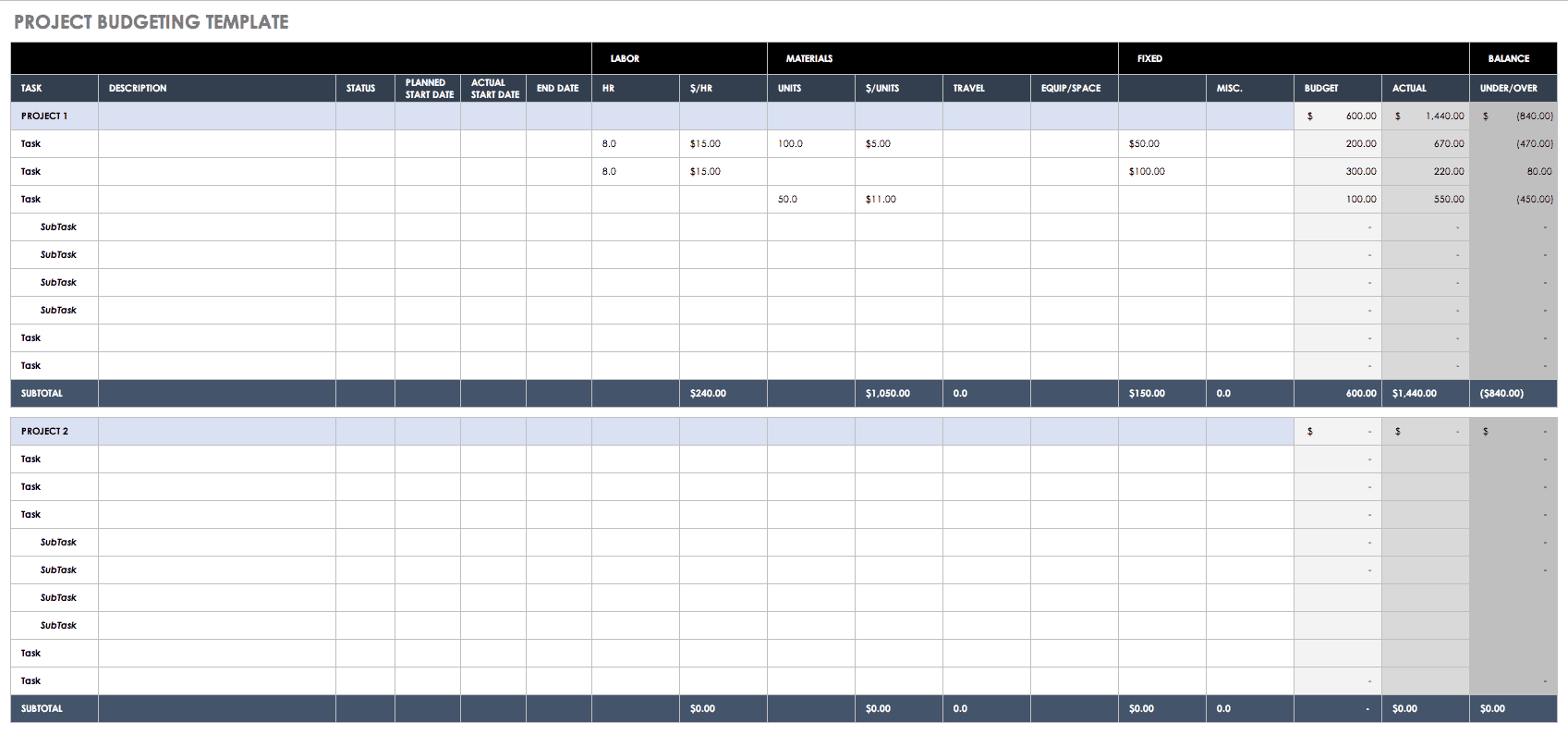

Plus, with a pre-built, customizable template in Smartsheet, you can get started faster than ever. Track project and budget performance all in one sheet. Use symbols to quickly identify tasks that may be at risk of going over budget, and bring visibility to status of estimated versus actual labor, materials, and other costs. Set up alerts and reminders to notify you as costs change, and attach documents like invoices and purchase orders directly to tasks, to keep details in context.

Try one or all of the following templates to help ensure your next project stays on budget:

Project Budget Template

Download Project Budget Template

Cost Management Plan Template

Download Project Cost Management Template

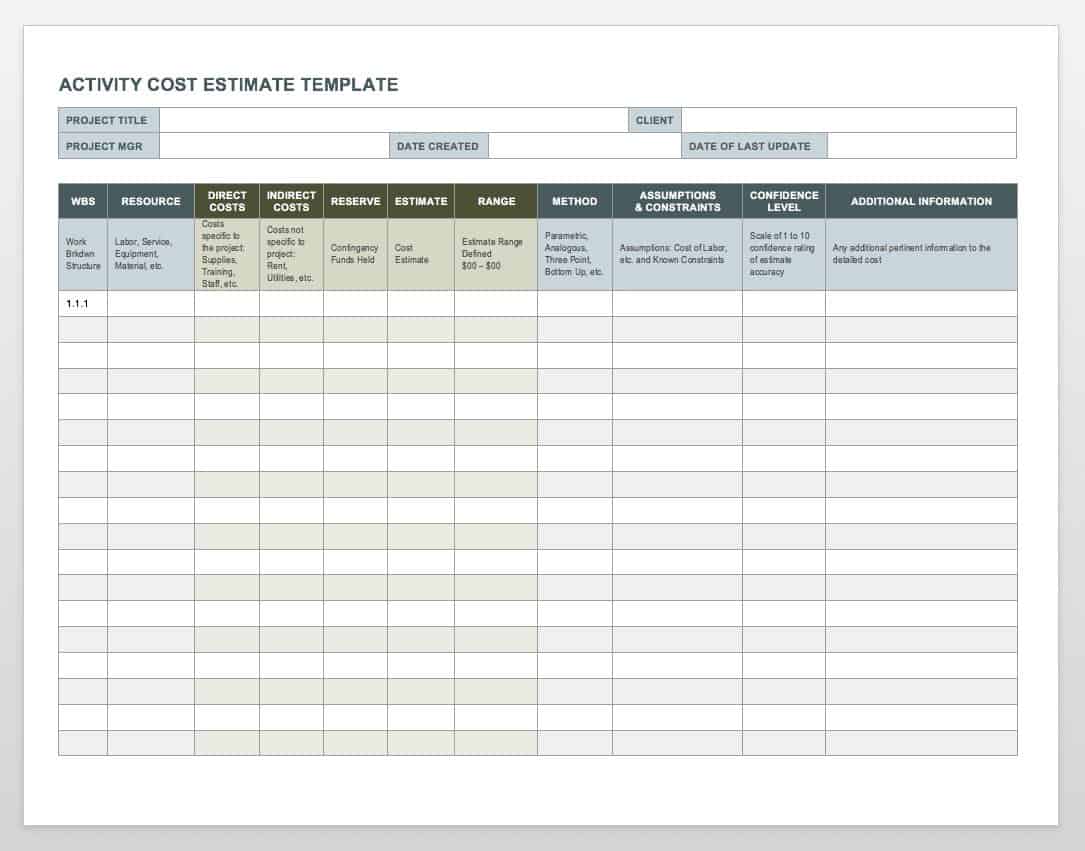

Activity Cost Estimate Template

Download Activity Cost Estimate Template

Smartsheet Project with Schedule & Budget Variance Template

Cost Management for IT Projects

IT project costs are notorious for going over budget, mainly because of development approaches that allow scope creep during the product development life cycle. There is also a tendency for IT cost estimates to be less fixed than those of hard projects in fields such as construction and engineering, where maturity in planning and estimating is higher. In Information Technology Project Management, Kathy Schwalbe suggests that the people creating cost estimates for IT projects lack experience compared to specialist cost surveyors who create cost estimates for construction projects.

Furthermore, given how multifaceted these projects tend to be and how quickly IT evolves, IT projects often suffer from the “first-time, first-use penalty,” which means that it is hard to form accurate estimates when a project or project elements have not been attempted before. This makes documenting lessons learned crucial for IT projects.

The U.S. research and advisory firm Gartner creates a research report for the project and portfolio management market that categorizes vendors into four categories based on their ability to understand market needs and to drive the acceptance of new technologies. These are graphed on axes labeled “completeness of vision” and “ability to execute,” respectively. The “magic quadrant” is the upper right of this graph in which leaders in both areas cluster.

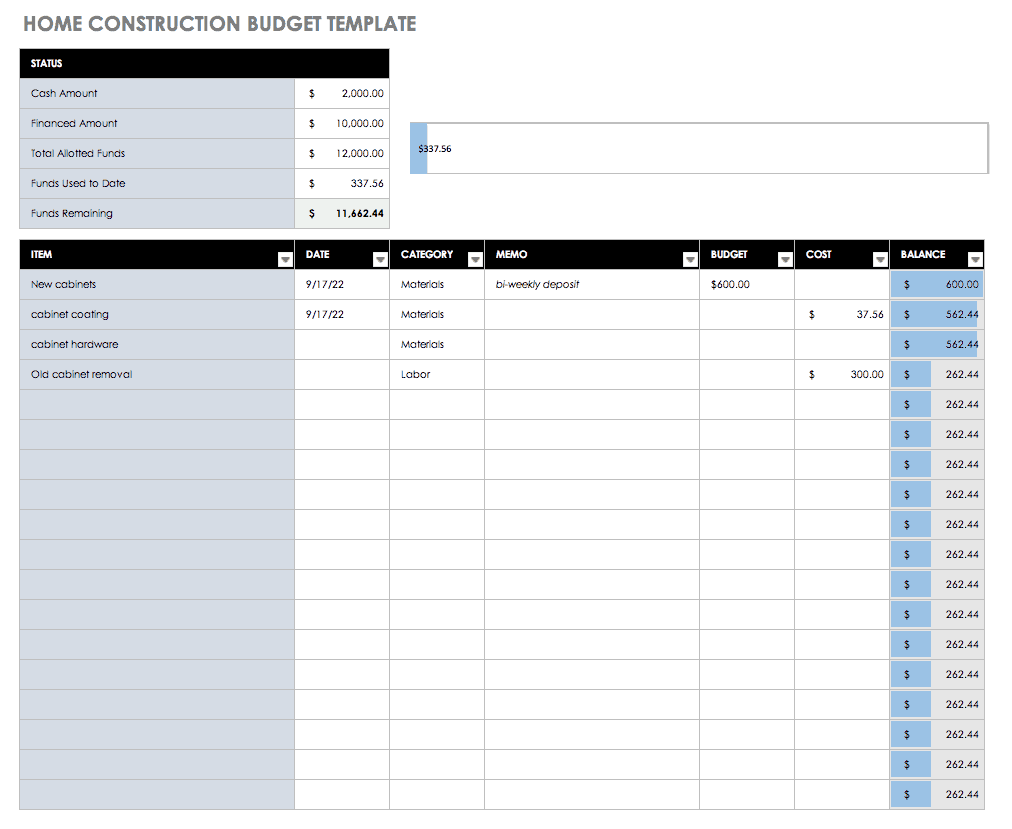

Cost Management in Construction Projects

Construction project cost managers, or quantity surveyors, oversee cost estimation and cost control while maintaining a project’s profitability. They are responsible for ensuring that a project remains within budget while meeting its scope, quality, and performance requirements.

Though the majority of construction projects are not subject to the “first-time, first-use penalty,” they are still highly complex. And as hard projects, their design, scope, and budgetary requirements must be planned before work begins. Experience and formal training are essential for quantity surveyors.

The evaluation and recommendation of bids is one of the quantity surveyor’s primary responsibilities, though they may be engaged in a project from inception to conclusion. In fact, quantity surveyors get their name from the bill of quantities, a cost estimate prepared by the surveyor and by which contractors’ tenders are assessed.

To aid cost management for large, complex projects, quantity surveyors or project managers may use cost codes discussed earlier to set up multiple cost accounts. These accounts are essentially portions of budget marked for specific expenses such as labor, construction materials, architectural design, etc.

Home Construction Budget Template

Download Construction Budget Template

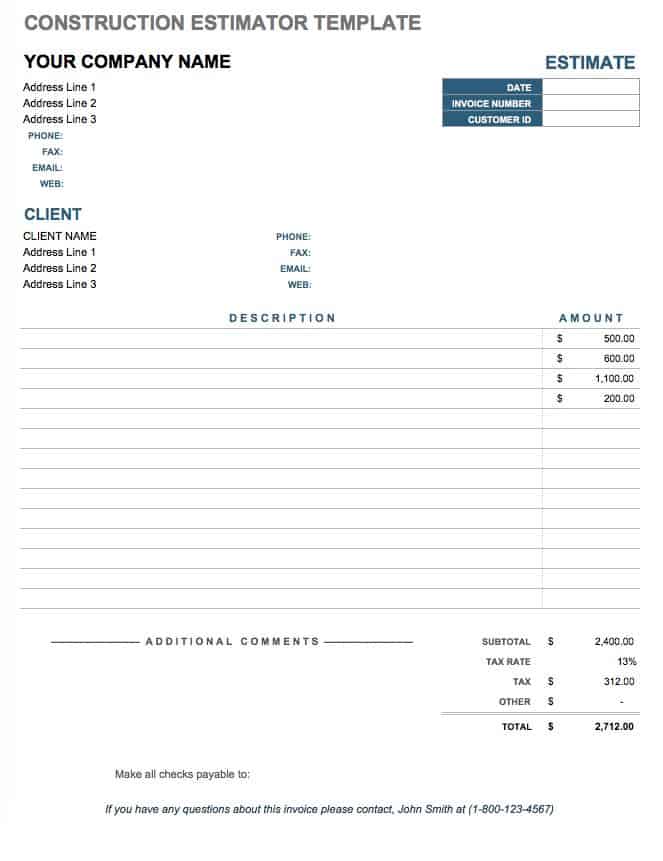

Construction Estimator Template

Download Construction Estimator Template

Excel | Word | PDF | Smartsheet

Exploring Cost Management as a Career

Professional cost managers, sometimes called quantity surveyors, work on large projects (such as construction). But project managers also need an understanding of cost management strategies and techniques to perform their duties.

Cost management requires creative problem-solving skills and a thorough understanding of the factors that affect project costs. As such, cost managers are in high demand and have opportunities to progress to lead project managers.

One popular cost management profession is cost accounting, which is determining the costs focused on creating a product or providing a service. Cost accountants deal with budget preparation and profitability analysis, and their main responsibilities include collecting and communicating cost-related data to aid management decision-making and create financial transparency.

Cost accountants typically study accounting or finance at the undergraduate level, and many pursue master’s degrees in business administration or finance with a specialization in accounting. They typically need a license to advance their careers, which can be obtained after meeting some combination of work and educational requirements.

How Smartsheet Can Help with Cost Management Across Your Projects

The best marketing teams know the importance of effective campaign management, consistent creative operations, and powerful event logistics -- and Smartsheet helps you deliver on all three so you can be more effective and achieve more.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.